By Li Ran, Wu Chunfang, CNPC Petroleum Economics & Technology Research Institute

Review of 2017

1. Crude oil output has declined for 2 consecutive years, net import volume exceeded 400 million tons for the first time

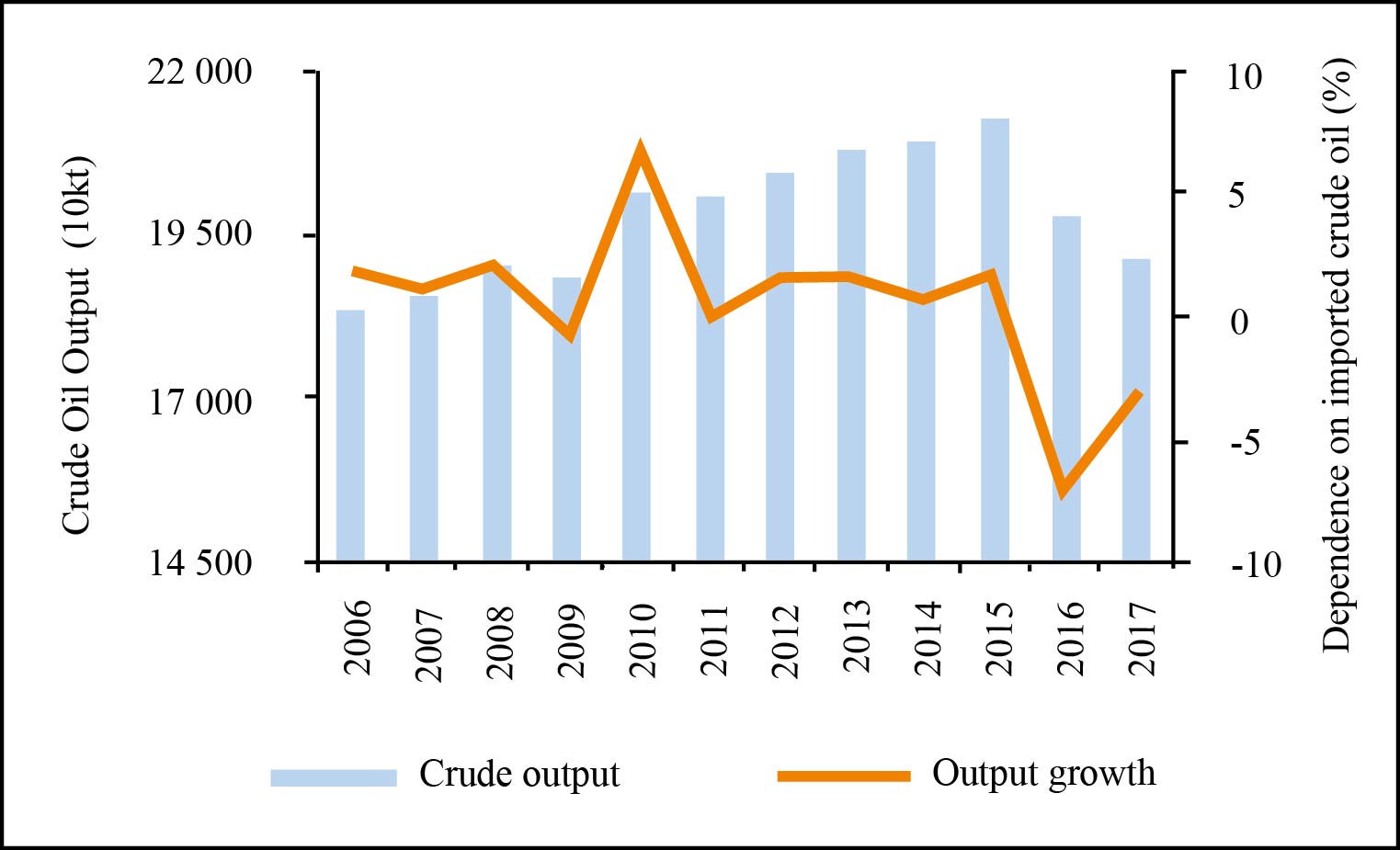

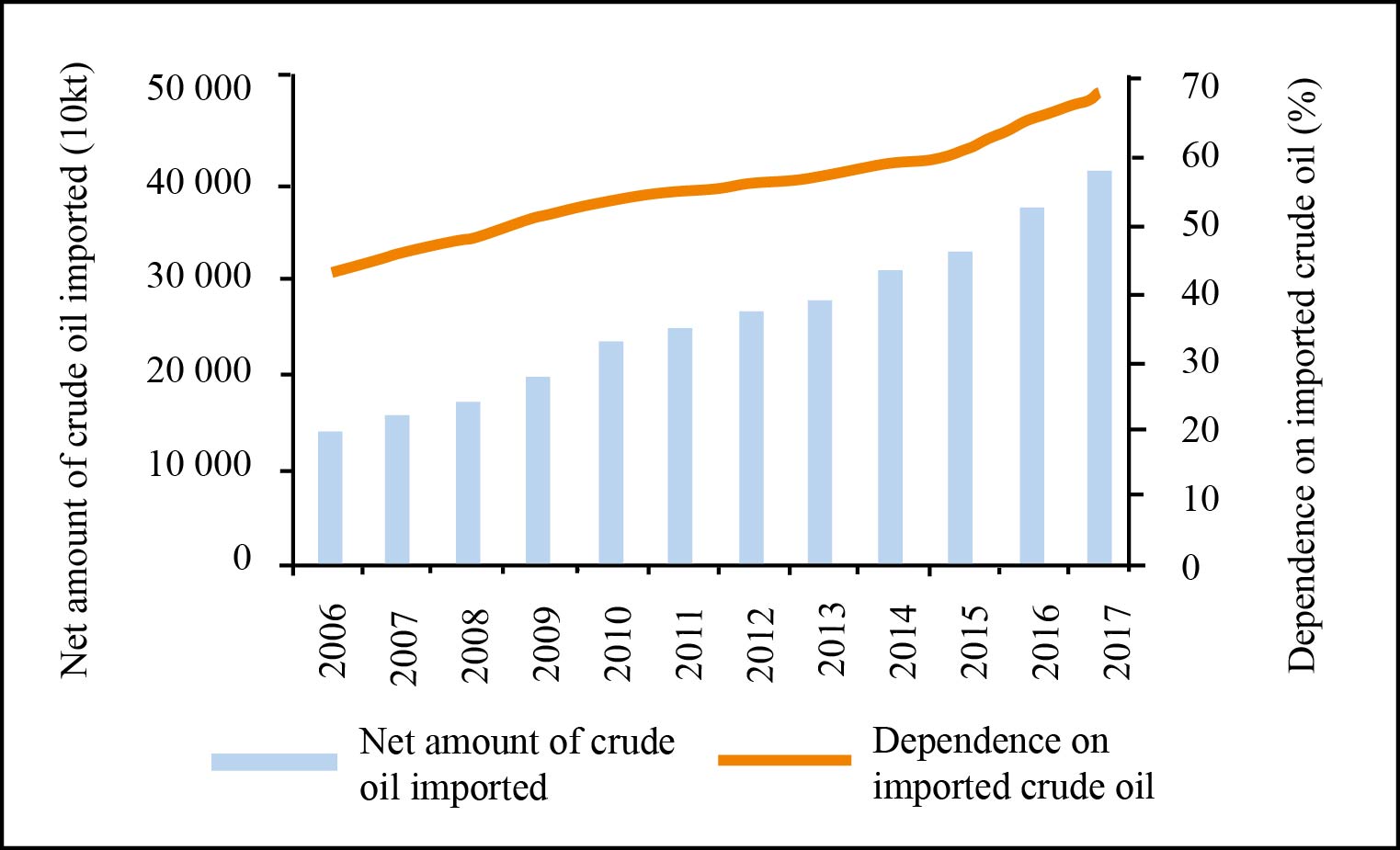

With low oil prices internationally, China crude oil output declined further in 2017 after a drastic downward adjustment in 2016. Output in 2017 was 191 million tons, down 3.2% from the previous year; the reduction was 4.1 percentage points smaller than in 2016 (see Figure 1). China’s crude oil consumption grew steadily, if not rapidly, in 2017, reaching 607 million tons, an increase of 5.3% over the previous year. Due to reduced crude oil output and rapid growth of refining capacity, the net import volume of crude oil continued to increase rapidly in 2017, reaching 420 million tons, an increase of 9.8% over the previous year; growth was 3.9 percentage points slower (see Figure 2).

