By Guo Shicheng, CNCIC

Supply and demand

In 2019, the global total capacity of M-phenylenediamine (MPD) was 105 kt/a, the output was 85 kt, and the consumption was 79 kt. MPD was mainly used in the production of resorcinol, dye and m-aramid fiber, with the consumption of 35 kt, 19 kt and 15 kt in the sectors respectively, accounting for 44.3%, 24.1% and 19.0% of the total consumption. It is predicted that the global demand for MPD will reach 106 kt in 2025, with an average annual growth rate of 5.0% during 2019-2025.

In 2019, the capacity of MPD was 80 kt/a, the output was 82 kt, and the operating rate was as high as 102.5% in China. Table 1 shows the main MPD producers in China in 2019. At present, there are five MPD projects being built and to be built (see Table 2 for details). It is estimated that the capacity will increase by 106.8 kt during 2020-2025, and will reach 186.8 kt/a by 2025.

Table 1 Major MPD producers in China, 2019

Producer | Location | Capacity (kt/a) | Raw materials/Production process |

Zhejiang Lonsen | Shaoxing, Zhejiang | 65 | Continuous nitration of benzene, catalytic hydrogenation process |

Sichuan North Hongguang Special Chemical Co., Ltd. | Yibin, Sichuan | 15 | Continuous nitration of benzene, catalytic hydrogenation process |

Table 2 Chinese MPD projects being built and to be built

Producer | Location | New capacity (kt/a) | Raw material |

Yancheng Deande New Material Technology Co., Ltd. | Yancheng, Jiangsu | 12 | Benzene |

Jiangxi Lesheng Chemical Co., Ltd. | Jingdezhen, Jiangxi | 6 | Benzene |

Sichuan North Hongguang Special Chemical Co., Ltd. | Yibin, Sichuan | 13.8 | Benzene |

Zhejiang Lonsen | Shaoxing, Zhejiang | 35 | Benzene |

Shandong Kesheng Chemical | Dongying, Shandong | 40 | Mixed dinitrobenzene |

Total | 106.8 |

In 2019, China's consumption of MPD was 61 kt, down by 3 kt compared with 2017. The demand is expected to reach 84 kt in 2025, with an average annual growth rate of 5.4% in 2019-2025. Table 3 indicates the consumption structure of MPD in China from 2019 to 2025.

Table 3 Chinese MPD consumption structure, 2019-2025

Application field | 2019 | 2025 | Growth rate (%) | ||

Consumption (kt) | Proportion (%) | Consumption (kt) | Proportion (%) | ||

Resorcinol | 35 | 57.4 | 47 | 56.0 | 5.0 |

Dyestuff | 13 | 21.3 | 16 | 19.1 | 3.5 |

Meta aramid | 5 | 8.2 | 9 | 10.7 | 10 |

Others | 8 | 13.1 | 12 | 14.2 | 7.0 |

Total | 61 | 100.0 | 84 | 100.0 | 5.4 |

China's net exports of MPD in 2017-2019 were at 21-26 kt, and the volumes are not expected to have a sharp increase, as downstream demand in overseas countries will have little upward momentum. It is expected that the operating rate of MPD in China will decrease to 61.6%.

