By Zhao Wenming, NPCPI

Current development of China’s ethylene industry

By the end of 2018, China’s ethylene capacities totalled 25 500 kt/a, output, 23 720 kt and equivalent consumption, 50 230 kt. The average operating rate of the domestic ethylene industry was 93.0%.

China’s ethylene industry has a high level of concentration, given the high threshold in terms of industry policies, resources and technical threshold. In recent years, the main industry body has been diversified against the backdrop of the rapid development of the coal/methanol-to olefin (CTO/MTO) industry. A market competition pattern dominated by Sinopec Group (Sinopec) and China National Petroleum Corporation (CNPC) with multiple capitals actively participating was gradually formed. In 2018, Sinopec and PetroChina had 11 380 kt/a and 5 910 kt/a ethylene capacities respectively and they combined accounted for 67.8% of the domestic total, down by 19.1 percentage points from 2010. Table 1 shows Chinese ethylene producers in 2018.

Table 1 Chinese ethylene producers

Company name | Capacity (kt/a) | Remarks |

Sinopec | 11 380 | 16 ethylene producers, with 21 plants, including 18 steam crackers, two CTO plants, one MTO plant |

CNPC | 5 910 | Seven ethylene producers, with 12 steam crackers |

CSPC | 2 150 | Two steam crackers |

China Energy | 1 290 | Four ethylene producers, with four plants, including one steam cracker, two CTO plants, one MTO plant |

Shaanxi Yanchang Petroleum (Group) | 1 050 | Two ethylene producers, with four plants, including two CTO plants, one ACO and one CPP plant |

NORINCO GROUP | 630 | Two steam crackers |

ChinaCoal | 600 | Two ethylene producers, with two plants: one CTO and one MTO plant |

