By Zheng Jiebin, China Chlor-Alkali Industry Association

China’s caustic soda industry further optimized capacity in 2017. Owing to brisk demand in sectors such as alumina, the caustic soda industry has maintained sound profits. Capacity will grow slightly in 2018, and both domestic demand and export will increase.

Capacity, output & industry concentration all increased

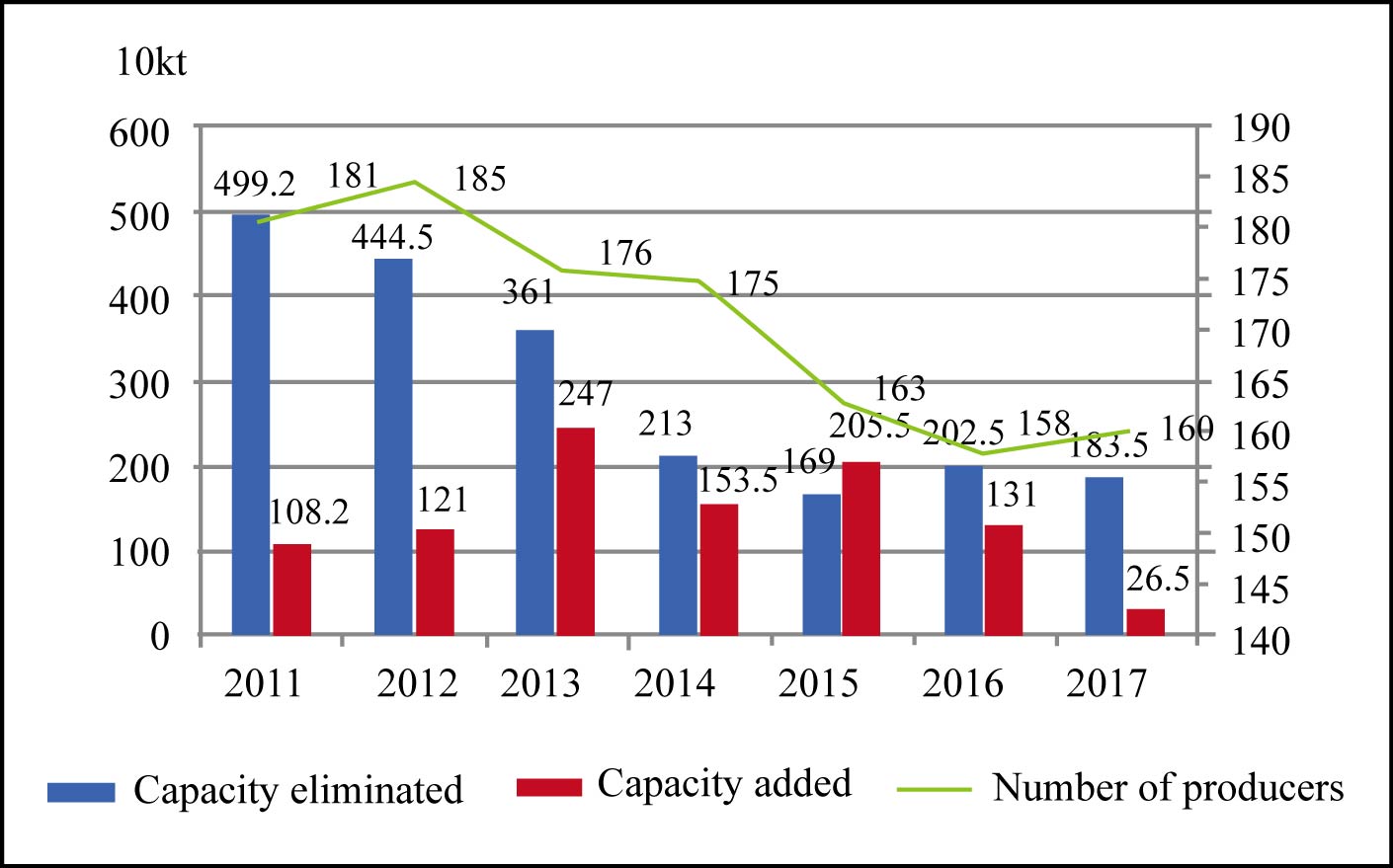

At the end of 2017 there were 160 caustic soda producers in China, three more than in 2016, and one producer had quit. Capacity was 41.02 million t/a, an increase of 1.835 million t/a over 2016. Capacity amounting to 265 kt/a was decommissioned and 1.57 million t/a was added. The average capacity of a single producer has increased from 220 kt/a in 2013 to 260 kt/a today, as industrial concentration has increased. Figure 1 shows the number of producers and the capacity of the caustic soda industry in China during 2011-2017.

