By Shen Shan, Oilchem.net

Hydrogenated benzene market overview

Motor benzol is one of the products generated in the coal pyrolysis-based crude gas process, and is one of the by-products in coking plants. The refining processes of motor benzol in China mainly consist of acid pickling and hydrogenation. The acid pickling process gives rise to low-purity benzene, and cannot separate toluene and xylene effectively, so a big amount of acid tar is generated without treatment in the production process, which seriously pollutes the environment. In addition, the low product quality, limited yield, and high cost make the process far less competitive than other large-sized refining benzene plants, so the Chinese government has specified that the process will be no longer used while the existing plants will be abandoned within a time limit.

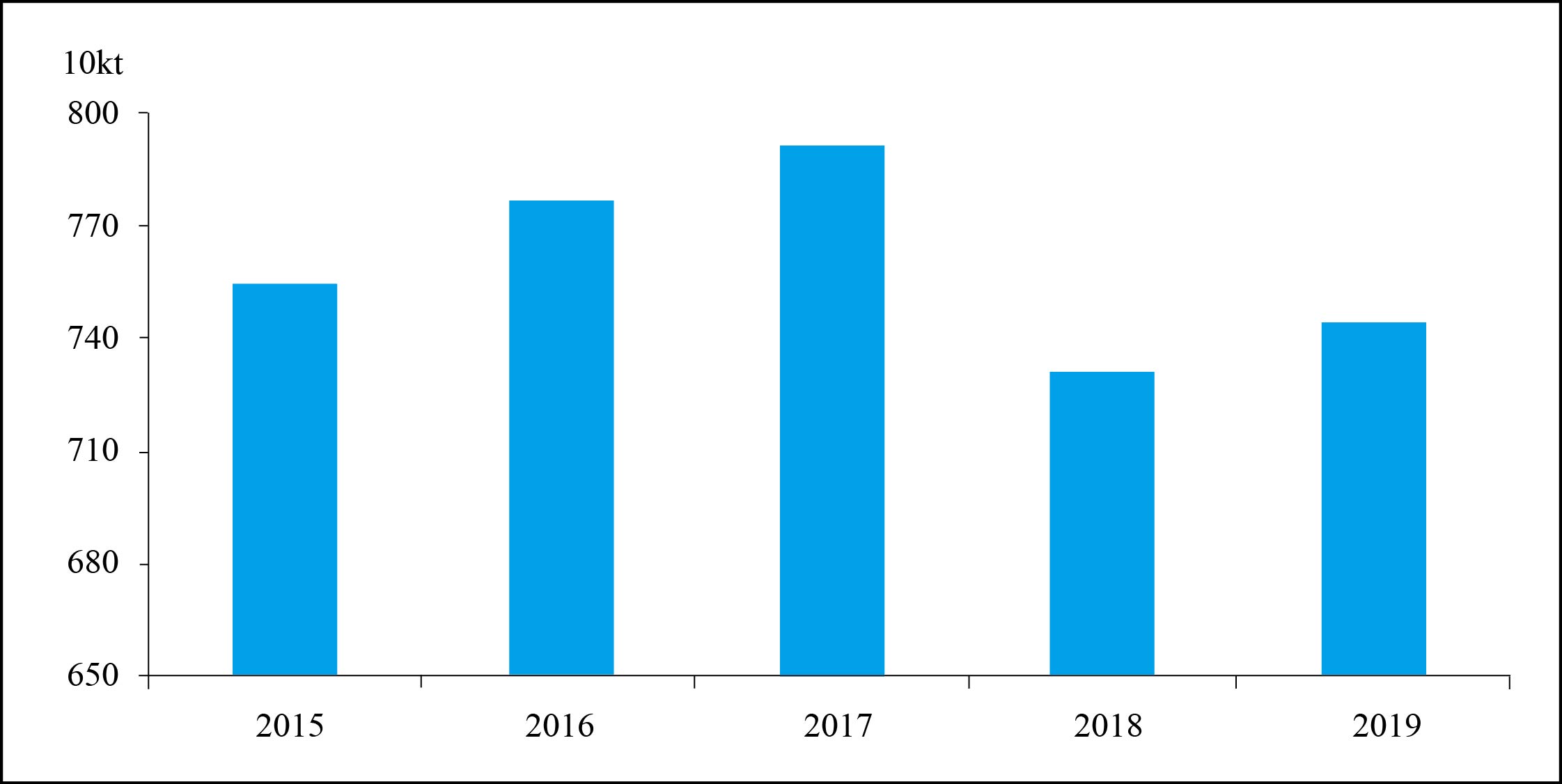

Motor benzol is mainly used in benzene hydrogenation industry. The shortage of benzene supply has spurred up expansion projects of hydrogenated benzene. In 2019 alone, China's hydrogenated benzene capacity reached 7.445 million t/a, 625 kt/a of which were idled. Figure 1 shows the Chinese capacity change during 2015-2019.

