By Zheng Jiebin, China Chlor-Alkali Industry Association

Industry develops stably

The production of domestic epichlorohydrin (ECH) began in the 1960s. The development speed was fast at the beginning, and then became relatively stable in recent years. As the scale of domestic chlor-alkali plants continues to increase, as an effective chlorine-consuming product, the new capacities of epichlorohydrin are mainly established at places close to chlor-alkali enterprises.

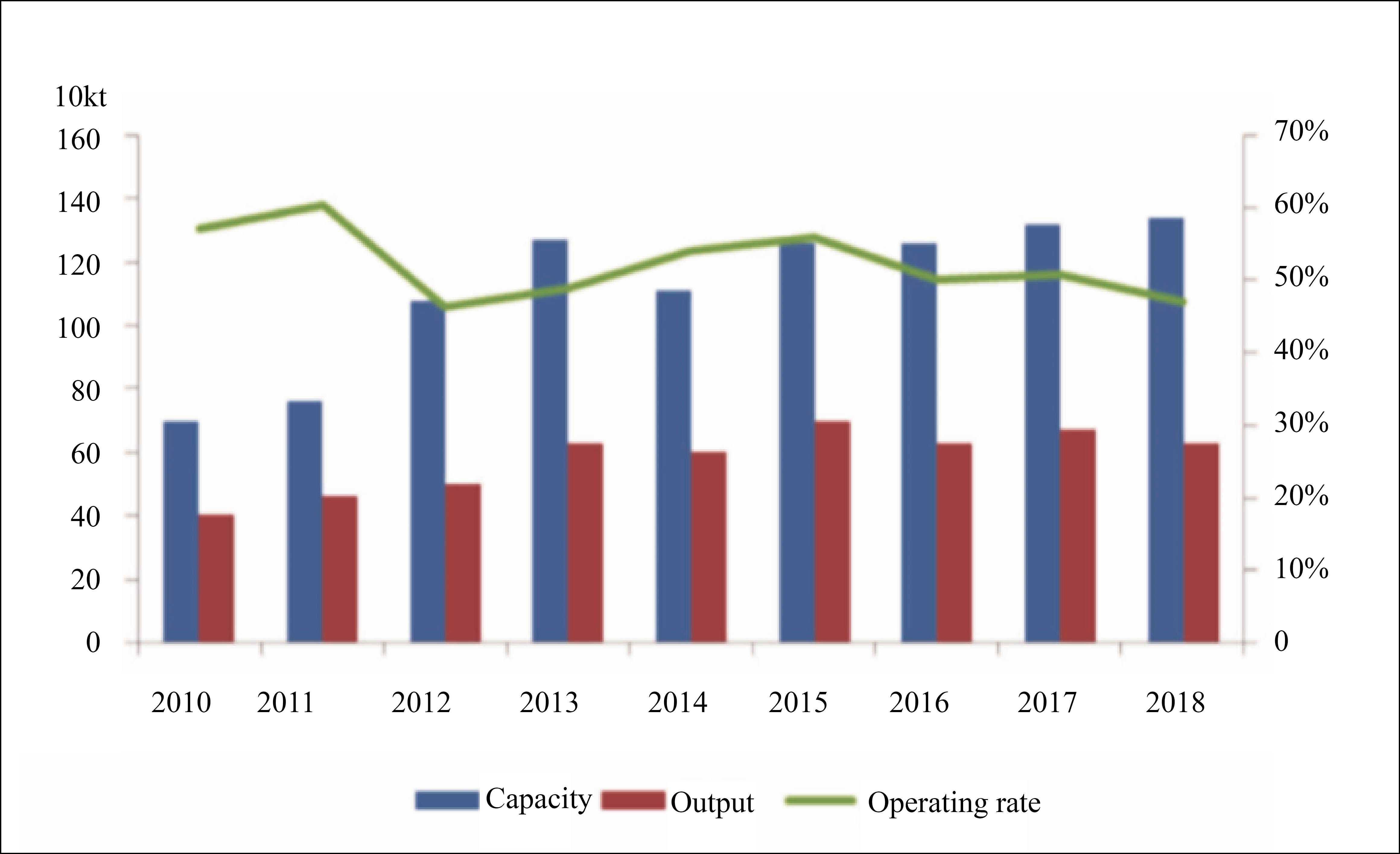

In 2018, China’s total capacity of epichlorohydrin was 1.34 million t/a, and there were more than 20 production enterprises, mainly located in Shandong (41%), Jiangsu (38%), Hebei (11%), Zhejiang (9%), and Hunan. Among them, the propylene-routed capacity was about 610 kt/a (46%), and the glycerin-routed capacity was about 730 kt/a (54%). The capacities, outputs and operating rates of epichlorohydrin in China are shown in Figure 1.

