By Wang Yuying, PetroChina Jilin Petrochemical Co., Ltd. Research Institute

Improved profitability, increased operating rates

China’s butadiene capacity reached 3.924 million t/a in 2017. Added capacity included a 100 kt/a butylene oxidative dehydrogenation unit of Jiangsu Sailboat Petrochemical Co., Ltd., a 50 kt/a C4 extraction unit of Puyang Bluestar New Material Co., Ltd. and a 64 kt/a C4 extraction unit of Shenhua Ningxia Coal Industry Group Co., Ltd.

The main sources of butadiene today are C4 extraction units and butylene oxidative dehydrogenation units. Due to high production costs, some butylene oxidative dehydrogenation units have been idle for a long time. Butylene oxidative dehydrogenation units of Shandong Yuhuang Chemical (Group) Co., Ltd., Shandong Huayu Rubber Co., Ltd. and Shandong Witt Chemical Co., Ltd. have been renovated to employ the C4 extraction process. The capacity of butylene oxidative dehydrogenation units has already been reduced from 13% of the total butadiene capacity in 2015 to 10% in 2017. C4 extraction units dominate and are mainly concentrated in the large petrochemical enterprises like Sinopec and PetroChina. Sinopec’s butadiene capacity was around 1.884 million t/a in 2017, or 47% of the national total. PetroChina’s capacity was around 1.141 million t/a, or 29%. Table 1 shows the major butadiene producers in China in 2017.