Fund Energy | 430 | Two ethylene producers, with two MTO plants |

Shenghong Group | 370 | One MTO plant |

Shaanxi Coal | 330 | One CTO plant |

Ningxia Baofeng Energy | 300 | One CTO plant (coke oven gas-based methanol) |

Zhejiang Xingxing New Energy | 300 | One MTO plant |

Shandong Shenda Chemical | 210 | One MTO plant |

Qinghai Salt Lake | 160 | One CTO plant |

China BlueStar Shenyang Chemical | 150 | One CPP plant |

Chengzhi Clean Energy | 120 | The former Wison Clean Energy, one MTO plant |

Shandong Yangmei Hengtong Chemical | 120 | One MTO plant |

Total | 25 500 |

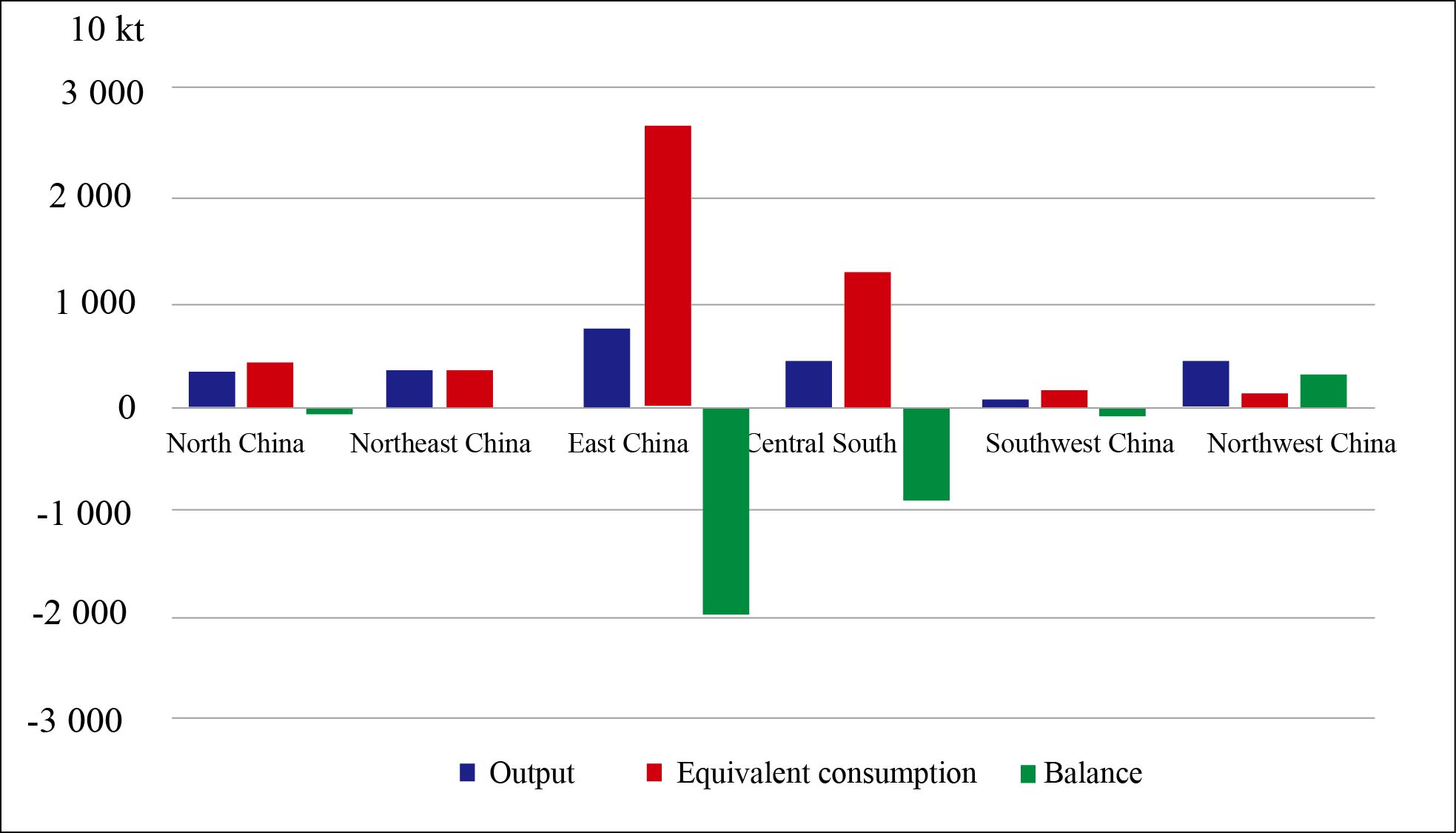

In terms of industrial layout, China's ethylene industry has basically covered major domestic areas, with capacities concentrated in southeast coastal regions and also in northeast China, north China and northwest China. The ethylene plant start-up in Sichuan province during the “12th Five-Year Plan” period filled the ethylene production gap in southwest China. At present, the regional supply-demand difference is obvious. Northwest China is a major ethylene supply region, while the supply shortage in east, central and south China remains huge.

