By He Guoying, Sinopec Chemical Sales Company East China Branch

Market overview

China’s polyolefins (PO) market underwent narrow fluctuations in 2018. The price movements can be divided into four stages:

In January-March, domestic PO prices inched downwards due to a slow recovery in downstream demand and pile-up in inventories during China’s Lunar New Year holiday.

The market then regained steam in April-June, on a string of plants maintenance and restocking activities of downstream producers and traders.

However, trade weakened in the wake of the price rises. This, together with the arrival of the off-season for consumption slightly dragged down domestic PO prices in June-September.

Moving into the last quarter of 2018, the escalated trade dispute between the US and China and concerns about slowing world economy triggered a slump in global crude oil values and domestic PO prices decreased. The market outlook is dim.

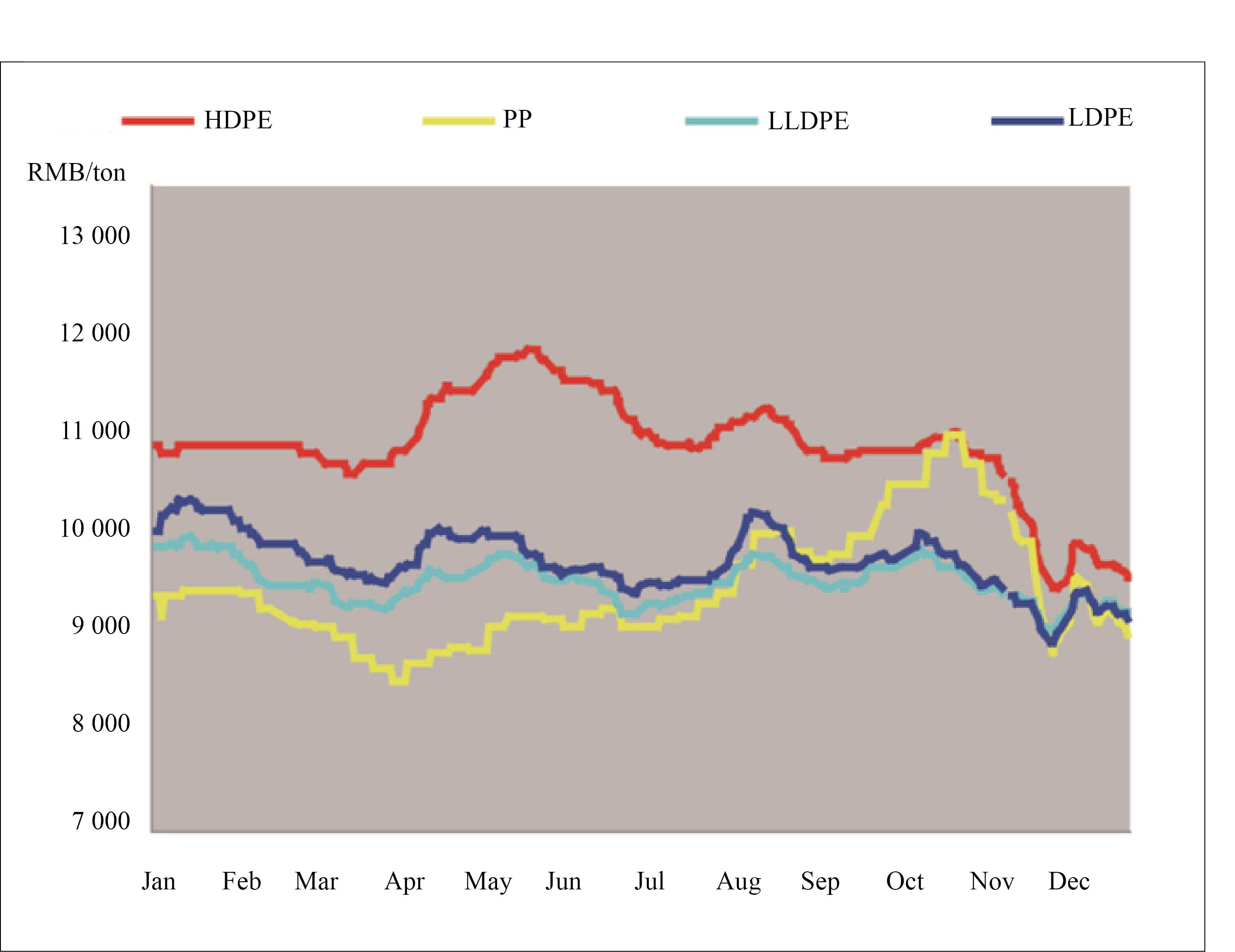

Figure 1 Domestic PO prices in 2018

Prices of low density polyethylene (LDPE) and linear low density PE (LLDPE) experienced mild fluctuations, by 10-15% throughout the year. The price gap between the two was narrowed. HDPE prices posted a wider swing of 22%, peaking at RMB12 000/t in May and fell back later in the year but remained above the levels in the same period of previous years. The price decline was mainly attributed to increased supply, as some plants recovered production after maintenance. PP prices fluctuated by 26%. PP yarn prices were largely stable in the first half of 2018 and surged later in the year because of the turnaround season for petrochemical producers from July, elevated futures prices and short availability.

