By Wang Shikui, China National Chemical Information Center

China’s ammonium phosphate prices kept falling in the first quarter of 2019, with the prices ending the quarter with monoammonium phosphate (MAP) a little rebounding and diammonium phosphate (DAP) stepping down. DAP prices fell further at the end of June, a decline of RMB100/t year on year, while MAP prices bottomed out gradually.

Ammonium phosphate prices towards opposite direction

DAP market

Domestic DAP prices were largely soft at the beginning of January, but some producers kept offers firm as they were fulfilling export orders. Deliveries in northeast China were cut by nearly 40% compared with the past few years. At the end of the month, trades became subdued and thus prices fell back. Ex-works (EXW) prices of 64% DAP in Hubei were at RMB2 750-2 800/t and deals could be notionally done at RMB2 700-2 750/t.

From February 1 to February 20, traded prices in northeast China fell while the prices in north China were remained stable. Some DAP producers trimmed operating rates or shut units down for maintenance, keeping the overall rates low. Late in the month, DAP prices continued to soften, with 64% DAP in Yingkou region down by almost RMB50/t month on month to RMB2 800/t EXW. The mainstream EXW prices of 64% DAP were concentrated at RMB2 750/t at the end of the month and deals were concluded at RMB2 700/t.

DAP trades increased as the spring plowing took place on schedule. Producers accelerated selling, but held prices unchanged. Operating rates of downstream blended fertilizer producers remained low, reflecting limited demand for DAP. At the end of March, EXW prices of 64% DAP were reported at RMB2 700-2 750/t and deals were around RMB2 650/t in Hubei.

The prices were largely stable through April, with a slight fall late in the month. In April, when the spring plowing application became seasonally robust, the deliveries of goods to north, east and central China were consecutively under the way, while the deliveries to northeast and northwest China finished. Besides, a certain number of goods were delivered to ports, several producers said. The overall supply became tight, keeping the prices firm. Late in the month, however, prices fell back, as the wholesales activities were almost coming to an end. EXW prices of 64% DAP were heard at RMB2 660-2 720/t in Hubei at the end of April, with few deals done.

The seasonal application for agricultural use ended in May and there were only a small number of requirements for industrial use in Heilongjiang, Hebei and Shandong. Export prices fell to US$359-360/t FOB. At the end of May, some DAP plants were shut for short-lived maintenance, and EXW prices of 64% DAP were largely posted at RMB2 600-2 650/t in Hubei.

In June, DAP purchases for summer use came to an end, but the autumn phosphor fertilizer trades were not robust yet. Export prices fell to US$339-340/t. EXW prices of 64% DAP were lower to RMB2 520-2 550/t in Hubei by the month-end.

MAP market

MAP market tracked the downtrend in January, with EXW offers falling by RMB50-100/t due to unfavorable factors – high inventories faced by producers, thin buying interest from downstream compound fertilizer producers, and continuously falling prices of raw materials such as sulphur and synthetic ammonia. At the end of the month, EXW offers for 55% powder (with acceptance) were heard at RMB2 100-2 150/t in central China.

The downtrend continued into February, with few deals done. Downstream compound fertilizer producers reported difficulties in sales, as the festival air remained after the Chinese Lunar New Year holidays, so their inventories were largely big. By the end of the month, EXW prices of 55% powder were at RMB2 000-2 100/t in central China.

Domestic MAP trades were still lackluster throughout March. Prices showed a recovery sign, as downstream compound fertilizer producers raised offers in response to a rise in urea prices. Late in the month, MAP prices rose, and EXW prices of 55% powder (spot exchange) were reported at RMB1 950-2 030/t in central China.

Prices stabilized after a slight rise through April. Producers focused on fulfilling orders. By the month end, EXW prices of 55% powder (spot exchange) were at RMB2 000-2 070/t in central China.

In May, MAP transactions decreased and traded prices fell back by RMB30-50/t. The weakening market was mainly because producers almost fulfilled previous orders but saw few fresh deals done as downstream compound fertilizer producers were busy in the production of summer phosphor fertilizer and showed limited demand for MAP. By the end of May, EXW prices of 55% powder (spot exchange) were heard at RMB1 960-2 030/t in central China.

In June, supply decreased due to maintenance shutdowns and prices stabilized. Several producers even raised offers tentatively towards the month-end. At the same time, downstream compound fertilizer producers began to produce autumn high-phosphor fertilizer, and hence traded volumes increased. EXW prices of 55% powder rose to RMB2 020-2 040/t in central China.