Figure 1 China regional ethylene supply-demand balance

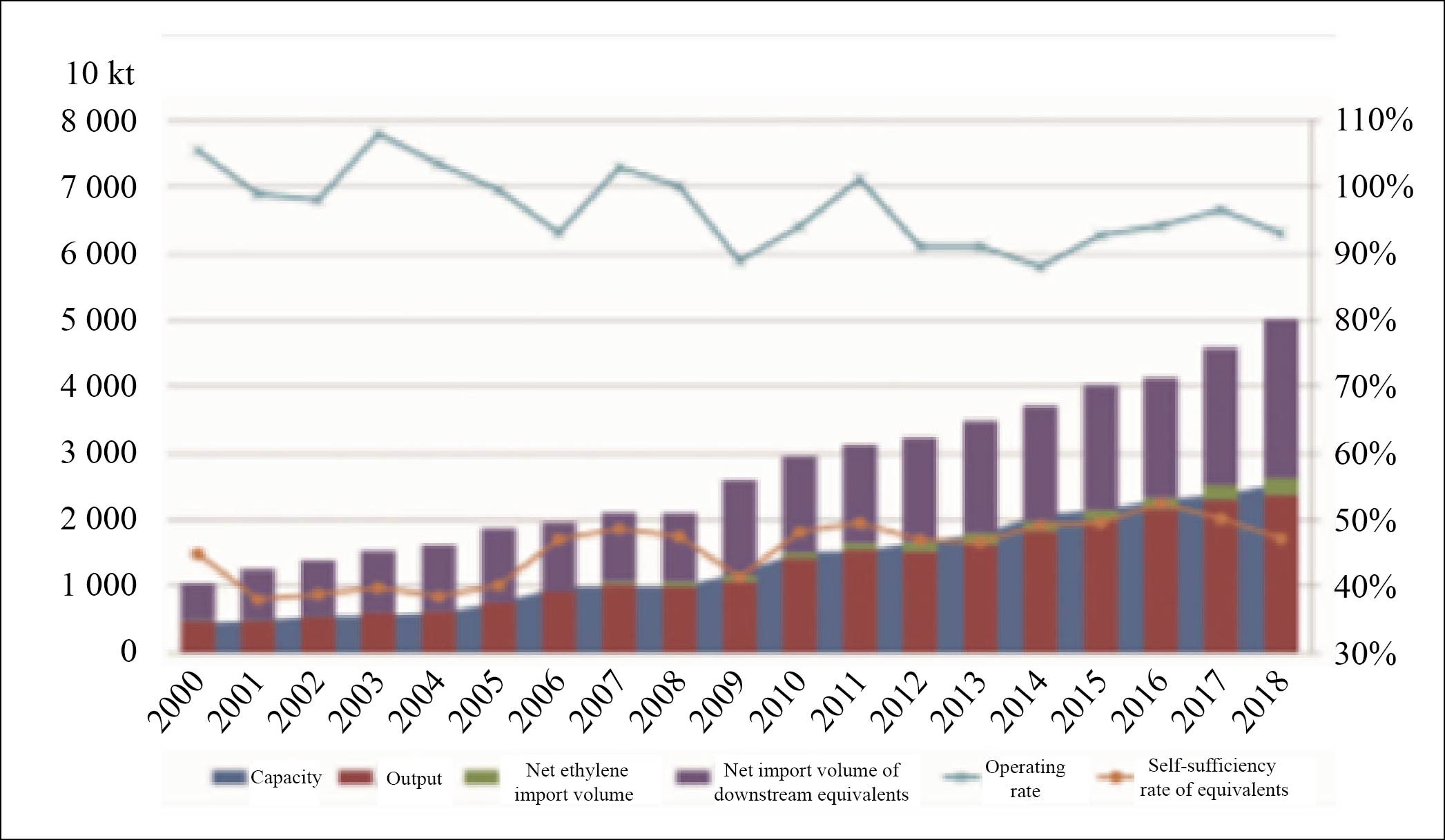

Domestic equivalent ethylene consumption refreshed a record high in 2018, at 50 230 kt, up by 9.5% year on year, because of larger-than-expected increase in downstream polyethylene (PE) and monoethylene glycol (MEG) consumption. The ethylene equivalents gap was as high as 26 510 kt and self-sufficiency rate fell to 47.2%. Strong demand and limited domestic supply have resulted in high operating rates of the domestic ethylene industry. The net import volume of ethylene and its equivalents has been increasing. Figure 2 shows China’s ethylene supply-demand situations in 2000-2018.

Figure 2 China ethylene supply-demand 2000-2018

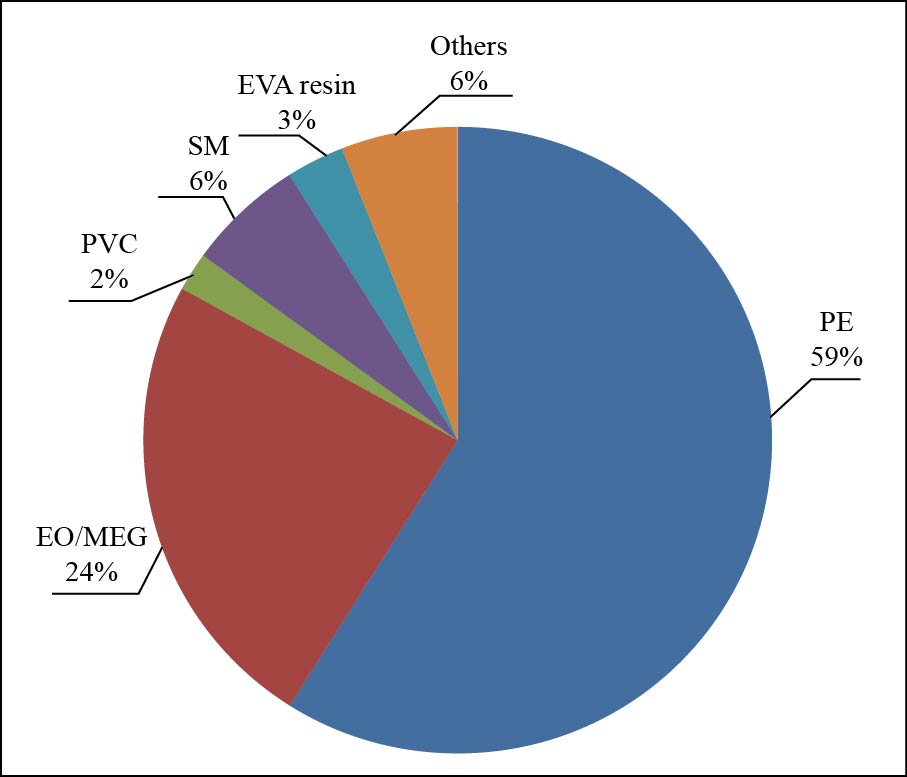

In terms of consumption structure, in China, PE and ethylene oxide (EO)/MEG are major consumers of ethylene, accounting for 59% and 24% respectively of domestic ethylene equivalent consumption in 2018. The average growth rate of PE reached 9.1% in the past five years, far outpacing the consumption growth of ethylene at 7.5% during the period. Figure 3 shows the consumption structure of China’s ethylene equivalent consumption in 2018.

