By Jia Ruixue, Gong Yongqiang, Chemsino

In the first half of 2018 the price trend of PTA spot goods in China was quite stable. Starting from the second half of the year, however, the price went all way up from RMB6 000/t to RMB9 300-9 500/t at the end of August with a shocking increase margin of over 50%.

Supply shortage ignites the market

PTA is mostly used to produce polyester. Downstream products of polyester mainly include various fabrics and clothes. By the end of 2017 the capacity of PTA in China was 50.0 million t/a (including an idle capacity of around 10.0 million t/a). The capacity of polyester was around 50.0 million t/a.

The apparent consumption of PTA in China was over 10.0 million tons in 2004, over 30.0 million tons in 2015 and reached 35.0 million tons in 2017. Due to the unduly rapid capacity expansion, oversupply became more prominent. Most enterprises started to implement plans for production reduction in 2014. More units such as those in Xianglu Petrochemical Co., Ltd., Pengwei Petrochemical Co., Ltd., Jialong Petrochemical Co., Ltd. and Huabin Petrochemical Co., Ltd. were laid idle. The overall operating rate was much lower than before. New capacities also became less after 2015. Only a few units such as the third-phase unit in Hengli Petrochemical Co., Ltd. (2015), the third-phase unit in Zhuhai BP Chemical Co., Ltd. (2015), the second-phase unit in Hanbang (Jiangyin) Petrochemical Co., Ltd. (2016) and the unit in Tongkun Group Jiaxing Petrochemical Co., Ltd. (2017) started production. There are no new capacities in 2018 up to now. Table 1 shows the major PTA producers in China (not including Taiwan, the same below) and their capacities.

Table 1 Major PTA producers in China

Producer | Location | Capacity (kt/a) |

Hengli Petrochemical Co., Ltd. | Dalian of Liaoning | 6 600 |

Xianglu Petrochemical Co., Ltd. | Xiamen of Fujian | 6 150 |

Yisheng Dahua Petrochemical Co., Ltd. | Dalian of Liaoning | 5 950 |

Ningbo Yisheng Petrochemical Co., Ltd. | Ningbo of Zhejiang | 5 600 |

Huabin Petrochemical Co., Ltd. (Far East Petrochemical Co., Ltd.) | Shaoxing of Zhejiang | 3 200 |

Tongkun Group Jiaxing Petrochemical Co., Ltd. | Jiaxing of Zhejiang | 3 200 |

Zhuhai BP Chemical Co., Ltd. | Zhuhai of Guangdong | 2 950 |

Chengxing Group Hanbang (Jiangyin) Petrochemical Co., Ltd. | Jiangyin of Jiangsu | 2 800 |

Sanfangxiang Group Helen Petrochemical Co., Ltd. | Jiangyin of Jiangsu | 2 400 |

Hainan Yisheng Petrochemical Co., Ltd. | Danzhou of Hainan | 2 000 |

Honggang Petrochemical Co., Ltd. | Lianyungang of Jiangsu | 1 500 |

Yangzi Petrochemical Co., Ltd. | Nanjing of Jiangsu | 1 350 |

Formosa Plastics (Ningbo) Co., Ltd. | Ningbo of Zhejiang | 1 200 |

Yizheng Chemical Fiber Co., Ltd. | Yizheng of Jiangsu | 1 000 |

Others | 5 000 | |

Total | 50 900 |

The demand growth of PTA in the downstream polyester sector has reached as high as 10%. There is also a new wave for the completion of polyester projects in China in 2018. A new polyester capacity of nearly 5.0 million t/a has already been put in market, needing to consume around 4.0 million tons of PTA a year. There are no new PTA capacities in 2018. The demand of PTA is brisk in this gap period. The toppling of the supply/demand balance is one of factors for the ignition of the PTA market this time.

Next few years will become the peak period for capacity growth

2019-2022 will become another peak period for the growth of the PTA capacity in China. New capacities of at least 30.0 million t/a will be constructed or planned for construction in future. Table 2 shows the partial new capacities of major PTA producers in China.

