By Luo Yamin, CNCIC

Liquid crystal polymers (LCPs) can be classified into thermotropic liquid crystals and lyotropic liquid crystals. Products completing with thermotropic liquid crystal polymers (TLCPs) include polyphenylene sulfide (PPS), polyphthalamide (PPA), polycyclohexanemethylene terephthalate (PCT) and some special nylons. These products can be as thin as 0.25mm, while TLCPs can have a thickness of 0.1mm.

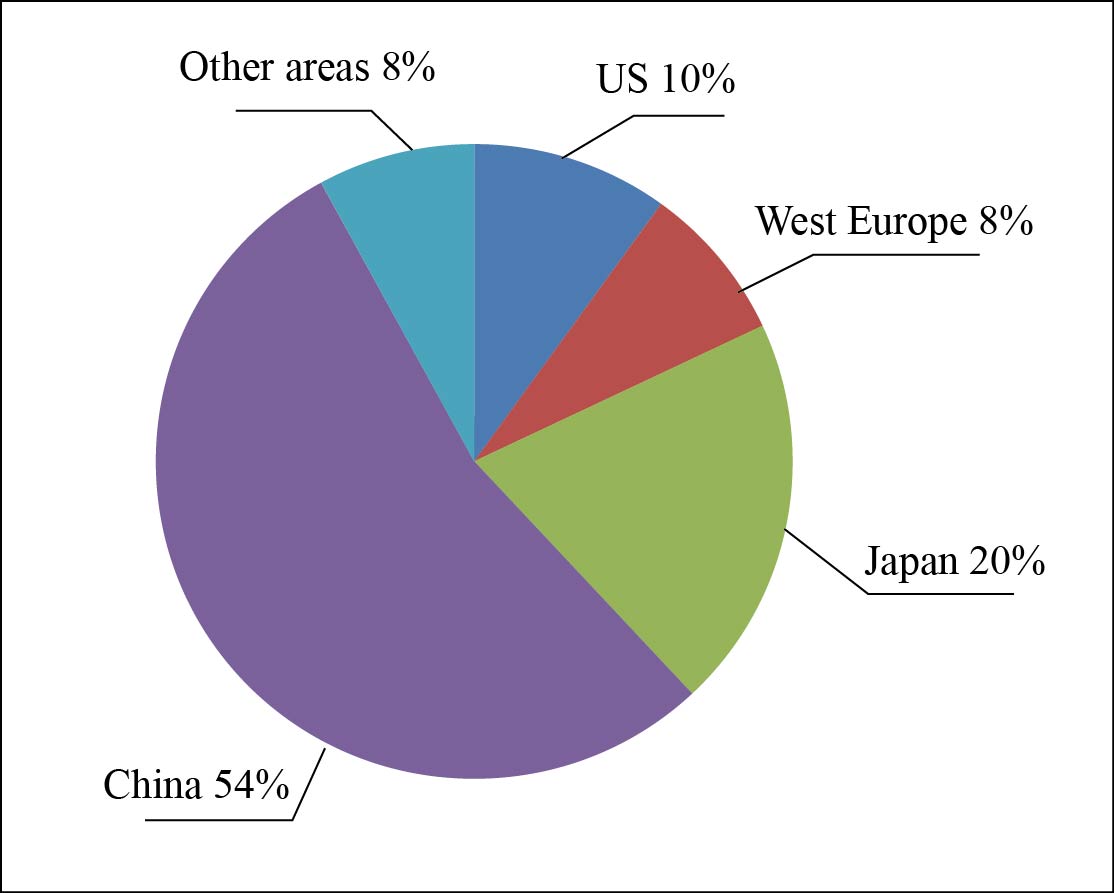

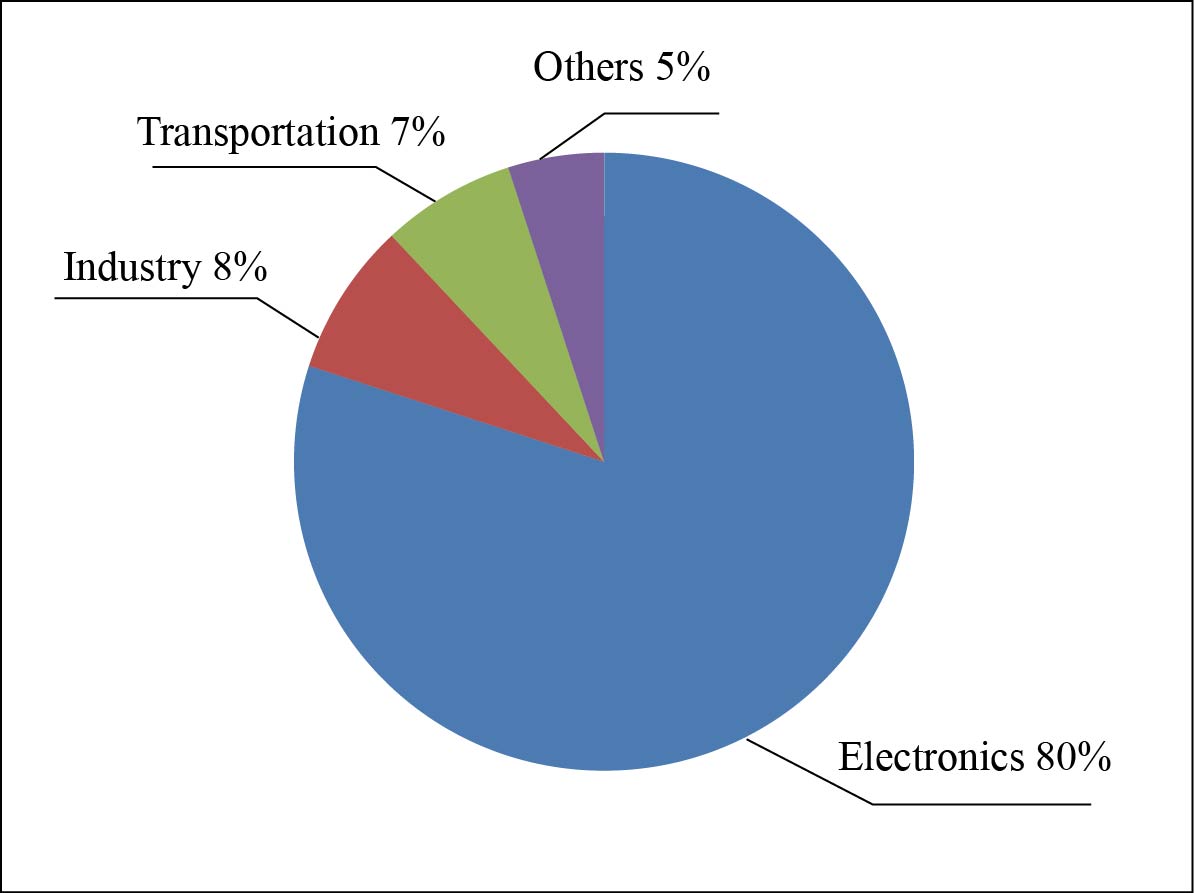

Asian market takes 80% of the total consumption

The global consumption of TLCPs in 2017 was about 39 000 tons. Asia is the largest market, consuming more than 80% of the total products, among which, China accounts for more than 50% and Japan 20%. The United States takes about 10% of the total market. TLCPs were initially used in microwave ovens or other stoves. Nowadays, consumers of TLCPs include electronics, industry, and transportations, accounting for 80%, 8% and 7% respectively. The consumption structure of global TLCPs is shown in Chart 1.

Chart 1 Global TLCPs consumption structure

With its unique high strength, high temperature resistance and high fluidity, TLCPs have obtained huge growth opportunities given the electronic industry's miniaturization trend and the increasing popularity of microinjection technology. Two factors have jointly promoted the growth of consumption of TLCPs in the field of electronic appliances: one is the popularity of high pin density SMT connection technology; the other is the increasing production of smartphones, tablets and virtual reality devices. In the field of electronic appliances, most liquid crystal polymers are used for surface mounting of components. The lead-free solder requires materials with better high-temperature resistance, and the miniaturization of electrical appliances requires thin-shell components, which have driven the consumption of TLCPs in this field. In addition, TLCPs are one of the few materials whose thermal expansion coefficient and circuit board are consistent. Therefore, TLCPs are widely used in the manufacture of chip carriers, coils, spools, sockets, printed circuit boards, capacitor housings, optoelectronic devices, potentiometers and switches, as well as playing laser head holders, guides and vehicles of electronic packaging and circuit board production equipment, and protective shell of auto potentiometer, etc.

