By Xia Bin, CNPC Northeast Refining & Chemical Engineering Co., Ltd. Jilin Design Institute

Polystyrene (PS) plays an important role in synthetic resins. Its output and consumption rank only after polyethylene, polyvinyl chloride and polypropylene. It is mainly used in packaging containers, electronic appliances, building materials, daily necessities and medical equipment.

Slowdown in capacity expansion

China’s capacity of general polystyrene (GPPS)/high impact polystyrene (HIPS) reached 3.75 million t/a in 2017. The producers are mainly concentrated in the Yangtze River Delta and Pearl River Delta. The capacity in East China accounts for more than 60% of the national total, and the products are shipped to East China, North China, Central China, South China and Southwest China. The capacity in South China accounts for about 17% of the total, and the products are mostly consumed by local users.

Among China's GPPS/HIPS manufacturing enterprises, joint ventures and foreign-funded enterprises occupy an important position. Nine of the top 10 producers in China are joint ventures or foreign-funded enterprises. In terms of products, joint ventures and foreign-funded enterprises such as Chi Mei, Secco, and Ningbo Formosa Plastics can produce various products such as HIPS for electrical appliances, biaxially oriented polystyrene (BOPS) and high transparency GPPS, while state-owned enterprises such as Yanshan PC, Guangzhou PC and Fushun PC can only produce general brands. In 2017, HIPS products accounted for 40% of the total GPPS/HIPS products, which is basically equal to domestic demand. The main GPPS/HIPS production enterprises and capacity in China in 2017 are shown in Table 1.

Table 1 China’s major GPPS/HIPS producers in 2017

Producer | Capacity (kt/a) |

Zhenjiang Chi Mei Chemical | 440 |

Jiangsu CITIC Guoan New Material | 460 |

Sinopec Shanghai | 300 |

Formosa (Ningbo) | 200 |

Total (Ningbo) | 200 |

Total (Foshan) | 200 |

BASF-YPC Styrene | 180 |

Shaanxi Yanchang Petroleum Refining & Petrochemical Company | 160 |

Jiangsu Lv’an Qingfeng New Material | 150 |

Guangdong Xinghui Synthetic Material | 150 |

Tianjin Rentai Chemical | 140 |

PetroChina Dushanzi | 130 |

Fujian Fangxing Chemical | 120 |

Sitailong PC (Zhangjiagang) | 120 |

Fujian Tianyuan Chemical | 120 |

Huizhou Renxin New Material | 120 |

Jiangsu Sabron Petrochemical | 100 |

Zhanjiang Xinzhongmei Chemical | 100 |

Astor Chemical Industrial (Jiangsu) Co., Ltd. | 100 |

Lianyungang Xingda Zhongsheng Rubber Technology | 60 |

PetroChina Fushun PC | 60 |

PetroChina Yanshan PC | 50 |

Sinopec Guangzhou PC | 50 |

Huajin Group Panjin Ethylene Industrial | 40 |

Total | 3 750 |

In 2017, the pace of GPPS/HIPS expansion slowed down. With the improvement in year-on-year demand, the domestic industry structure has been gradually optimized, and the effective utilization rate of capacity has improved. The operating rate in 2017 reached 72.3%, an increase of 1.2% year-on-year.

According to the guidelines of the “13th Five-Year Plan (2016-2020)”, the pace of China's PS capacity expansion will be slowed significantly, and the industry will go through consolidation in the next few years.

Profit surge

In 2017, the supply and demand ratio of the domestic PS industry continued to improve, which also brought about a substantial increase in industry profits. In 2017, the apparent profit of PS averaged RMB388/t, the highest level since 2011. In 2017, China's GPPS/HIPS production and apparent consumption both increased slightly. The annual output was 2.71 million tons, an increase of 1.6% over 2016. The apparent consumption was 3.365 million tons, an increase of 3.1% over 2016. The statistics of China's GPPS/HIPS supply and demand in 2007-2017 are shown in Table 2.

