By Ma Baijun, PetroChina Jilin Petrochemical Company

Profits of fuel ethanol firms collapsed in 2019 due to factors like decelerated capacity expansion, weakening demand and price reduction (a concession that new entrants made to develop downstream markets).

Going forward in controversies

Domestic fuel ethanol is mainly produced by corn, which will remain the most reliable, most cost-efficient raw material for a period. Fuel ethanol manufacturers concentrate in northeast and east China, especially northeast China, which is a major corn production area.

Ethanol gasoline applied in China is E10 achieved by mixing gasoline blending component oil (90%) with fuel ethanol (10%). Other varieties classified according to volume ratio include E15, E85, etc. Ethanol gasoline will improve octane value and reduce air pollutants.

In September 2017, 15 departments like the National Development and Reform Commission (NDRC) and National Energy Administration (NEA) jointly issued Plan to Expand Production of Biofuel Ethanol and Propel Application of Ethanol Gasoline for Vehicles, calling for propelling application of ethanol gasoline across the country in 2020. By the end of December 2019, only 14 provinces, municipalities or autonomous regions have fully or partially adopted ethanol gasoline, which has been in controversies since its initial application.

Market shares of ethanol gasoline have exceeded 90% in Jilin, Heilongjiang and Liaoning, and the application in Tianjin has been smoothing. However, in some places the situation was not optimistic (e.g. sliding market shares, stopping using in Xuancheng, Huangshan, Maanshan, etc.). In Hubei, for a time, only Wuhan, Suizhou and Xiaogan used ethanol gasoline. Henan province, where using ethanol gasoline is mandatory, consumed 5.18 million tons of ethanol gasoline in 2018, accounting for 57% of oil consumption. Market shares in Guangxi were even lower, failing to reach 50%.

Promotion slowing down affected trade pattern

Things changed in 2019. For example, promotion of ethanol gasoline slowed down, and promotion range narrowed, cooling down enterprises’ enthusiasm for fuel ethanol, two major suppliers of which will probably be SDIC and COFCO.