Figure 1 Caustic soda producers & capacity in China, 2011-2017

Growth of caustic soda output in China has varied considerably in recent years, due to economic conditions, added capacity, varying profitability and the market constraint of alkali/chlorine balance. December 2017 output was 2.994 million tons and the year’s total output was 33.652 million tons, an increase of 5.4% over 2016. Table 1 shows the monthly output of caustic soda in China in 2017.

Table 1 Monthly output of caustic soda in China, 2017 (kt)

Month | January-February | March | April | May | June | July | August | September | October | November | December | Total |

Output | 5630 | 3103 | 3089 | 2942 | 2887 | 2806 | 2707 | 2829 | 2789 | 2846 | 2994 | 33652 |

Caustic soda was in short supply in China before 2008, but then, briefly, capacity and output increased rapidly, and operating rates were high. With the onset of the financial crisis and a sudden surplus of capacity, operating rates were curtailed – utilization was the lowest in 2009 and 2010, when the overall operating rate dropped below 70%. As much capacity has been eliminated in recent years, capacity growth has slowed down and the overall operating rate has been around 80%. In 2017, the average operating rate was around 82%.

Rising prices slowed export; domestic consumption is concentrated in the east

During January-December 2017, China exported 983 kt of liquid soda, a YoY drop of 18%; 537 kt of solid soda was exported, a drop of 24.5%. Table 2 shows the monthly export volumes. Rising domestic prices are the main reason for the decline. Destinations for China’s exported liquid soda include mainly Australia, Taiwan, Vietnam, the United States, the Philippines, Papua New Guinea, Thailand, Indonesia and Singapore. Solid soda destinations mainly include Vietnam, Uzbekistan, Nigeria, Kazakhstan, Namibia, Indonesia, Singapore, Ghana and Tanzania.

Table 2 Export of caustic soda from China, 2017 (kt)

Month | January | February | March | April | May | June | July | August | September | October | November | December | Total | Growth (%) |

Liquid soda | 52.6 | 112.0 | 64.6 | 105.0 | 59.1 | 88.7 | 107.0 | 75.2 | 86.3 | 40.4 | 111.0 | 81.3 | 983.0 | -18.0 |

Solid soda | 33.6 | 28.6 | 50.5 | 46.5 | 57.1 | 53.9 | 54.2 | 58.4 | 37.8 | 33.0 | 31.0 | 52.3 | 537.0 | -24.5 |

China’s alumina sector is its biggest caustic soda consumer. Most new alumina units in China employ the Bayer process, as before. Due to the seriously lower quality of the remaining regional bauxite resources, consumption of caustic soda per ton of alumina will increase.

China’s alumina capacity and output have both increased rapidly in recent years – capacity is estimated to have reached 79.10 million t/a in 2017, and output was probably near 69.02 million tons. The overall operating rate was 87%, and the operating rate in the first half year was much higher than in the second half.