Figure 1 Chinese hydrogenated benzene capacity, 2015-2019

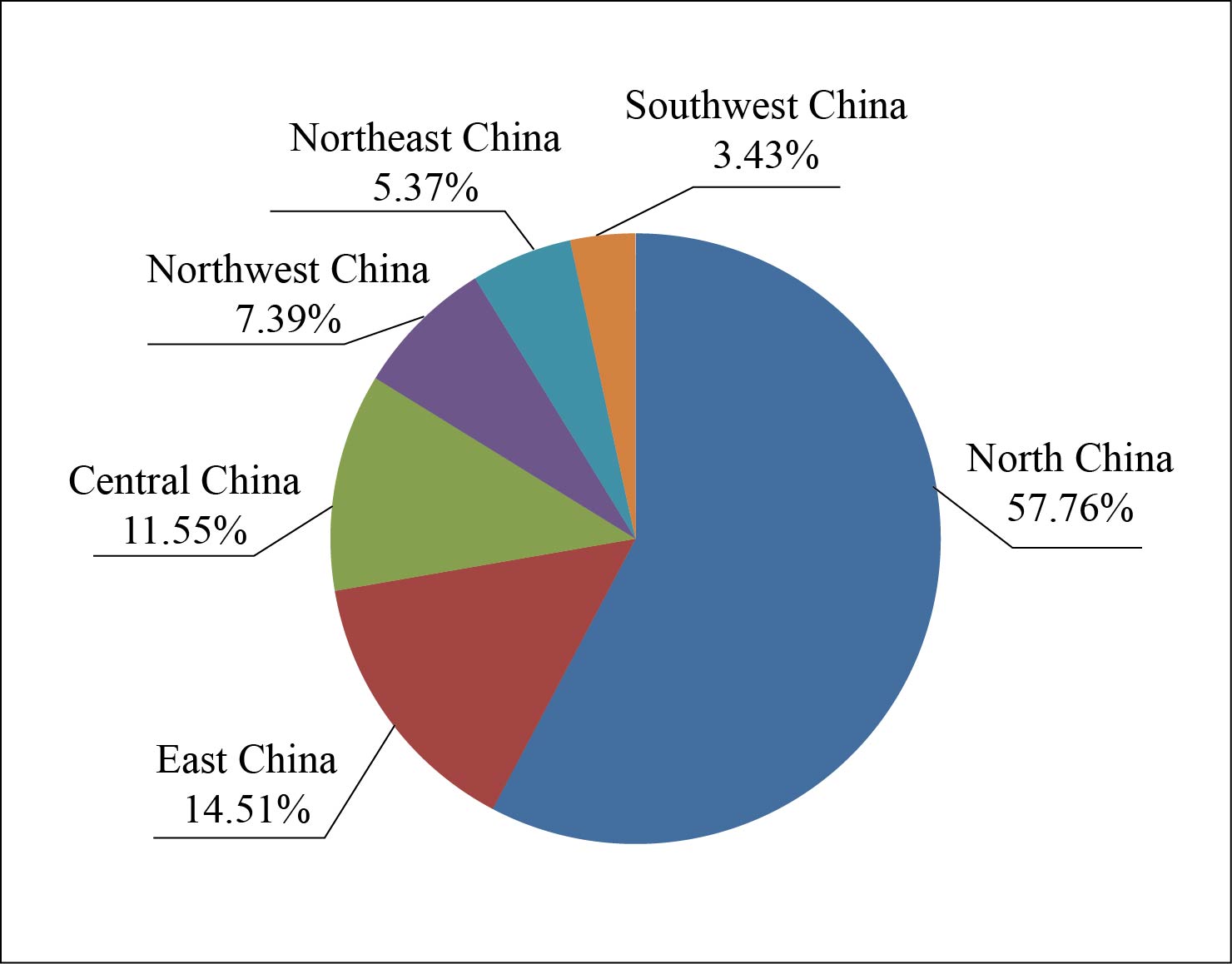

The hydrogenated benzene capacity in China is mainly concentrated in North China, East China, Northwest China and Central China, among which the capacity in North China accounts for 57.76% of the total capacity in China (see Figure 2 for details). At present, hydrogenated benzene plants with a capacity of more than 200 kt/a each are convened in North China and East China.

Figure 2 Chinese hydrogenated benzene capacity distribution by region

Some coking plants have been shut down as an effort to echo the policy of eliminating laggard plants, so the growth rate of motor benzol capacity in China has been slowing down gradually since 2012. In addition, the downturn in steel market leads to increasing supply gluts in the coking market, putting a lid on the capacity expansion. A sharp increase in the coke profit since 2019 has perked up the operation rate of coking plants and thus eased the supply tightness, so hydrogenated benzene producers reported that they could manage their cost. Year 2019 saw the highest profit margin in China's benzene hydrogenation industry, which resulted in a slight increase in raw material inventory and benzene inventory. Table 1 shows the supply and demand of motor benzol in China from 2015 to 2019.

Table 1 Chinese motor benzol supply and demand, 2015-2019 (kt)

Capacity | 2015 | 2016 | 2017 | 2018 | 2019 |

Supply | 4 060 | 4 054.5 | 3 940 | 3 823 | 4 710 |

Demand | 3 997 | 4 232 | 4 115 | 3 900 | 4 450 |

Supply-demand balance | 63 | -177.5 | -175 | -77 | 260 |

Market likely not to be upbeat

The domestic motor benzol market was subdued in 2019. The development trend of benzene hydrogenation industry completely followed that of petroleum benzene, and the main negative factors affecting the market were as follows: first, styrene and benzene at ports of East China was overstocked, resulting in a spree of inventory digestion in the first half of 2019; secondly, with the start-up of large-scale refining and chemical projects, the benzene output in Shandong plants increased sharply, which weighed down on the market trend; thirdly, the operating rate of downstream plants decreased broadly amid environmental issue, with the annual operating rate of hydrogenated benzene plants at about 65% in 2019, so the demand for motor benzol was limited.

Looking ahead to 2020, the elimination of laggard coking capacities will be coming to an end, and the total capacity will not change significantly, with a slight increase expected. However, the public security event is endangering global trade, leading to a plunge in commodity prices. As such, although the capacity of benzene hydrogenation plants is expected to grow, the weakening benzene prices will hamper the operating rates, which will weigh down on the prices of motor benzol. There are many uncertain factors in 2020, such as the economic situation, crude oil, end-user markets and supply, so the motor benzol and hydrogenated benzene markets in 2020 are not likely to be bullish. The prices are expected to stay low in the first half of 2020.