By Tan Jie, Sinopec Maoming Petrochemical Company

With many new projects coming on stream in recent years, China’s capacity to make polyolefin (polypropylene and polyethylene) has increased rapidly, reaching 44.07 million t/a in 2019. In detail, polypropylene capacity was 25.02 million t/a, and polyethylene capacity was 19.05 million t/a.

Given factors like technologies and limited varieties, domestic output of polyolefin cannot satisfy actual demand, which currently requires a large quantity of imports. In 2019, import volume of polyolefin was up 16.48% YoY to 20.16 million tons (polypropylene, up 6.43% YoY to 3.49 million tons; polyethylene, up 18.83% YoY to 16.67 million tons).

Polypropylene import

1. Major import sources

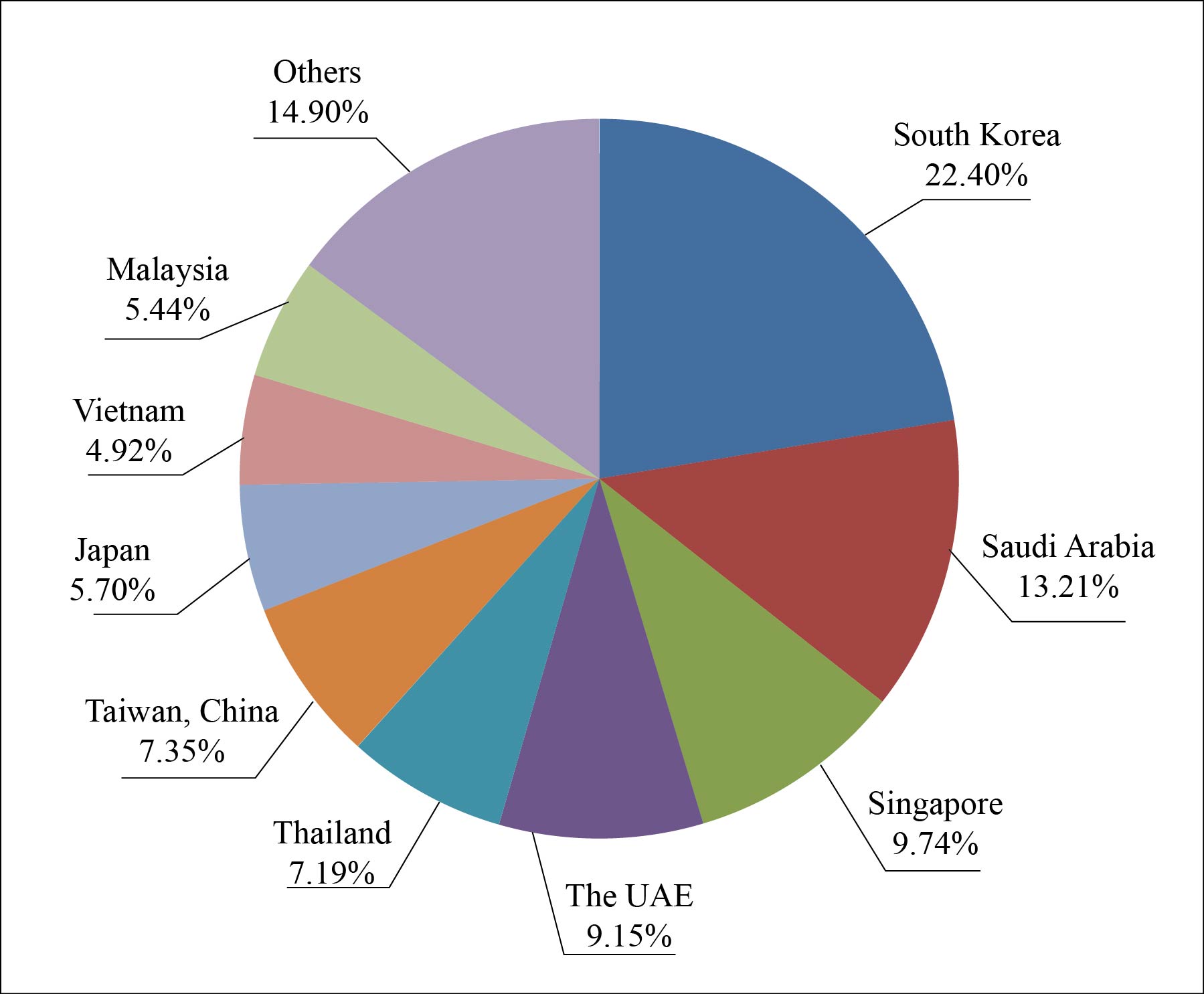

In 2019, polypropylene imported from six major sources grew 7.88% YoY to 2.41 million tons, taking up 69.03% of the nation’s total. The six places were South Korea (781.9 kt, down 1.88% YoY), Saudi Arabia (461.1 kt, up 4.91% YoY), Singapore (339.9 kt, down 0.23% YoY), the UAE (319.5 kt, up 54.45% YoY), Taiwan (256.5 kt, down 1.8% YoY) and Thailand (251 kt, up 33.02% YoY), accounting for 22.4%, 13.21%, 9.74%, 9.15%, 7.35% and 7.19%, respectively, of the total.