Figure 3 Consumption structure of China ethylene equivalent consumption in 2018

China is currently importing a large amount of ethylene and its derivatives each year. The import sources display different characteristics: ethylene mainly originates from the Asia-Pacific region (South Korea, Japan and China’s Taiwan province), while its derivatives flow from the Middle East and surrounding countries and regions in Asia, with over 80% (calculated based on ethylene equivalent) being PE and MEG. The price difference of PE is great. Imported PE from the Middle East are mostly general-purpose material, while that from the US, Japan and Western Europe are mainly specialty material. Imported cargoes from the Middle East and Asia-Pacific take up one fourth and one fifth of China’s ethylene equivalent consumption, respectively. The products from the Middle East in particular, occupy over 50% of PE and MEG imports into China, because of their strong cost-competitiveness. As for the development trend, new ethane crackers and downstream plants have been put into operation since the end of 2016, and these new products are very cost-competitive. Therefore, the exports from the US to China may increase sharply in the future. In the meantime, there will remain a hefty amount of ethylene derivatives exports from the Middle East to China.

Features and trends of ethylene feedstock diversification development in China

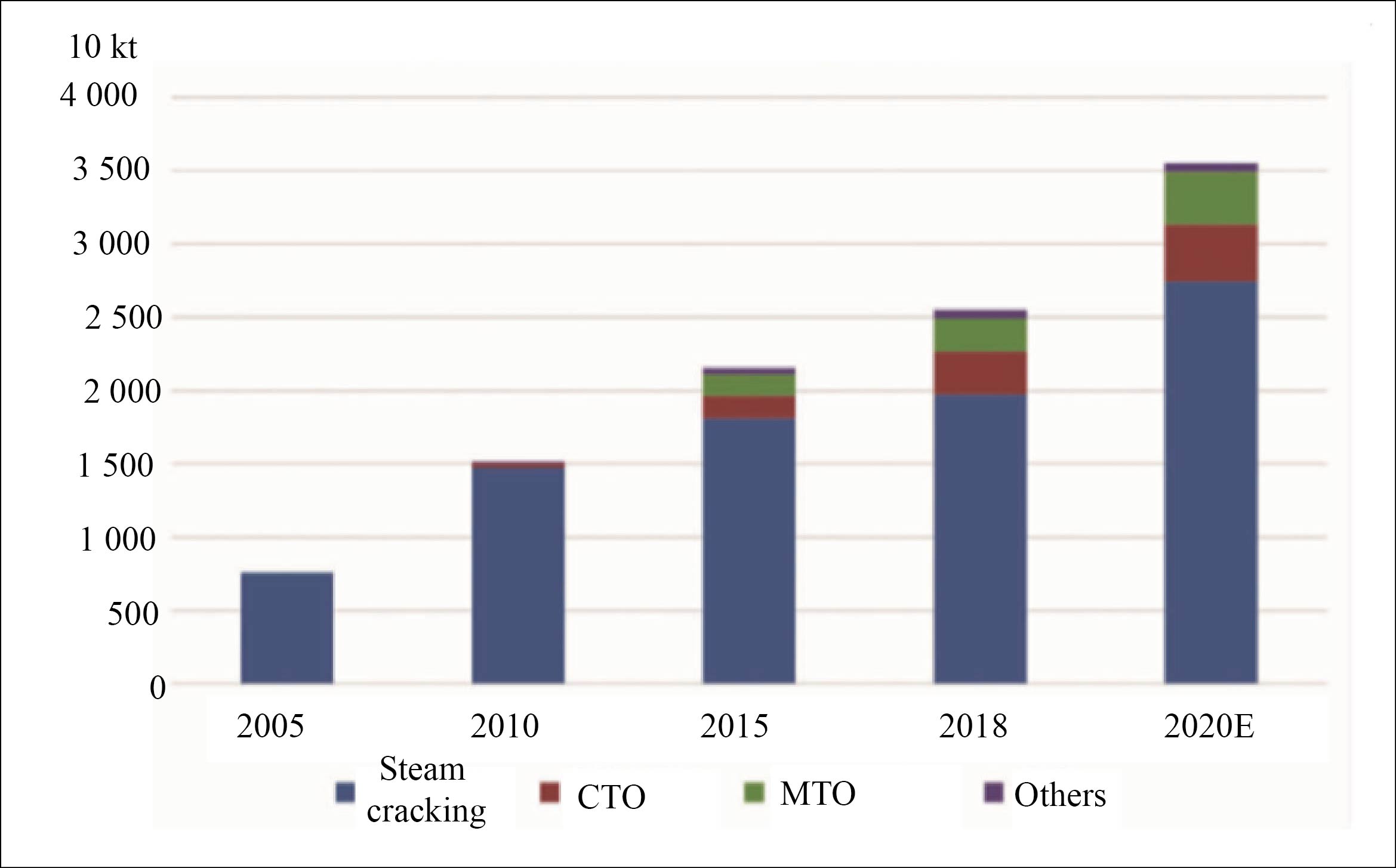

By the end of 2018, 19 740 kt/a, or 77.4% of domestic ethylene capacities came from steam crackers, 2 910 kt/a, or 11.4% from CTO plants, 2 250 kt/a or 8.8% from MTO plants and 600 kt/a or 2.4% from CPP and ACO routes in combination.

