By Zeng Xianfen, Oilchem

Precious metal catalysts play an extremely important role in petrochemical, fine chemical, environmental protection, energy and electronics industries and have become one of the most crucial catalysts due to their high catalytic activity and selectivity, high temperature resistance, oxidation resistance and corrosion resistance. Platinum, palladium, rhodium and ruthenium are most commonly used precious metal catalysts.

Although production started late in China, the domestic precious metal industry has ushered in rapid growth, with capacities and output both registering notable gains, thanks to continuous investment into research and development, and increasing demand from the downstream fine chemical, petrochemical, medicine, environmental protection and fuel cells industries. In recent years, companies that have certain technological advantages in specific application fields have emerged, including Xi’an Kaili, Hangzhou Canan, Shaanxi Rock, Hangzhou Kaida, Zhejiang Metallurgical Research Institute, Shaanxi Kaida and Shanghai Sun Chem.

Precious metal catalysts drive rapid development of fine chemical industry

Precious metal catalysts find wide applications in the fine chemical industry, with the annual consumption volume in China at around 1 000 tons. Chemical raw materials and intermediates are two major consumers. In 2011-2016, the compound annual growth rate (CAGR) of China’s chemical medicine API (active pharmaceutical ingredient) reached 10.54% and it achieved RMB573.5 billion of sales income in 2017. Production of antibiotics (Penem, Moxifloxacin, Aztreonam, etc.), antiviral drugs, a new generation of targeted cancer therapeutic drugs, vitamins, blood lipids, blood pressure lowering and other cardiovascular drugs and treatment of steroidal hormones such as rheumatism and skin diseases all requires a large amount of precious metal catalysts.