Stable production in the first five months

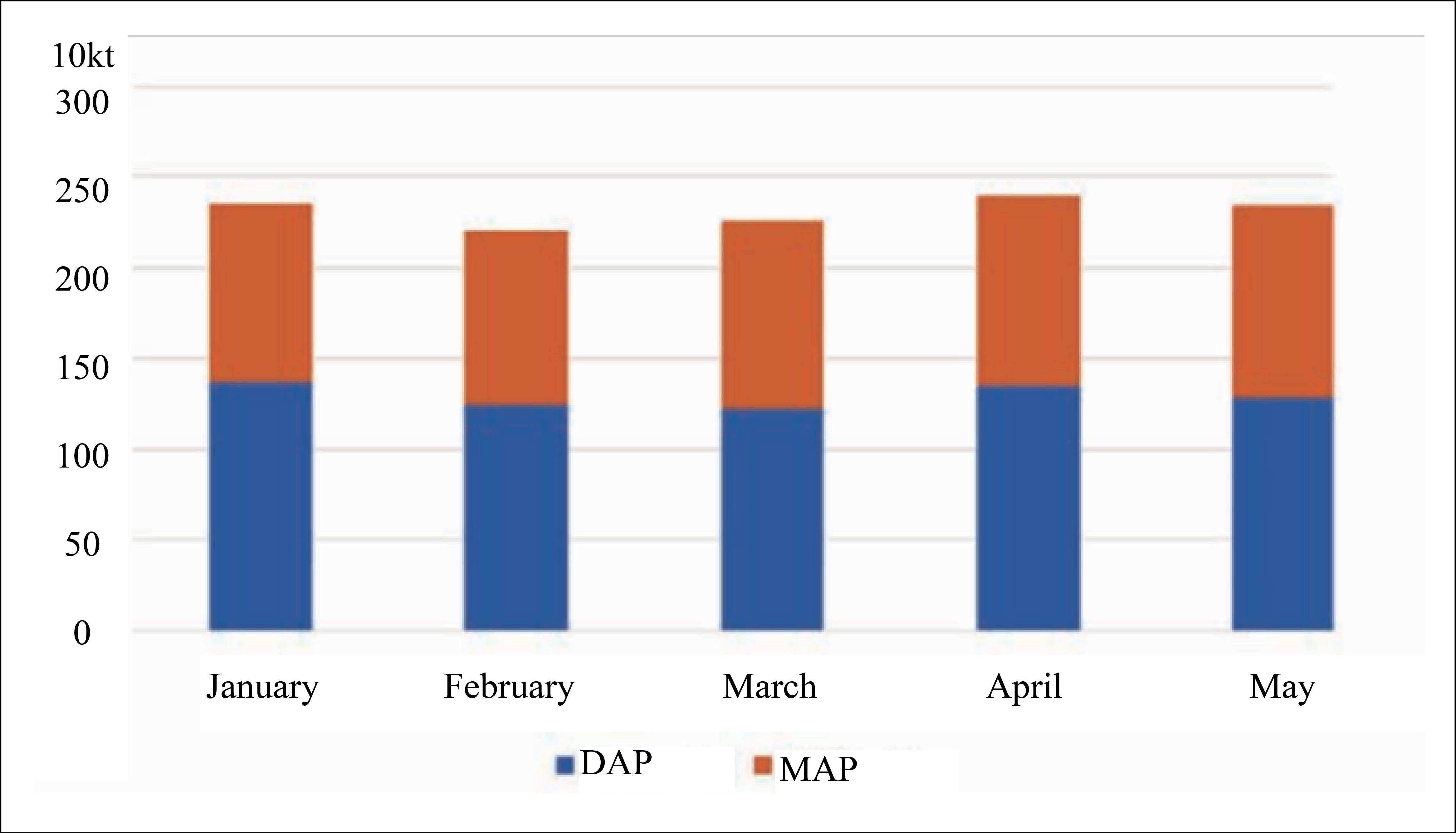

The production of domestic ammonium phosphate was largely stable in the first five months of the year. The output reached 11.53 million tons (Figure 1), almost flat with the same period of last year, with MAP occupying 5.04 million tons and DAP 6.49 million tons.

Figure 1 Chinese ammonium phosphate output in January-May, 2019

DAP output was only at 1.25 million tons in February, when some big-sized producers closed business for the Chinese Lunar New Year holidays, plus restriction policies for environmental-protection, resulting in a reduction in operating rates. It was recorded as the lowest output during the first half of the year. Later the output kept growing and hit the highest of 1.37 million tons in April, as demand for spring plowing strengthened and increased export orders drew a big quantity of goods to arrive at ports.

