By Song Yang, OilChem China

In recent years, the production capacity of China's pure benzene has expanded rapidly, but it is still difficult to meet downstream’s strong demand, and the supply continues to be tight. However, some downstream industries have shown signs of overcapacity to varying degrees. There is a regional mismatch between downstream production units and pure benzene capacity expansion units. Therefore, the supply and demand pattern and trade flow may change in the future.

China's production capacity grew faster than the global average

From 2017 to 2021, the production capacity of China's pure benzene grew faster than the global average (See Figure 1). In 2021, China's production capacity accounted for 1/4 of the world's total capacity, being a crucial role.

Figure 1 The development trend of global pure benzene industry from 2017 to 2021

Domestic supply, demand and trends

1. The increased demand exceeded the supply

From 2017 to 2021, the supply and demand of pure benzene kept growing in China, with an average annual growth rate of 8.7% in production, 4.3% in imports, and 10.5% in downstream consumption within five years.

In recent years, the production capacity of pure benzene has continued to increase. On the one hand, the extension of the industrial chain of integrated refining and chemical enterprises has brought the increase of production capacity. On the other hand, some independent refineries have been put into operation, and the domestic supply capacity of pure benzene has gradually increased. In 2021, the production capacity of China's pure benzene increased to 18.53 million t/a and the output increased to 14.525 million t/a, a year-on-year increase of 15.3%.

Hydrogenated benzene, an alternative product, had a limited production affected by raw materials and policies, so the growth rate of its output was weaker than that of pure benzene. In 2021, China's hydrogenated benzene production increased to 3.47 million tons, a year-on-year increase of 1.5%.

In terms of downstream consumption, the consumption of pure benzene increased significantly to 21.004 million tons in 2021, an increase of 18.7% year-on-year, which benefited from the large-scale production of new downstream plants, especially the styrene plants. The increased demand was higher than the supply.

In terms of import and export, due to the continuous enlargement of the domestic supply gap, the domestic price is higher than the foreign price most of the time, so the imported pure benzene has price advantage. In 2021, the import volume increased to 2.961 million tons, a year-on-year increase of 41%. However, due to the continuous shortage of domestic supply and the absence of policy advantage in export, the export volume of pure benzene was still small, with an average export volume of only 26 000 tons in last five years. Figure 2 shows the composition of domestic pure benzene supply and demand, and Table 1 shows the changes in the supply and demand of China's pure benzene from 2017 to 2021.

Figure 2 Composition of supply and demand of China's pure benzene in recent years

2. The production capacity share of "three barrels of oil" dropped to 53%

Before 2017, the production enterprises of China's pure benzene were mainly the state-owned enterprises such as Sinopec and PetroChina. In recent years, with the successive commissioning of private refining and chemical enterprises, the concentration of pure benzene industry has dropped from a high level, and the share of "three barrels of oil" dropped to 53% in 2021, down 18 percentage points from 2017. See Figure 3 for details.

Figure 3 The production enterprises nature of pure benzene in China

In 2021, the total production capacity of domestic private refineries was 6.672 million t/a, accounting for 36.0%, of which Zhejiang Petrochemical had the largest production capacity, with a total production capacity of more than 2.5 million t/a. Among state-owned enterprises, Sinopec had a total production capacity of 5.046 million t/a, accounting for 27.2%. PetroChina had total production capacity of 3.616 million t/a, accounting for 19.5%. CNOOC and its joint ventures had a total production capacity of 1.17 million t/a, accounting for 6.3%. China Sinochem had a total production capacity of 640 000 t/a, accounting for 3.5%. Other state-owned enterprises had a total production capacity of 550 000 t/a, accounting for 3.0%, including North Huajin Chemical Industries Group Corporation and Shanxi Yanchang Petrochemical (Group) Co., Ltd. Other joint ventures had a total production capacity of 835 000 t/a, accounting for 4.5%.