Figure 1 Output of crude oil in China and growth

Figure 2 Net import of crude oil to China & import dependence

2. Growth of apparent consumption of petroleum picked up, import dependence hit a new high

The economy in China stabilized and improved in other ways in 2017. The number of local refineries that gained the right to use imported crude oil and the right to import crude oil was higher. The oil refining capacity in China had been steady in the previous two years but rose in 2017. All these factors promoted the growth of petroleum consumption. The apparent consumption of petroleum in China was 584 million tons in 2017, an increase of 28 million tons over the previous year and the growth was 5.1%, 2.2 percentage points faster than in the previous year and the highest level since 2011. Due to the reduced domestic output, the pattern of petroleum consumption improved, and the net import volume in 2017 was 392 million tons, an increase of 9.7% over the previous year, with growth 0.14 percentage points higher. Import dependence of petroleum reached 67.2%, 2.8 percentage points higher than the previous year.

3. Output of oil products increased further, growth of net import volume slowed drastically

A sustained increase in the amount of crude oil processed domestically in 2017 resulted from completion of a huge oil refinery by Yunnan Petrochemical Co., Ltd. and a project (second phase) at Huizhou Refinery and an increase of crude oil import by local refineries. The processed volume was 568 million tons, an increase of 5.0% over the previous year, with growth 1.4 percentage points higher. The output of oil products in 2017 was 358 million tons, an increase of 2.8% over the previous year, and growth was 0.4 percentage points higher. See Table 1 for details.

Table 1 Output of gasoline, diesel & kerosene, & growth (million tons)

| Year | Gasoline | Diesel | Kerosene | Total of gasoline, diesel & kerosene | ||||

| Output | Growth (%) | Output | Growth (%) | Output | Growth (%) | Output | Growth (%) | |

| 2015 | 121.04 | 9.7 | 180.08 | 2.1 | 36.59 | 21.9 | 337.7 | 6.6 |

| 2016 | 129.32 | 6.8 | 179.18 | -0.5 | 39.84 | 8.9 | 348.34 | 3.1 |

| 2017 | 132.76 | 2.7 | 183.18 | 2.2 | 42.31 | 6.2 | 358.25 | 2.8 |

China tightened export quotas for oil products in 2017, and the net export volume dropped by 8.7% to 36.45 million tons. In contrast, the average growth in the net export amount of oil products in the previous five years was around 50%. The 2017 net export amount of gasoline was 10.54 million tons, an increase of 1.06 million tons and 11.2% over the previous year. The net export amount of diesel was 16.52 million tons, an increase of 2.04 million tons or 14.1%. The net export amount of kerosene was 9.38 million tons, a drop of 0.20 million tons or 2%.

4. Consumption of oil products rebounded, growth was slower for gasoline and faster for diesel

Short-term improvements in industry, communication and real estate made in 2017 triggered a restoration of growth in the consumption of oil products. China consumed 322 million tons of oil products in 2017, an increase of 2.2% over the previous year, with growth 2.7 percentage points higher. The growth of gasoline consumption was the slowest since 2006. Both the consumption of diesel and the consumption growth recovered remarkably. Kerosene consumption maintained high growth.

A drastic reduction in the growth of passenger car sales was the main reason for the slower growth of gasoline consumption. The passenger car market weakened abruptly in 2017, with only 24.158 million vehicles sold, an increase of only 1.6% over the previous year, with growth 12.8 percentage points lower.