It is noteworthy that the impact from the futures market on the spot market is increasing. LLDPE futures, after 10 years’ rapid development are directly affecting spot prices, due to its highlighting financial attributes and the active participation of hedging funds. The price correlation between LLLDPE futures and spot prices is as high as 80% in 2018.

Downstream industries

1. Slowing growth in plastics products industry

The US-China trade war and China’s slowing economy are thwarting the exports of plastics products. Domestic output is also declining. Data from the National Bureau of Statistics (NBS) showed that China’s plastics products output totalled 54.355 million tons in the first 11 months of 2018, almost flat from the same period of 2017, but the production volume registered a fourth-consecutive-month fall from August.

2. The increase in home appliances production slows

The production volume of three major home appliances in China reached 321.6 million units in January-November 2018, up by 8.6% year on year. In detail, the output of washing machines were 64.46 million units, down by 0.3% year on year, that of refrigerators totalled 74.19 million units, up by 2.9% year on year and the colour TV output amounted to 182.95 million units, up by 14.9% year on year.

3. Auto production and sales log in a dramatic fall

China’s auto production and sales sustained a growth rate of above 10% since 2013 and reached 29 million units in 2017. However, from 2018, shrinking demand triggered a year-on-year drop in auto output since July of over 10%. During the first 11 months of 2018, domestic auto output totalled 25.82 million units, down by 2.3% year on year, marking the first negative increase in the year.

Market outlook

China’s petrochemical capacity expansion took a breath in 2015-2018. Capacity addition of the synthetic resin industry is listed at Table 1. The increase in PO supply will outweigh that in demand in 2019. The capacity additions of polyethylene (PE) will be 2.85 million t/a, mainly including HDPE and LLDPE, with no LDPE expansion plans. PP capacities are estimated to increase by 4.8 million t/a. If all these new plants start up as scheduled, it will impose greater challenges to the PO market. Supply/demand forecast for synthetic resins in 2018-2019 is in Table 2.

Table 1 New synthetic resin capacities in 2019

Product | Company | Capacity (kt/a) | Expected start-up time | Remarks |

PE | Baofeng Phase II | 300 | Apr 2019 | HDPE |

Zhongan United Coal Chemical | 350 | Jun 2019 | HDPE/LLDPE | |

Qinghai Damei Coal Industry | 300 | Apr 2019 | HDPE/LLDPE | |

Zhejiang Petrochemical | 750 | Jun 2019 | HDPE/LLDPE | |

Baolai Petrochemical | 750 | Sep 2019 | HDPE/LLDPE | |

Daqing Lianyi Petrochemical | 400 | Oct 2019 | HDPE | |

Total | 2 850 | |||

PP | Zhejiang Satellite Petrochemical | 150 | Feb 2019 | |

Baofeng Phase II | 300 | Mar 2019 | ||

Shenzhen Grand Resource | 600 | Mar 2019 | ||

Zhongan United Coal Chemical | 350 | Jun 2019 | ||

Zhejiang Petrochemical | 900 | Jun 2019 | ||

Qinghai Damei Coal Industry | 400 | May 2019 | ||

Ningbo Fuji Petrochemical Phase II | 800 | Aug 2019 | ||

Baolai Petrochemical | 600 | Sep 2019 | ||

Gansu Huating Coal | 200 | Oct 2019 | ||

Daqing Lianyi Petrochemical | 500 | Oct 2019 | ||

Total | 4 800 |

Table 2 Synthetic resin supply/demand forecast in 2018-2019

Product | 2018 | 2019 | |||||

Capacity (kt/a) | Apparent consumption (kt) | YoY growth (%) | Capacity (kt/a) | YoY growth (%) | Apparent consumption (kt) | YoY growth (%) | |

PE | 18 840 | 29 590 | 8.4 | 21 690 | 15.1 | 31 930 | 7.9 |

PP | 22 390 | 24 520 | 5.2 | 27 190 | 21.4 | 26 730 | 6.9 |

Global crude oil prices stayed in a downtrend since October 2018, and slumped by over 40% from the high set, despite a robust rally on December 26. Research agencies have revised down their oil price forecast for 2019, citing the downside risks on world economy and concerns over slowing growth in world petroleum demand.

Rapid capacity expansion and steady growth in downstream demand will tighten the PO market competition. The PP market will come under heavy supply pressure. Domestic PP prices may hover at low levels, ranging between RMB7 500-10 000/t.