Changes took place in the competitiveness of different ethylene production routes after 2015, when international crude oil values fluctuated at low levels. A new round of capacity expansion focus on steam crackers, while the investment enthusiasm in CTO/MTO projects faded.

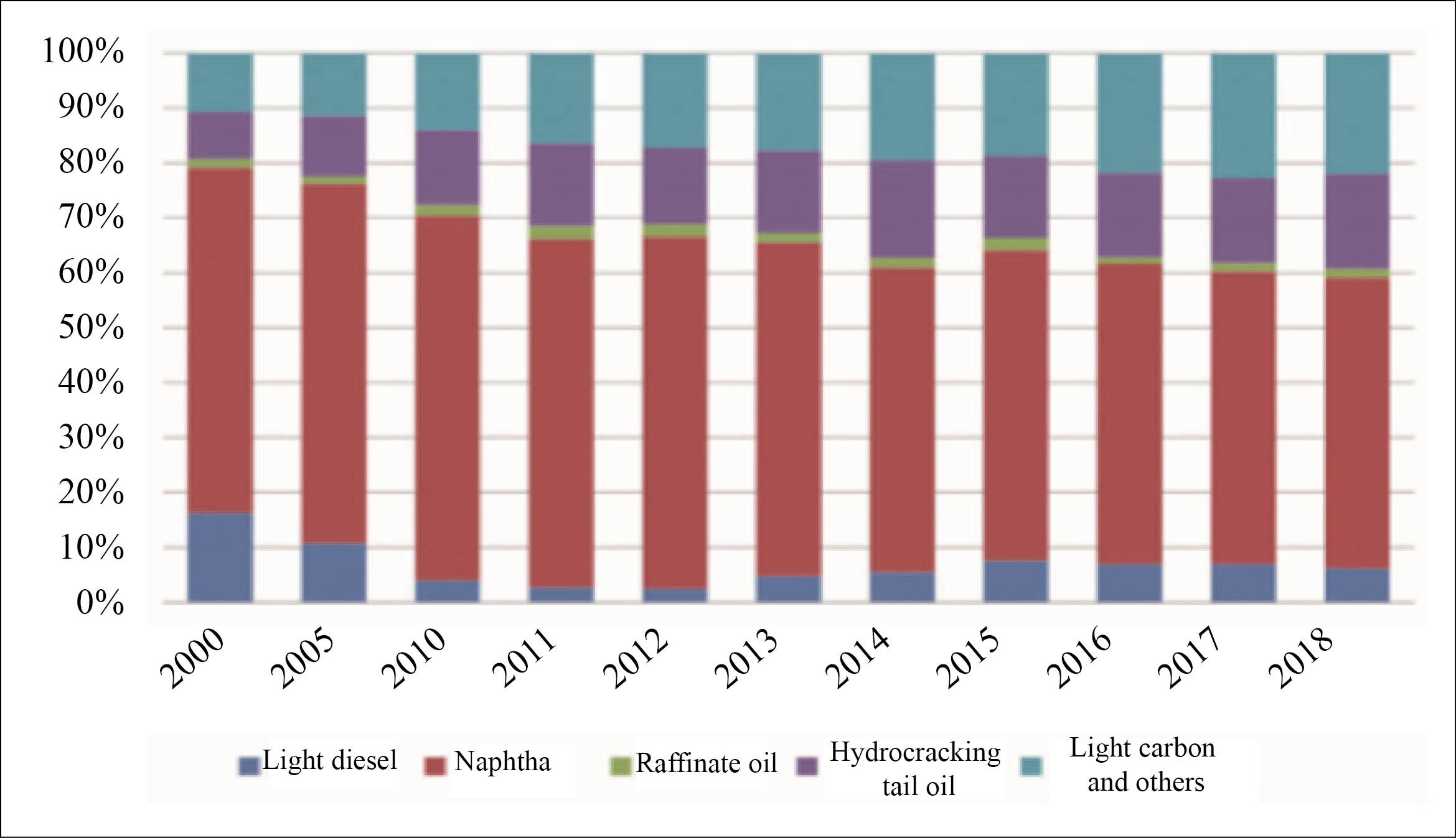

1. Light and heavier feeds for steam crackers

In recent years, Chinese ethylene producers have been insisting on the development of lightweight feedstock and focusing more on low-cost feedstock, especially in the face of the structural contradictions in the domestic refined oil products market, that is low oil prices and surplus domestic diesel supply. On one hand, the integration of refining and chemical can reduce the proportion of naphtha and constantly raise the utilization rate of the by-product light carbon. Meanwhile, intensifying the dry gas recovery to get ethane/ethylene and paying attention to the retrieve of butadiene (BD) tail gas and hydrogenated raffinate C5 to ethylene cracking furnaces to further enhance the utilization of by-products, especially the light-weight feedstock and to reduce feedstock costs. On the other hand, the proportion of using diesel as cracking materials has been on the rise in order to alleviate the structural contradictions concerning the production and sales of refined oil products. In 2018, ethylene feedstock used in domestic steam crackers consisted of 6.1% of light diesel, 53% of naphtha, 1.6% of raffinate oil, 17.4% of hydrocracking tail oil, 21.9% of light carbon and others. Compared to 2010, the proportion dropped by 13.6 percentage points for naphtha, increased by 7.9 percentage points for light carbon and rose by 2.2 percentage points for light diesel. Figure 4 shows the changes in feedstock structure of China’s steam crackers since 2010.

Figure 4 Changes in feedstock structure of China’s steam crackers

The development of large-sized integrated refining and chemical projects is making more room for the feedstock optimization of steam crackers. This will enhance the level of lightweight feedstock and reduce the proportion of naphtha. In the meantime, a majority of newly built integrated refining and chemical plants have taken into account the plight of the diesel market and therefore, devices aimed to covert diesel into aromatics and premium ethylene feedstock are also designed to be constructed, through which the proportion of light diesel directly used as ethylene cracking feedstock will fall further.

2. Opportunities and challenges for imported ethane-based ethylene production

Dramatic declines in ethane prices due to acute surplus supply amid the US shale gas boom have sharpen the competitive edge of ethane-based ethylene production and attracted ethylene producers mainly using naphtha as feedstock. Since 2016, the US ethane prices began to rally, on the start-up of new ethylene capacities in the US and more exports to Europe and Asia and will unlikely return to the level before the US shale gas revolution.