Sustained rapid development of “new energy” vehicles inhibited the growth of gasoline demand. In China, 0.777 million “new energy” vehicles were sold in 2017, an increase of 53.3% over the previous year. Sales of “new energy” vehicles already reached 1.73 million, reducing the annual growth of gasoline consumption by over 1.0 percent. Five ministries and commissions including the Ministry of Industry and Information Technology issued the “Parallel Management Approaches for Passenger Car Enterprises on Scores for Corporate Average Fuel Consumption and New Energy Vehicles” in September 2017 to restrict the excessive production of traditional oil-fueled vehicles by large auto manufacturers and accelerate popularization of “new energy” vehicles.

Operation of high-speed railways offsets gasoline consumption. With the rapid development of high-speed railways in China, their advantages in saving cost and travel time became prominent. High-speed railways, therefore, partially replace highway transportation for medium/short-distance passenger traffic. In 2017, both the proportion of passenger traffic volume employing highways and the proportion of passenger turnover volume declined for the fifth consecutive year, contributing around 20% to the slowing of growth in gasoline consumption.

Increased industrial production triggered a rebound of diesel consumption. The industrial added value in enterprises of considerable scale in 2017 increased 6.6% YoY, and growth was 0.6 percentage points higher. The accelerated expansion in the manufacturing sector boosted the development of upstream and downstream sectors and promoted the terminal consumption of oil products. The consumption of diesel was therefore higher.

Tighter control of overloading transport vehicles greatly increased the consumption of diesel. China strictly implemented regulations on vehicle overloading in 2017, so sales of diesel vehicles increased drastically. The sales of heavy-duty trucks in 2017 amounted to 0.233 million vehicles, a big increase of 44.4% over the previous year, with growth 22.4 percentage points higher.

As the economy improved overall in 2017, both electricity consumption and real estate investment increased dramatically, promoting transportation of large-volume commodities such as coal and steel. The highway cargo turnover volume in 2017 was 6 670 billion t/km, an increase of 9.2% over the previous year, with growth 3.8 percentage points higher. The consumption of diesel in transportation was in turn boosted.

Rising prices of liquified natural gas (LNG) weakened its diesel-replacing power. After September 2017, with the approach of the heating season in the north and a shift from coal to natural gas under way in some regions, both civil and industrial consumption of natural gas increased drastically. Also, LNG was in short supply, and the supply of natural gas for non-civil uses was even tighter. So LNG prices rose by 85%. The price of 0# diesel rose by only 21.5%, however, making the price difference between LNG and 0# diesel much wider. Compared with compressed natural gas (CNG), diesel was more attractive to buyers, so consumption of diesel increased.