TLCPs can be blended with other polymers for better performance or cost performance. In the field of automobile manufacturing, TLCPs are mainly used for oil circuits and electronic equipment, such as shells of motor permanent magnets and vehicle sensors, lamp holders, reflectors, and the like. TLCPs can also be used in a variety of chemical and industrial processes such as chemical probe shells, industrial machinery heat seals, winches, pump and instrument bushings, valve liners and reactor equipment. They can replace materials such as fluororesins that are difficult to process. In the aerospace and defense sectors, TLCPs are used as lightweight materials for a variety of internal parts. Other application areas include fibers such as fiber materials for optical fiber and plastic reinforcement.

Global capacity

1. US

As a major manufacturer, AMOCO has been able to produce a wide range of liquid crystal polymers before 1993. By continuously optimizing its business, AMOCO eventually decided to produce only Xydar grade. It was acquired by Solvay in 2001 and is now producing three series, including Xydar. In 1995, DuPont's capacity of Zenite reached 2 700 t/a, and the product has better performance in melt flow, hardness and dimensional stability. By 2002, the capacity expanded to 3 200 t/a, and DuPont acquired Eastman’s TLCPs business in 2003, bringing the total capacity to 8 000 t/a. When DuPont sold its liquid crystal polymer business to Celanese in 2010, its production capacity has reached 9 500 t/a. Celanese's own capacity of Ticona, its original liquid crystal polymer, had already reached 6 000 t/a in 2002. Today, Celanese and Solvay offer not only liquid crystal polymer resins, but also enhanced products such as fiberglass for increased strength or dyeability.

In 2017, the TLCPs capacity in US was about 16 000 t/a, and the output was about 14 000 tons, with 10 000 tons of exports. Among the 4 000 tons of products consumed in the United States, about 75% to 80% are consumed by electronic appliances and 8% by industrial and transportation, which is similar to the global consumption structure. It is predicted that the future consumption will increase by an average of 5% per year, and the consumption structure will not change much.

2. Europe

There are no companies producing TLCPs in Europe, as Bayer, Imperial Chemical Industry and Rhone Poulenc all withdrew from this sector in the early 1990s. At present, the supply for the European market is mainly from the United States, and only a small amount comes from Japan’s Sumitomo. Celanese occupies about 80% of the European market, while Solvay occupies half of its high-end market.

In 2017, the consumption of TLCPs in Europe was about 3 100 tons, of which 70% were for electronic appliances, 15% for transportation, and 15% for others. Compared with five years ago, the proportion of electronic appliances has decreased, while the traffic sector has increased accordingly.

3. Japan

About 2/3 of TLCPs producers and capacities of the world concentrate in Japan, including Polyplastics, Sumitomo, Toray, Ueno Pharmaceuticals, Unitika and Nippon Oil. Among them, Polyplastics ranks the first with a capacity of 15 000 t/a. It expanded its capacity three times during 2008-2015, and also produces masterbatch in mainland China, Taiwan, and Malaysia. Sumitomo Chemical ranks the second with a capacity close to 10 000 t/a, which is also the first company in Japan to develop liquid crystal polymers. It now has two TLCPs factories. The total capacity of the six companies is 30 000 t/a.

In 2017, Japan's TLCPs production and export was respectively 23 000 tons and 16 000 tons, and domestic consumption was about 7 000 tons. In the consumption structure, electronic appliances accounted for 65%, transportation sector accounted for 10%, and the others 25%.

4. China

Shanghai PRET Composites Co., Ltd. is a major producer of TLCPs in China. It has expansion plans, but its main business is automotive materials, and it will take some time to enter the field of electronic appliances.

In 2017, the consumption of TLCPs in mainland China nearly reached 20 000 tons, but more than 95% of the demand relied on imports. More than 85% of TLCPs in China are used in the electronics and electrical industry, and only 5% to 6% are for the industrial and automotive industries. China is the world's largest mobile phone and computer manufacturing region, but it is hard for TLCPs to substitute other materials as they are more expensive.

In China, the market growth rate of TLCPs is expected to be 5% in the next few years, in line with its growth rate in the global market.

Supply pattern is stable

The market for TLCPs in the coming years is still driven by following factors:

● The trend of miniaturization and ultra-thinness of electrical appliances requires smaller and thinner integrated circuits and components;

● Demand for lightweight in the automotive industry requires lighter materials, so as to reduce carbon emissions;

● Application of low-risk flame retardant materials in various fields;

● Overall market development of major downstream markets.

Overall, the consumption of liquid crystal polymers will maintain an average annual growth rate of around 5% in the coming years. As a high-quality product, the number of producers will not change much in the future, and the supply side will remain relatively stable.