Calculated based on the theoretical model, the full costs of one-ton imported ethane-based olefin production is largely equivalent to those of steam crackers under Brent crude oil values at US$40/bbl, CTO under coal prices at RMB73/t and MTO under methanol prices at RMB1 333/t. The imported ethane-based route is the most cost-effective and has robust margins among all industrial ethylene production processes. This is the direct reason why Chinese buyers showed stronger enthusiasm in importing ethane to produce ethylene since 2015. Incomplete statistics showed that ethylene crackers using imported ethane as feedstock with a total capacity of over 20 million t/a are carrying out preliminary work in China. Table 2 shows some of the projects.

Table 2 Major imported ethane-based cracker projects to be built in China

Projects | Capacity (kt/a) | Remarks |

Jinsheng Chemical Jinzhou Ethane Cracker Project | 2 000 | |

Dalian Huikun New Materials Xizhongdao Ethane Cracker Project | 2 000 | |

Tianjin Bohua Chemical Ethane Cracker Project | 1 000 | |

Nanshan Group Longkou Ethane Cracker Project | 2 000 | |

Yangmei Hengyuan Chemical Qingdao Ethane Cracker Project | 2 000 | |

Shandong Mingyu chemical Ethylene Project | 1 200 | Ethane, naphtha blend |

Zhejiang Satellite Petrochemical Lianyungang Light Olefin Comprehensive Utilization Project | 2 500 | |

SP Chemical (Taixing) Light Olefin Comprehensive Utilization Project | 650 | Ethane, naphtha blend |

Fujian Yuantai Jiangyin Ethane Cracker Project | 2 000 | |

Fujian Yongrong Meizhouwan Ethane Cracker Project | 1 500 | |

Guangxi Investment Group Qinzhou Ethane Cracker Project | 1 000 |

Ethylene capacities of the above announced projects total 17 850 kt/a (some are blend feedstock), which may translate into over 22 000 kt/a of ethane demand. This is obviously overheating.

The ethane-based ethylene route is mature and technical risks are very limited, but three major aspects shall be paid attention to: feedstock sources, product structure and supply chain.

As for feedstock sources, the US and the Middle East are major ethane producing regions, with average annual output at above 20 000 kt. Most of the products are directly fed into steam crackers to produce ethylene. However, the increase in ethane output in the Middle East cannot meet the growing demand of ethylene and therefore leaving small volumes available for exports. The US has a large amount of ethane coming from the shale gas exploration, but its newly built ethane cracker projects are of large scale. The single source of imported feedstock not only imposes risks over supply stability but also over price fluctuations.

In terms of product structure, the major risk lies in the single structure of the products yielded from ethane cracking. Apart from ethylene, there are limited propylene and other heavier components but a lot of hydrogen. As the yield structure of ethane cracking is quite different from that of other cracked feedstock, it is difficult to adapt the design of compression, separation section and downstream units to the large-scale replacement of ethane with other feedstock, although the latest cracking furnace technology can well adapt to the flexible feeding of various feedsock. In the long run, the development space of the downstream industrial chain is narrow, and the ability to resist market fluctuations is weak, although the single product structure with high ethylene yield has stronger profitability in recent years. Attention shall also be paid to the optimal utilization of co-product hydrogen.