1. Penem antibacterial drugs

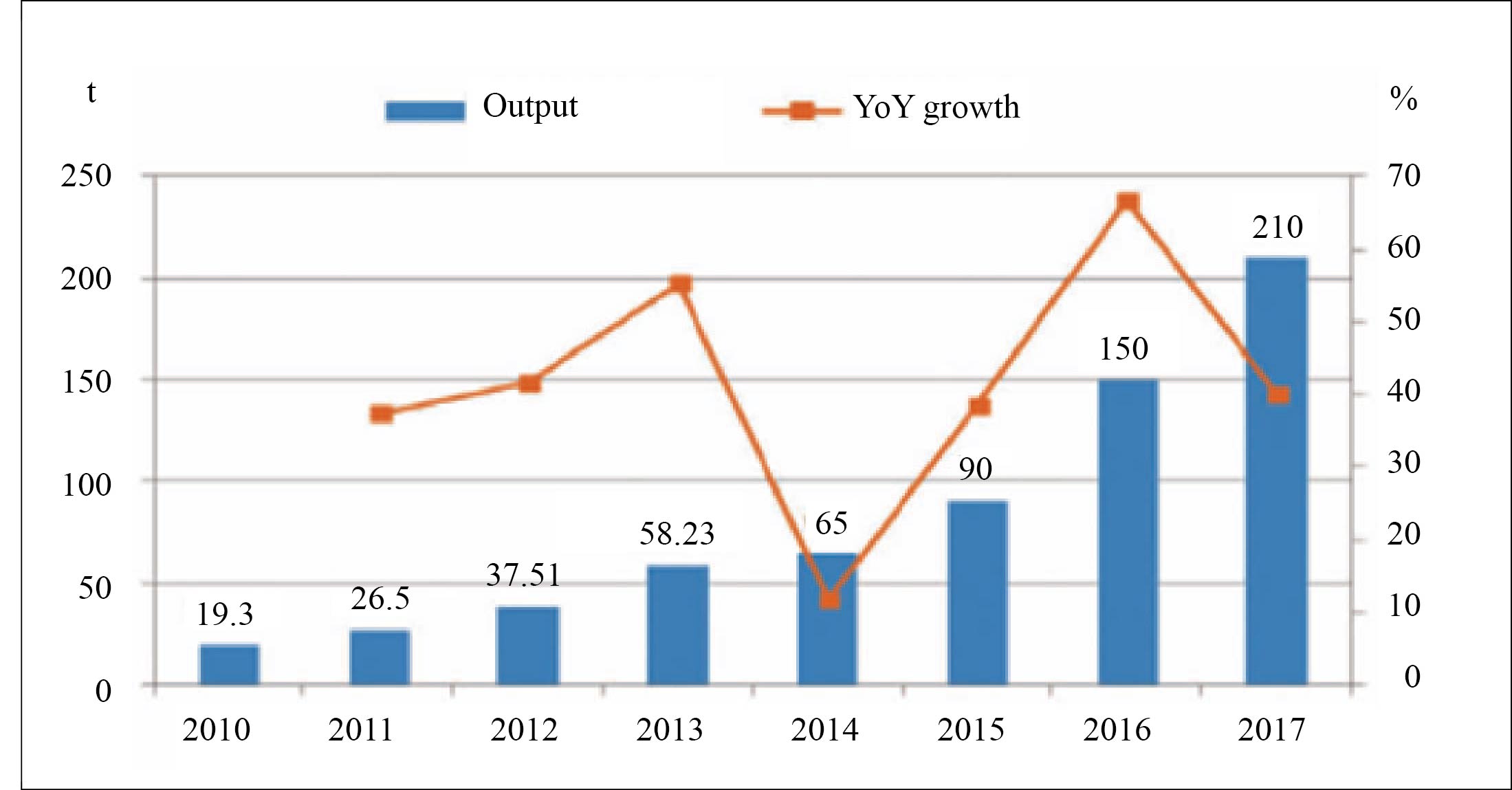

Penem antibacterial drugs are a new class of antibacterial drugs with the most extensive antibacterial spectrum and strong antibacterial activity. In China, the annual growth rate of penem antibacterial drugs sales has reached as high as 32.4% in recent two years. Figure 1 shows changes in China’s meropenem output in 2010-2017.

Figure 1 China’s meropenem output in 2010-2017

In China, Pd/C catalyst used in penem production is mainly provided by Xi’an Kaili and Shaanxi Rock. The former producer, which occupies over 60% of the domestic market share is a major supplier of homogeneous catalyst for penem production.

2. Antiviral drugs

The world annual sales revenue of anti-infective drugs totalled US$108.4 billion in 2015 and will rise to US$183.2 billion in 2021, with CAGR at 7.7% during the period. The production of API for this kind of medicine almost all use precious metal catalysts.

Xi’an Kaili is involved more in the production of catalysts for antiviral drugs. Xi’an Kaili and Shaanxi Rock are major producers of valacyclovir Hydrochloride Pd/C, with the latter taking up a bigger market share.

3. ACEI

ACEI is one of the three major antihypertensive drugs. Almost all API of ACEI use precious metal catalysts, with an annual consumption volume of around 30 tons. Foreign enterprises occupy the market share.

