Year:2018 ISSUE:12

COLUMN:POLYMERS

Click:306 DateTime:Jun.22,2018

By Yan Feng

Insufficient domestic PC output

Covestro expanded its polycarbonate (PC) production capacity in Shanghai to 400 kt/a in 2026, bringing China's capacity to 888 kt/a in 2017. Before 2015, almost all of China’s polycarbonate manufacturing enterprises were foreign-owned or Sino-foreign joint ventures. After Ningbo Zhetie Dafeng Chemical Co., Ltd. and Luxi Chemical Group Co., Ltd. separately completed plants, the supply pattern changed. Phosgene and non-phosgene methods are respectively employed by approximately 80.0% and 20% of capacity. Polycarbonate production facilities are concentrated mainly in East and North China, with 795 kt/a or 89.59% of total capacity in East China; and 78 kt/a or 8.78% in North China.

Due to insufficient PC output, China imports a large amount every year. According to customs statistics, the import volume in 2017 was 1 384 900 tons, a year-on-year increase of approximately 5.0%. In recent years, the unit price of imported PCs has changed largely. In 2017, the unit price for imports was US$2 923.94/t, an increase of approximately 9.62% over the same period of last year. There is also a certain amount of exports. In 2017, the export volume was 288 400 tons, an increase of approximately 29.2% over the same period of last year. China's PC imports come mainly from South Korea, Thailand and Taiwan, together supplying 801 600 tons in 2017, accounting for 57.9% of imports, an increase of 2.51% year-on-year. South Korea has always been China’s largest source of imports. In 2017, it supplied 319 800 tons, or 23.09% of the total. Taiwan has long been second source, supplying 308 000 tons in 2017, 22.2% of the total and up by 23.1% over the previous year. In 2014, imports from the United States amounted to 156 300 tons, accounting for 10.6% of the total imports, but the US share decreased to 103 000 tons in 2017, only 7.4% of the total.