From the perspective of supply chain, the major risk lies in the low fault tolerance caused by immature system. The delivery of the ethane, the associated gas from the shale gas exploratiton in the US to ethylene enterprises in China’s coastal areas may go through the natural gas processing plants, natural gas liquids (NGL) separation plants, specialized export facilities (storage, deep cooling, loading), very large ethane carriers (VLEC), special receiving facilities etc. As the current international ethane ocean shipping market has not yet formed a scale, there are certain risks concerning the ocean shipping capacity and security.

3. Development trends of diversified ethylene feedstock

Low oil prices since 2015 have changed the competitiveness of different ethylene production processes and enhanced the diversification of ethylene feedstock.

Strong profitability of steam crackers has attracted investment into the sector. Steam cracker projects at Jilin and Fushun Petrochemical, which have been idled for several years resumed operation. SK (Wuhan), SABIC (Tianjin) and Dushanzi Petrochemical are carrying out renovations. State-owned enterprises, including Sinochem (Quanzhou), Sinopec Zhangjiang Zhongke and PetroChina Jieyang are accelerating their large refining and chemical projects. Private-owned and foreign-invested companies also show investment fever. The development of refining and chemical integration projects still dominates newly built steam crackers, but light hydrocarbons, especially ethane cracking, have become a hot spot. Meanwhile, the crude-based ethylene cracker at ExxonMobil (Huizhou) has also brought new ideas for the integrated development.

Attitudes towards CTO investment tend to be cautious. Although the driving force remains in place on surplus coal capacity and the pressure from industrial transformation, the competitiveness and profitability have been squeezed by low oil prices. In addition, the huge investment scale, combined with stricter restrictions from water resources and environmental protection concerns have slowed down CTO investment. Constrained by factors such as regional market digestion capacity and transportation conditions, polyolefins and other solid products are main downstream products. However, enterprises have begun to pay more attention to the differentiation and high-end development of polyolefin brands.

The investment enthusiasm for MTO has faded. Although some MTO projects are progressing in the eastern part of China due to the low entry barriers of the industry, high methanol prices and low cost competitiveness have weakened the profitability of MTO. The future development direction is to optimize the downstream integration extension scheme, combined with its own conditions.

By 2020, domestic ethylene capacity will reach 35 520 kt/a, up by around 10 000 kt/a from 2018. Of the capacity additions, steam crackers account for 77% and be the largest contributor. Figure 5 shows the changing trends of China’s ethylene production processes.

Figure 5 Changing trends of China’s ethylene production processes

New features and development trends of China's ethylene consumption market

China’s ethylene equivalent consumption posted a rapid rise of around 10% in 2017 and 2018, much higher than the GDP growth.

