By Xiang Zhengjian, Wang Lining, Dai Jiaquan, Li Ran, CNPC Economics & Technology Research Insititute

China energy development trend

There is great uncertainty in energy development, as it is mainly subject to population, economy, technology and policy. Accordingly, the central government has set up standards (baseline scenario) and reinforced carbon reduction incentives (enhanced policy scenario) to explore the transfer and upgrade way in the sector.

First, technology is the fundamental driver to achieve energy policy targets and gear up energy development. Technologies along the whole chain from exploration, processing, transferring to end-user application are improving in the case of baseline scenario, resulting in a stable enhancement in energy efficiency and a reduction in costs of new-type technologies. It is believed that there will be innovation and breakthrough in energy-related technologies before 2030, with renewable energy sources such as wind and light to replace traditional energy sources gradually.

Secondly, policy is the most important factor that affects energy development progress. With policies regarding energy, climate and environmental-protection put into effect and deepening worldwide energy cooperation triggered by initiatives such as ‘One Belt and One Road’, China’s energy production and consumption, technology and political system are developing well in the case of baseline scenario.

Thirdly, economic growth primarily determines the extent of energy development. Chinese population will continue to increase before 2030, but at a limited pace. The key factors that drive economic growth will transfer from labor force and investment to total factor productivity. Hence industrial structure will be optimized and the ratio of the tertiary industry will keep rising stably.

China will continue to see shifts in its economic and energy development in the coming future. In details, economic development will transfer from investment-driven to consumption-driven, from factor input to innovation-driven, from extensive high-pollution development mode to intensive green development mode, and it will also attach importance to improving living standards. Whilst energy demand will transfer from production-preferred to consumption-preferred, and end-users’ eyes will be more on high-quality energy. The improvement in energy supplying technologies is boosting clean energy, which can not only meet new end-user demand but also replace traditional high-carbon energy.