Figure 1 Capacities, outputs and operating rates of epichlorohydrin in China, 2010-2018

In 2018, the overall operating rate of the industry is about 47%, and the operating rate of the glycerin process is slightly higher than that of the propylene process. Glycerol routed lines’ raw material, refined glycerin, was mainly from imported crude glycerin refining, imported refined glycerin and biodiesel by-product glycerin refining. The operation of domestic crude glycerin refining enterprises has been affected by the strengthening of environmental protection supervision and law enforcement, and the tight supply has also caused a shortage of industrial glycerin supply. At present, the glycerol route still dominates the production of epichlorohydrin.

Epichlorohydrin has many downstream industries, but about 90% goes to epoxy resin. The other derivatives have small demands and are widely distributed. In 2018, the national epoxy resin capacity exceeded 2 million t/a, but the industry concentration is not high, and most production enterprises have a capacity of less than 20 kt/a. The capacities are mainly in East China, with Jiangsu and Anhui provinces producing more than 70% of the total. The large-scale epoxy resin producers have rich product categories, and the products are mainly based on liquid basic epoxy resin. The operating rate of China’s epoxy resin manufacturers has been declining due to the environmental protection policies in recent years, and the industry as a whole is still in a situation of oversupply. With the slowdown in demand growth from the downstream industries, the development of the epoxy resin industry is expected to be relatively stable in the future.

Market trend looks good

China's biodiesel producers are mostly small private enterprises, mainly distributed in Shandong, Hebei, Jiangsu and Zhejiang regions. Biodiesel capacity utilization has been at a low level. Since 2015, with the increasingly strict environmental protection requirements, the stable production of industrial refined glycerin has been influenced. The supply of glycerin is insufficient, hence largely restricting the production of glycerin-routed epichlorohydrin. The spot supply of epichlorohydrin tends to be tight on the market.

With the rising prices of propylene and the impact of environmental taxes, the production cost of propylene-based epichlorohydrin increased, which, however, also benefited the market of epichlorohydrin. Following the sharp rise in the market prices of epichlorohydrin in 2017, the market is likely to show a slight reversal in the next two years. However, with the support of high raw material costs, the market is unlikely to have a large decrease.