4. Vitamins

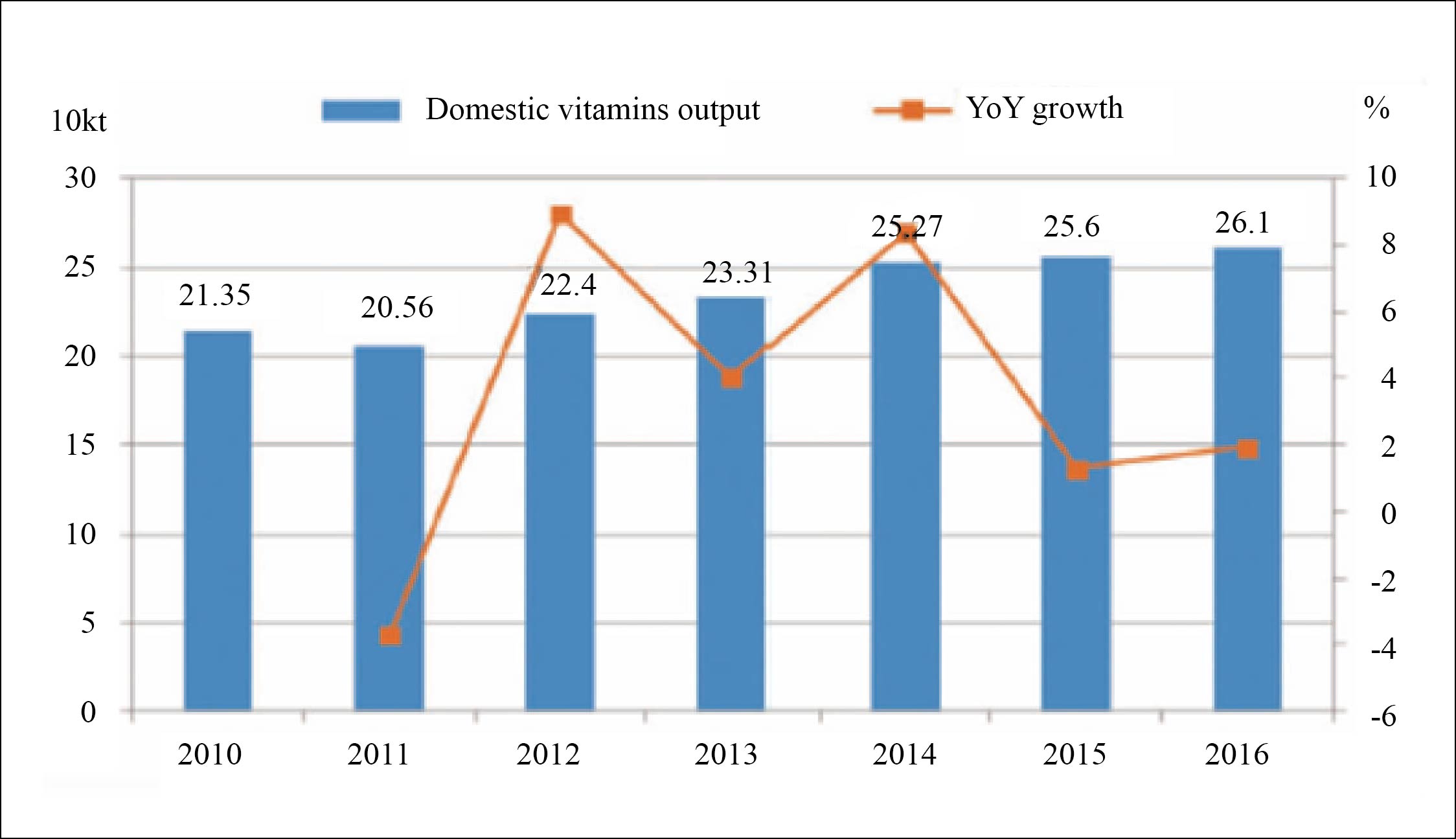

As for catalysts used for biotin and natural VE, Shaanxi Rock grasp a larger market share than other domestic counterparts. Synthetic VE-used catalysts are all made by VE producers themselves. Figure 2 shows changes in domestic Vitamins output in 2010-2016.

Figure 2 China’s vitamins output in 2010-2016

5. Pesticides

Domestic output of chemical pesticides API (100% of active ingredients) stood at 3.778 million tons. Precious metal catalysts are also widely used in the production of pesticides raw materials and intermediates. This is notable the case for a wide variety of new pesticides developed in recent years, such as Coragen, indoxacarb, dicamba, dinotefuran, Topramezone, fluramine, oxazolin, boscalid, bifenthrin.

In the pesticides industry, Xi’an Kaili, Hangzhou Canan and Shaanxi Rock outperform others in precious metal catalysts. Xi’an Kaili takes up a bigger share in several new pesticides.

6. Dyes and pigments

China’s total dye production capacity reached 1.33 million t/a in 2016, with a year-on-year growth rate of 5.6%. By 2021, the sales income of the domestic dyeing industry is expected at RMB124.6 billion, with an average annual growth rate of 6-8%. Among the catalysts for the production of pigment intermediates, Xi'an Kaili and Hangzhou Canan stage outstanding performances, especially the yellow pigment intermediate DCB catalyst, which can only be produced by Xi'an Kaili and Hangzhou Canan.

7. Flavors and fragrances

The synthesis of flavors, fragrances and their intermediates mainly involves selective hydrogenation reduction, especially the selective hydrogenation of α, 'β-unsaturated aldehydes and ketones, in which previous metal catalysts display good selective hydrogenation properties, and is widely applied in the production of flavors and fragrances. The market is mainly dominated by overseas products

8. Others

Precious metal catalysts used in rosin products are partially imported, while Xi’an Kaili and Hangzhou Canan also cover a relatively large market share. The catalysts required for the production of doxitard are produced by producers themselves.

Moxifloxacin Pd/C catalyst is mainly produced by Xi’an Kaili and Shaanxi Rock and the former grasps a bigger market share.

In recent years, the global market size of targeted drug s, tinib small molecule inhibitors, has been expanding at a CAGR of 10%. Xi'an Kaili is closely following the progress and has obvious advantages in the production of small molecule anti-tumor drugs.

Vast market potential

Assumptions and Countermeasures of Fine Chemical Industry Development in 2017-2025, completed under the guidance of the Chemical Industry and Engineering Society of China (CIESC) puts forward that the output value of China’s fine chemical industry to the total domestic chemical industry was only 48% in 2016 and is expected to rise to 55% by 2025. Precious metal catalysts are used in almost all fine chemical industries and the rapid development of the latter is poised to provide a huge potential for the former’s development.

As China’s environmental and energy-saving requirements become increasingly stringent, the production process of fine chemical products is bound to develop into a green and environmentally friendly process. This brings more room for growth in the application of precious metal catalysts. Waste water and waste gas treatment in the fine chemical industry also provides new requirements for precious metal catalysts applications.

In addition, the rapid development of new chemical materials, such as fluorine materials, silicon materials, high-end fibers, liquid crystals, OLEDs, and biodegradable materials will open new markets to and certainly boost the demand for precious metal catalysts.

At present, China imports around 100 tons of precious metal catalysts for the use in fine chemical industry. In particular, some high-end catalysts have not yet been able to achieve stable mass production. The development of China’s precious metal catalysts still has a long way to go.