Table 2 China’s GPPS/HIPS supply-demand during 2007-2017 (kt)

Year | Production | Import | Export | Apparent consumption | Self-sufficiency (%) |

2007 | 2 055 | 1 214 | 33 | 3 236 | 63.6 |

2008 | 1 749 | 1 066 | 29 | 2 786 | 62.8 |

2009 | 1 111 | 1 108 | 16 | 2 203 | 50.4 |

2010 | 1 500 | 1 077 | 28 | 2 549 | 58.8 |

2011 | 1 852 | 962 | 33 | 2 781 | 66.7 |

2012 | 1 850 | 919 | 37 | 2 732 | 67.7 |

2013 | 2 371 | 885 | 33 | 3 223 | 73.6 |

2014 | 2 670 | 786 | 49 | 3 407 | 78.3 |

2015 | 2 525 | 744 | 24 | 3 245 | 77.8 |

2016 | 2 668 | 654 | 58 | 3 264 | 81.7 |

2017 | 2 710 | 710 | 55 | 3 365 | 80.5 |

In the past decade, the domestic consumption of PS has shown an overall upward trend. During 2010-2014, with the expansion of capacity at foreign/joint ventures, China’s PS production increased, imports declined, and apparent consumption increased slightly. In 2015, the plunge in oil prices triggered a slump in the commodity market, and domestic PS consumption fell in 2015. Then in 2016 and 2017, with the recovery of the chemical market, PS production and apparent consumption have rebounded. As China's economic growth is set to slow in the future, its chemical industry will also witness a corresponding slowdown. It is expected that domestic consumption will fluctuate within a small range in the future, and it will be difficult to achieve big growth in the short term.

China's PS imports finally stopped declining in 2017. A total of 710 kt of GPPS/HIPS were imported, up 8.5% year-on-year; the export volume was 55 kt, a decrease of 5.1% year-on-year.

