By Zhang Jie, OilChem

Given the serious shortage of potassium resources, China relies heavily on potassium chloride imports. However, the combination of imports and domestic production leads to a prominent problem of potash fertilizer supply excess. As the downstream compound fertilizer plants continue to reduce the consumption amount of fertilizer for ordinary fields, the demand for traditional potash fertilizer is also decreasing. The situation is not optimistic.

The main variety of potash fertilizer is potassium chloride, and meanwhile, potassium sulfate has emerged in recent years. The consumption of other potash fertilizers such as potassium magnesium sulfate and potassium nitrate is not high. Domestic potassium resources are mainly concentrated in Qinghai, and Qinghai Salt Lake and Geermu Zangge are the main potassium chloride producers. Internationally, Canada, Russia, Belarus, Israel, Jordan and Laos all enjoy widely distributed potassium resources, which are also China’s major potash fertilizer import origins.

In terms of potassium sulfate, China is in a state of self-sufficiency and the supply is even enough for export. Potassium sulfate products are divided into two types by different processing routes, namely, resource-based potassium sulfate and processed potassium sulfate. The resource-based potassium sulfate products are concentrated in Xinjiang and Qinghai. The country's largest producer of potassium sulfate, SDIC Xinjiang Lop Nur Potassium Salt Co., Ltd., has a capacity of 2 million t/a. The plants with processed potassium sulfate are distributed in various regions of the country, mainly based on the Mannheim production process introduced from Germany, with potassium chloride and potassium sulfate as the main raw materials.

From the perspective of domestic potash production capacity distribution, potassium chloride products are mainly produced in Qinghai, while resource-bases potassium sulfates are also in Xinjiang and Qinghai, leaving only Mannheim potassium sulfate plants spread all over the country. Among them, North China has the largest production capacity, accounting for 22.5% of the country's total, followed by Central China, East China and South China. Although North China has the largest proportion, many of the plants have not resumed production after the backward capacity had been eliminated. The average annual operating rate in the region is between 50-60%.