More applications in plates

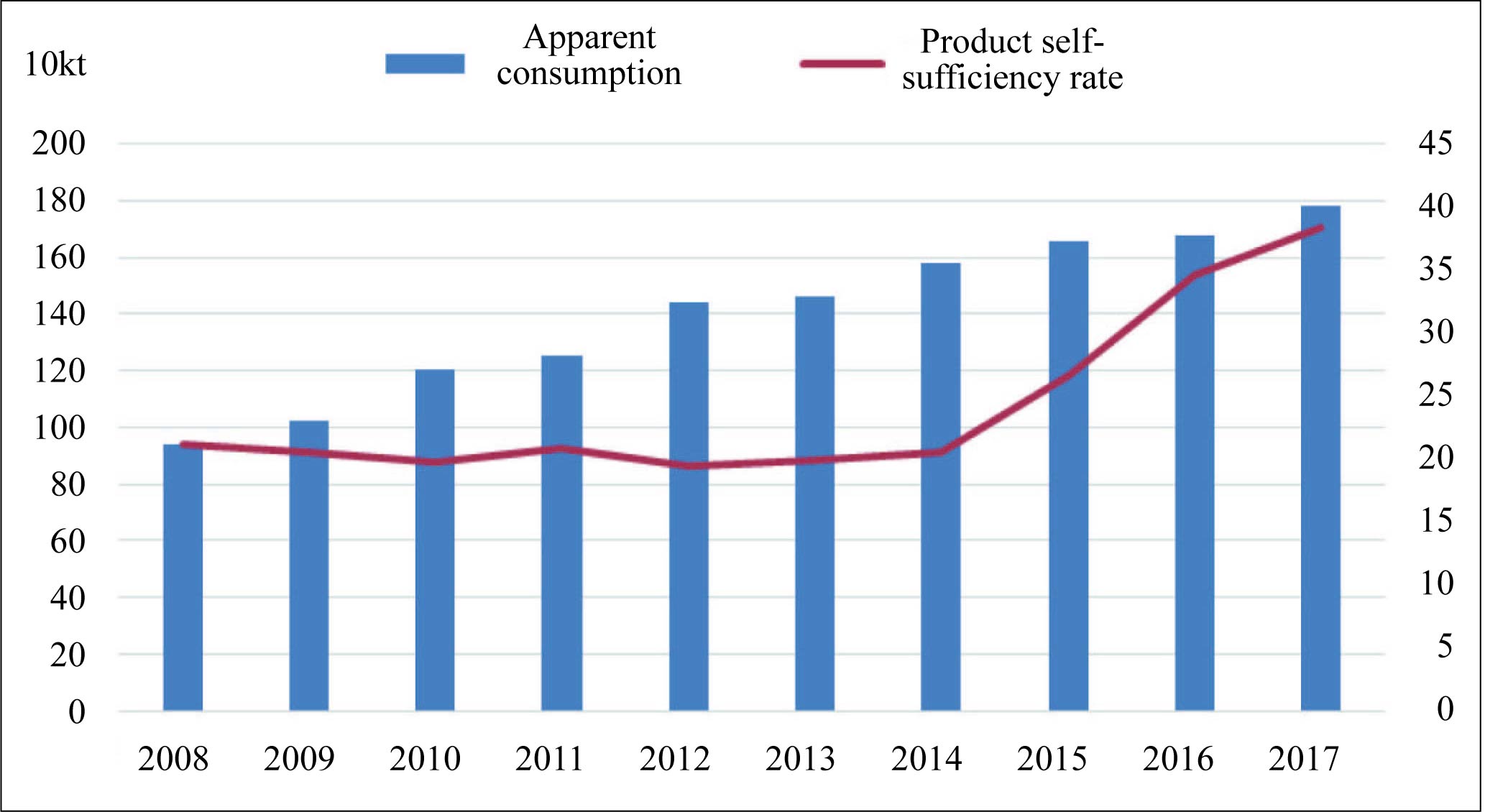

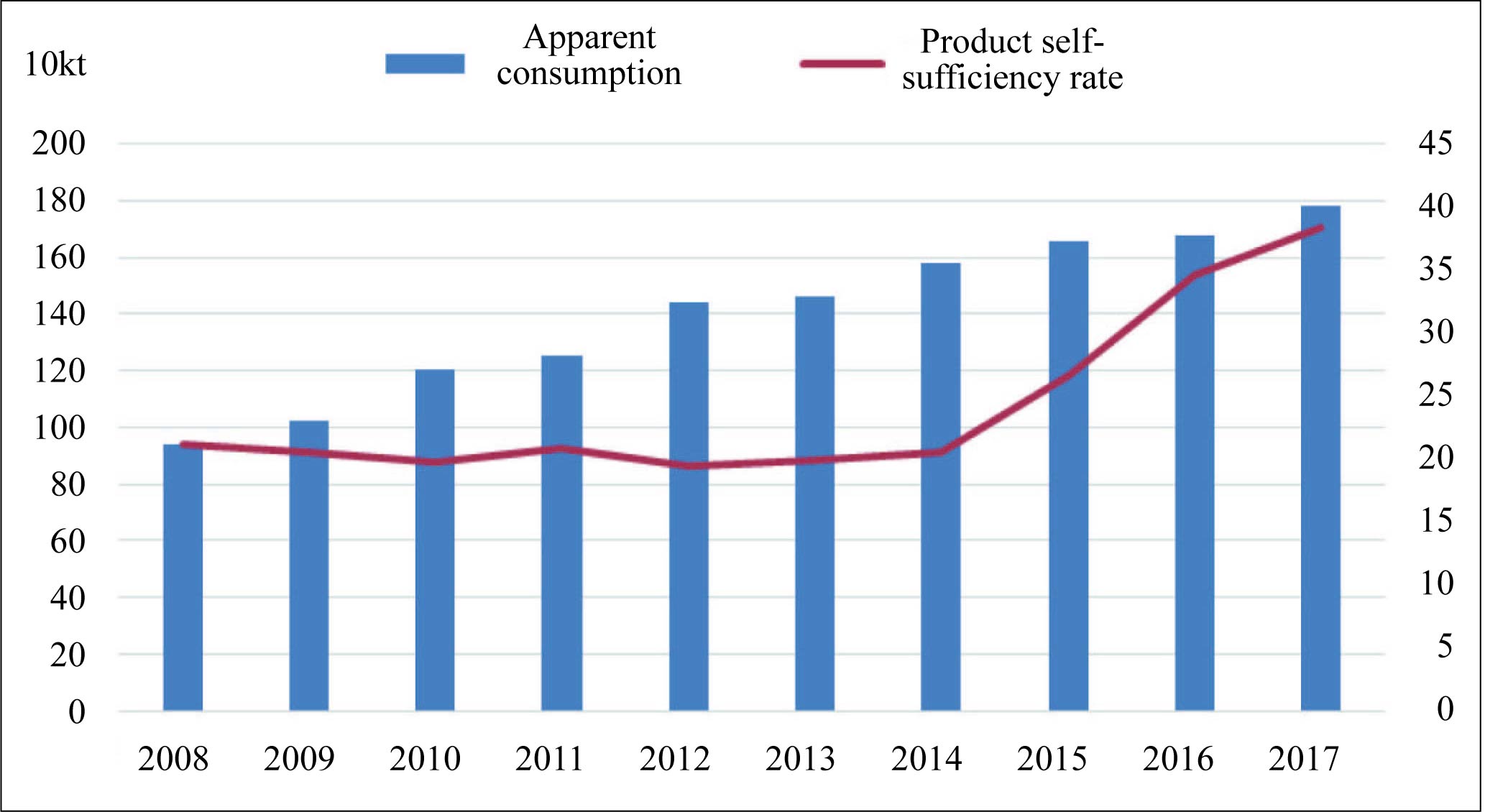

In recent years, with the rapid development of domestic construction, automotive and optical media industries, the demand for PC in China has continued to increase. The apparent consumption of PC in 2017 was 1.78 million tons, an increase of approximately 6.2% year-on-year, and 38.4% was imported. The balance of supply and demand for PC in China in 2008-2017 is shown in Figure 1.

Figure 1 China's PC supply-demand, 2008-2017

In China PCs are used mainly in electronic/electrical, film/sheet, appliance/household and optical media industries: 18.9% for films/sheets, 29.2% for electronics/electrical, 16.0% for appliances/household articles, 8.9% for the automotive sector, 8.5% for optical media, 6.5% for packaging, 2.9% for sports/leisure and 2.1% for medical equipment, leaving 7.0% for other areas.

In the next few years, with the construction of large public buildings and highway noise barriers, it is expected that the application of PC in the field of plates will grow. The future of PC plate development is R&D in very strong, very transparent, highly weather resistant plates. For the nation’s intensifying efforts to save energy and reduce emissions, increasing plasticization of vehicles is inevitable, and use of PC in auto glass will increase. Rapid development of domestic high-speed trains and large-scale aircraft offers a good opportunity to use PC in high-end fields. In the long term, demand for PC in making optical media will shrink further. By 2021, China's consumption of PC is estimated to reach 2.2 - 2.3 million tpy, with the electrical and electronic sectors as the fastest-growing areas, followed by appliances/household goods.