Changes in consumption pattern

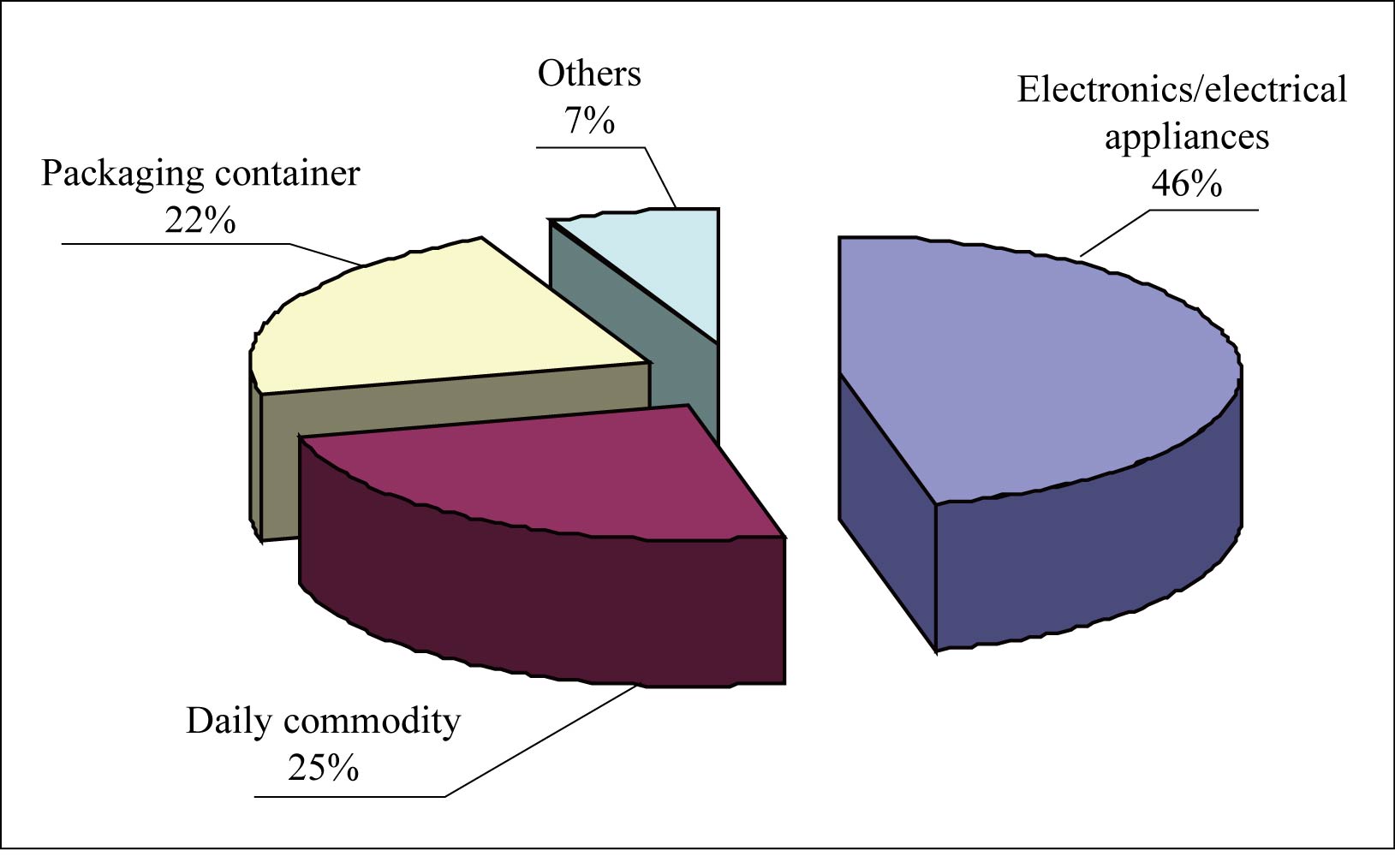

The major consumers of GPPS/HIPS in China are sectors like electronic appliances, daily necessities, packaging containers and so on. Among them, electronic appliances are the largest one. The current consumption pattern of China's GPPS/HIPS is shown in Figure 1.

Figure 1 China’s GPPS/HIPS consumption Pattern

In terms of electronic appliances, the total output of household air conditioners in 2017 was 180 million units, up 20.0% year-on-year, and the output of household refrigerators was 86.703 million units, up 13.6% year-on-year. The consumption of GPPS/HIPS in refrigerators was basically stable. However, in the past two years, HIPS was increasingly replaced by ABS, especially in air conditioner casings and high-end cabinets. The substitution from recycled materials in applications like TV casings and toy manufacturing is also substantial. In the future, China's home appliance industry will bid farewell to the stage of rapid growth and enter a period of slow growth. In this context, the growth of GPPS/HIPS consumption in the field of electronic appliances will also slow down.

GPPS/HIPS are widely applied to daily necessities, including kitchen utensils, dental utensils, accessories, ballpoint pens, etc. However, the application of GPPS/HIPS in traditional toys has been replaced by PP due to the obvious advantage of price. The lifting of the ban on disposable lunch boxes and the use of more food packaging will stimulate the packaging industry and hence push up the demand for PS. But the decrease in the production of CD and DVD cases will cause a drop in the use of GPPS/HIPS.

It is worth noting that with the increasing use of domestic LED lights, the use of PS in the field of light guide plates and diffuser plates is getting larger and larger, and it also promotes the development of technology in this area. With the vigorous development of China's emerging consumption sectors, the lost traditional markets have been somewhat compensated.

China's GPPS/HIPS consumption pattern changes with the rise and fall of the application fields and the impact of alternatives and will also change quietly with the development of emerging applications.

Need for cautious expansion

The future of China's PS industry will present the following development trends:

1. The PS plants are to be scaled. In China, PS joint ventures and foreign-funded enterprises occupy an important domestic position with their advanced production technology and economy of scale. As domestic PS capacity is in surplus, some PS plants with small capacity and backward technology will inevitably be impacted, leading to more closure or shutdown (for example, Qilu PC’s 25 kt/a unit was shut down and sold in 2017).

2. The flow of goods is becoming more diverse. In recent years, the domestic PS industry has developed rapidly, and the circulation of cargos has become more frequent and convenient. With the improvement of technology and intensified competition in the industry, the flow of goods in the main production and consumption areas of East China, South China and North China are diversified.

3. Emerging application areas such as 3D printing materials and LED lights will become the driving forces in the future. Traditional applications such as electronic and electrical components, daily necessities and packaging materials have slowed down, and the future use of PS in 3D printing and in the field of light guide plates and diffuser plates will become strong.

The GPPS/HIPS overcapacity cannot be ignored. There is a need for caution in launching new PS or expansion projects. As the existing PS brands cannot meet the demand and import dependency of some products is still high, PS manufacturers should continuously improve the technical content of the products and develop new brands to enhance the whole industry.