Table 2 Partial new capacities of major PTA producers in China

Producer | Location | Capacity (kt/a) | Time for starting production |

Chengda Chemical New Material Co., Ltd. | Nanchong of Sichuan | 1 000 | Already completed, not yet fixed |

Xinfengming Group Dushan Energy Co., Ltd. | Jiaxing of Zhejiang | 2 200 | Q3, 2019 |

Hengli Petrochemical Co., Ltd. fourth-phase project | Dalian of Liaoning | 2 200 | October, 2019 |

Zhongtai Group Kunyu New Material Co., Ltd. | Korla of Xinjiang | 1 200 | October, 2019 |

Zhongjin Petrochemical Co., Ltd. | Ningbo of Zhejiang | 3 300 | 2019-2020 |

Blue Ridge Tunhe Chemical Industry Co., Ltd. | Changji of Xinjiang | 1 200 | 2019-2020 |

Baota Petrochemical Co., Ltd. | Yinchuan of Ningxia | 1 200 | 2019-2020 |

Hengli Petrochemical Co., Ltd. fifth-phase project | Dalian of Liaoning | 2 500 | March, 2020 |

Baihong Petrochemical Co., Ltd. | Quanzhou of Fujian | 2 500 | August, 2020 |

Jiangyin Chengxing Industrial Group Co., Ltd. | Tianjin | 2 200 | 2020 |

Tongkun Group | Jiujiang of Jiangxi | 2 400 | First half of 2021 |

Jiutai New Material Co., Ltd. | Hohhot of Inner Mongolia | 1 800 | 2022 |

Shaanxi Coal and Chemical Industry Group Yulin Chemical Co., Ltd. | Yulin of Shaanxi | 1 800 | 2025 |

China North Industries Group Corporation | Panjin of Liaoning | 2 000 | NA |

Huadian Coal Industry Group Co., Ltd. | Yulin of Shaanxi | 1 700 | NA |

Urumqi Petrochemical Co., Ltd. | Urumqi of Xinjiang | 1 200 | NA |

Total | 30 400 |

The fourth-phase 2.5 million t/a PTA project in leading enterprise Hengli Petrochemical Co., Ltd. is planned to start production next year and the contract on the fifth-phase 2.5 million t/a project will be signed right afterwards. The total capacity of 5 production lines in the company will reach 11.6 million t/a. Some major polyester enterprises such as Baihong Petrochemical Co., Ltd. and Xinfengming Group Dushan Energy Co., Ltd. have also announced to launch PTA projects. In addition, emerging enterprises such as chlor-alkali giant Zhongtai Group and coal giant Shaanxi Coal and Chemical Industry Group Yulin Chemical Co., Ltd. also have plans for constructing PTA units. The PTA sector will therefore have a new round of development in next few years.