In 2017, prices first declined and then started to increase in June, reaching a five-year high of RMB29 800/t in December.

Development trend

Due to strong growth of PC demand and profit, many companies plan to build or expand PC capacity, including Wanhua Chemical Group’s 70 kt/a unit (put into production in January 2018), Covestro’s plan of expanding to 600 kt/a, Shandong Lihuayi adding 100 kt/a, Zhejiang PC adding 260 kt/a, Lutianhua Zhonglan New Materials adding 100 kt/a, Luxi Chemical Group adding 135 kt/a (Phase II), Yangquan Coal Group Qingdao Hengyuan Chemical adding 110 kt/a, Fujian Global Union Chemicals adding 130 kt/a, Quanzhou Henghe Chemical adding 100 kt/a and SSTPC adding 260 kt/a. Based on these plans, PC capacity is expected to reach about 2.45 million t/a by 2021, which will ease the persistent shortage and greatly promote development of China’s engineering plastics sector. In addition, the supply pattern will diversify. However, with the successive launches of these plants, domestic companies may create an excess supply of low-end products and a shortage of high-end products.

With this increase in domestic supply, import will decline. But without independent, mature technology, the new capacity will not be quick and effective in replacing high-end imports. Importing a certain amount of PC products will remain necessary in the future to meet domestic demand, especially for high-performance PC products. We should actively develop new products to avoid homogenous competition and meet the varied requirements of the market, while actively developing technologies to enhance the market competitiveness of China's PC products.