Table 1 Major butadiene producers in China, 2017

| Producer | Capacity (kt/a) | Major downstream product |

| Sinopec | ||

| Sinopec Yangzi Petrochemical Co., Ltd. | 206 | |

| Sinopec Fujian Refining & Chemical Co., Ltd. | 180 | |

| Sinopec Qilu Petrochemical Co., Ltd. | 170 | SBR, BR |

| Sinopec Maoming Petrochemical Co., Ltd. | 164 | BR, SBC |

| Sinopec Yanshan Petrochemical Co., Ltd. | 135 | BR, SBC |

| Sinopec Shanghai Petrochemical Co., Ltd. | 120 | |

| Sinopec Gaoqiao Petrochemical Co., Ltd. | 45 | BR, SBR, ABS |

| Sinopec Guangzhou Petrochemical Co., Ltd. | 34 | |

| Shanghai SECCO Petrochemical Co., Ltd. | 210 | |

| Sinopec SABIC (Tianjin) Petrochemical Co., Ltd. | 200 | |

| Ningbo ZRCC Lyondell Chemical Co., Ltd. | 160 | |

| BASF-YPC Co., Ltd. | 130 | |

| Sinopec-SK (Wuhan) Petrochemical Co., Ltd. | 130 | |

| Sinopec subtotal | 1 884 | |

| PetroChina | ||

| PetroChina Daqing Petrochemical Co., Ltd. | 231 | BR, ABS |

| PetroChina Jilin Petrochemical Co., Ltd. | 230 | SBR, ABS |

| PetroChina Dushanzi Petrochemical Co., Ltd. | 205 | SBR, BR, SBC |

| PetroChina Fushun Petrochemical Co., Ltd. | 160 | SBR |

| PetroChina Sichuan Petrochemical Co., Ltd. | 150 | BR |

| PetroChina Lanzhou Petrochemical Co., Ltd. | 135 | SBR, NBR, ABS |

| PetroChina Jinzhou Petrochemical Co., Ltd. | 30 | BR |

| PetroChina subtotal | 1 141 | |

| CNOOC and Shell Petrochemical Co., Ltd. | 165 | |

| Shandong Yuhuang Chemical (Group) Co., Ltd. | 100 | BR |

| Shandong Qixiang Tengda Chemical Co., Ltd. | 100 | BR |

| Jiangsu Sailboat Petrochemical Co., Ltd. | 100 | |

| Shandong Kenli Petrochemical Group Co., Ltd. | 100 | |

| Liaotong Chemical Co., Ltd. | 100 | ABS |

| Shenhua Ningxia Coal Industry Group Co., Ltd. | 64 | |

| Shandong Huayu Rubber Co., Ltd. | 60 | |

| Shandong Witt Chemical Co., Ltd. | 60 | BR |

| ChemChina Tianjin Bluestar (Puyang) Co., Ltd. | 50 | |

| 3 924 |

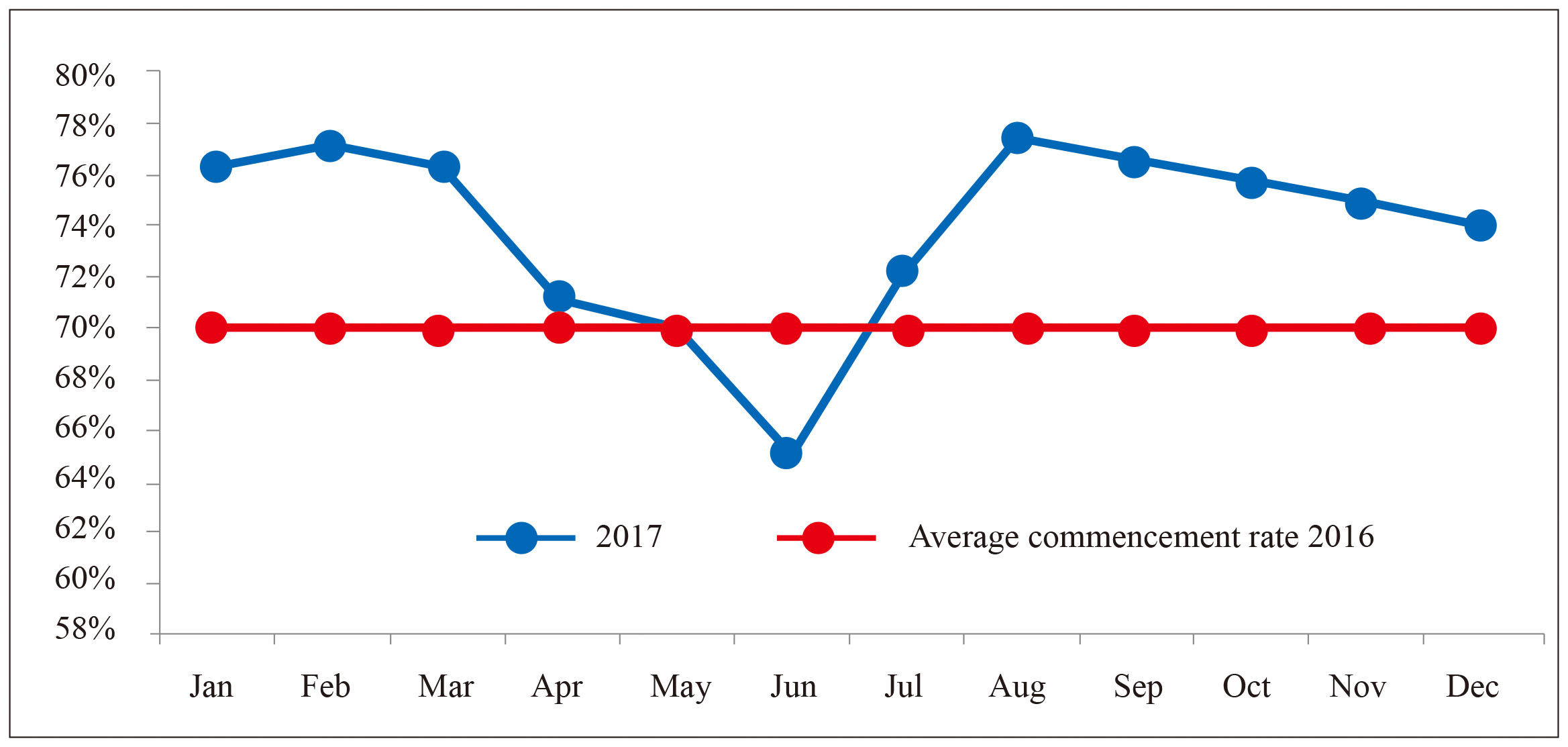

The price of butadiene stayed high in 2017 and the overall profitability of producers improved. Even the average profit of butylene oxidative dehydrogenation units exceeded RMB1 000 per ton of product. The startup of new butadiene units is thereby encouraged. Figure 1 shows the operating rate trend of butadiene units in China in 2017.