Energy demand grows slowly on higher energy efficiency and changing energy needs

1. Primary energy demand growth to slow down from a peak after 2035

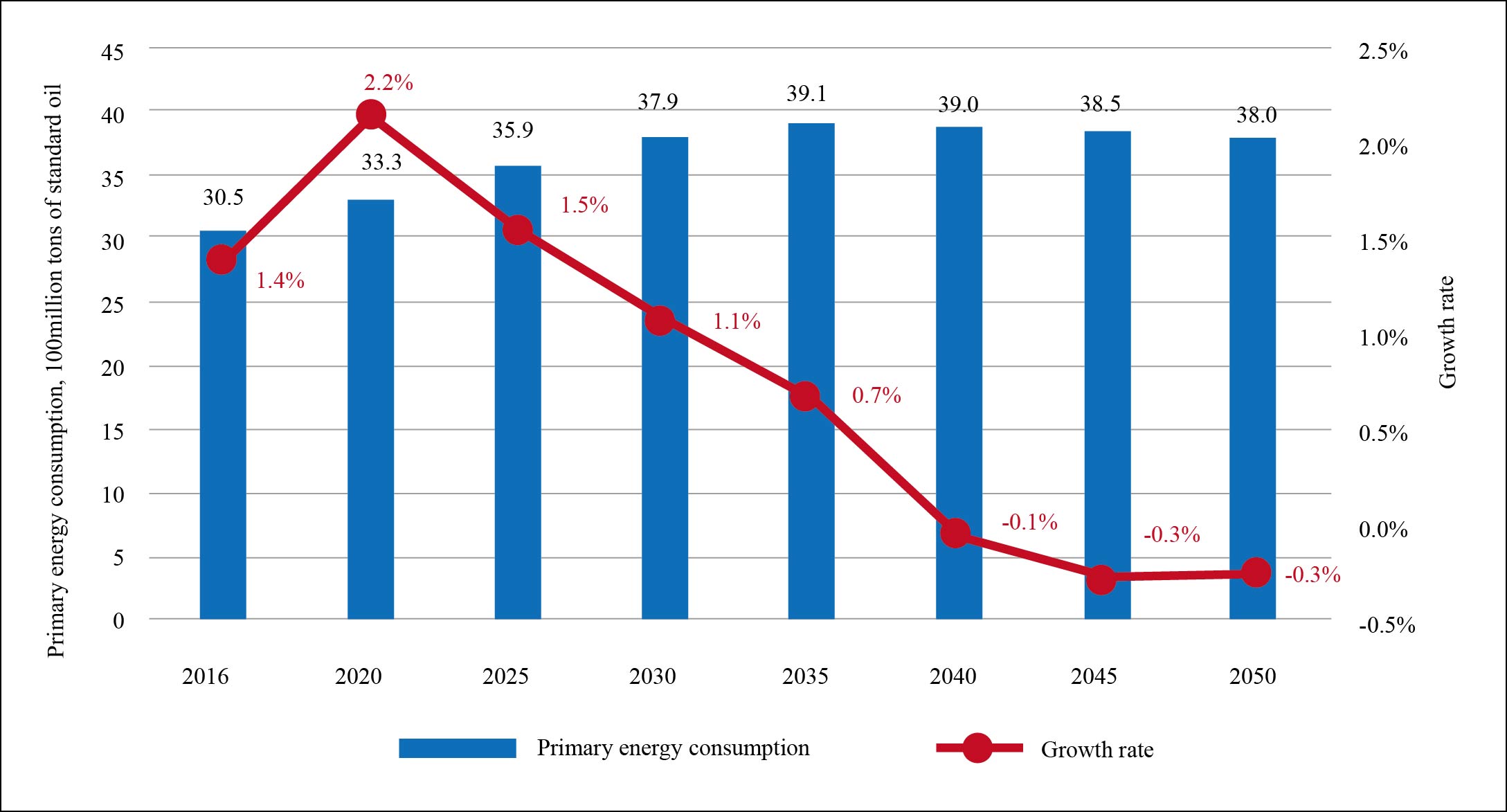

Energy is the backbone to drive up national economic development. In China, the total energy consumption will keep rising, but the growth in primary energy demand will slow down gradually, because optimized economic structure leads to higher presence of the tertiary industry and slower urbanization progress. The growth rate will fall from 9.5% in 2000-2010 to 2% in 2015-2020, to 1.1% in 2020-2035, and later down to 0.3% in 2035-2050 (see Figure 1). The total primary energy demand is expected to reach a peak around 2035, estimated at 3.92 billion tons of standard oil (5.6 billion tons of standard coal).

Figure 1 Primary energy consumption and its growth rate in China

2. Energy consumption per capita to rise stably while energy consumption per GDP to decrease

China’s economy will keep growing soundly by 2050 and thus GDP will exceed US$31 000 per capita (calculated at 2010’s fixed price) in 2050, equivalent to the level seen in moderately developed countries. Energy consumption will rise from 2.18 tons of standard oil per capita in 2015 to 2.73 tons of standard oil per capita in 2050.

Economic growth will rely more on total factor productivity, as urbanization and industrialization have come to an end. As a result, energy consumption per GDP will increase at a slower pace, estimated at 54.8% lower in 2035 and 74% lower in 2050 from 2015.

3. More Chinese energy demand caters to residential living

Energy demand has turned from production-preferred to living consumption-preferred, as domestic industrialization has stepped into a latter phase and urbanization is stably under way. End-user energy consumption will reach a peak around 2035, which represents that energy consumption for industrial use will decrease while that for architecture and tariff use will rise. China’s energy consumption in industrial sector will reach a peak around 2025, the consumption in traffic sector will see a peak after 2035, while the consumption in architecture (including residential and commercial buildings) will keep growing before 2050. The proportion of coal used in end-user segments will decrease sharply, that of petroleum will drop after 2020, while that of natural gas and power will keep rising, with the ratio of power reaching 38.4% by 2050.