Market trend in the first half of the year

Potassium chloride: price heading south

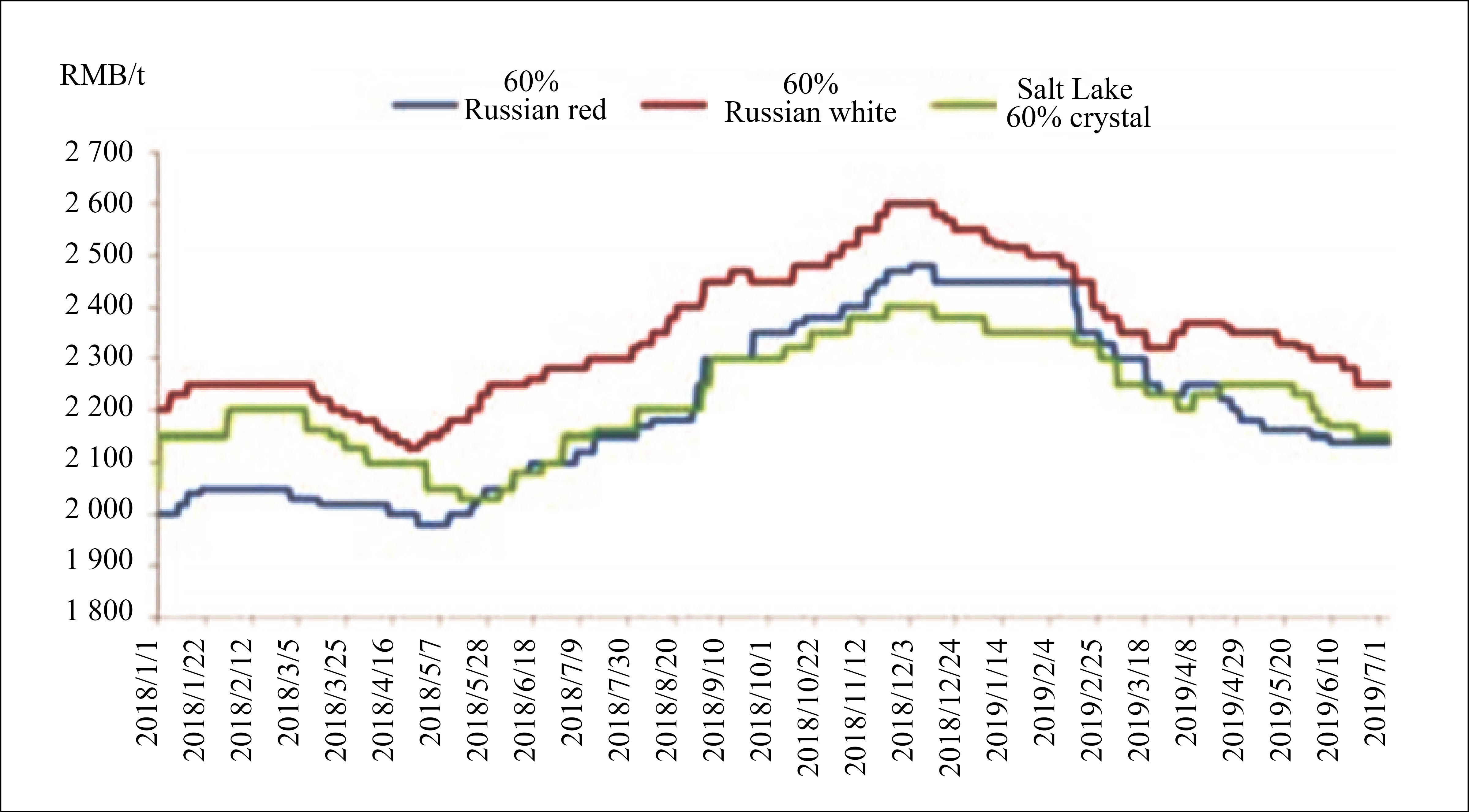

From the domestic potassium chloride price chart (Figure 1), it can be seen that the price of potassium chloride reached a high point in December 2018, and then started to fall at the beginning of this year. Among them, 62% white potassium market’s decline was the hugest one, all the way down from the end of last year's RMB2 580-2 600 / t to the current RMB2 230-2 250 / t, a drop of RMB350 / t.

