Year:2018 ISSUE:11

COLUMN:POLYMERS

Click:295 DateTime:Jun.08,2018

China Rubber Industry Association

Major economic indicators of China’s rubber industry, such as present price industrial output value, sales revenue and export delivery value, increased dramatically in 2017, showing that the market’s slackness since 2012 was relieved. Profitability, however, declined, with profits 5.07% lower than in the previous year. The present price industrial output value achieved was RMB346.490 billion, sales revenue was RMB337.584 billion, export delivery value was RMB107.084 billion and the rate of the export value was 30.91%.

China imported 2 793.3kt of natural rubber in 2017, according to customs statistics, a YoY increase of 11.7%, and the import value was US$4 917 million, an increase of 46.6%. The import volume of technically specified natural rubber (TSNR) was 1 680.6 kt, up only 1.4% YoY, but the import value was up 35.9%, at US$3 036 million. The import volume of composite rubber was 120 kt, a drop of 24.7% YoY, and the import value was US$407 million, down 7.3%. The import volume of mixed rubber was 2 751.8 kt, up 51.4% YoY, and the import value was US$4 826 million, up 96.8%.

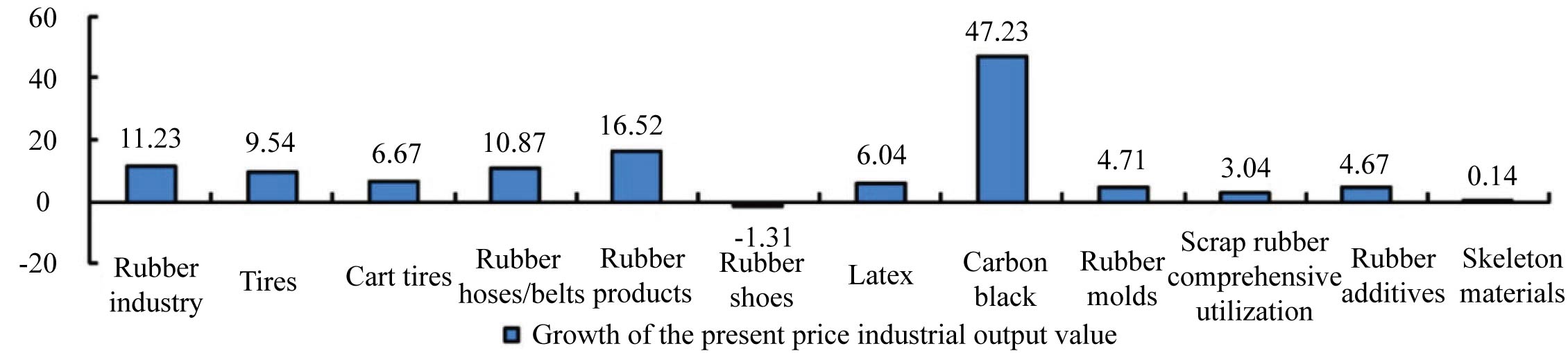

Drastic increase of the present price industrial output value

The present price industrial output value achieved by the rubber industry in 2017 increased 11.23% YoY and growth was 8.30 percentage points faster than in 2016 and 22.81 points faster than in 2015 (which had the poorest financial results in recent years), according to statistics covering major member enterprises of the China Rubber Industry Association. Among rubber sectors, only in rubber shoes did the present price industrial output value decline, and it declined more slowly. In sectors with a positive change, the growth in rubber additives and skeleton materials was slower than in the previous year; tires, cart tires, carbon black and scrap rubber comprehensive utilization reversed their declining trends of the previous year and achieved positive growth; rubber hoses/belts, rubber products, latex and rubber molds maintained their rising trends, and their growth was faster. See Figure 1 for details.