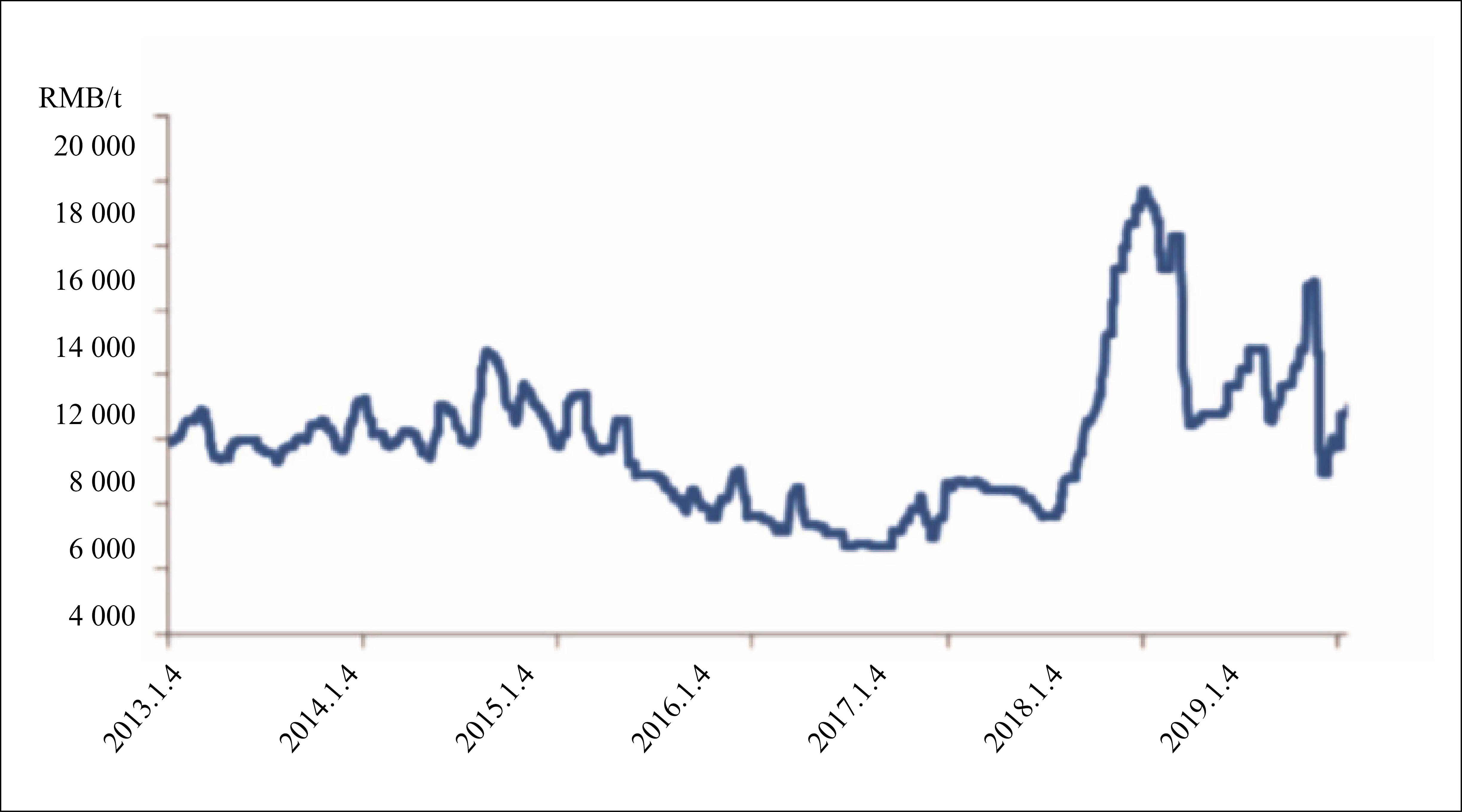

The domestic epichlorohydrin market has been rising sharply since mid-May this year, reaching a new high of the year. Since the beginning of this year, the cumulative increase in prices has been as high as 50%, and the profitability has increased significantly. The average price trend of China's epichlorohydrin from 2013 to 2019 is shown in Figure 2.

Figure 2 The average price of China's epichlorohydrin from 2013 to 2019

As the prices of epichlorohydrin continue to rise, downstream industries’ profit margins keep narrowing. At the same time, due to factors such as safety production and environmental protection, some downstream enterprises have curtailed their production or shut down the units. The overall demand from epoxy resin industry is relatively weak, which is difficult to be changed in the short term. In addition, due to the increase in the prices and profits of epichlorohydrin, the enhanced enthusiasm in new and expanded capacity will lead to a new wave of expansion.

Future development

As the only consumer of epichlorohydrin, the development of epoxy resin industry directly determines the future development of epichlorohydrin. The epoxy resin industry is going to face the problem of overcapacity, and the average operating rate of the industry is not high. It is expected that the development of epoxy resin will gradually ease in the future, and the demand growth for epichlorohydrin will also slow down. The epichlorohydrin producers need to expand into other application areas and actively explore the international market.

Integration of upstream and downstream. To accelerate the construction of epoxy resin together with the raw material lines so as to form integrated production and improve the competitiveness of the capacities.

Broaden the application of intermediate products. Actively develop and produce intermediate products such as acryl alcohol and propylene chloropropene to enhance their ability to withstand market risks.

Broaden the applications other than epoxy resin. Sectors like chlorohydrin rubber, glycidyl methacrylate, specialty adhesives, and polyepichlorohydrin resins should be vigorously expanded.

Going to the international market. Increase export efforts and implement scaled operations at the same time to resolve the excess capacity.

Reduce the cost and improve the quality. Strengthen scientific management, attach importance to energy conservation and emission reduction and environmental protection, solve the problem of saponification wastewater treatment, realize the effective use of by-products such as calcium chloride or sodium chloride, reduce costs and improve product quality.

Develop new green processes. Low-grade glycerol synthesis and propylene / chlorine / hydrogen peroxide one-step synthesis will have great economic potential.