Figure 1 Major import sources of polypropylene in 2019

2. Major destinations of imported polypropylene

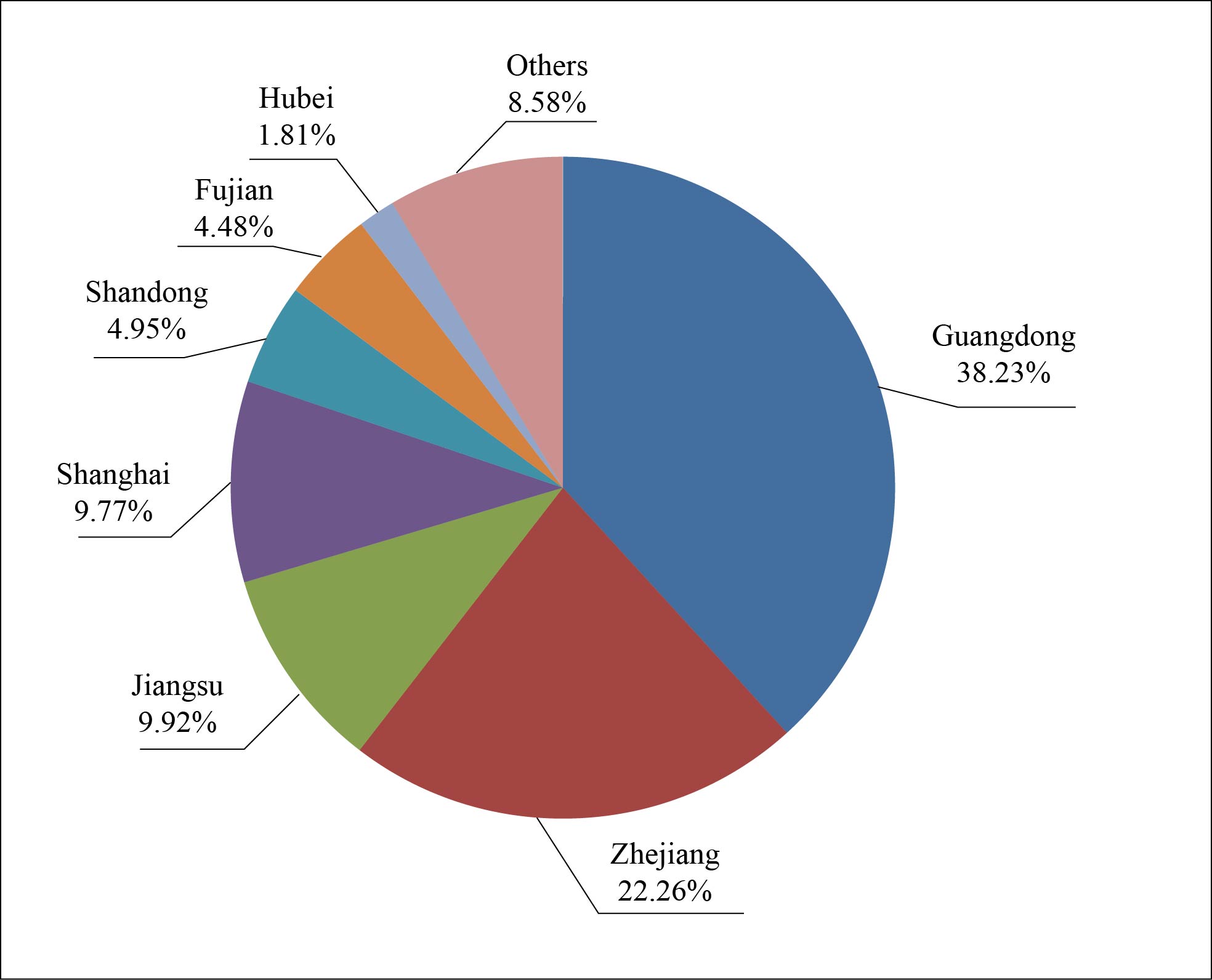

Around 80.19% of imported polypropylene was absorbed by Guangdong (38.23%), Zhejiang (22.26%), Jiangsu (9.92%) and Shanghai (9.77%) in 2019. Combined import volume of the four places reached 2.8 million tons. In detail, import volume of Guangdong was up 2.16% YoY to 1.33 million tons, that of Zhejiang up 33.15% YoY to 777.2 kt, that of Jiangsu down 5.33% YoY to 346.2 kt and that of Shanghai down 8.75% YoY to 341.2 kt.

Figure 2 Major destinations of imported polypropylene in 2019

3. Major modes of import trade

China imported 3.14 million tons (up 7.05% YoY) of polypropylene in 2019 via two modes – general trade (2.08 million tons, up 15.92% YoY) and feeding processing trade (1.06 million tons, down 6.9% YoY). As for their proportions in total import volume, general trade accounted for 59.52%, while the other 30.38%.