The unduly low self-sufficiency rate of PX will be remarkably improved

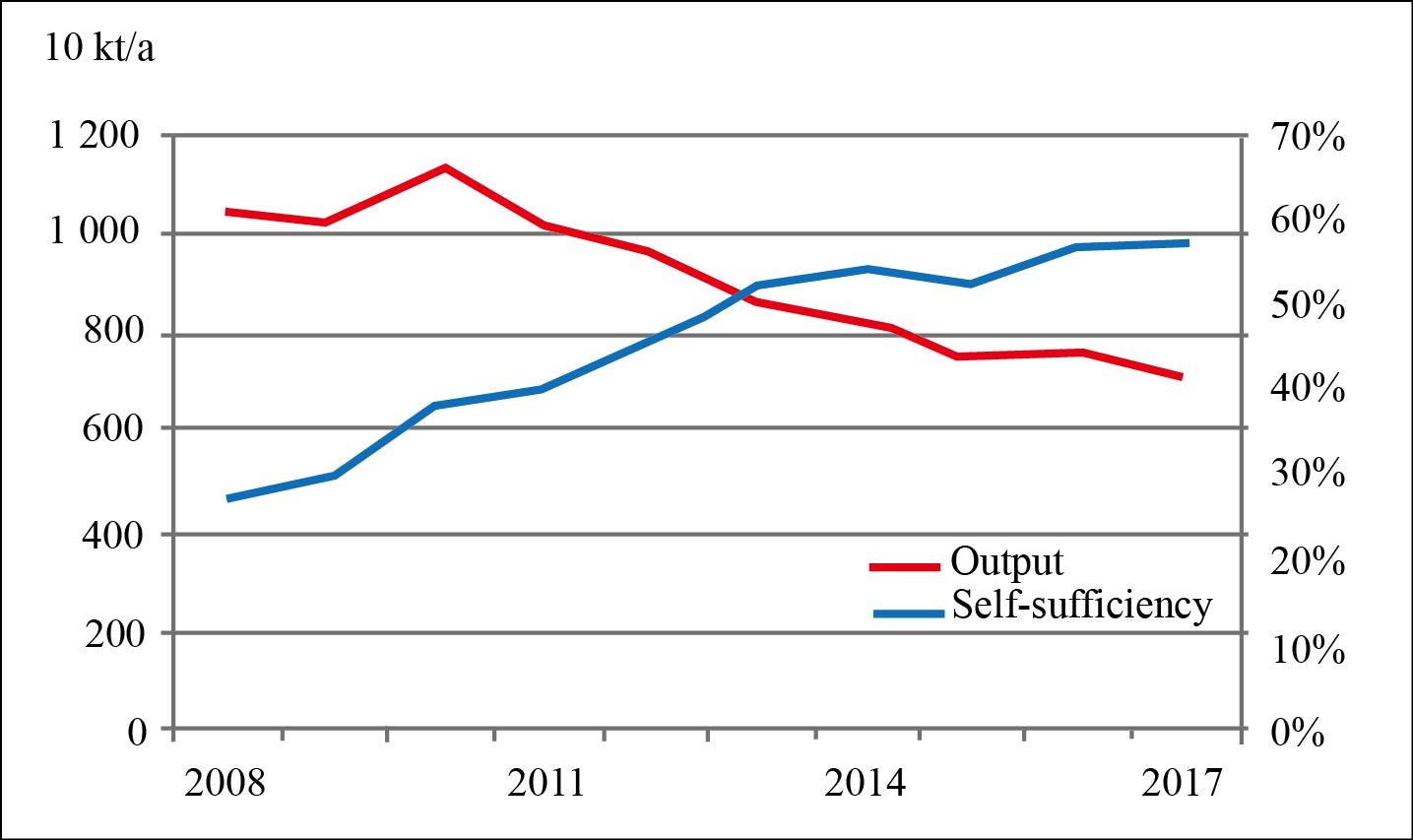

PX is a major raw material for the production of PTA. The PTA capacity in China has made a sustained expansion in past dozen years, but the PX capacity fails to make synchronous development and even has stagnancy. The supply gap is therefore widening and the import dependence is increasing. The entire polyester industrial chain is affected. Figure 1 shows the trend of the PX self-sufficiency rate and output in China in past decade.

Figure 1 Trend of PX self-sufficiency rate and output in China in Past Decade

Korea and Japan export great quantities of PX to China. The fuse for the price hike of PTA this time is also triggered by the wanton price increase of PX made by suppliers because of the production suspension or production reduction of several foreign PX units due to force majeure. Making a vigorous development of the PX sector has already become a common understanding. A large number of PX units will be constructed in China in next few years. Table 3 shows the new capacities of major PX producers in China.

Table 3 New capacities of major PX producers in China

Producer | Location | Capacity (kt/a) | Time for starting production |

Hengli Petrochemical Co., Ltd. | Dalian of Liaoning | 4 500 | Beginning of 2019 |

Zhejiang Petrochemical Co., Ltd. first-phase | Zhoushan of Zhejiang | 4 000 | Beginning of 2019 |

Shenghong Petrochemical Co., Ltd. | Lianyungang of Jiangsu | 2 800 | Second half of 2019 |

Zhejiang Petrochemical Co., Ltd. second-phase | Zhoushan of Zhejiang | 4 000 | 2020 |

Tangshan Risun Petrochemical Co., Ltd. | Tangshan of Hebei | 2 000 | 2020 |

Hebei Xinhua United Petrochemical Co., Ltd. | Tangshan of Hebei | 5 570 | NA |

Caofeidian Middle East Gulf refining & chemical integrated project | Tangshan of Hebei | 3 000 | NA |

Hebei Yihong Petrochemical Co., Ltd. | Tangshan of Hebei | 3 000 | NA |

China-Venezuela Guangdong Petrochemical Co., Ltd. oil refining project | Jieyang of Guangdong | 2 600 | NA |

Jinjiang Petrochemical Co., Ltd. | Zhangzhou of Fujian | 2 000 | NA |

Total | 33 470 |

It can be seen from Table 3 that the project soon put on stream in Hengli Petrochemical Co., Ltd. has a PX capacity of 4.5 million t/a and the first-phase project and the second-phase project under construction in Zhejiang Petrochemical Co., Ltd. have a total PX capacity of 8.0 million t/a. In case most of projects being constructed or planned for construction during 2019-2025 can start production on schedule, the conservative estimation is that the new PX capacity will be over 20.0 million t/a. The status of making PX import in great quantities will be thoroughly changed and the unduly low self-sufficiency rate of raw material PX will also be remarkably improved at that time.