MAP market saw the output highest in January, because downstream compound fertilizer producers kept operating rates high in winter and hence demand for MAP strengthened. The lowest output appeared in May, as downstream compounder fertilizer producers were much more interested in high-nitrogen fertilizer in summer than in MAP.

Import & export

Export volumes of domestic ammonium phosphate totaled 3.338 million tons from January to May, an increase of 48.1% compared with the same period of last year, with DAP occupying 2.151 million tons, up by 39.1% year on year and MAP 1.187 million tons, up by 67.6%.

Import volumes totaled 6 kt, a decline of 91.7% year on year. The volumes of DAP were zero versus those at 65 kt in January-May 2018, while the volumes of MAP had a year-on-year increase of 34.7%.

DAP

Export prices fell from US$411.6/t early this year to US$386.7/t in May. Slight rises in the middle of the period hardly rippled over the overall price trend.

Yunnan Yuntianhua United Commerce Co., Ltd. was the biggest exporter in China during the period, with the volumes of 360 kt, accounting for 16.7% of the total exports; Fujian Pingtan Funong Agricultural Means of Production Co., Ltd. was ranked No.2, with the volumes of 224 kt, taking up 10.4% of the total; Guizhou Kailin Fertilizer Co., Ltd. was the third biggest, occupying 9.1%. The export volumes of the top three producers totaled 780 kt, contributing 36.3% to the total. Details were included in Table 1 for the top 10 DAP exporting producers in China during the period.

Table 1 Top 10 DAP exporters in China during January-May 2019

Producer | Export(kt) | Export sum (US$ million) | Price (US$/t) | Share (%) |

Yuntianhua United Commerce Co., Ltd. | 360 | 142.446 | 395.9 | 16.7 |

Fujian Pinngtan Funong Agricultural Means of Production Co., Ltd. | 224 | 87.635 | 391.1 | 10.4 |

Guizhou Kailin Fertilizer Co., Ltd. | 196 | 76.939 | 391.7 | 9.1 |

Wengfu International Trade Co., Ltd. | 164 | 65.007 | 397.4 | 7.6 |

Hubei Yihua International Trade Co., Ltd. | 147 | 57.652 | 393.5 | 6.8 |

Yidu Xingfa Chemical Co., Ltd. | 123 | 47.146 | 383.2 | 5.7 |

Yunnan Hongxiang Chemical Co., Ltd. | 81 | 32.191 | 398.0 | 3.8 |

CNAMPGC Holding Co, Ltd. | 70 | 27.906 | 396.5 | 3.3 |

Anhui Huilong Agricultural Means of Production Co., Ltd. | 64 | 24.478 | 383.4 | 3.0 |

Ruili Tianping Border Trade Co., Ltd. | 63 | 25.756 | 412.0 | 2.9 |

Others | 660 | 262.528 | 397.8 | 30.7 |

Total | 2 151 | 849.684 | 395.0 | 100.0 |

In terms of export destinations, India was ranked the top, with the exports from China to India at 790 kt, accounting for 36.7% of the total. Top 10 DAP export destinations were listed as below.

Table 2 Top 10 DAP export destinations during January-May 2019

Destination | Export(kt) | Export sum (US$ million) | Price (US$/t) | Share (%) |

India | 790 | 307.107 | 388.9 | 36.7 |

Vietnam | 170 | 66.318 | 390.8 | 7.9 |

Thailand | 166 | 65.58 | 394.1 | 7.7 |

Japan | 164 | 67.995 | 413.7 | 7.6 |

Indonesia | 143 | 56.556 | 395.0 | 6.7 |

Australia | 138 | 55.698 | 402.4 | 6.4 |

Pakistan | 113 | 44.025 | 389.8 | 5.3 |

New Zealand | 82 | 32.818 | 400.2 | 3.8 |

Peru | 40 | 15.758 | 392.0 | 1.9 |

Iran | 39 | 21.552 | 547.4 | 1.8 |

Others | 305 | 116.277 | 399.8 | 14.2 |

Total | 2 151 | 849.684 | 397.6 | 100 |

MAP

MAP export prices were stable-to-lower in the first five months. To be specific, the prices rose from US$429/t in January to US$429.8/t in February, and then fell to US$372.3/t in May. The level contained both agricultural and industrial grades, and in fact, the export prices of agriculture-grade MAP were much lower than the level, at below US$300/t.