Figure 1 Present Price Industrial Output Values of Rubber Industry Sectors, 2017

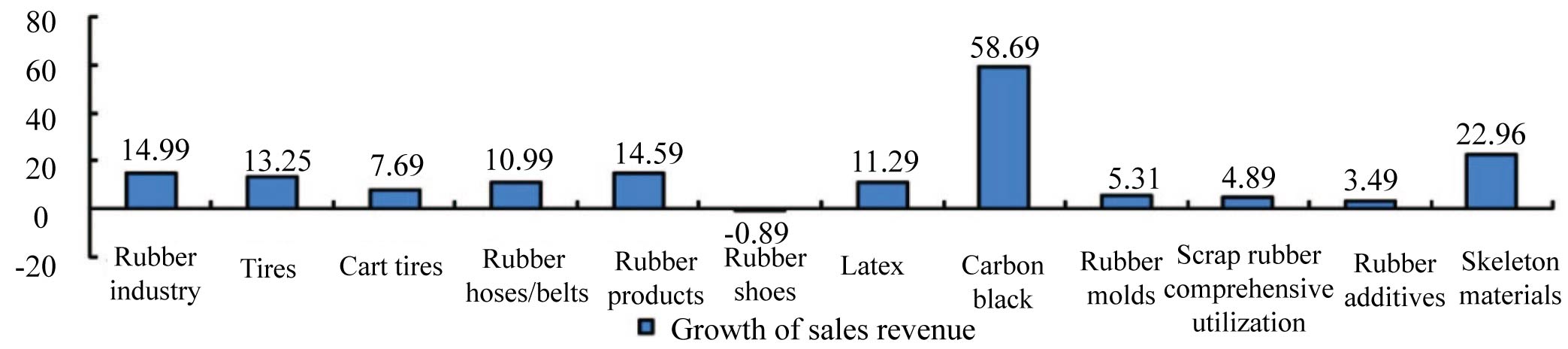

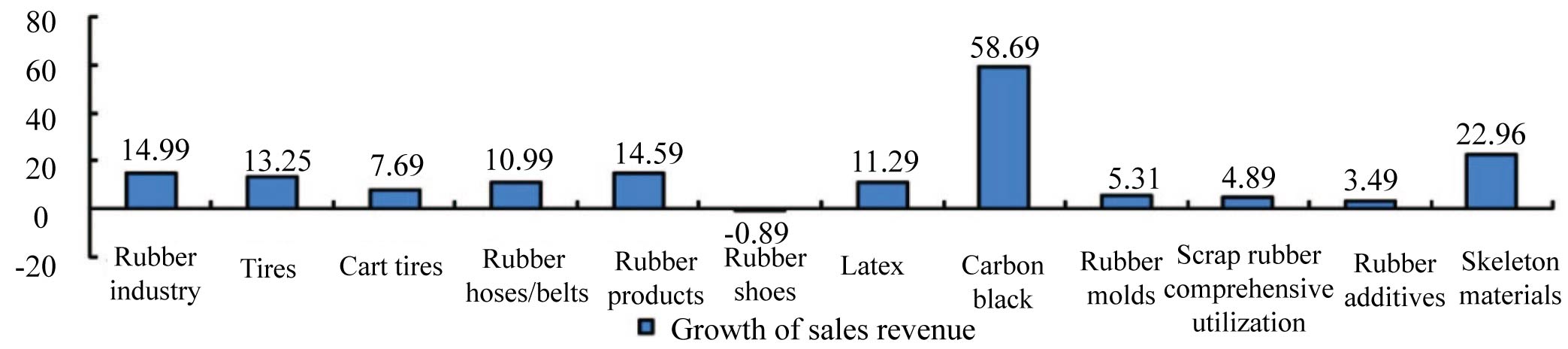

Drastic increase of sales revenue

The sales revenue earned by the rubber industry in 2017 increases 14.99% YoY, with growth 10.56 percentage points faster than in 2016 and 26.29 points faster than in 2015. Among rubber sectors, only in rubber shoes did sales revenue decline, continuing the poor performance that started in 2012. Among sectors with positive revenue growth, rubber additives grew slower than in the previous year; cart tires, rubber hoses/belts, carbon black and scrap rubber comprehensive utilization recovered from their declining trends of the previous year; tires, rubber products, latex, rubber molds and skeleton materials maintained their positive trends, with faster growth. See Figure 2 for details.