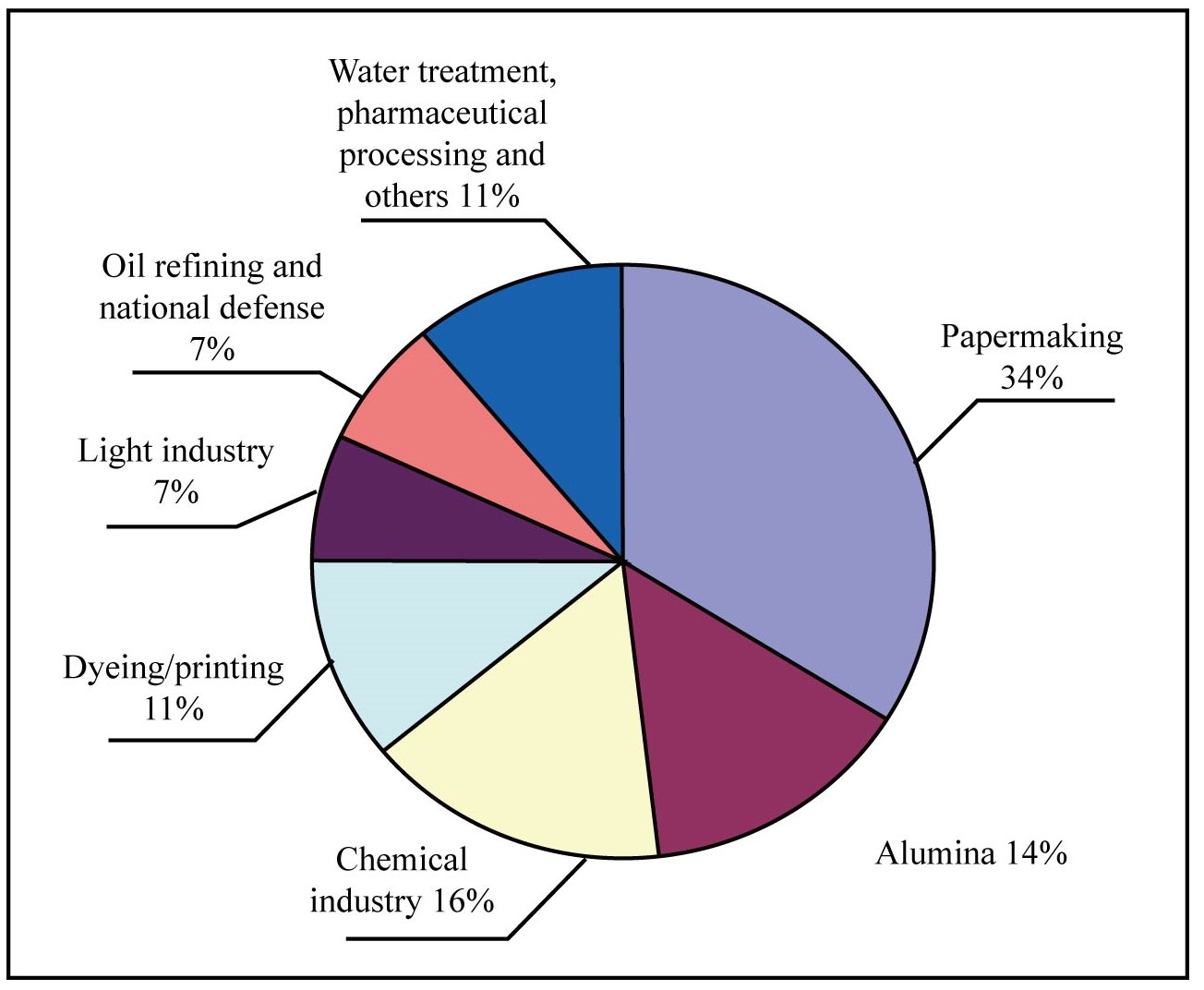

Consumption of caustic soda is concentrated mainly in eastern regions and demand in western regions is quite limited. Figure 2 shows China’s caustic soda consumption pattern by sector in 2017. Shandong is a major region for caustic soda production, as well as the region with the most concentrated consumption. Downstream sectors consuming caustic soda in eastern coastal areas are well developed, owing to the excellent location, convenient import of raw materials and convenient export of downstream products. The same sectors in western regions are relatively weak. Most of the liquid soda produced in western regions must be processed into solid soda and taken all the way to North China, East China and South China for sale.