Primary energy structure divided into three parts

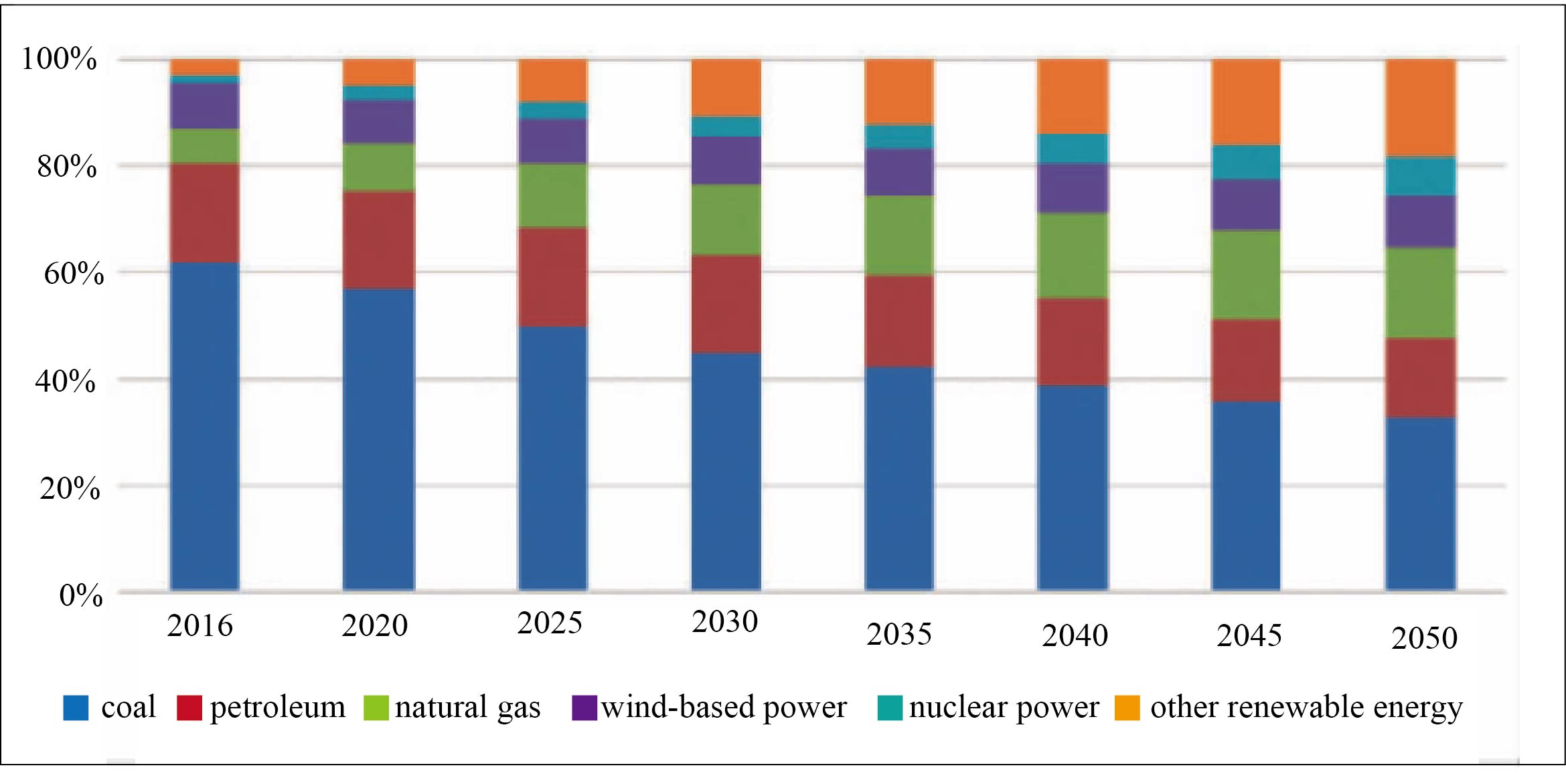

The structure in primary energy market is being optimized along with ongoing transformation of domestic energy development. Non-fossil, coal and oil & gas will stand out as three key components in the market by 2050. In details, non-fossil energy will take up 35% of the total primary energy by 2050, coal will occupy 33%, while oil & gas will constantly account for 32% in total, with natural gas 17% and oil 15% (see Figure 2).

Figure 2 China’s primary energy demand structure

Petroleum demand to grow at a slower pace, to reach a peak around 2030

China’s petroleum demand will be mainly used in traffic and as industrial raw materials in the future, with their aggregated proportion up from less than 70% in 2016 to over 75% in 2035. Petroleum demand will keep increasing at a mid-low rate before 2030 and its application in traffic and industrial sectors will take up 75 million tons and 46 million tons respectively during 2015-2030. Finished oil demand will reach a peak of 3 800 million tons around 2030. In details, diesel demand will fall stably after a current peak, gasline demand will hit a peak near 2025, and kerosene demand will maintain a fast growth in line with rapidly-developing air transport industry before reaching a peak around 2040.

