By Zhang Rui, Beijing Guohua New Material Technical Centre

Silicone rubber is mainly classified by vulcanizing method into HTV (high-temperature vulcanized), RTV (room-temperature vulcanized) and LSR (liquid silicone rubber). Application sectors are extremely extensive.

HTV: The technical level is yet to be improved

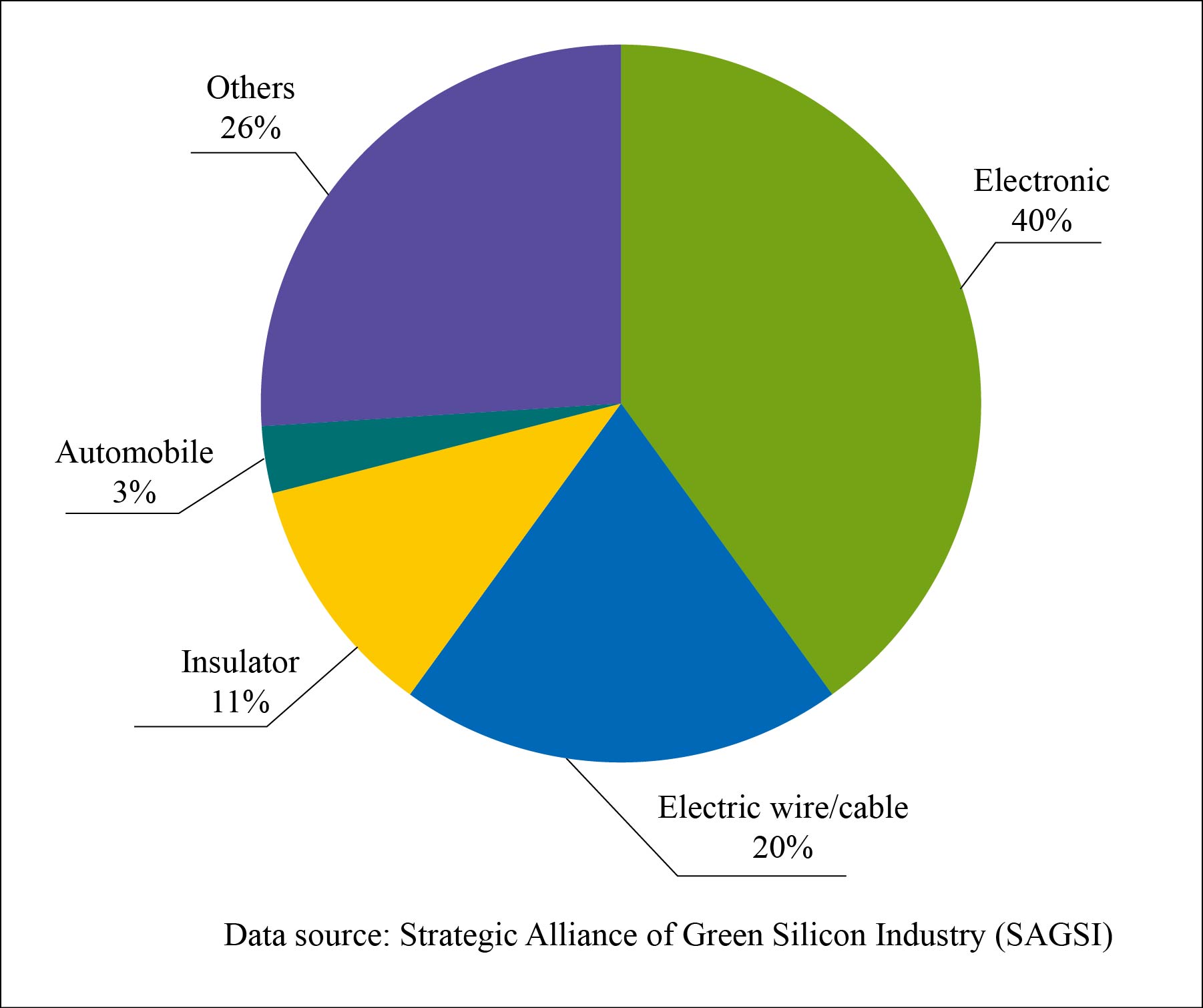

The capacity of HTV in China was around 560 kt/a in 2017, an increase of 3.8% over the previous year. The output was around 480 kt, an increase of 8.9%. The operating rate was 85.7%, being 3.9 percent higher than 2016. The increase of the HTV capacity in 2017 mainly came from the expansion of the HTV capacity in Hoshine Silicon Industry Co., Ltd. to 30 kt/a. The market demand of HTV in China reached around 675 kt in 2017. Figure 1 shows the consumption proportion of HTV in various sectors in 2017.