Figure 1 China’s potassium chloride market prices, 2018-2019

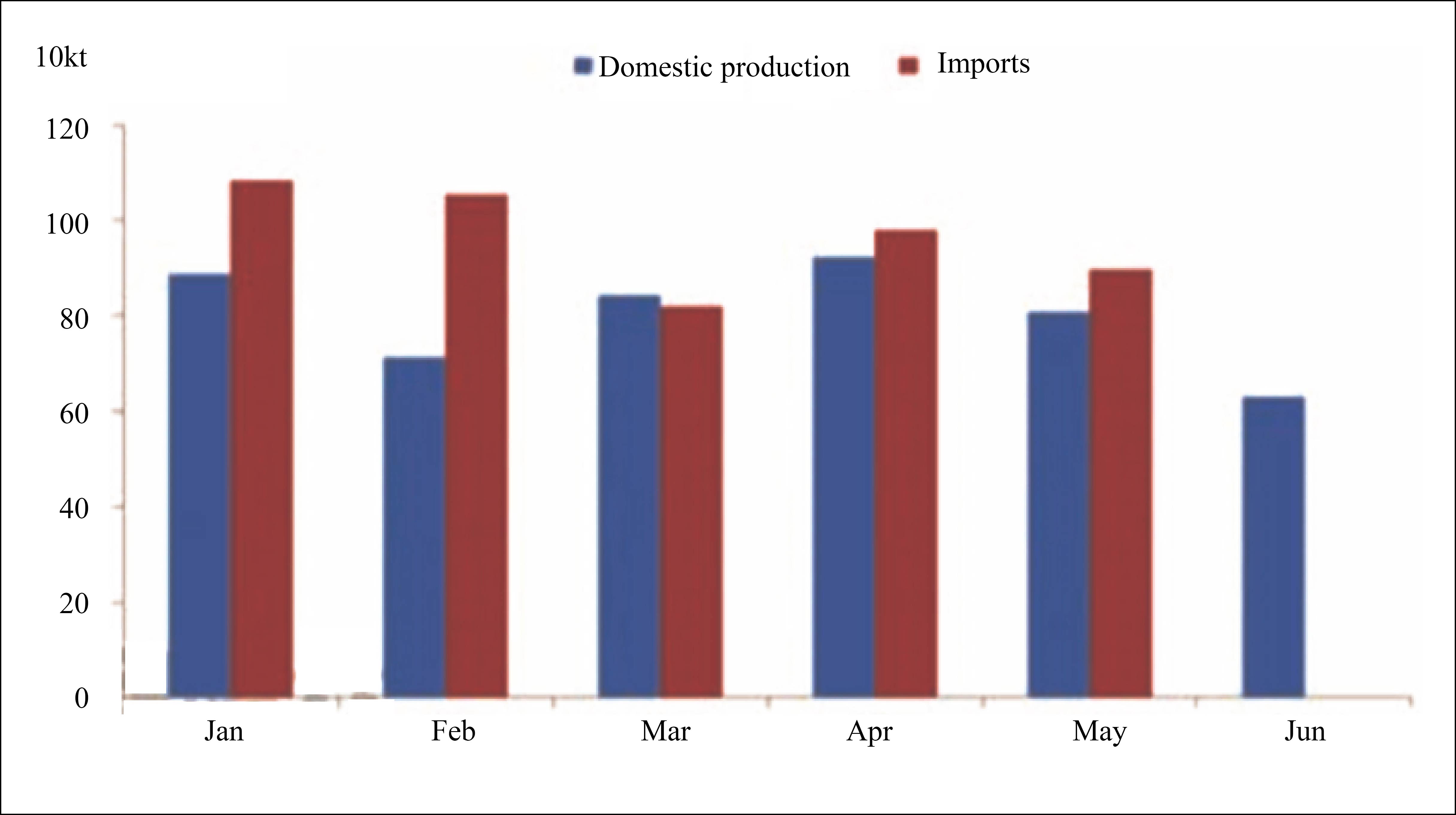

The supply of potassium chloride in China (Figure 2) shows that domestic production in the first half of this year was 4 794 100 tons, an increase of 14.33% compared with the same period last year. However, the output has decreased drastically since May. In the first half of this year, the import of potassium chloride increased greatly. The total import volume from January to May reached 4 830 800 tons, an increase of 17.4% over the same period last year. In general, the domestic supply of potassium chloride is always at a high level, resulting in an unbalanced fundamental.

Figure 2 Domestic production and imports of potassium chloride, January to June 2019

From the perspective of shipping and imports in the first half of this year (Table 1), the import volume via land transport was relatively small. The total import volume of border trade during January to May was 442 000 tons, compared with the total import volume of 583 000 tons in the same period last year. There is a reduction of 141 000 tons and a year-on-year decrease of 24.19%. The supply of seaborne shipments was relatively sufficient. The port inventory showed that the domestic inventory of potassium chloride was at a high level this year, and the average port inventory was around 2.8 million tons. As of the end of June, the total inventory of China's top ten ports was 2.97 million tons. Compared with 2.02 million tons in the same period last year, the growth rate was as high as 46.97%.

Table 1 China’s potassium chloride imports in 2019 (kt)

Month | Import | By land | By sea |

January | 361.8 | 150.5 | 211.4 |

February | 1 052.8 | 79.2 | 973.6 |

March | 817.0 | 84.7 | 732.3 |

April | 979.1 | 64.3 | 914.8 |

May | 895.0 | 63.4 | 831.6 |

Potassium sulfate: market prices soared suddenly

The potassium sulfate prices turned up at the end of April and early May. The Mannheim 52% water-soluble potassium sulfate had the biggest increase, and the price of SDIC Xinjiang Lop Nur Potassium Salt was relatively low. The main reason was that the price of Lop Nur Potassium Salt started higher. In the case of poor sales, Lop Nur Potassium Salt gave traders a greater discount, and in order to compete for market shares, traders sell at the rebate discount prices. However, Mannheim routed products were benefiting from the surge in demand for water-soluble fertilizers this year. The state began to control the use of field fertilizers, while water-soluble fertilizers were less polluting, and the profits were high. Therefore, most factories began to shift to water-soluble fertilizers, which greatly pushed up the demand for Manheim routed full-water-soluble 52% potassium sulfate.

Exports are another reason for the improvement in the potassium sulfate market. At the beginning of this year, the export tariffs of potassium sulfate were eliminated, greatly increasing its export volume. From January to May, the total export volume of potassium sulfate was 145 600 tons, while the export volume in the same period last year was only 2 600 tons, an increase of 5 500%. The exports were mainly shipped to Southeast Asia and Iran. Although the export volume of potassium sulfate began to decrease in June, there were still export orders, for both resource-based potassium sulfate and Mannheim routed potassium sulfate.

The operating rates of potassium sulfate plants have been relatively high this year; and the inventories of the factories have been relatively low, with 52% full water-soluble potassium sulfate as the major products. The sales were smooth.

Judging from the supply and demand situation in the market, the domestic potassium sulfate market was in a relatively balanced state. The Tobacco biddings in southern regions started to begin at the mid of the year, which has become strong support for resource-based potassium sulfate. It is expected that prices will be adjusted up. However, Mannheim routed potassium sulfate is expected to remain at a high level in the short term, given that the new orders are sufficient and the sales large.

Potash fertilizer market forecast for the second half of the year

Potassium chloride: Seen from the current market situation, the production of high-phosphorus fertilizers in the fall is the mainstream. Although there will be a certain amount of demand for potassium chloride, the total amount will not be too large. In the case of the excessive supply of potassium chloride in China, it is expected that the possibility of significant improvement will be slim. The market prices of potassium chloride are already near the costs of traders; hence the room of sharp fall is also limited.

Potassium sulfate: Potassium sulfate enjoyed good market in the first half of the year. However, with the decreases in potassium chloride prices and the approaching end of robust downstream demand for the water-soluble fertilizer, Mannheim routed products are not likely to be optimistic in the second half of the market. At present, the prices of resource-based potassium sulfate are low. Since the Tobacco biddings in southern regions and downstream compound fertilizers’ autumn peak season have started, the resource-based potassium sulfate products’ prices tend to increase.