Dr. Kai Pflug, Management Consulting – Chemicals (kai.pflug@mc-chemicals.com);

Daniel Philip Senger, CDI Global (daniel.philip.senger@cdiglobal.com)

China’s GDP growth rate in the third quarter of 2019 was 6.0%, the lowest rate since 1992, with the manufacturing sector the biggest drag on growth. Several factors have led to the economic slowdown, including the ongoing trade conflict between China and the United States and the weakened automotive demand. For the chemical industry, uncertainty has been highlighted by tightening environmental regulations. While this will ultimately improve industry standards, it has created another negative factor, weighing on short to medium term performance.

In this situation, one would expect foreign chemical investment in China to suffer. However, the recent past has seen the announcement of some massive projects by leading global chemical players.

BASF, arguably the world’s largest pure chemical company, has been leading the way. At its Nanjing site, the company’s joint venture with Sinopec, will add a second cracker and other facilities, with an investment of about US$4 billion.

BASF, in an even bolder move, will invest US$10 billion in Zhanjiang, Guangdong province, a project that was officially launched in November 2019. The Verbund project will initially include plants to produce engineering plastics and TPU, followed by steam cracking units with an annual production capacity of 1 million tons of ethylene and more than 30 production units that offer downstream products such as petroleum refining byproducts, chemical products and chemical byproducts.

ExxonMobil in September 2018 signed a cooperation framework agreement with the Guangdong government for building a 1.2 million-tons-per-year ethylene flexible feed steam cracker, two PE lines and two differentiated PP lines. Total investment is estimated at around US$10 billion.

LyondellBasell in September 2019 signed a memorandum of understanding for a 50:50 JV with China's Bora Enterprise Group to invest in a petrochemical complex in northeast China. Products include PE (800 kt), PP (600 kt) and styrene (350 kt), with an estimated investment of US$12 billion.

Solvay just expanded its R&D center and specialty plastics production in China. Ilham Kadri, the CEO of Solvay, stated that “Even if GDP has slowed, there is much growth to come from China…The ease of doing business is improving year-on-year.”

While these massive capital outlays may seem counterintuitive, there is a clear rationale for these investments given by the individual companies.

BASF predicts that China’s share of the global chemical market will increase from its current approximately 40% to 50% in 2030. Yet in 2018 BASF only had slightly above 7% of its workforce located in China, and sales accounted for only 11.6% of its global total. This clearly indicates that given its claim to be a truly global chemical player, BASF is still underrepresented in China.

Another reason for BASF’s investment decision is the change in regulation, which now allows full foreign ownership of petrochemical facilities in China (these were previously only allowed in joint ventures with domestic companies). According to Mr. Brudermueller, the CEO of BASF, this both speeds up decision making and alleviates the fear of utilizing core technology in China.

ExxonMobil expects its new facility to help meet demand growth for chemicals in China. Indeed, while 6.0% GDP growth is low by Chinese standards, it is still much higher than the 1.9% GDP growth achieved in the USA in the third quarter of 2019, or the 0.2% growth achieved in the Euro zone in the same period. In a press release, ExxonMobil also emphasizes the alignment between the investment and China`s national goals: “[The investment will] support progress toward China’s national petrochemical development priorities, which include self-sufficiency, diversified feedstock sources, rebalancing fuels versus chemicals and advancing new competitive technology”.

LyondellBasell’s CEO Bob Patel gave a succinct rationale for his investment in China: “China is the largest, fastest growing market in the world for our core products.”

For all these companies, another likely reason for their China investment is the strong China growth in important chemical markets such as automotive, electronics and new energy vehicles. Given the current developments and market size, China may well become the dominant global market for these industries. Clearly, leading global chemical companies aim to remain suppliers to these markets.