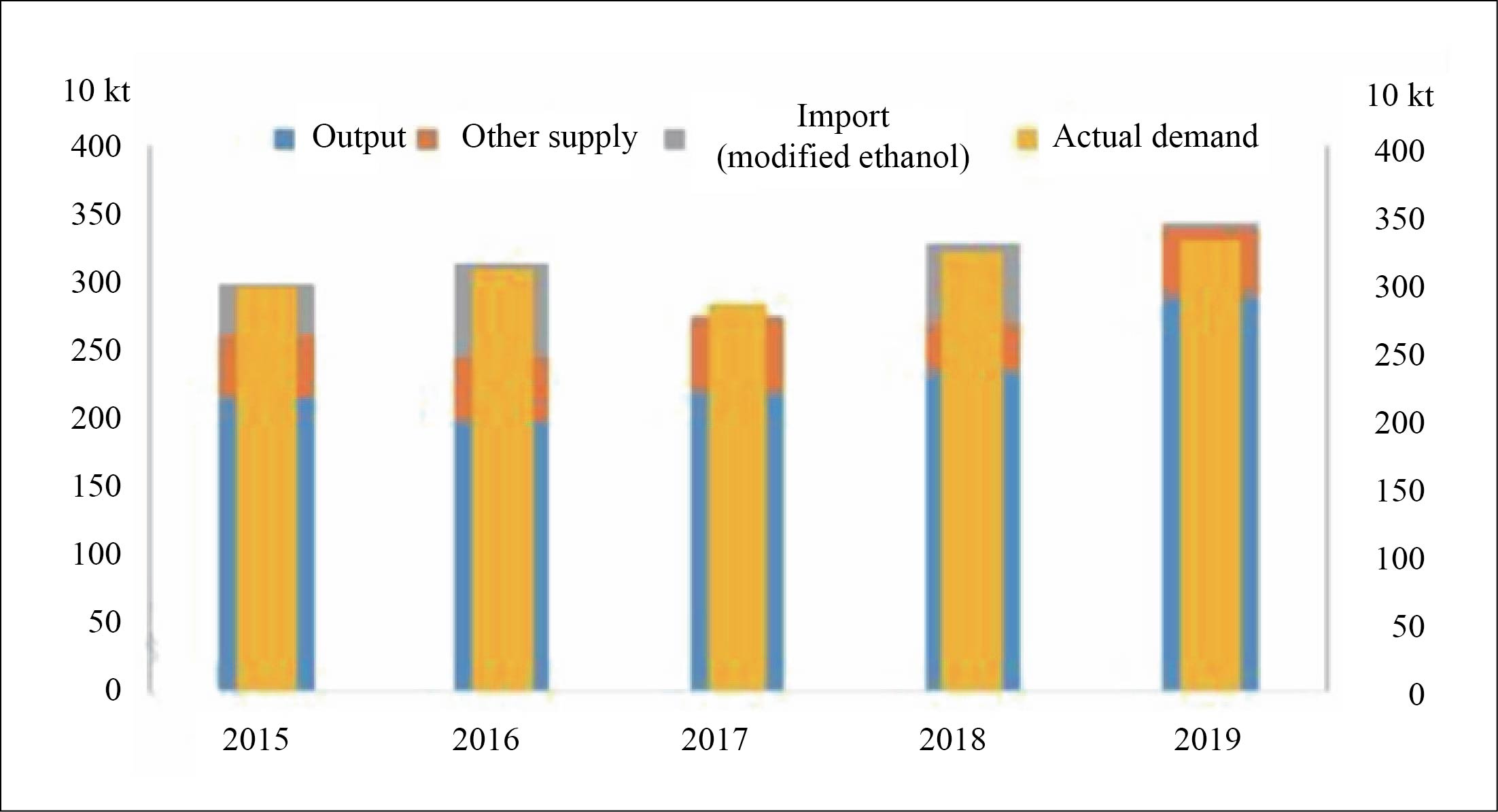

China’s fuel ethanol capacity reached 4.3 million t/a in 2019, and output was around three million tons mainly from northeast China (adopting corn as raw material) and east China (corn, cassava, coal, etc.). From 2017 to 2019, domestic output of fuel ethanol was up 31.69%, far exceeding demand growth of 13.03%.

Figure 1 China’s demand and supply of fuel ethanol during 2015-2019

Most domestic new fuel ethanol projects have been in planning or preparation since 2019 (see Table 2 for details). Private enterprises will be more difficult to engage in fuel ethanol, a kind of product related to both energy and agriculture.

Table 1 China’s fuel ethanol producers in 2019

Company | Unit location | Raw materials | Capacity (kt/a) |

COFCO Biotechnology Anhui Fengyuan Group Co., Ltd. | Bengbu, Anhui | Wheat/corn | 750 |

Henan Tianguan Fuel Ethanol Co., Ltd. | Nanyang, Henan | Wheat/corn/root crops | 700 |

Jilin Fuel Alcohol Co., Ltd. | Jilin | Corn | 700 |

COFCO Biotechnology Energy (Zhaodong) Co., Ltd. | Zhaodong, Heilongjiang | Corn | 400 |

Jilin Boda Biochemical Co., Ltd. | Jilin | Corn | 300 |

Wanli Runda Biotechnology Co., Ltd. | Baoqing, Heilongjiang | Corn/rice | 300 |

SDIC Bio-energy (Tieling) Co., Ltd./Tiefa Coal Industry (Group) Co., Ltd. | Tieling, Liaoning | Corn | 300 |

COFCO Guangxi Biomass Energy Co., Ltd. | Beihai, Guangxi | Cassava | 200 |

Guangdong Bio-energy Co., Ltd. | Zhanjiang, Guangdong | Cassava/rotten rice | 150 |

Shandong Fu’en Biological Chemical Co., Ltd. | Juxian, Shandong | Cassava | 120 |

Yanchang Petroleum - Dalian Institute of Chemical Physics | Xi’an, Shaanxi | Coal | 100 |

Zhongrong Technology Co., Ltd. | Qian’an, Hebei | Coal | 100 |

Shandong Longlive Ethanol Technology Co., Ltd. | Dezhou, Shandong | Corncob | 55 |

Liaoyuan Jufeng Biochemical Technology Co., Ltd. | Liaoyuan, Jilin | Corn | 50 |

Zonergy Co., Ltd. | Bayannur, Inner Mongolia | Stalks of sweet sorghum | 30 |

Jinan Shengquan Co., Ltd. | Zhangqiu, Shandong | Cellulose | 20 |

Shandong Zesheng Biotechnology Co., Ltd. | Dongping, Shandong | Cornstalk | 20 |

Total | 4 295 |

Table 2 Some fuel ethanol projects in construction, planning or preparation

Company | Project location | Raw materials | Capacity (kt/a) | Current situation |

Sinopec | Jinggangshan, Jiangxi | Cassava | 100 | In construction |

Meijie Guozhen Green Refining Co., Ltd. | Fuyang, Anhui | Cellulose | 182 | In construction |

SDIC Bio-energy (Jidong) Co., Ltd. | Jidong, Heilongjiang | Corn | 300 | In construction |

SDIC Bio-energy (Hailun) Co., Ltd. | Corn | 300 | In construction | |

Jilin New Tianlong Industry Co., Ltd. | Siping, Jilin | Cellulose | In planning | |

COFCO Biotechnology (Xinganmeng) Co., Ltd. | Inner Mongolia | Corn | 600 | In preparation |

Jilin Fuel Alcohol Co., Ltd. | Jilin | Cellulose | 80 | In preparation |

Inner Mongolia Shiqi Co., Ltd. | Tongliao, Inner Mongolia | Corn | 300 | In preparation |

COFCO Biotechnology Co., Ltd. | Bengbu, Anhui | Cellulose | 100 | In planning |

Inner Mongolia Jonoon Biotechnology Co., Ltd. | Inner Mongolia | Corn | 300 | In preparation |

Inner Mongolia Liniu Biological Chemical Co., Ltd. | Inner Mongolia | Corn | 150 | Rebuilding and expansion |

Total | 2 412 |