By Chen Huimin, China National Chemical Information Center

Wet electronic chemicals are generally classified into general chemicals and functional chemicals according to their composition and usage. General wet electronic chemicals mainly include ultra-clean high-purity acids (such as hydrofluoric acid, nitric acid, hydrochloric acid) and alkalis (such as sodium hydroxide, potassium hydroxide, ammonia), and ultra-clean high-purity organic solvents (like methanol, Ethanol, acetone). Functional chemicals refer to formula and compound chemicals that have special functions via compounding process and can meet special requirements in manufacturing. Functional chemicals are generally used together with photoresists, including stripping solution, developer solution, etching solution, cleaning solution, etc. The ultra-clean high-purity reagents account for 88% of the total and the functional chemicals 12% by consumption.

Wet electronic chemicals are the key electronic chemical materials for new energy, new generation electronic information technology, and new display technology. Purity is the most important index. The level of purity directly affects the yield, electronic performance and reliability. In terms of product standards, China has not yet promulgated a unified product quality standard. At present, the most commonly standard worldwide is the SEMI standard formulated by the Semiconductor Equipment and Materials International.

Wet electronic chemicals’ status quo and development trend

With the rapid development of downstream industries such as semiconductors, display panels, and solar cells, wet electronic chemicals have maintained rapid growth. The global wet electronic chemicals market has grown from US$3.8 billion in 2014 to US$5.6 billion in 2019. The compound annual growth rate during 2014 to 2019 is about 8%. It is expected that the global wet electronic chemicals market will keep a growth rate of 6% in the next few years, and the global market size will reach US$7.5 billion by 2024. The wet electronic chemicals market scale and forecast from 2014 to 2020 are shown in Chart 1.

Chart 1 Global wet electronic chemicals market, 2014-2020

The wet electronic chemicals industry in China started late and did not enter a period of rapid development until 2010, driven by the rapid development of downstream industries such as integrated circuits, display panels and solar energy. The size of China's wet electronic chemicals market in 2018 was RMB8 billion, with a compound annual growth rate of 17.5% from 2010 to 2018. In 2010, the output of wet electronic chemicals in China was only 155 kt, while in 2018 this number increased to 495 kt, with an annual compound growth rate of 15.6% through 2010 to 2018.