Figure 1 Consumption proportion of HTV in various sectors in 2017

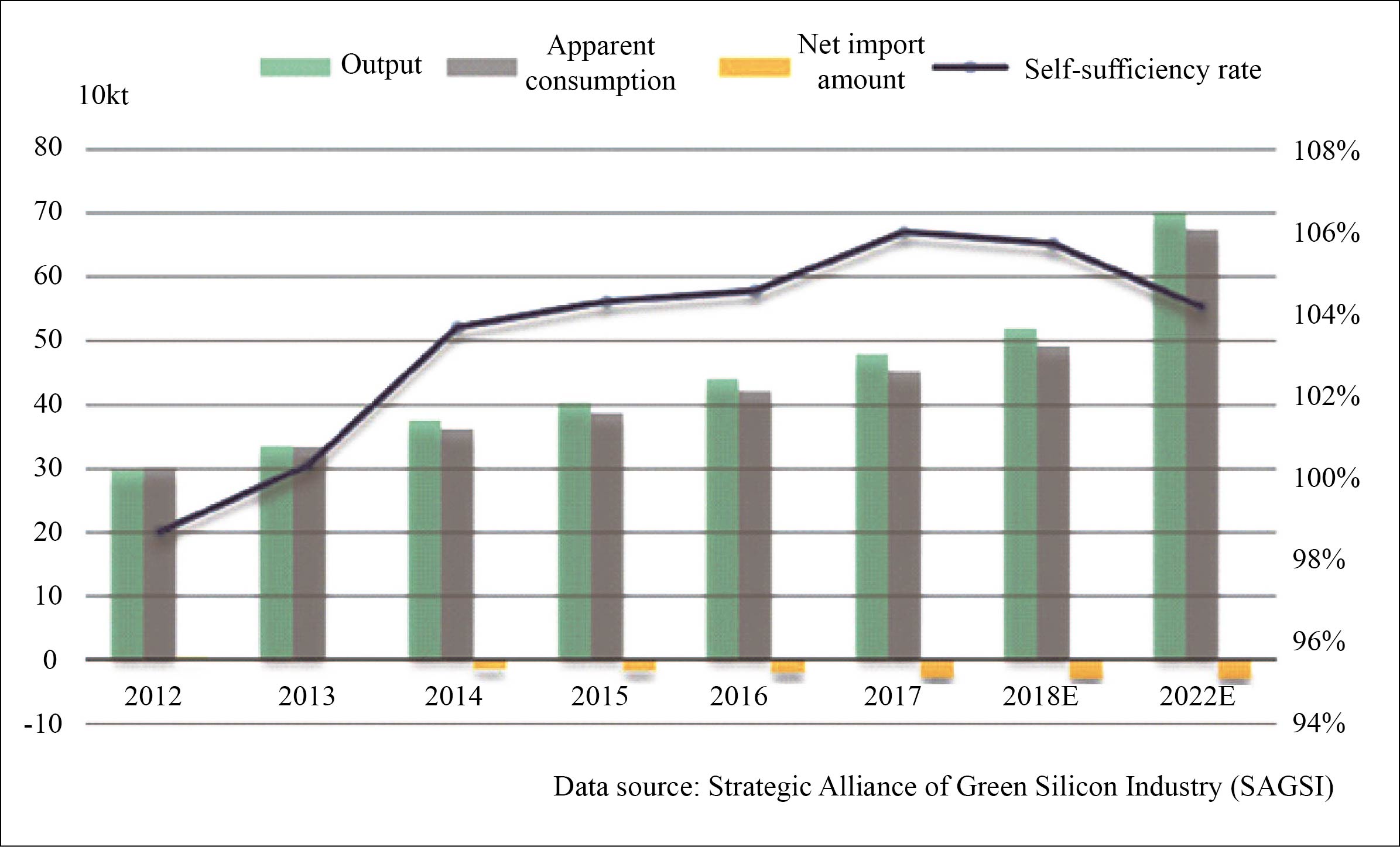

The export amount of HTV in China was around 48.8 kt in 2017, an increase of 23.9% over the previous year. The export amount of 110 raw rubber was 5.668 kt, a drop of 37.9%. The import amount of HTV was 21.7 kt, an increase of 7.5%. The import amount of 110 raw rubber was 2.903 kt, a drop of 27.2%. It is expected that the output of HTV in China will reach 703 kt in 2022 and the demand will be 675 kt. Figure 2 shows the supply/demand status and the product self-sufficiency rate of HTV during 2012-2017.