5. Market share of local refineries increased for five years in a row, aggravating market competition

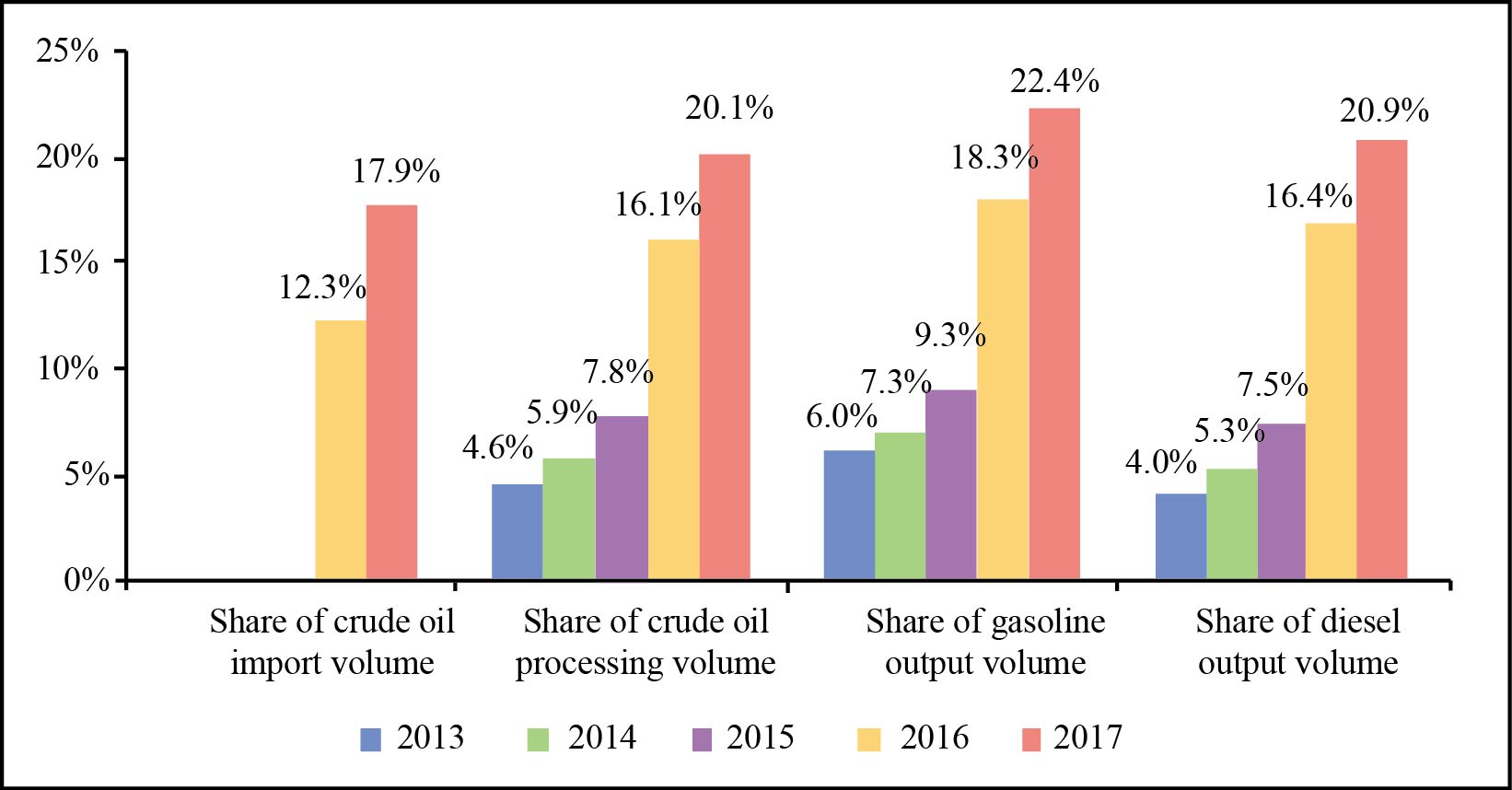

Ten more enterprises got crude oil quotas of 20.36 million tons in 2017, bringing the total of quotas to 105.63 million tons. After the bottleneck of processing raw materials was broken by local refineries, both the amount of crude oil processed and the output of oil products increased drastically. The market share expanded rapidly for five consecutive years. The amount of crude oil processed and the output of oil products both accounted for over 1/5 of the national total, much higher than in the previous year (see Figure 3).

Figure 3 Market share of local refineries

6. Energy used in transportation diversified notably, but displacement of traditional oil products was not big

In 2017 the national government issued a number of policies regarding transportation fuels, actively arranged clean, efficient and smart energy systems and accelerated optimization of the energy structure, with some impact on the petroleum market.

Electric vehicles will not replace oil-fueled vehicles in the near future. With encouragement from state policies, electric vehicles have developed rapidly in China in recent years. Due to constraints such as high cost, short running mileage, technical bottlenecks and insufficient recharge facilities, however, the proportion of electric vehicles among vehicles on the road is still very small. In 2017, major European countries such as France, Britain and Germany proposed or announced that sales of oil-fueled vehicles will be prohibited before the middle of this century, and timetables were defined. China also launched research on prohibiting the sales of oil-fueled vehicles. With the progress of technology and the improvement of facilities, electric vehicles will have an increasing impact on the sales of oil-fueled vehicles, finally replacing them, but before 2030, large-scale replacement will be impossible. Oil-based fuels will still dominate transportation energy for a considerable period of time.

