By Tan Jie, Research Institute of Sinopec Maoming Petrochemical Co., Ltd.

The output fails to meet the demand, the import dependence is serious

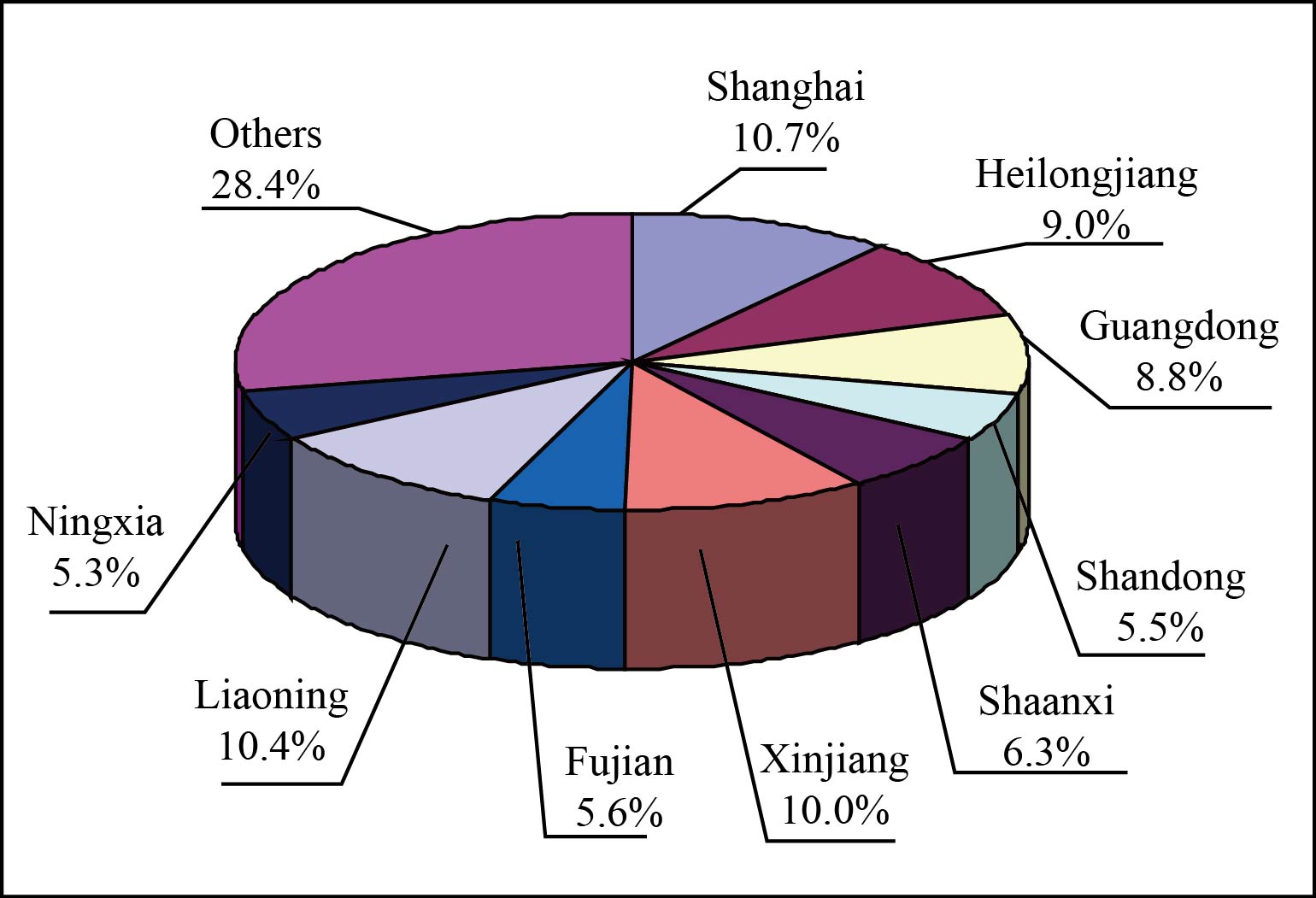

With the rapid development of the coal chemical industry in China, the capacity of HDPE has made a stable increase. The capacity reached 7 105 kt/a in 2017. PetroChina Dushanzi Petrochemical Co., Ltd. is the biggest HDPE producer in China today and the capacity is 710 kt/a, accounting for 10.0% of the national total. Table 1 and Figure 1 show the major HDPE producers in China in 2017 and the capacity distribution in various provinces and municipalities.