2. Development of natural gas – the fastest-growing fossil energy - to boost energy transformation

Natural gas development will be in a boom period on the back of increasing urban population, perfecting natural gas pipe network, rapidly-growing distributed energy system and ongoing environmental pollution treatment. Natural gas consumption will reach 620 billion m3 and 700 billion m3 by 2035 and 2050 respectively. Power generation, manufacturing and residential living will be the key application fields in the future, with the former two sectors having great demand potential but companied by challenges and uncertainties as well. Natural gas-based power is praised for environmental protection and high efficiency, but the high price of feedstock natural gas will cast a shadow on the development. In a nutshell, natural gas demand from industrial, residential and power sectors will rise rapidly prior to 2035, with an average annual growth rate at 5.8% during 2015-2035. After 2035, especially after 2040, demand from industrial and residential sectors will meet a peak, so the growth in natural gas demand will slow down significantly, with an average annual growth rate only at 0.7% during 2035-2050.

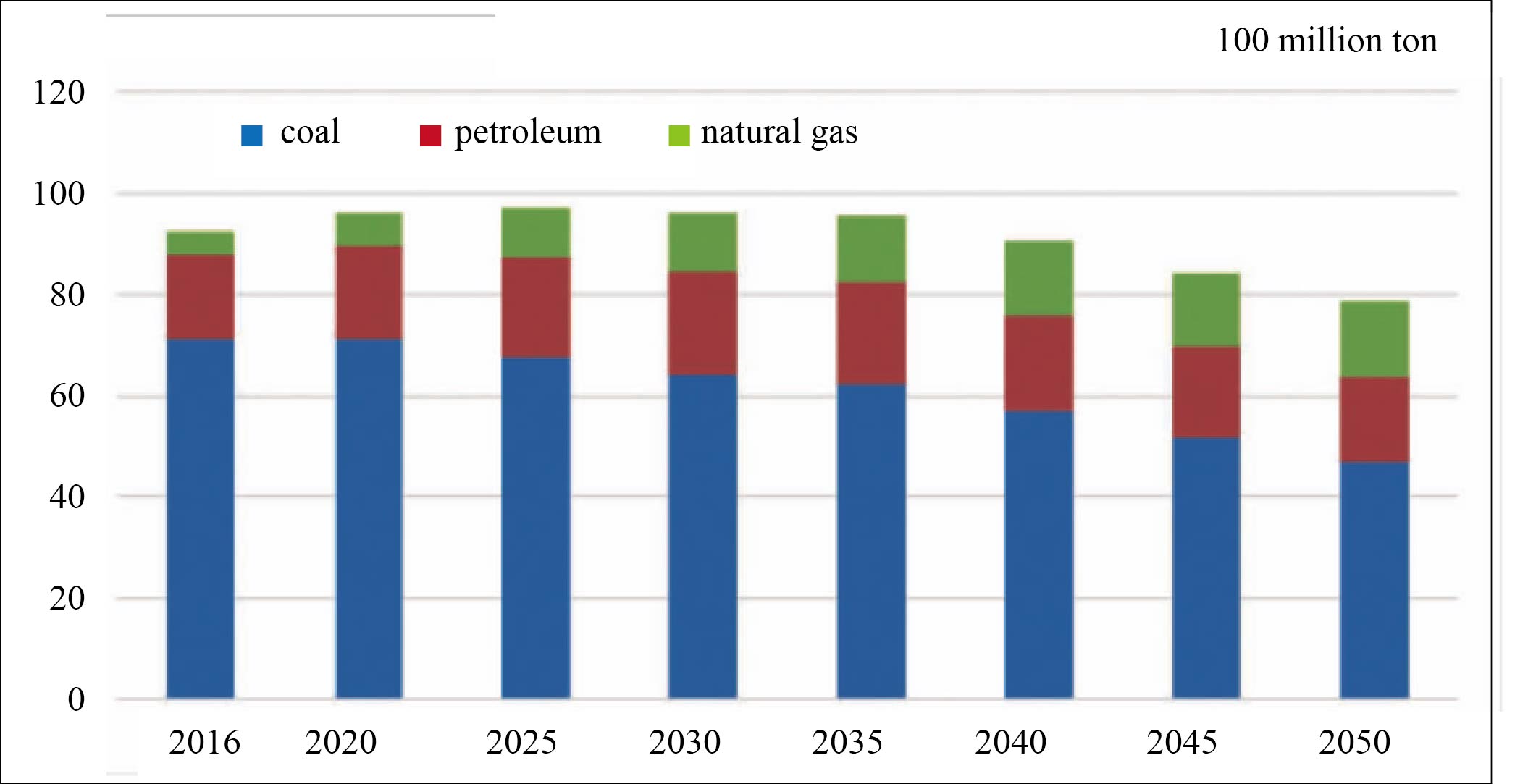

3. Coal demand to shrink from a peak

Coal demand has reached a peak and will shrink gradually in the near future. Demand in 2050 will fall to around 70% of what was seen in 2015. Industrial and power sectors are major drivers that affect coal demand, with coal consumption in the industrial sector to drop by 1.75% during 2016-2050. Coal demand in architectural segment is also shrinking rapidly, with an average annual decreasing rate at 3.1%, as a result of improving electrification. Electricity coal will take up over 60% of total coal before 2035, but later the demand will fall along with increasingly competitive new-energy power generation technologies.

4. Non-fossil energy, especially renewable energy such as wind and light, to grow fast

Non-fossil energy market will brace a fast-growing chance on the back of restricted energy resource environment and changes in economic growth impetus. In the face of climate changes, air pollution prevention and treatment, intensive competition among renewable energy technologies, new electricity power will be mainly generated by non-fossil energy, accounting for 86.4% of the total prior to 2050. The structure in power generation market will be diversified in the future, but most in a low-carbon mode. In details, the proportion of coal-based power will fall below 50% in 2030 while that of non-fossil-based power will rise to 43.5% and 55% in 2035 and 2050.