Figure 2 China’s caustic soda consumption by Sector, 2017

Market recovery promotes capacity expansion, demand will see sustained increase

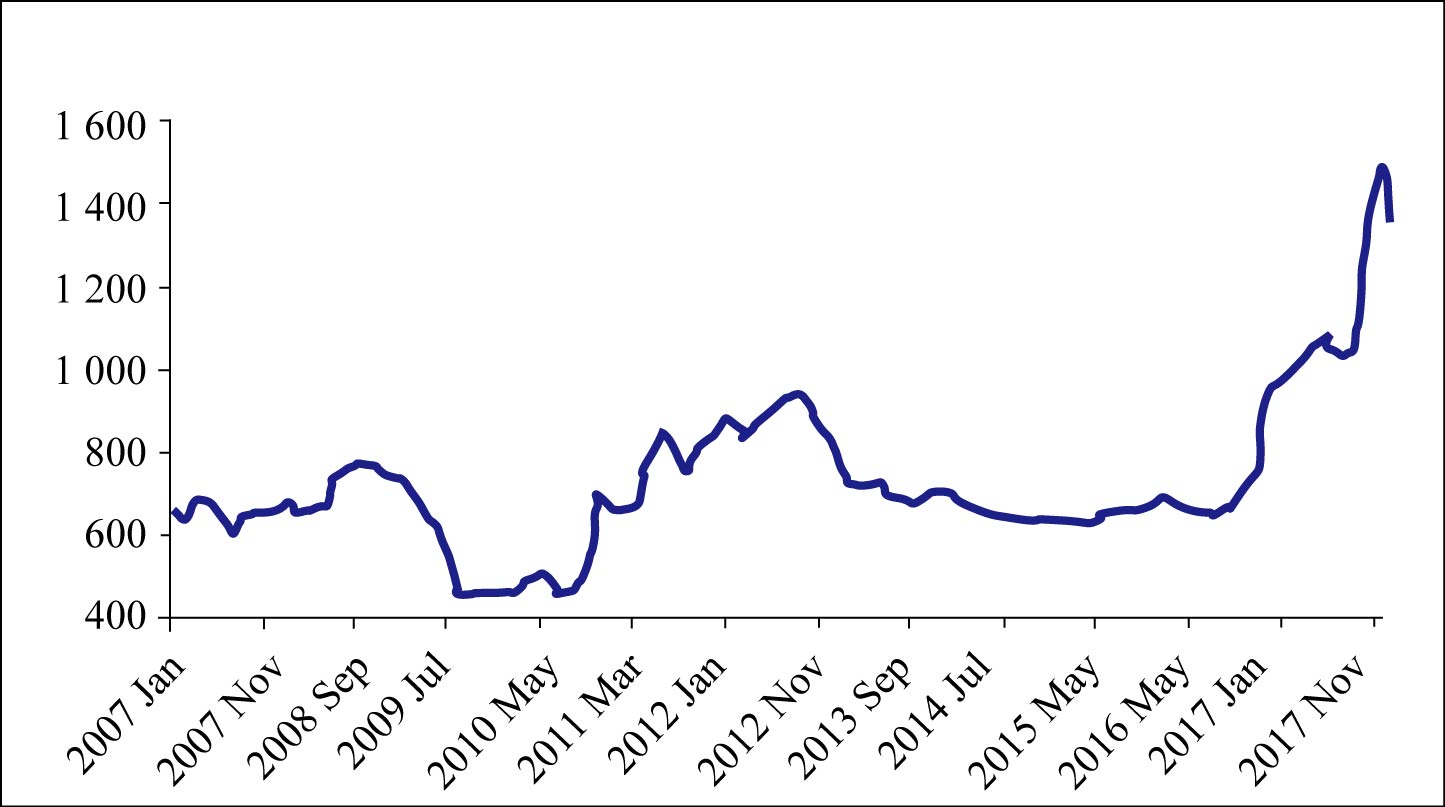

The caustic soda market in China was stable in 2007-2017, as prices fluctuated. Prices started a sustained increase from the fourth quarter of 2016, and then started a sustained decline at the end of 2017. Figure 3 shows details.

Figure 3 Price of 32% liquid soda in China, 2007-2017

The sustained recovery of the caustic soda market in China in recent years has promoted construction of caustic soda expansion projects that were planned earlier. With elimination of units using the diaphragm process and old units using the ion membrane process, however, domestic capacity will increase only slightly in 2018.

Demand for caustic soda will grow. Steady urbanization will push demand for caustic soda’s terminal products to increase rapidly during the Thirteenth Five-Year Plan period (2016-2020). China has always been a net exporter of caustic soda, mainly to countries now encompassed by the “One Belt One Road” strategy. With the development of economies in “One Belt One Road” regions, demand for exported caustic soda will increase further.