Figure 2 Sales revenues of rubber sectors, 2017

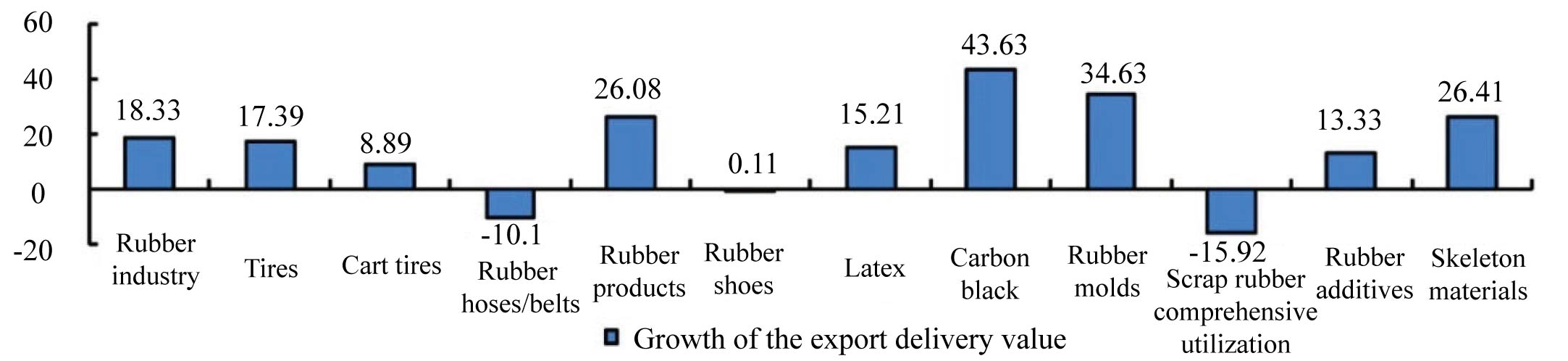

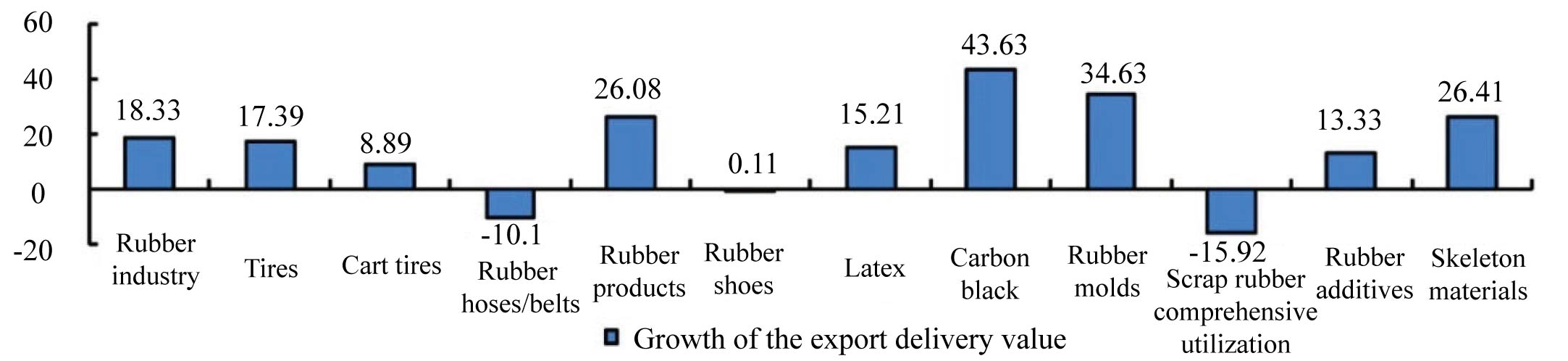

Drastic increase of export delivery value

The export delivery value earned in 2017 increases 18.33% YoY, with growth 18.54 percentage points faster than in 2016 and 30.43 points faster than in 2015. The rate of the export value was 30.91%, 1.85 percentage points higher than the previous year. Among rubber sectors, the export delivery value of rubber hoses/belts and scrap rubber comprehensive utilization declined. Export delivery value of Rubber hoses/belts grew in 2016; scrap rubber comprehensive utilization declined for the second consecutive year. In sectors with positive growth, the growth in rubber shoes was slower than in the previous year; after declining the previous year, tires and carbon black both grew; cart tires, rubber products, latex, rubber molds, rubber additives and skeleton materials maintained their rising trends, and growth was faster for all. See Figure 3 for details.

Figure 3 Export Delivery Values of rubber sectors, 2017

Notable growth in rubber sectors

(1) Tires

For 41 major tire enterprises, the present price industrial output value in 2017 was 9.54% higher than in the previous year, and sales revenue was 13.25% higher. The overall output of tires was 5.08% higher YoY; output of low-end radial tires was 6.15% higher, and output of all-steel radial tires was 6.99% higher. The export delivery value was up 17.39% YoY; the rate of the export value was 38.25%, being 2.56% higher. The export delivery volume of tires was 9.39% higher than in the previous year; the figure for radial tires was 10.72% higher; the rate of the export was 47.38%, 1.87 percentage points higher. The profit of the tire sector in 2017 was 49.56% lower than in the previous year.

(2) Cart tires

For 40 major cart tire enterprises, the present price industrial output value in 2017 was 6.67% higher than the previous year and the sales revenue was 7.69% higher. Among leading products, the output of bicycle tires was 7.54% higher than in the previous year, the output of electric bicycle tires was 7.14% higher and the output of motorcycle tires was 10.68% lower. The export delivery value was 8.89% higher than in the previous year; the rate of the export value was 27.76%, 0.57 percentage points higher. The profit of the cart tire sector in 2017 was 35.1% lower than in the previous year.