Renewable energy technologies will bring more profits. The costs of wind-based power and solar energy will continue to fall. This, combined with higher power grid absorptive capability and fast-growing distributed energy system, will reduce the comprehensive cost of wind and light constantly.

Safe, highly-efficient, clean and low-carbon energy becomes trendy

1. Remarkably higher electrification in end-user sectors

Electrification in end-user sectors will rise to 33% and 38.1% in 2035 and 2050, versus the level of 21.6% in 2016 alone. Higher living standards bring up residents’ power demand. Meanwhile, wide application of big data and cloud computing gives rise to increasing demand for commercial-use power. Power consumption in architectural sector will grow at 3.6% during 2016-2050. The average annual growth rate of power demand in industrial sector will be 0.78% amid fast-growing high-end manufacturing and strategically emerging markets. The growth rate of power in traffic sector will reach 6.3% in line with promotion and penetration of high-speed rail and electrombile.

2. Energy-related CO2 emission to peak by 2030

Energy-related CO2 emission will reach a peak before 2030 and this is not in synch with the peak of energy demand that will come before 2035, mainly because incremental demand is mainly for non-fossil energy and demand for fossil energy such as coal is shrinking. CO2 emission in 2050 will be close to the level seen in 2010. Carbon intensity will decrease rapidly, with the level in 2035 and 2050 down by over 62% and 82% compared to 2010. A reduction in energy intensity (energy consumption per GDP) contributes to more than 75% of the lower carbon intensity.

3. Clean energy to meet increasing demand and optimize structure

China’s energy development can be divided into two stages, with year 2035 as a watershed. Prior to the year, clean energy will be the new engineer. To be specific, coal demand will decrease stably, petroleum demand will rise mildly, while renewable energy, natural gas and nuclear energy will grow fast. After the year, non-fossil energy will replace coal and petroleum. Fossil energy demand will fall by 0.53 billion tons of standard oil (0.75 billion tons of standard coal) totally during 2035-2050. Demand for coal (electricity coal and industrial coal) will be the key contributory factor, while natural gas demand will increase. Non-fossil energy including wind power and solar energy will keep growing at a fast pace and will directly replace coal and petroleum (see Figure 3).