3. The production capacity and consumption in East China ranked first

From 2017 to 2021, the supply capacity expansion of pure benzene in various regions in China was relatively balanced, and the overall growth rate was relatively consistent. In absolute terms, the production capacity of pure benzene in East China ranked first in China. This region was also the main consumer of benzene in China, so the production unit was close to the downstream consumer market (Figure 4).

Figure 4 Distribution of pure benzene production capacity in China in recent years

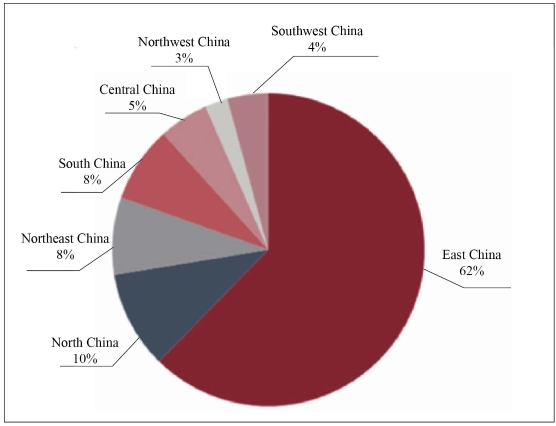

In 2021, the consumption of China's pure benzene was about 21 million tons, and the main consumption area was East China, accounting for 62% (Figure 5). East China is a relatively developed region in China, with the largest domestic population, and it is the main consumer market for industrial products. Pure benzene is one of the raw materials for chemical products, and its consumption fields are also concentrated in East China, consistent with the main domestic consumption market.

Figure 5 Regional distribution of pure benzene consumption in China

4. The consumption proportion of phenol may continue to rise

Styrene is the largest downstream product of pure benzene. In recent years, the domestic styrene production capacity has grown rapidly, and the industry has become obviously oversupplied. Caprolactam is the second largest downstream product market. However, in recent years, the domestic production of caprolactam has expanded rapidly, while the terminal consumption capacity has expanded relatively slow, so it has also begun to become oversupplied. Phenol is the third largest downstream product, and its production capacity is expected to have a production peaks in 2022-2023, and the proportion of pure benzene consumption is expected to continue to rise. Figure 6 shows the consumption structure of pure benzene in China in 2021.

Figure 6 The consumption structure of China's pure benzene in 2021

5. The traditional goods supply from Shandong to Jiangsu is variable

In 2021, there was a certain regional mismatch between downstream production units and pure benzene capacity expansion units. In particular, multiple sets of styrene units in Shandong have been put into operation intensively, which increased local demand, promoted the activity of the Shandong market, and reduced the quantity of pure benzene from Shandong to Jiangsu. See Figure 7 for the geographical distribution of newly-added benzene production and consumption units in China in 2021. In addition, market participants believe that further expansion of downstream capacity in Shandong in 2022-2023 will lead to a larger supply gap.

Figure 7 Geographical distribution of newly-added benzene production and consumption installations in China in 2021

6. Import volume first decreased and then increased

From 2017 to 2021, the import volume of domestic pure benzene first decreased and then increased, mainly due to the change in the domestic demand gap (see Figure 8 for details). In 2021, the downstream had a concentrated production expansion, the demand gap further expanded, and the import volume increased significantly.

Figure 8 The imports trend of China's pure benzene from 2017 to 2021

Among the main import sources, South Korea is China's most important county of origin. In the past five years, China's imports of pure benzene from South Korea have continued to maintain the largest import volume. Among the other countries and regions, Southeast Asian countries have become the main growth point of China's imports of pure benzene because of their convenient geographical conditions and preferential tariffs.

To sum up, pure benzene is a chemical product with rapid development and large scale in China in recent years, and it has a scale advantage in the world. At the same time, it should be noted that due to the long-term domestic supply gap, China's pure benzene supply has a certain dependence on foreign market. On the other hand, due to the overcapacity of styrene and caprolactam in the downstream industries of pure benzene, the related industries have entered the initial stage of optimization and integration. In the future, the growth of terminal consumption in downstream will be the key factor to influence whether the pure benzene industry can maintain a healthy development.