Sharing travel produces impacts on the demand of gasoline. Shared commuting modes such as carpooling, timeshare rental and travel services appeared one after another in 2017. With encouragement from the government to the sharing economy and the gradual standardization of shared commuting, sharing travel is expected to reduce the gasoline consumption by 4.00 million tons in 2020 and the annual growth of gasoline consumption will fall to 3.5% during the Thirteenth Five-Year Plan period (2016-2020).

Fifteen ministries and commissions issued the “Implementation Scheme for Expanding the Production of Bio-Fuel Ethanol and Promoting the Use of Vehicle Ethanol Gasoline” on September 13, 2017. It is proposed in the document that, by 2020, ethanol gasoline will generally be used all over the country. Based on this forecast, the annual consumption of gasoline will be reduced by 33.43 million tons in next three years. The annual amount of fuel ethanol used will reach around 15.00 million tons in 2020. According to the plans for fuel ethanol capacity today, however, ethanol capacity will fall short by around 10.00 million t/a before 2020. Production units need to be constructed or expanded to meet the demand. Due to factors such as grain-supply security, high oil consumption and consumer mindset, some problems still need to be solved in order to promote the application of ethanol gasoline.

Outlook for 2018

The growth of petroleum demand in China will make slow this year, the import volume of crude oil will increase further, and the dependence on imported petroleum will approach 70%. The demand for oil products will continue to grow slowly, the supply will keep increasing rapidly, the relaxed supply/demand balance will last, and net export will increase rapidly once again .

1. Growth of petroleum demand will slow down, import dependence will keep growing

China’s economy will see stable and sound growth in 2018. The apparent demand for petroleum is expected to be around 610 million tons, a YoY increase of 4.5%, with growth around 0.6 percentage points lower. With the rapid increase of oil refining capacity, the apparent demand of crude oil in China is expected to amount to 643 million tons this year, a YoY increase of 5.4%. The amount of crude oil processed is expected to be around 598 million tons, a YoY increase of around 30 million tons or 5.3%. The net import volumes of petroleum and crude oil will be 418 million tons and 447 million tons, respectively, YoY increases of 6.5% and 7.7%. Crude oil output will pick up slightly. The dependence on imported petroleum and crude oil will go up to 68.5% and 70.0%, respectively.

2. Growth of oil products demand will slow down

China’s economy will grow steadily in 2018. However, the development of sectors for terminal consumption of oil products will slow down, and the growth of demand for oil products will be slower, due to transformation of economic structure, adjustment of the real estate market, tightening of environmental protection and development of alternative energy sources. It is expected that the demand for oil products in 2018 will be 328 million tons, a YoY increase of 2.0%, with growth 0.2 percentage points lower. See Table 2 for details.

Table 2 Apparent consumption of major oil products, & growth (million tons)

| Type | Parameter | 2016 (actual value) | 2017 (estimated value) | 2018 (expected value) |

| Total of gasoline, diesel and kerosene | Growth (%) | -0.5 | 2.2 | 2 |

| Demand | 314.8 | 321.81 | 328.1 | |

| Gasoline | Growth (%) | 3.9 | 2 | 2.8 |

| Demand | 119.84 | 122.22 | 125.6 | |

| Diesel | Growth (%) | -5 | 1.2 | -0.1 |

| Demand | 164.7 | 166.66 | 166.5 | |

| Kerosene | Growth (%) | 9.2 | 8.8 | 9.3 |

| Demand | 30.26 | 32.93 | 36 |

The demand for gasoline will maintain a medium/low growth. With stricter supervision, resources of blended oil products will be constrained in 2018, promoting the demand for gasoline. However, the growth of gasoline demand will be hampered by the difficulty of restoring high growth in the passenger car market coupled with multiple factors such as implementation of a tax exemption policy, issuance of a “double score” policy for “new energy” vehicles, development of “sharing travel” and popularization of ethanol gasoline. According to comprehensive forecasts, demand for gasoline is expected to be 126 million tons in 2018, an increase of only 2.8% over 2017. Demand for diesel will decline slightly. Stable growth of industrial production, a sustained brisk demand for large-volume commodities and control of vehicle overloading will back the demand for diesel. Real estate controls and stricter environmental protection will however speed up the transformation of sectors with high pollution, high energy consumption and surplus capacity. The power of LNG to replace more traditional fuels will be restored. The rigid demand for diesel will therefore face pressure for reduction. It is expected that the demand for diesel will amount to 167 million tons this year, a YoY drop of 0.1%, with growth 1.3 percentage points lower. Demand for kerosene will maintain high growth, likely to reach 36 million tons this year, a YoY increase of 9.3%.