Price and gross margin

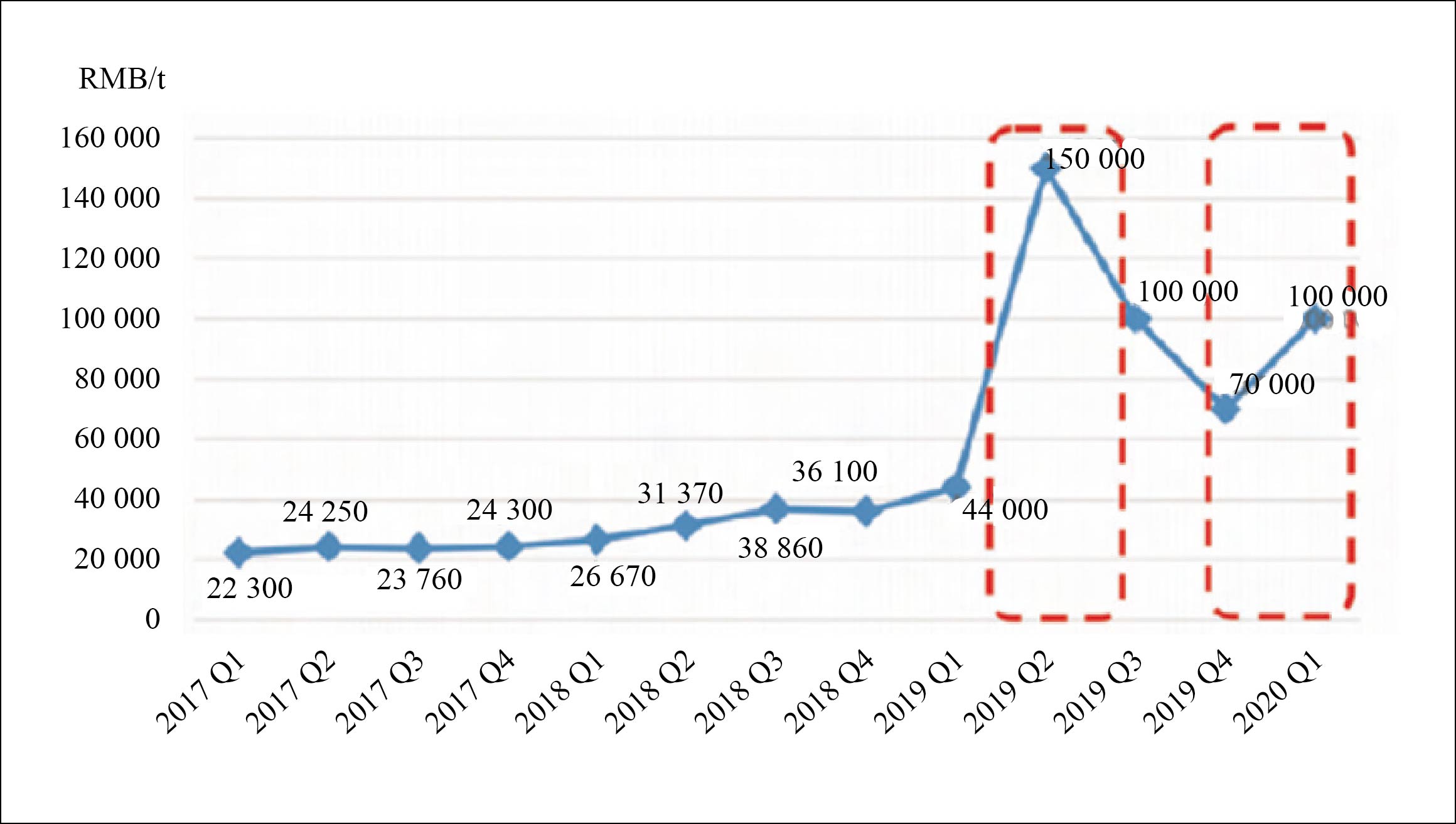

The MPD prices fluctuated normally in the range of RMB24 000-36 000/t during 2017-2018, as shown in Figure 1. The domestic prices soared to a high of RMB150 000/t after March 21, 2019 when an explosion occurred in Jiangsu Province, and dropped to RMB70 000/t at the end of 2019. The prices rose to RMB100 000/t due to the outbreak of COVID-19 in 2020. It is expected that the price and gross margin in China will gradually return to a normal level as a result of waning implications of the epidemic and the releasing of new capacities.

Figure 1 Domestic MPD prices, 2017-2019

Suggestions on investment

The investments on MPD projects should be cautious. (1) There are great risks of security in the production of MPD, as the raw material mixed dinitrobenzene is hazardous and explosive. (2) MPD production is mainly dominated by Zhejiang Lonsen and Sichuan North Hongguang Special Chemical Co., Ltd., so the market access is quite high. (3) The market capacity is small and there is limited room for future growth. (4) At present, the price and gross profit rate of products are off from the normal level. However, with the start-up of new capacities, the price and gross margin will return to the normal level.