Table 1 Major HDPE producers in China, 2017

| Producer | Capacity (kt/a) | Source of raw material ethylene |

| PetroChina Liaoyang Petroleum Chemical Fiber Co., Ltd. | 85 | Naphtha |

| PetroChina Daqing Petrochemical Co., Ltd. | 640 | Naphtha |

| Sinopec Qilu Petrochemical Co., Ltd. | 390 | Naphtha |

| Sinopec Yangzi Petrochemical Co., Ltd. | 240 | Naphtha |

| Sinopec Beijing Yanshan Petrochemical Co., Ltd. | 140 | Naphtha |

| PetroChina Lanzhou Petrochemical Co., Ltd. | 290 | Naphtha |

| Sinopec Shanghai Petrochemical Co., Ltd. | 385 | Naphtha |

| PetroChina Dushanzi Petrochemical Co., Ltd. | 710 | Naphtha |

| Shanghai SECCO Petrochemical Co., Ltd. | 375 | Naphtha |

| PetroChina Jiiin Petrochemical Co., Ltd. | 300 | Naphtha |

| Sinopec Maoming Petrochemical Co., Ltd. | 350 | Naphtha |

| Sinopec SABIC (Tianjin) Petrochemical Co., Ltd. | 300 | Naphtha |

| Liaoning Huajin Chemical (Group) Co., Ltd. | 300 | Naphtha |

| Fujian Refining & Petrochemical Co., Ltd. | 400 | Naphtha |

| Sinopec-SK (Wuhan) Petrochemical Co., Ltd. | 300 | Naphtha |

| PetroChina Sichuan Petrochemical Co., Ltd. | 300 | Naphtha |

| CNOOC and Shell Petrochemical Co., Ltd. | 275 | Naphtha |

| PetroChina Fushun Petrochemical Co., Ltd. | 350 | Naphtha |

| Shaanxi Pucheng Clean Energy Chemical Co., Ltd. | 150 | Coal |

| Shaanxi Yanchang Coal Yulin Energy and Chemical Co., Ltd. | 300 | Coal |

| Shenhua Baotou Coal To Liquid and Chemical Co., Ltd. | 150 | Coal |

| Ningxia Baofeng Energy Group Co., Ltd. | 150 | Coal |

| Shenhua Ningxia Coal Industry Group Co., Ltd. | 225 | Coal |

| Total | 7 105 |

As the output of HDPE in China fails to meet the needs in actual production, great quantities of HDPE have to be imported each year. The import amount was 6 393.9 kt in 2017, an increase of 21.3% over the previous year. The import of HDPE in China is mainly made from Saudi Arabia, Iran and the United Arab Emirates of the Middle East and peripheral countries such as Korea and Thailand. The amount imported from Saudi Arabia in 2017 was 1 369.3 kt, accounting for around 21.4% of the total and an increase of around 35.7% over the previous year.

Figure 1 HDPE capacity distribution in major provinces and municipalities of China, 2017

The market prospect is promising, the price fluctuation margin will not be too big

The apparent consumption of HDPE in China has made a stable increase in recent years. The apparent consumption of HDPE went up to 12 140 kt in 2017, an increase of 11.7% over the previous year. Products were mainly used in films, sheets, injection-molded products, blow-molded products and pipes. In terms of consumption structure, the percentage in the total was 28.6% for films and sheets, 24.0% for injection-molded products, 13.3% for pipes, 17.1% for blow-molded products, 5.7% for fibers and 6.2% for drawing.

With the acceleration of urbanization, the upsurge of infrastructure construction, the demand increase of packaging products, the consumption increase of household electric appliances and the promotion of residential pipeline renovation, the total demand of HDPE is expected to reach 15 000 kt in 2021. In downstream sectors, the development prospect of HDPE pipes is the most promising. Eighty-five percent of water drainage pipes in new residential houses will use plastic pipes and traditional cast iron pipes will be basically eliminated. Eighty percent of rainwater drainage pipes in buildings will use plastic pipes. Eighty-five percent of water supply pipes and heating pipes in buildings will use plastic pipes and galvanized steel pipes will be basically eliminated. HDPE pipes have great toughness, high corrosion resistance and good insulation behavior. Operation and installation are also convenient. HDPE pipes therefore have huge market potentials.

Due to impacts from the drastic crude oil price fluctuation and the downstream demand, the market price of HDPE has made some ups and downs in recent years. The market price was on the whole quite stable in 2017 and the average price was RMB10 332/t. The highest price was RMB10 800/t in December and the lowest price was RMB10 040/t in October. It is expected that the market price of HDPE in China will still have ups and downs within a certain range for a considerable period of time in future, but the fluctuation margin will not be too big.

Future development trend

The capacity of HDPE in China will continue to make a constant increase in next few years. The capacity growth will mainly come from the 400 kt/a unit in CNOOC and Shell Petrochemical Co., Ltd., the 250 kt/a unit in Jiutai Energy Group Inner Mongolia Co., Ltd., the 400 kt/a unit in Yan’an Energy and Chemical Group Co., Ltd., the 350 kt/a unit in Yangquan Coal Industry Group Qingdao Hengyuan Chemical Co., Ltd., the 400 kt/a unit in SinoChem Quanzhou Petrochemical Co., Ltd. and the 150 kt/a unit in Zhong’an United Coal Chemical Co., Ltd. In case these units can be smoothly undertaken on schedule, the capacity of HDPE in China is expected to reach 10 200 kt/a.

Despite a constant increase of the capacity, as there is a considerable gap between the capacity and the actual demand and most of new HDPE units are coal chemical units the output will still be unable to meet the needs in actual production. Coal-based and methanol-based HDPE is now faced with dual pressures of low oil price and environmental pressure. Construction plans in some enterprises may be pigeonholed due to problems in capital. It is expected that China will remain to be the biggest HDPE production country in the world and also a net import country in 2021. Close attention should therefore be paid in future to the HDPE supply/demand status in relevant regions or countries so as to avoid impacts on the development of the HDPE sector and related sectors in China.

The development prospect of the coal chemical industry has many uncertainties. The future expansion of the HDPE capacity will mainly be concentrated in coal-to-olefin projects. The market is slack today and the profit margin of HDPE products is being reduced. From a long-term point of view, however, the HDPE consumption market still has huge potentials. The source of HDPE in China will be more diversified and the market will present a status of taking naphtha chemical products and imported products as the lead and making a rapid increase of coal chemical products.

The HDPE sector in China needs to make a constant upgrading of the overall technical level, further reduce the energy consumption and the material consumption, improve the product quality, accelerate the research and development of new products, vigorously develop special products and gradually reduce the dependence of the special product market on imported resources so as to constantly meet the needs in actual production in China.