Figure 2 Supply/demand status and product self-sufficiency rate of HTV during 2012-2017

The overall technical level of the HTV sector in China is yet to be improved today. The major future direction of technical development will be concentrated on the molecular structure design, the molecular weight control, the vinyl content and distribution and the polymerization technology of raw rubber, halogen-free flame-retarding silicone rubber, silicone rubber with no need of secondary vulcanizing, medical silicone rubber and silicone rubber with special functions such as high-temperature resistance, high strength, great transparency and high damping.

RTV: Foreign enterprises occupy medium/high-end markets

RTV is mainly used in bonding/sealing agents, potting materials and molds. Products with the highest consumption are sealing agents used in building and decoration markets.

Major RTV producers in the world today include DowDuPont, Momentive, Wacker, Shin-Etsu of Japan, Sika of Switzerland and Henkel. In China these enterprises mainly occupy medium/high-end markets. Local enterprises in China are mainly concentrated in Guangdong, Jiangsu and Zhejiang. There are more than a dozen enterprises whose silicone rubber capacity has reached over 20 kt/a. They mainly include Hangzhou Zhijiang Silicone Chemicals Co., Ltd., Guangdong Baiyun Chemical Industry Co., Ltd., Chengdu Guibao Science & Technology Co., Ltd. and Hubei Guike Science & Technology Co., Ltd.

