By Ning Shoujian, China Biodiesel Industry Association

Two stages of China’s biodiesel exports

China’s biodiesel exports can be divided into two phases during the period from 2006, when the industry started, to the end of 2019.

The first phase lasted from 2012 to 2015, with South Korea being the major export destination. At that time, Henan Yatai exported around 2 000 tons of biodiesel to South Korea’s AEKYUNG and Hengshunda’s C16 and C18 methyl ester exports also targeted South Korea, based on the US standards. Later, biodiesel was shifted for domestic sales and the first-stage exports halted by the end of 2015, as the domestic oil blending market was hot and the quality of domestic products had not yet reached the EU standard.

The second phase is the export boom to EU, began from June 2016 to present, driven by Zhuoyue New Energy. The company obtained the (International Sustainability & Carbon Certification) ISCC certification, the first of its kind for China’s biodiesel industry and opened the breakthrough for China’s biodiesel exports in the EU market.

As for the exports of used cooking oil (UCO), Sichuan Jindeyi Grease Company first obtained the ISCC and has been sustaining the business up until now. By 2019, Jiangsu Taizhou Keyuan Grease Co has had relatively large export volume.

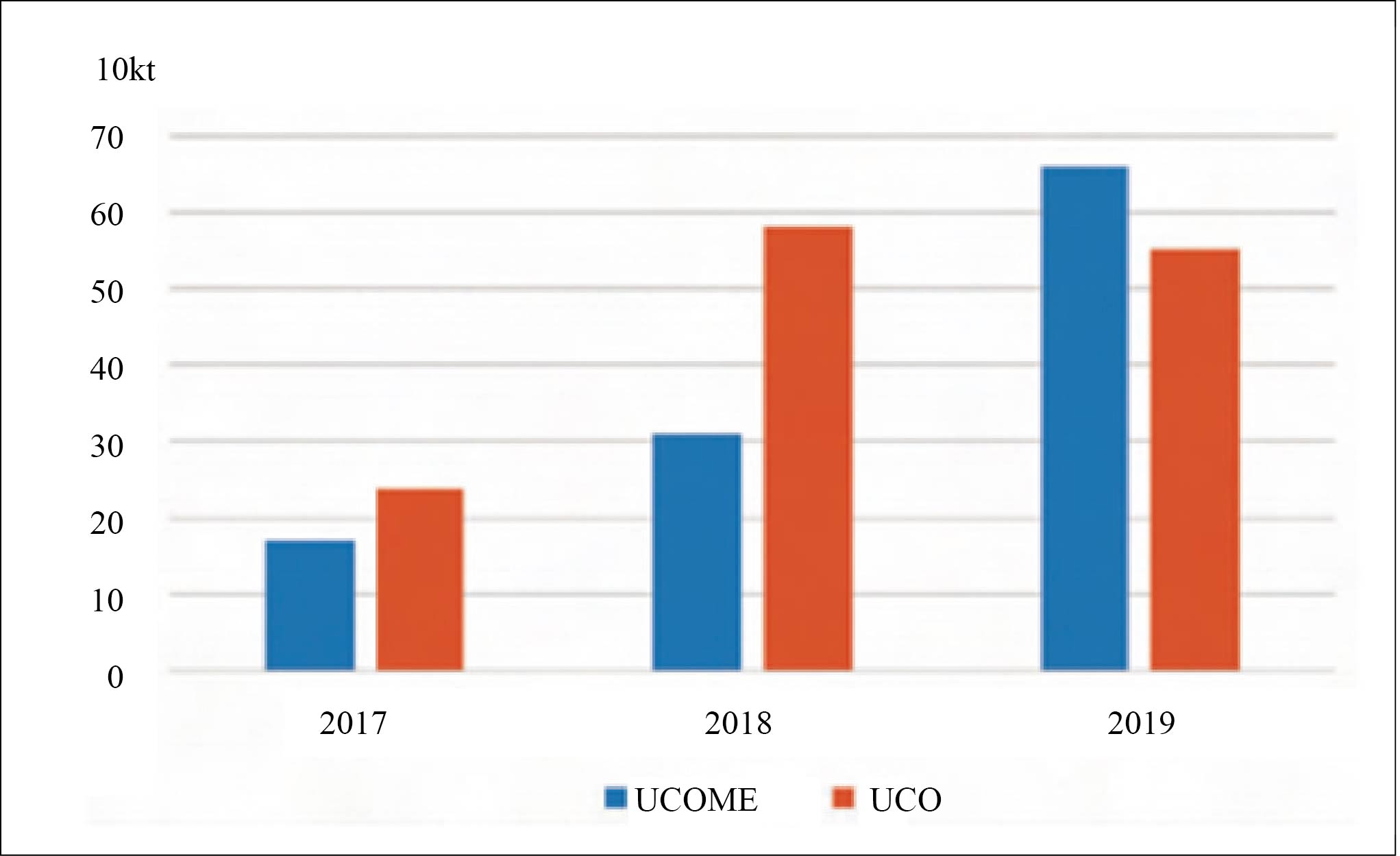

In 2016-2018, China’s UCO exports were higher than biodiesel, with the export volume at 240.6 kt and 172.8 kt, respectively in 2017 and at 581.2 kt and 314.6 kt in 2018. The trend was reversed in 2019, when China exported 550 kt of UCO and 662.2 kt of biodiesel. Details are shown in Figure 1.