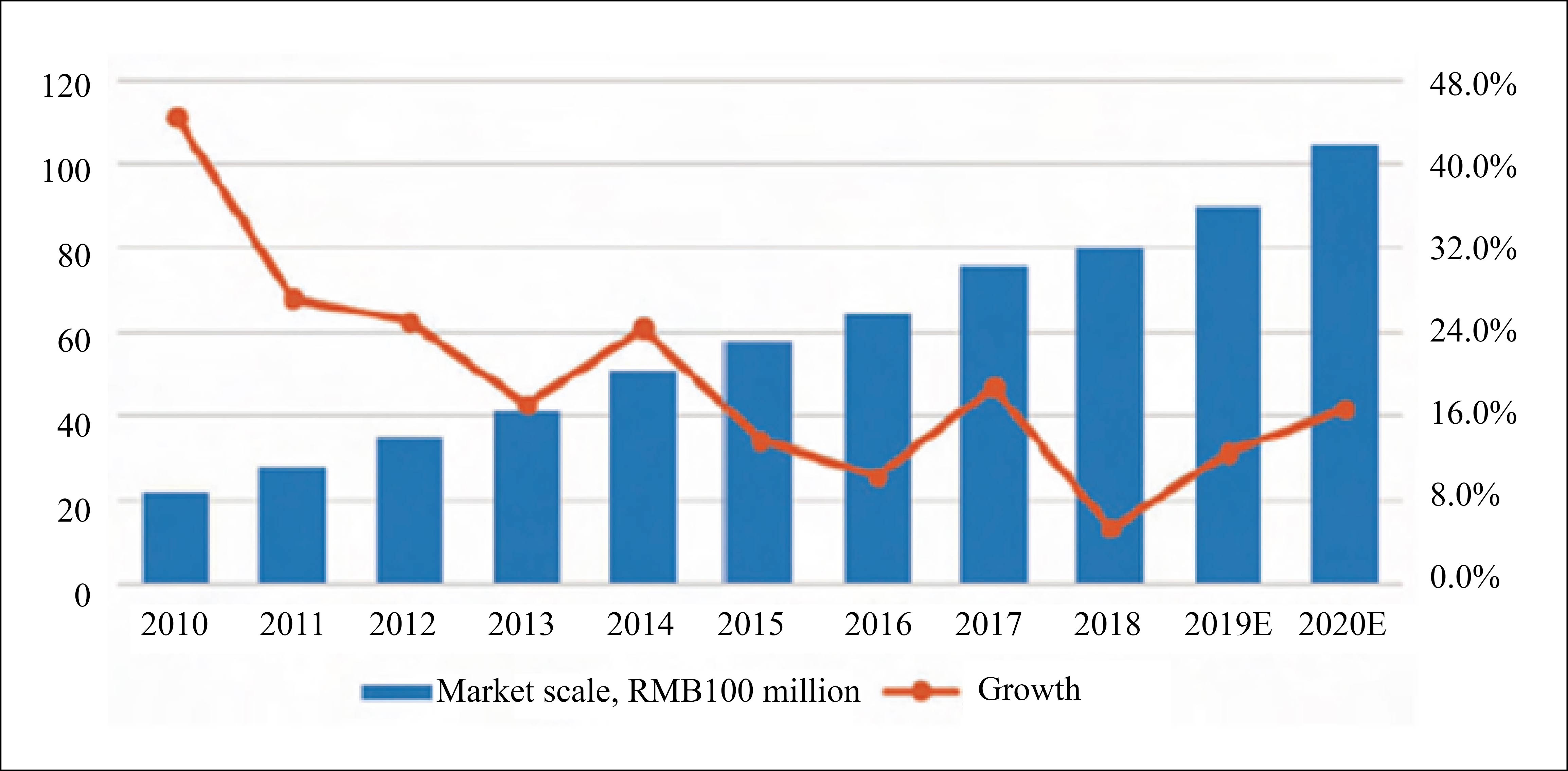

In 2018, the demand for wet electronic chemicals in China was 905 kt, and the display panel was the largest consumer, with a consumption share of 37.7% of the total; the share of integrated circuits and solar energy were respectively 31.2% and 31.1%. The scale and forecast of China's wet electronic chemicals market from 2010 to 2020 are shown in Chart 2.

Chart 2 China’s wet electronic chemicals market scales, 2010-2020

The growth rate of demand for wet electronic chemicals in China is closely related to the development of display panels, integrated circuits and solar cells. From 2014 to 2018, China's new display revenue growth reached 26%. In 2019, China's integrated circuit output was 201.82 billion, an increase of 16% year-on-year and an average annual growth rate of 14.7% from 2014 to 2019. In 2019 Chinese solar cells (photovoltaic battery) output was 129 million kilowatts, an increase of 33.9% year-on-year and an average annual growth rate of 24% from 2014 to 2019. However, in recent years, the demand growth has slowed down, and the overall trend is downward. It is expected that in the next few years, the demand for wet electronic chemicals from the field of display panels in China will maintain a relatively high growth rate, with an expected growth rate of about 25%; the growth of demand from integrated circuits is expected to increase by more than 15%; while the demand from solar cells expected to continue to slow down to 15%. Overall, the growth of demand for wet electronic chemicals from three major application markets is expected to keep in the band of 15% to 20%.

Challenges faced by the wet electronic chemicals industry

The rapid development of the electronic information industry has brought development opportunities to the wet electronic chemicals industry in China, but the localization of wet electronic chemicals is also facing many challenges.

At present, the mainstream capacities of wet electronic chemicals in China are still at G2 and G3 standards, while foreign wet electronic chemical manufacturers have achieved G5 standard. China is still highly dependent on imports in the field of high-end products. The localization rate of wet electronic chemicals for 6-inch and below wafer processing has increased to 82%, but the localization of wet electronic chemicals for 8-inch and above wafer processing is less than 20%.

Wet electronic chemicals, as the key chemical materials for electronic information industry, are updating quickly. The future development trend of electronic information products directly affects the development direction of the wet electronic chemical industry. The emergence of new products and new processes will also put forward higher quality requirements on wet electronic chemicals. In order to adapt to market demand, domestic enterprises must accelerate the localization process.