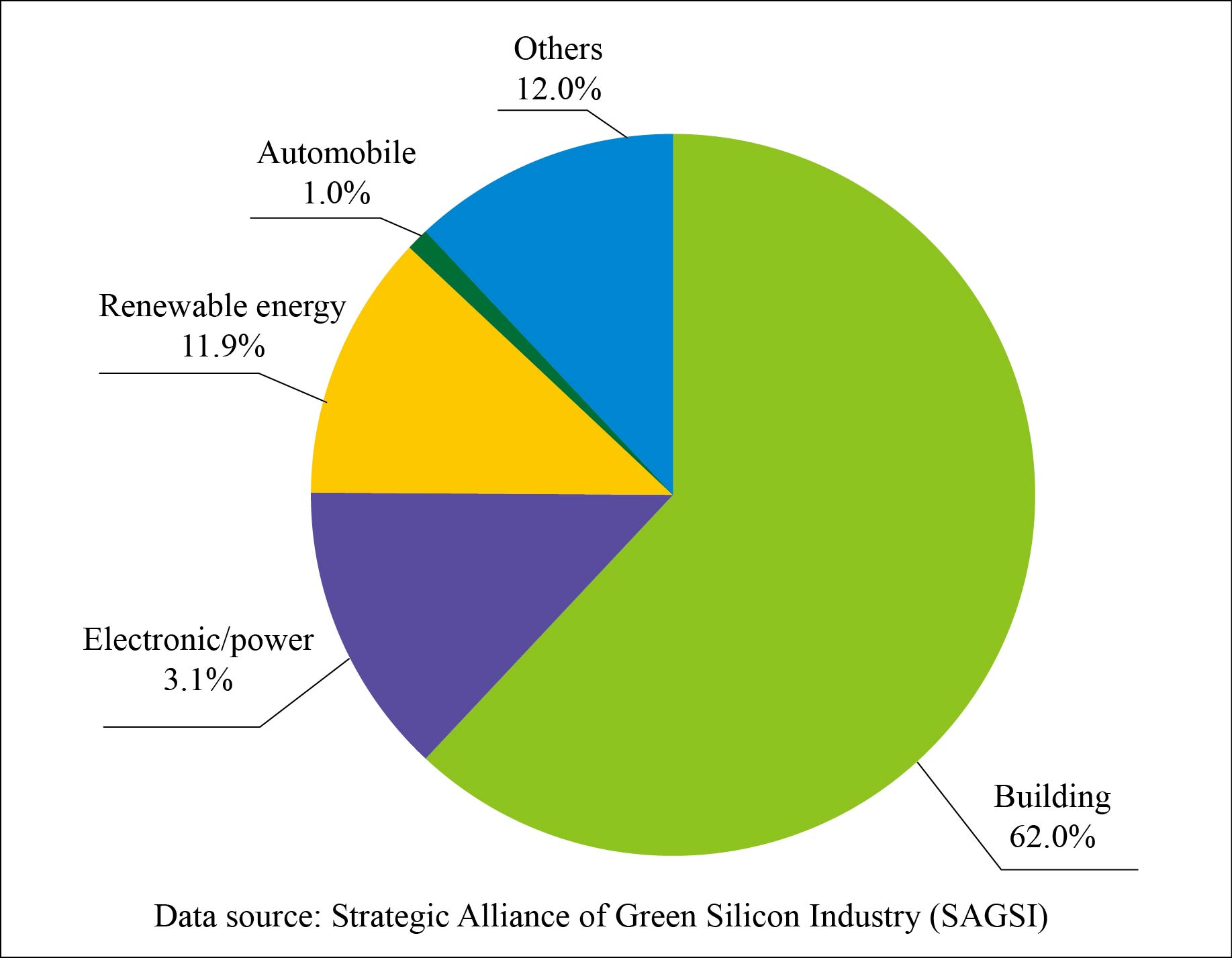

The import amount of RTV in China was around 3.401 kt in 2017, a drop of 43% from the previous year. The export amount of RTV was around 7.165 kt, a drop of 8.0%. The import amount of 107 raw rubber was around 6.140 kt, an increase of 79%. The export amount of 107 raw rubber was around 16.0 kt, an increase of 172%. The consumption of RTV in China reached 689.0 kt in 2017, an increase of 13.7% over the previous year. The output was around 693.0 kt and the market gap was 3.8 kt. Figure 3 shows the consumption structure of RTV in China in 2017.