Figure 3 Carbon emissions led off by different energy categories

Stricter policies accelerate energy transformation

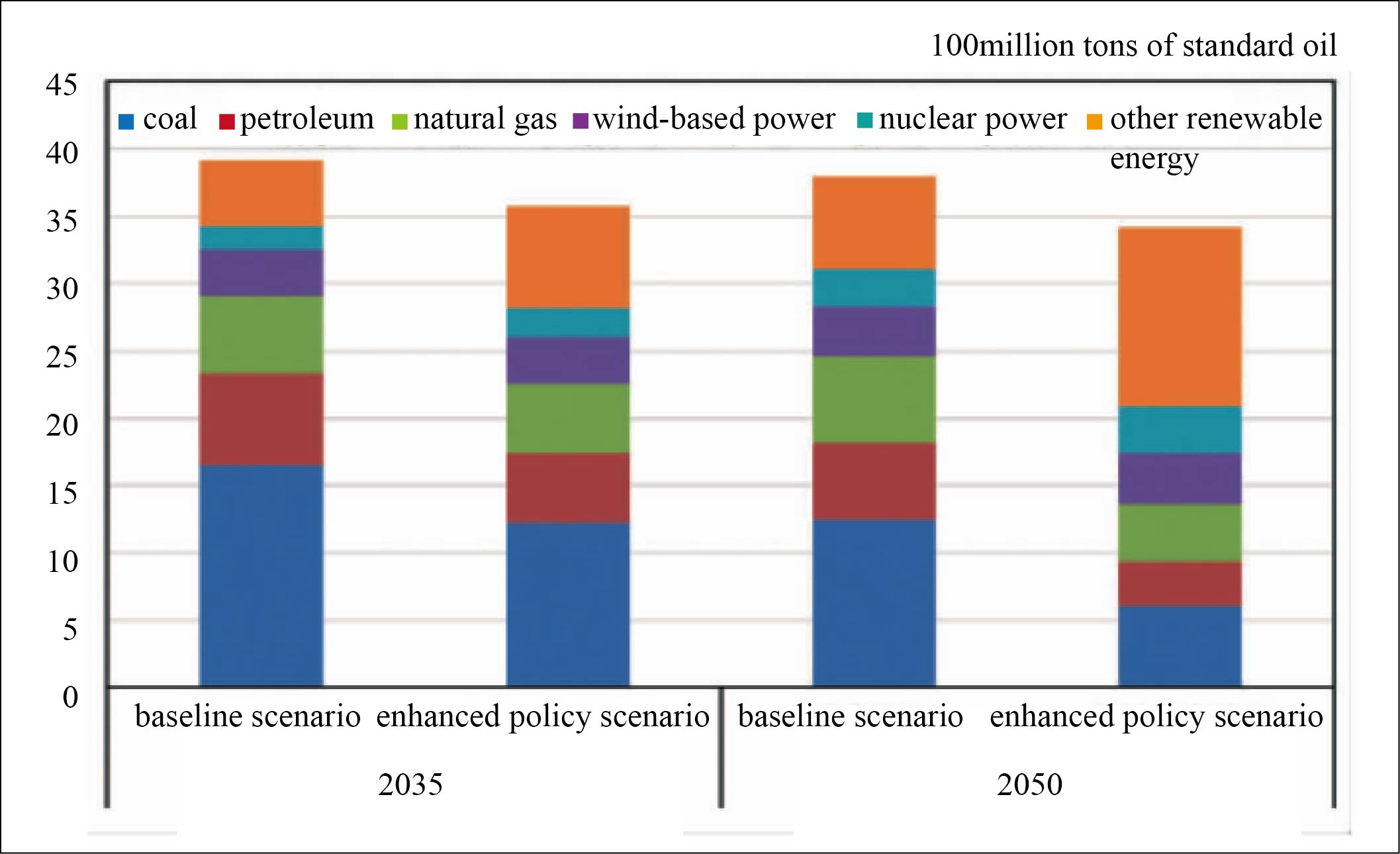

High energy consuming industries are getting restricted in the case of enhanced policy scenario while new-emerging industries such as service, information and high-end manufacturing are growing remarkably. On the energy demand side, the central government is dedicated to enhancing energy efficiency in diversified sectors, heightening electrification in terminal sectors, and adopting effective measures to carry out green production and popularize green living concept. On the energy supply side, the government implements stricter policies of utilizing fossil energy and carves non-fossil energy power technology into a more competitive position by combined measures covering levying taxes of carbon and environment, making carbon transactions and enacting finance & tax system.

End-user energy demand will reach a peak around 2030 (see Figure 4) and the electrification rate will be nearly 50% in terminal sectors. The rate will reach 48.5% in 2050 in the case of enhanced policy scenario, higher by 10 percentage points than that at baseline scenario. Power based on non-fossil energy will account for 85% of the total power in 2050, up by 29 percentage points compared with that in the case of baseline scenario.

Figure 4 Primary energy demand

China is sustainably and vigorously on its way to transform energy market, with production and consumption structure being optimized. During the period, the government, enterprises and users will forge a clean, low-carbon, safe and highly-efficient energy system.