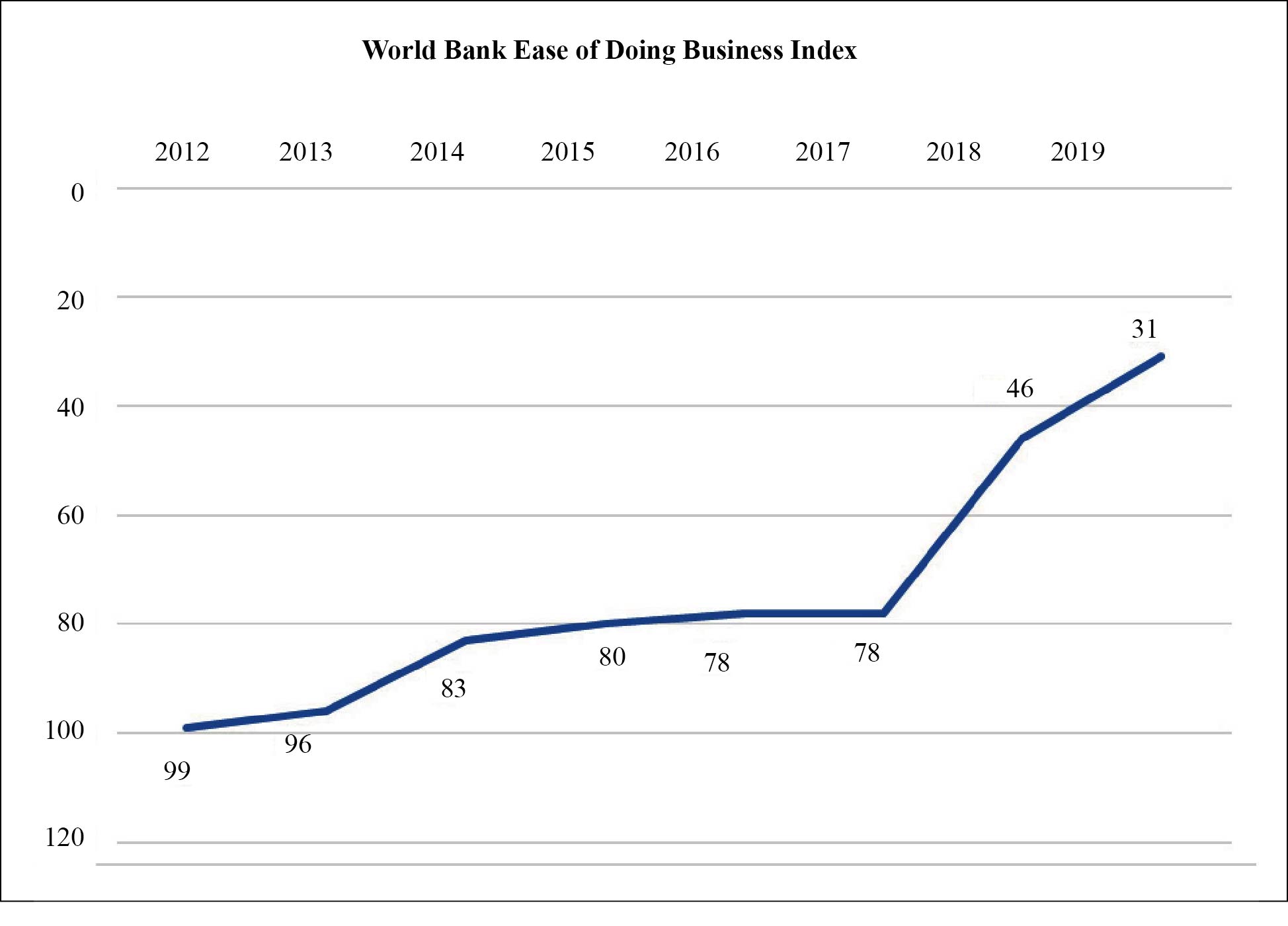

An additional factor – already highlighted above by the CEO of Solvay – is that it is getting easier and easier to do business in China. In the World Bank Doing Business Index, China’s position has constantly improved in the past few years. From 2017 to 2019 alone, China moved from position 78 to position 31. China was also among the 10 countries listed by the World Bank that improved the most in their ease of doing business score from 2018 to 2019 (Fig. 1), as the country carried out eight business reforms during the 12 months to May 2019.

Figure 1 China in the World Bank Doing Business Ranking by year (1= best rank )

According to Martin Raiser, World Bank Country Director for China, “China has undertaken substantial efforts to improve the domestic business climate …, maintaining an active pace of reforms,” adding “Laudable progress has been achieved on a number of Doing Business indicators.” Indeed, China’s ease of doing business now outranks France (32), Switzerland (36), Netherlands (42), Belgium (46), India (63) and Vietnam (70), and is only slightly behind Japan (29).

Why do chemical companies not invest in India at the same scale, despite recent good growth of chemicals in India? One reason is simple. India’s chemical market is still much smaller than China`s, reaching only Euro 101 billion in 2017 compared to China’s Euro 1 293 billion, or less than 8% of China’s market (source: CEFIC). It is true that India`s chemical market has potential for further growth – in November 2019, the Indian Union minister for chemicals and fertilizers Sadananda Gowda claimed that the chemical sector has the potential to contribute over US$300 billion to GDP over the next five years. However, to reach this figure, an annual growth rate of 15% would have to be achieved between 2017 and 2024 – probably too optimistic a forecast. And even if this growth rate is achieved, the Indian market in 2024 would be only about 20% the size of the Chinese market in 2017.

For multinational companies looking beyond organic growth, the environment for mergers and acquisitions (M&A) is enticing as private Chinese chemical companies are increasingly becoming available for sale due to industry consolidation, capex requirements, or ownership generational handover. Some of these companies – particularly in specialty chemicals - need the management and technical expertise to grow their business both onshore and offshore, which international companies can surely provide.

Any activities of multinational chemical companies will be supported by China’s new Foreign Investment Law, which arguably will greatly improve the business environment for foreign investors. The law, which will come into effect on January 1, 2020, stipulates that foreign companies investing in China can participate in the market on an equal basis. It obliges the government to keep confidential any trade secrets of foreign investors. The new Foreign Investment Law was passed in just three months – an unusually quick turnaround for Chinese legislation, where similar laws often take several years. Some reports suggest that the Law’s quick approval was an attempt by the Chinese government to respond to international criticism about China’s lack of openness to foreign businesses.

As a consequence of the improved regulation, the most recent investments and the huge market, China is likely to become the most modern and cost-efficient production site for chemicals in the world. Therefore, it is doubtful whether any global chemical player can afford to stay away from China, a country that according to BASF will soon be responsible for half of the world’s global chemical production.