Yunnan Yuntianhua United Commerce Co., Ltd. was the biggest MAP exporter in China during the period, with the volumes of 315 kt, accounting for 26.5% of the total exports; Hubei Harvin (Group) Chemical Co., Ltd. was ranked No.2, with the volumes of 214 kt, taking up 18% of the total; Yunnan Hongxiang Chemical Co., Ltd. was the third biggest, with the volumes of 130 kt, occupying 11%. The export volumes of the top three producers totaled 659 kt, contributing 55.5% to the total. The high share reflected that the export concentration of MAP was well higher than that of DAP. Details were included in Table 3 for the top 10 MAP exporting producers in China during the period.

Table 3 Top 10 MAP exporters in China during January-May 2019

Producer | Export(kt) | Export sum (US$ million) | Price (US$/t) | Share (%) |

Yuntianhua United Commerce Co., Ltd. | 315 | 120.708 | 383.4 | 26.5 |

Hubei Harvin (Group) Chemical Co., Ltd. | 214 | 72.743 | 340.4 | 18.0 |

Yunnan Hongxiang Chemical Co., Ltd. | 130 | 50.626 | 388.0 | 11.0 |

Wengfu International Trade Co., Ltd. | 80 | 34.888 | 434.5 | 6.8 |

Anhui Sierte Fertilizer Industry Co., Ltd. | 65 | 20.698 | 316.8 | 5.5 |

Guizhou Kailin Fertilizer Co., Ltd. | 63 | 24.183 | 382.6 | 5.3 |

Chongqing Agricultural Means of Production Co., Ltd. | 55 | 18.023 | 326.3 | 4.7 |

Yichang Xinyang Fertilizer Industry Co., Ltd. | 34 | 12.974 | 376.2 | 2.9 |

Fujian Funong Agricultural Means of Production Co., Ltd. | 33 | 12.953 | 393.0 | 2.8 |

Sichuan Lomon Phosphorous Chemistry Co., Ltd. | 26 | 14.063 | 545.2 | 2.2 |

Others | 171 | 81.264 | 475.2 | 14.4 |

Total | 1 187 | 463.124 | 390.2 | 100 |

In terms of export destinations, Brazil was ranked the top, with the exports from China to Brazil at 389 kt, accounting for 32.8% of the total; Australia was the second, with the volumes of 336 kt, taking up 28.3%; Argentina took the third position, with the volumes of 132 kt, occupying 11.1%. The export volumes of the top three destinations totaled 857 kt, contributing 72.2% to the total. The high share reflected that the export concentration of MAP was well higher than that of DAP. Details were included in Table 4 for the top 10 MAP export destinations in China during the period.

Table 4 Top 10 MAP export destinations during January-May 2019

Destination | Export(kt) | Export sum (US$ million) | Price (US$/t) | Share (%) |

Brazil | 389 | 132.132 | 339.3 | 32.8 |

Australia | 336 | 136.439 | 406.5 | 28.3 |

Argentina | 132 | 49.256 | 373.1 | 11.1 |

Uruguay | 54 | 18.843 | 347.7 | 4.6 |

India | 39 | 16.422 | 422.6 | 3.3 |

Thailand | 31 | 11.080 | 362.0 | 2.6 |

Japan | 23 | 10.041 | 434.9 | 1.9 |

Taiwan, China | 20 | 7.375 | 367.8 | 1.7 |

Malaysia | 17 | 6.126 | 357.0 | 1.4 |

Turkey | 14 | 7.52 | 527.7 | 1.2 |

Others | 131 | 67.889 | 517.8 | 11.0 |

Total | 1 186 | 463.124 | 390.3 | 100.0 |

Outlook for 2H 2019

DAP: Domestic DAP producers are focusing on fulfilling export orders now, with limited inventory levels. The prices in July-August will be firm, with little possibility of downtrend, as fertilizer preparation season is coming for autumn. In the fourth quarter, the fertilizer reservation for winter will bolster the market. Besides, phosphate ore prices will increase because phosphate ore mining is usually halted in winter. This will give support to the DAP prices too. Destocking at ports after the first half of the year will be another contributory factor to the DAP market. Therefore, the prices are expected to be largely stable in the second half of the year.

MAP: Domestic MAP market remained subdued from last November, despite slight rises. However, the prices in the third quarter are expected to regain ground, because downstream compound fertilizer producers have reported low inventories since this year, the sales of autumn MAP products will start earlier than before, and more strict policies of environmental protection in Hubei - the major production region will be implemented. The tightness of natural gas supply is likely to be much eased this year, so compound fertilizer producers will not buy as many MAP as last year, keeping MAP prices from a sharp rise in the fourth quarter.