Figure 1 China’s biodiesel VS UCO exports in 2017-2019

EU biodiesel market

By the end of 2019, EU was China’s major biodiesel export market, accounting for over 90% of China’s total diesel exports in 2017-2019. This was mainly related to EU’s diesel market and biodiesel policies.

The development trend of diesel passenger cars began in Europe in the 1980s, and diesel passenger cars have now become an important part of the European passenger car market. In Europe, 100% of heavy vehicles use diesel power, 90% of taxis are diesel passenger cars. In western Europe, diesel passenger cars take up over 50% of the passenger car market and the share in France, Spain, Belgium and Norway even exceeds 70%.

According to EU requirements, by 2020, the proportion of renewable biofuels in transportation energy consumption of its member countries shall reach 10%. This will translate to 20 million t/a of biodiesel demand in EU. In addition, energy utilization rate for biofuels produced from UOC can be doubled. Thus, for EU countries, where the price of biodiesel is higher than that of diesel, the purchase of biodiesel produced from UCO as raw materials to meet the requirements of the EU Renewable Energy Directive is their best choice. That’s the main reason behind China’s rising biodiesel prices from 2016 to the end of 2019.

Current situation of China’s biodiesel industry

China currently has around 2.30 million t/a of designed biodiesel capacity. Its biodiesel output totalled around 1.20 million tons in 2019 (including hydrocarbon-based biodiesel).

There are 5-10 million tons of UCO produced in China annually. Even if a part of imported palm oil scrap is used as a supplement, the volume is still not enough to meet the import demand for UCOME from the EU.

Prices of biodiesel produced from UCO have been falling from the January peak at around US$1 300/t due to the coronavirus outbreak. This, combined with the crude futures crash in early March dragged down the prices of biodiesel produced from UCO to around US$1 040/t CIF on April 2, down by around 20%. China’s export prices of UCO dropped from US$850/t CIF to US$710/t CIF during the period, down by around 16%.

China exported 128.3 kt of biodiesel in January-February 2020, with the average price at RMB7 032/t. Its export volume in the same period of 2019 reached 44.7 kt, with the average price at RMB5 818/t. Part of the exports in 2020 were previously purchased by domestic traders in 2019 but delayed to be loaded in 2020. But the overall export volume increased notably from the 2018 level.

Opportunities and challenges

The rampant coronavirus pandemic and diving global crude values impose huge challenges and bring great opportunities for China’s biodiesel industry.

The virus has caused order cancellations. Global crude values have suffered cliff-like declines. The domestic refined oil product market is bearish (diesel prices were below RMB5 000/t), with limited trading volumes. Domestic biodiesel companies are facing intense competitions.

Some anti-virus materials or products have found new opportunities amid the pandemic. For instance, the prices of glycerin have reaped sharp gains. In the future, companies may face a reorganized market pattern. Biodiesel (fatty acid methyl ester) may seize new market opportunities and find new applications. Recently, biodiesel is very promising as a pesticide solvent.

From 2016 to the end of 2019, EU occupied over 90% of China’s biodiesel export market. Boasting obvious inherent advantage, China’s biodiesel exports may have a brighter and broader market.

China has introduced a series of preferential funding policies to actively support small and medium-sized enterprises. The next stage is very likely to be a new round of investment boom. This is a very good opportunity for expanding the actual output of the industry and improving the overall technical management level.

China’s biodiesel export market outlook

China’s biodiesel export market is poised to expand further. Trading volumes will grow in line with domestic output and capacity expansion. Biodiesel exports may follow the trends as below:

1. Higher concentration level

Large enterprises has begun to sign independently supply and sales contracts with overseas buyers since 2018, while small-sized companies have teamed up with each other to jointly export. The industry concentration level is expected to rise further. Export volumes will increase with new comers participating in constantly.

2. Export destinations to increase

In 2016-2019, China mainly exported biodiesel to Netherlands, Spain and Malaysia, which together accounted for over 90% of China’s biodiesel exports. EU enterprises are the actual users of China’s biodiesel exported to Malaysia. Chinese enterprises also need to pay attention to changes in relevant laws and regulations brought about by changes in the export destinations of biodiesel.

3. Imports likely to increase

As the virus has crippled Malaysia’s palm oil market, suppliers there may look to export the product to China. Other soybean oil and rapeseed oil producing countries and regions may encourage the export of related grease-derived products, including biodiesel to boost their domestic economy.