(3) Rubber hoses/belts

For 49 major rubber hose/belt enterprises, the present price industrial output value in 2017 was 10.87% higher than in the previous year and sales revenue was 10.99% higher. Among leading products, output of conveyor belts was 12.27% higher than in the previous year, output of V belts was 5.82% lower and output of rubber hoses was 17.69% higher. The export delivery value was 10.11% lower than the previous year; the rate of the export value was 9.52%, being 2.22 percent lower. Profit of the rubber hose/belt sector in 2017 was 28.53% higher than in the previous year.

(4) Rubber products

For 58 major rubber product enterprises, the present price industrial output value in 2017 was 16.52% higher than in the previous year, and sales revenue was 14.59% higher. Among leading products, the output of automobile damping products was 17.04% higher than in the previous year, and the output of “O” seal rings was 5.20% higher. The export delivery value was 26.08% higher than in the previous year; the rate of the export value was 24.05%, 1.82 percentage points higher. Profit of the rubber product sector in 2017 was 20.09% higher than in the previous year.

(5) Rubber shoes

For 25 major rubber shoe enterprises, the present price industrial output value in 2017 was 1.31% lower than in the previous year and sales revenue was 0.89% lower. Output of rubber shoes was 1.61% lower than in the previous year. The export delivery value was 0.11% higher than in the previous year; the rate of the export value was 14.35%, being 0.43 percent points higher. The export volume of rubber shoes was 22.74% higher than in the previous year; the rate of the export volume was 11.71%, being 2.32 percent points higher. Profit of the rubber shoe sector in 2017 was 12.96% higher than in the previous year.

(6) Latex

For 27 major latex enterprises, the present price industrial output value in 2017 was 6.04% higher than in the previous year, and sales revenue was 11.29% higher. Output of medical gloves was 1.64% higher than in the previous year, and the output of examination gloves was 13.04% higher. The export delivery value was 15.21% higher than in the previous year; the rate of the export value was 45.02%, 3.58 percentage points higher. Profit of the latex sector in 2017 was 10.78% higher than in the previous year.

(7) Carbon black

For 35 major carbon black enterprises, the present price industrial output value in 2017 was 47.23% higher than in the previous year, and sales revenue was 58.69% higher. The total output of carbon black was 6.32% higher than in the previous year; output of wet-process carbon black was 5.84% higher. The export delivery value was 43.63% higher than in the previous year; the rate of the export value was 13.03%, 0.33 percentage points lower. The export volume of carbon black was 0.95% lower than in the previous year; the rate of the export volume was 12.69%, 0.93 percentage points lower. Profit of the sector in 2017 was 43.63% higher than in the previous year.

(8) Rubber molds

For 21 major rubber mold enterprises, the present price industrial output value in 2017 was 4.71% higher than in the previous year, and sales revenue was 5.31% higher. The output of rubber molds was 5.44% higher than in the previous year. The export delivery value was 34.63% higher than in the previous year; the rate of the export value was 48.98%, 10.89 percentage points higher. The profit of the rubber mold sector in 2017 was 2.9% higher than in the previous year.

(9) Scrap rubber comprehensive utilization

For 31 major scrap rubber comprehensive utilization enterprises, the present price industrial output value in 2017 was 3.04% higher than in the previous year, and sales revenue was 4.89% higher. The output of reclaimed rubber was 7.52% higher than in the previous year, and the output of rubber powder was 2.38% higher. The export delivery value was 15.92% lower than in the previous year; the rate of the export value was 2.63%, 0.59 percentage points lower. The profit of the scrap rubber comprehensive utilization sector in 2017 was 4.12% lower than in the previous year.

(10) Rubber additives

For 45 major rubber additive enterprises, the present price industrial output value in 2017 was 4.67% higher than in the previous year, and sales revenue was 3.49% higher. The total output of rubber additives was 0.55% higher than in the previous year. Among leading products, output of accelerators was 0.27% lower, and output of antioxidants was 1.94% lower. The export delivery value was 13.33% higher than in the previous year; the rate of the export value was 32.27%, 2.46 percentage points higher. The export volume of rubber additives was 9.61% higher than in the previous year; the rate of the export volume was 30.61%, 2.53 percentage points higher.

(11) Skeleton materials

Among 20 major skeleton material enterprises the present price industrial output value in 2017 was 0.14% higher than in the previous year, and sales revenue was 22.96% higher. The export delivery value was 26.41% higher than in the previous year; the rate of the export value was 33.71%, 7.0 percentage points higher. The total output of skeleton materials by 35 enterprises was 5.94% higher than in the previous year; output of fiber cord was 0.71% lower, output of wire cord was 9.12% higher, output of bead wire was 0.73% higher and output of tube wire was 17.30% higher. The profit of the skeleton material sector in 2017 was 116.47% higher than in the previous year.