Figure 3 Consumption structure of RTV in China in 2017

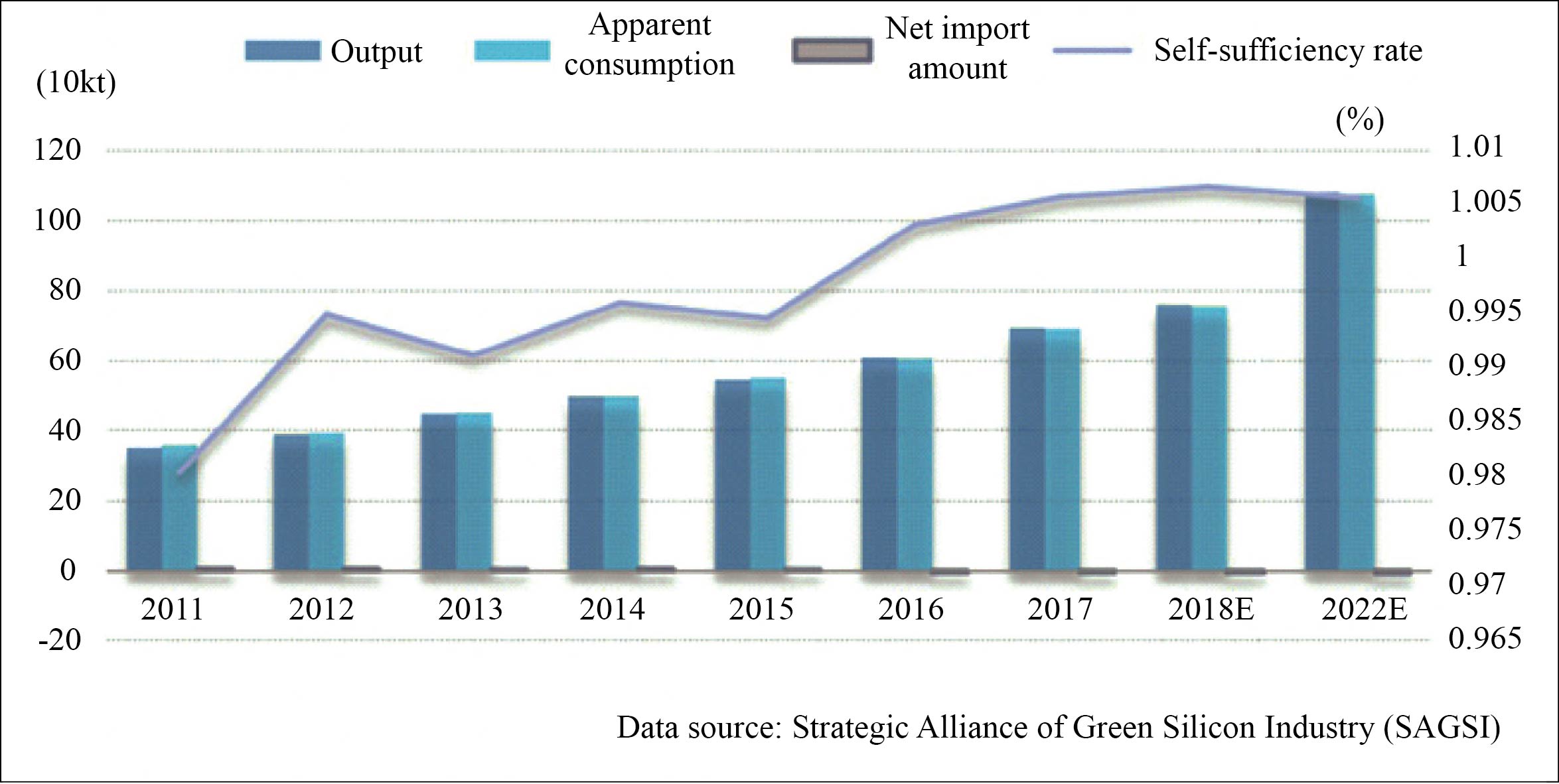

It is expected that the output of RTV in China will reach 760 kt in 2018 and the demand will be 755 kt. Figure 4 shows the supply/demand balance and the forecast of RTV in China during 2011-2017.

Figure 4 Supply/demand balance and forecast of RTV in China during 2011-2017

LSR: The output in top 5 enterprises accounts for 65%

LSR features good fluidity and fast vulcanizing and can have casting molding and injection molding. Typical LSR is nontoxic, odorless and transparent, has extremely high medical safety and food safety and can be used as filler for artificial mammas.

The commercial production of LSR in China started at the beginning of this century. With the gradual easing of supply, application sectors have been expanded. LSR is already extensively used in automobile, power insulation, electronic, food packaging, medical apparatus, health care, sports appliance, solar energy, optical, printer and military sectors.

Major LSR producers in China include DowDuPont, Shenzhen Square Silicone Co., Ltd., Shin-Etsu Silicone (Nantong) Co., Ltd., Guangdong Juhe Silicone Material Co., Ltd., Dongguan New Oriental New Material Co., Ltd. and Jiangsu Tianchen New Material Co., Ltd. The total output share of top 5 enterprises is 65%. The average operating rate was 67.6% in 2017, higher than 59% of 2016. Table 1 shows the major LSR producers in China in 2017.

Table 1 Major LSR producers in China in 2017

| Sr. No. | Producer |

| 1 | Dow Corning (Zhangjiagang) Silicone Co., Ltd. |

| 2 | Shenzhen Square Silicone Material Co., Ltd. |

| 3 | Shin-Etsu Silicone (Nantong) Co., Ltd. |

| 4 | Guangdong Juhe Silicone Material Co., Ltd. |

| 5 | Dongguan New Oriental New Material Co., Ltd. |

| 6 | Jiangsu Tianchen New Material Co., Ltd. |

| 7 | Shenzhen Zhengan Silicone Material Co., Ltd. |

| 8 | AB Specialty Silicones (Nantong) Co., Ltd. |

| 9 | Jiangxi Xinghuo Silicone Plant |

| 10 | Zhejiang Wynca Chemical Group Co., Ltd. |

| 11 | Anhui Yuhong Silicone Material Co., Ltd. |

| 12 | Guangdong BioMax Si&F New Material Co., Ltd. |

| 13 | Ningguo Xingxiang Silicone Material Co., Ltd. |

The future direction of technical development will mainly be concentrated on the improvement of system bonding performance, the research of single-component LSR storage feature and the development of new catalysts and inhibitors.