Spot goods and futures have tandem drive, striving to become a global pricing center of polyester series products

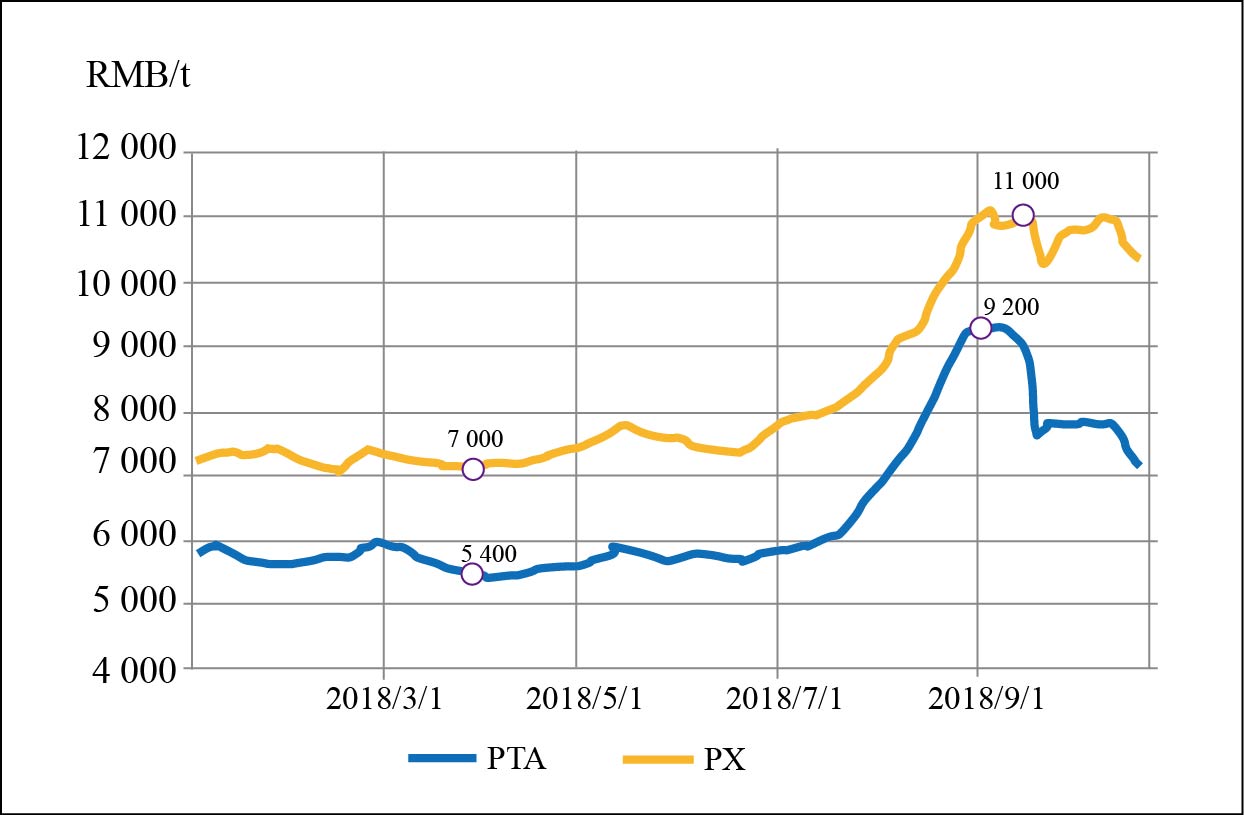

The market price of PTA in China is mainly classified into the price of spot goods and the price of futures. The market price of spot goods is mainly based on the production cost of PTA. Price fluctuations of raw material PX directly influence the production cost and the market price of PTA. Figure 2 shows the comparison of market price trend between PTA and PX this year.

Figure 2 Market price trends of PTA and PX in 2018

It can be seen from Figure 2 that before the price rise in the first half of 2018 the price difference between PTA and PX was basically stable. Starting from the second half of the year, however, the price difference became smaller in the course of drastic price rise in both PTA and PX. The price rise margin of PTA was larger than PX. The market of PTA futures was the main player in this. The market of PTA futures took advantage of various factors such as the temporary supply/demand imbalance of PTA and the price rise of raw materials to make speculations and pushed the market price of PTA spot goods to make a more rapid increase.