3. Growth of oil products output will be faster, net export will increase rapidly once again

Growth of oil products output will accelerate. According to plans, oil refining capacity in China will increase 36 million t/a in 2018, and the output of oil products grow faster. Output of oil products is expected to reach 375 million tons this year, a YoY increase of 4.6%, with growth 1.8 percentage points higher. The outputs of gasoline, diesel and kerosene will increase 4.2%, 3.9% and 9.2% YoY, respectively. See Table 3 for details.

Table 3 Output of major oil products (million tons)

| Type | Parameter | 2016 (actual value) | 2017 (estimated value) | 2018 (expected value) |

| Total of gasoline, diesel and kerosene | Growth (%) | 3.1 | 2.8 | 4.6 |

| Output | 348.34 | 358.25 | 374.9 | |

| Gasoline | Growth (%) | 6.8 | 2.7 | 4.2 |

| Output | 129.32 | 132.76 | 138.4 | |

| Diesel | Growth (%) | -0.5 | 2.2 | 3.9 |

| Output | 179.18 | 183.18 | 190.3 | |

| Kerosene | Growth (%) | 8.9 | 6.2 | 9.2 |

| Output | 39.84 | 42.31 | 46.2 |

The export of oil products will once again increase rapidly. Oil refining capacity in China did not grow in the 2014-2015, but then grew in both 2016 and 2017, and the growth of demand for oil products has no sufficient driver, so the present surplus of oil product resources is expected to worsen and export quotas are expected to be loosened. China may need to export 46.80 million tons of surplus oil products in 2018 to balance domestic supply and demand, a YoY increase of 28.4%, with growth 19.8 percentage points higher. A net 12.80 million tons of gasoline will need to be exported, an increase of 21.4%; a net 23.80 million tons of diesel will need to be exported, an increase of 44.1%; and a net 10.20 million tons of kerosene will need to be exported, an increase of 8.7%. See Table 4 for details.

Table 4 Net export volume of major oil products (million tons)

| Type | Parameter | 2016 (actual value) | 2017 (estimated value) | 2018 (expected value) |

| Total of gasoline, diesel and kerosene | Growth (%) | 57.1 | 8.6 | 28.4 |

| Net export amount | 33.54 | 36.44 | 46.8 | |

| Gasoline | Growth (%) | 65.6 | 11.2 | 21.4 |

| Net export amount | 9.48 | 10.54 | 12.8 | |

| Diesel | Growth (%) | 115 | 14.1 | 44.1 |

| Net export amount | 14.48 | 16.52 | 23.8 | |

| Kerosene | Growth (%) | 7.7 | -2.1 | 8.7 |

| Net export amount | 9.58 | 9.38 | 10.2 |

4. Market share of local refineries will grow further, oil product resources will be in serious surplus

The Ministry of Commerce has stated that the allowable import volume of crude oil for non-state trading will be 140 million tons in 2018, an increase of 62.6% over 2017. With the completion of large oil refining projects, with Zhejiang Hengli Petrochemical Co., Ltd. as the lead, local refineries will increase the imported amount of crude oil, the processed amount of crude oil, output of gasoline and diesel, and market share for the sixth consecutive year. The gasoline/diesel output by local refineries will grow from 21.5% of the national total in 2017 to 23.6% in 2018. A large increase of oil refining capacity will yield an oil refining capacity surplus of nearly 100 million t/a. Even if the operating rate is low, oil product resources in China will still be more than 45 million tons in surplus. There will be considerable pressure for export, and market competition will become more severe. With the completion of new refineries, competition in the oil product market will become fiercer in the second half of 2018.