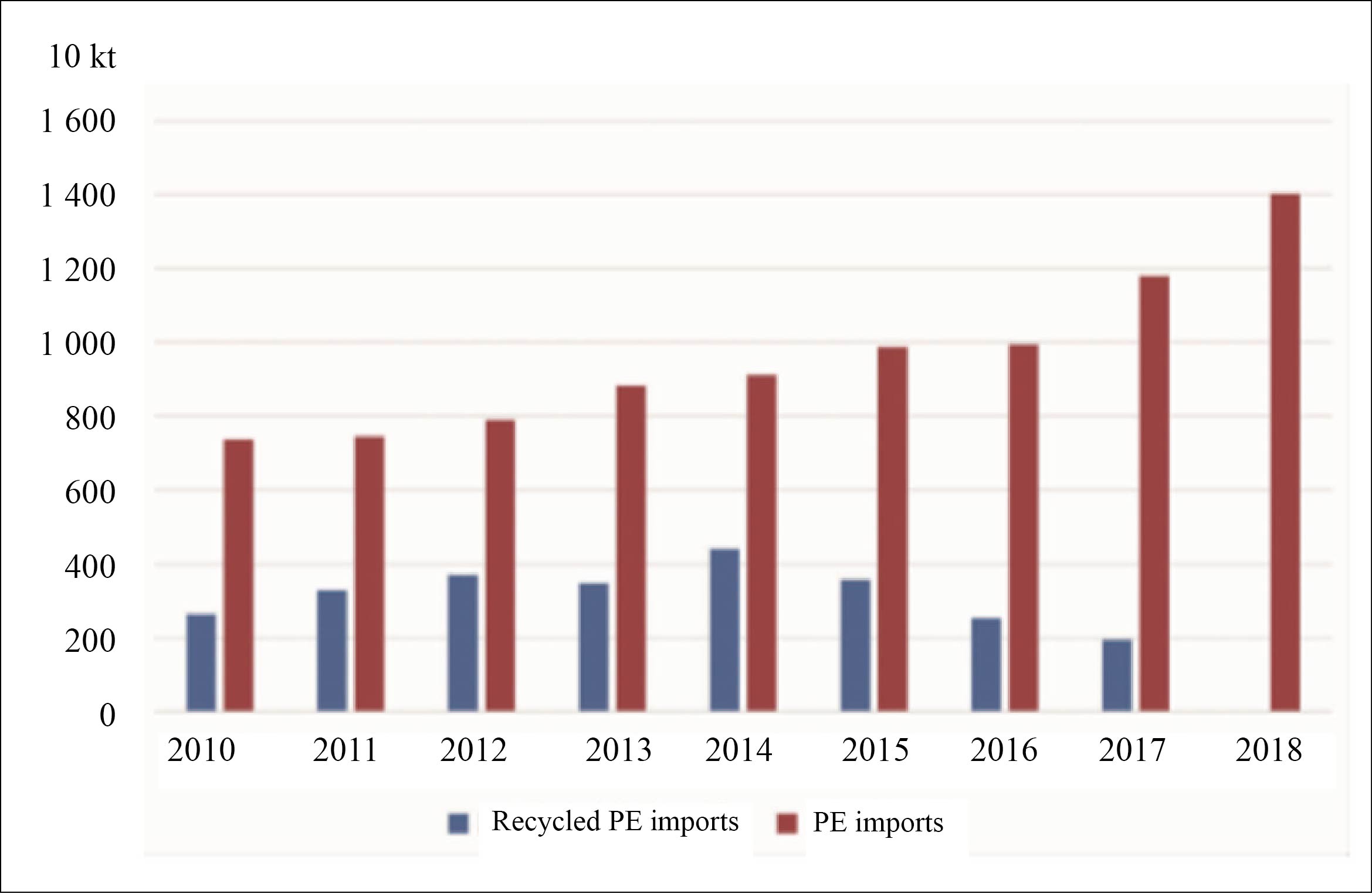

The types and quantities of solid wastes into China have declined sharply as China banned imports of 24 types of solid wastes, including waste plastics and slags since January 2018. Affected by this, China's imports of recycled polyethylene (PE) have basically returned to zero in 2018, leading to a soar in imports of virgin materials. Figure 6 shows China’s imports of recycled PE and virgin materials in 2010-2018.

Figure 6 China recycled PE and virgin materials imports in 2010-2018

Major changes have taken place in the domestic waste plastics recovery and recycling industry. The normalization of environmental supervision and low international crude oil values have narrowed the price difference between virgin and recycled materials. This has triggered continuous drops in the operating rates of the domestic recycled plastics plants and supply. Domestic recycled PE output has decreased from 5.5 million tons in 2015 to around 3.6 million tons in 2018.

Domestic consumption of virgin PE materials increased by over 2.1 million tons in 2018, equivalent to ethylene consumption of over 2 million tons, to cover the reduction in the imports of waste plastics and recycled products supply. If the volume is deducted, the growth rate of actual ethylene equivalent consumption stood at around 5.1%, a bit lower than China’s GDP growth.

From the perspective of end-user consumption, the explosive growth of China’s e-commerce industries, such as express delivery and take-out sectors has become a new driver behind domestic polyolefin consumption. Statistics showed that the business volume of domestic express delivery surged from 3.7 billion pieces in 2011 to 50.5 billion pieces in 2018, and the growth rate in recent two years stayed above 20%. The on-line catering and take-out market is also booming, posting an average annual growth rate of over 100% in recent three years. The express delivery and take-out industries have been fuelling demand for polyolefin packaging materials, which in turn has been boosting the demand for ethylene, propylene and other basic feedstock.

As for development trends, domestic ethylene consumption is affected by a series of competing negative and positive factors, including increasing consumption in new areas, weakening consumer market in the construction of new rural areas, the normalization of environmental protection supervision, the “Belt and Road” initiative, the ban of solid wastes imports, restricted use of plastics in express delivery packaging and downside risks over macro-economy. The growth rate of China’s ethylene consumption is expected to fall and ethylene equivalent demand may reach around 54 million tons in 2020.

Overall, the growth of domestic ethylene supply will outpace that of demand, which will narrow the supply gap rapidly and further press the market. Meanwhile, the downstream petrochemical market has entered into a “structural shortage” era, with fierce competitions among bulk general-purpose commodities, but high-end and special-purpose products still depending on hefty volumes of imports.

As for the macro industrial layout, the requirements of the “Petrochemical Industry Planning and Layout Plan (Revised Edition)” shall be implemented, focusing on long-term development potential, safety and environmental protection risks to ensure healthy and sustainable industry development, in accordance with the layout ideas of large-scale, base-based and integration.