Polyethylene import

1. Major import sources

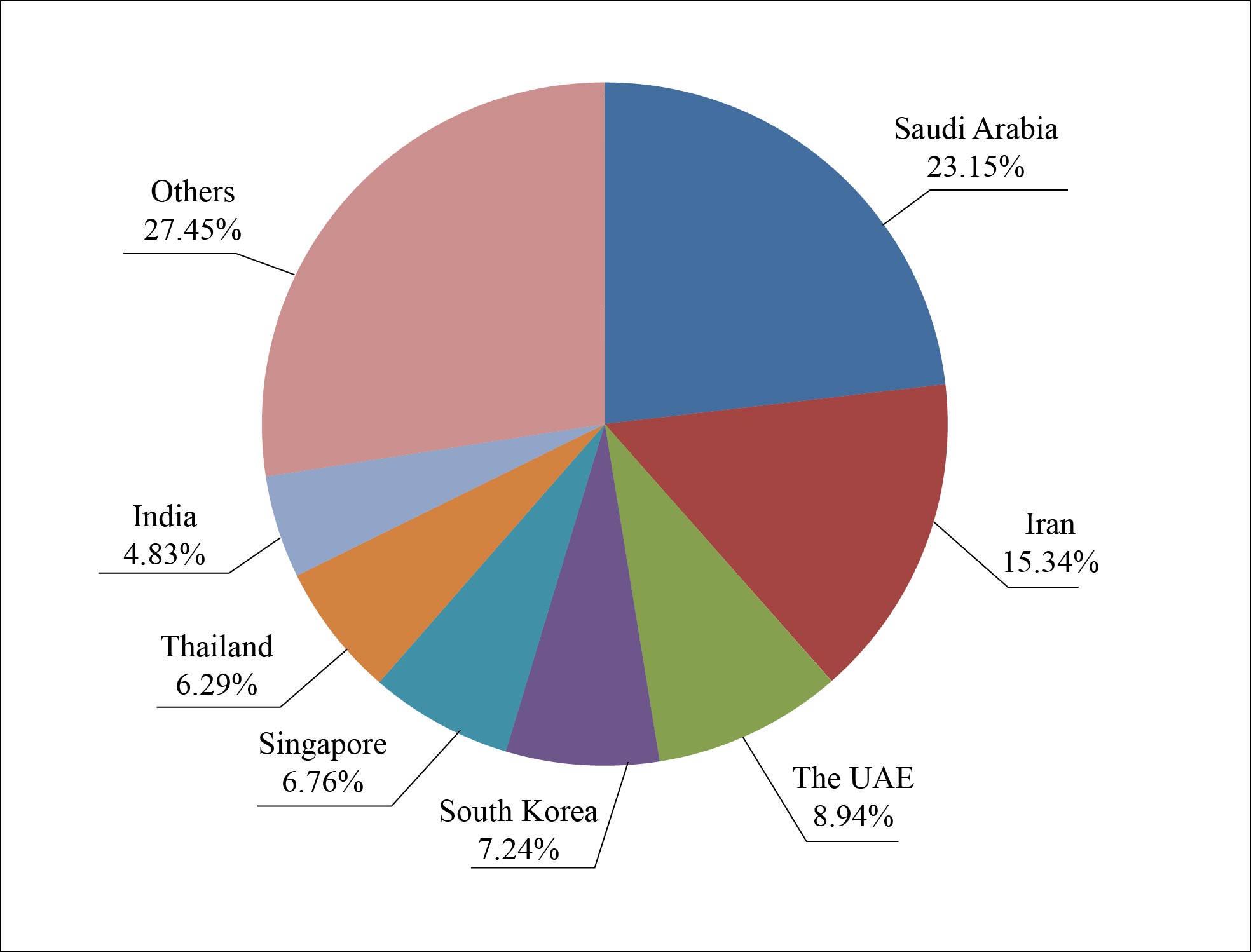

Last year 9.11 million tons (up 20.18% YoY) of polyethylene were imported from Saudi Arabia (3.86 million tons, up 22.49% YoY), Iran (2.56 million tons, up 35.57% YoY), the UAE (1.49 million tons, up 0.52% YoY) and South Korea (1.21 million tons, up 13.47% YoY). Combined import volume from the four sources accounted for 54.68% of China’s total – Saudi Arabia 23.15%, Iran 15.34%, the UAE 8.94%, South Korea 7.24%.

Figure 3 Major import sources of polyethylene in 2019

2. Major destinations of imported polyethylene

Importers from four places imported 11.77 million tons of polyethylene in 2019, up 19.55% YoY and accounting for 70.65% of the nation’s total. The four places were Zhejiang (4.75 million tons, up 39.65% YoY), Shanghai (2.58 million tons, up 17.62% YoY), Guangdong (2.56 million tons, up 3.4% YoY) and Shandong (1.88 million tons, up 5.95% YoY), absorbing 28.51%, 15.48%, 15.37% and 11.28%, respectively, of total import volume.

Figure 4 Major destinations of imported polyethylene in 2019

3. Major modes of import trade

Volume of polyethylene imported via general trade was up 26.61% YoY to 14.08 million tons in 2019, accounting for 84.49% of the nation’s total.

Future development

A large number of new projects will be put into production in the next few years, leading to severer competition. However, domestic demand for high-end polyolefin will rely on imports continually due to product homogeneity. Polypropylene import additions are forecast to fall, while polyethylene import will keep a high average annual growth.

The Middle East will remain the biggest import source of polyethylene, but imports from the US are forecast to grow as the country’s shale gas technology strengthens polyethylene competitiveness greatly.

Polyolefin produced by South Korea, Singapore and Thailand will still be welcomed by Chinese importers, because of rich varieties, stable quality, good use effect, etc. Guangdong, Zhejiang, Shanghai and Shandong will remain major destinations of imported polyolefin.