Figure 1 Operating rate of butadiene units in China, 2017

The output of butadiene in China grew in 2017, reaching around 2.63 million tons, an increase of 3.1% over the previous year. The average operating rate of butadiene units was 73.8%, notably higher than in previous years. The rate declined slightly during April-June, due mainly to nearly simultaneous shutdowns for overhauls of some butadiene units, such as those of Shanghai Petrochemical Co., Ltd., Liaotong Chemical Co., Ltd., Qilu Petrochemical Co., Ltd. and Yangzi Petrochemical Co., Ltd. in those months.

Expansion of the capacity, adjustment of the market pattern

Butadiene capacity in China will grow further, and the market pattern will adjust. Three of the butadiene units being constructed or planned for construction have considerable possibility for completion. Table 2 shows the details. If these units start production on schedule, the capacity is likely to reach 4.339 million t/a in 2018, and the domestic butadiene shortage would be relieved to a certain extent.

Table 2 Butadiene units being constructed or planned for construction in China kt/a

| Company | Capacity (kt/a) | Expected production startup | Remarks |

| CNOOC Huizhou Refining & Chemical Co., Ltd. | 145 | First quarter of 2018 | C4 extraction |

| Inner Mongolia Jiutai Energy Group Co., Ltd. | 70 | Yet to be set | Butylene oxidative dehydrogenation |

| Zhejiang Petrochemical Co., Ltd. | 200 | End of 2018 | A matched 1.40 million t/a ethylene unit to be constructed |

| Total | 415 |

Butadiene imported by China in recent years comes mainly from neighboring regions of Asia, the four biggest providers being Korea, the Netherlands, Indonesia and Taiwan. Korea has been the top import source since 2012. The amount of butadiene imported from Korea was 69.4 kt in 2016, accounting for around 25.4% of the total and 87.0 kt in 2017 (first 11 months), accounting for around 26.7%.

Backing of costs, rigidity of demand

The consumption of butadiene in China has risen overall in past six years, and the demand outlook is quite favorable. The apparent consumption of butadiene reached 2.958 million tons in 2017, an increase of 6.7% over the previous year. Table 3 shows the supply and demand of butadiene in China during 2012-2017.

Table 3 Supply & demand of butadiene in China, 2012-2017 (kt)

| Year | Output | Import volume | Export volume | Apparent consumption | Self-sufficiency (%) |

| 2012 | 2 177 | 344.8 | 39.5 | 2 482.3 | 87.7 |

| 2013 | 2 250 | 370.5 | 8.2 | 2 612.3 | 86.1 |

| 2014 | 2 441 | 202.7 | 11.7 | 2 632.0 | 92.7 |

| 2015 | 2 500 | 277.8 | 2.9 | 2 774.9 | 90.1 |

| 2016 | 2 550 | 273.3 | 50 | 2 773.3 | 91.9 |

| 2017(Jan.-Nov.) | 2 630 | 326 | 2.1 | 2 957.9 | 88.9 |

Major consumption sectors of butadiene in China today are still the makers of synthetic rubbers and latex. With restored demand growth in the automobile and household electric appliance sectors and the intensification of “One Belt One Road” infrastructure projects, the demand for synthetic rubbers and resins increased in 2017. The operating rate of BR and SBR makers picked up somewhat, and both the capacity and the operating rates of SBC makers were also higher, boosting the growth of butadiene demand. Consumption of butadiene in 2017 was 31.0% by BR makers, 26.0% by SBR makers, 17.5% by SBC makers, 19.0% by ABS makers, 2.5% by NBR makers and 2.5% by SBR latex makers. Both output and consumption of butadiene will likely increase further in 2018.

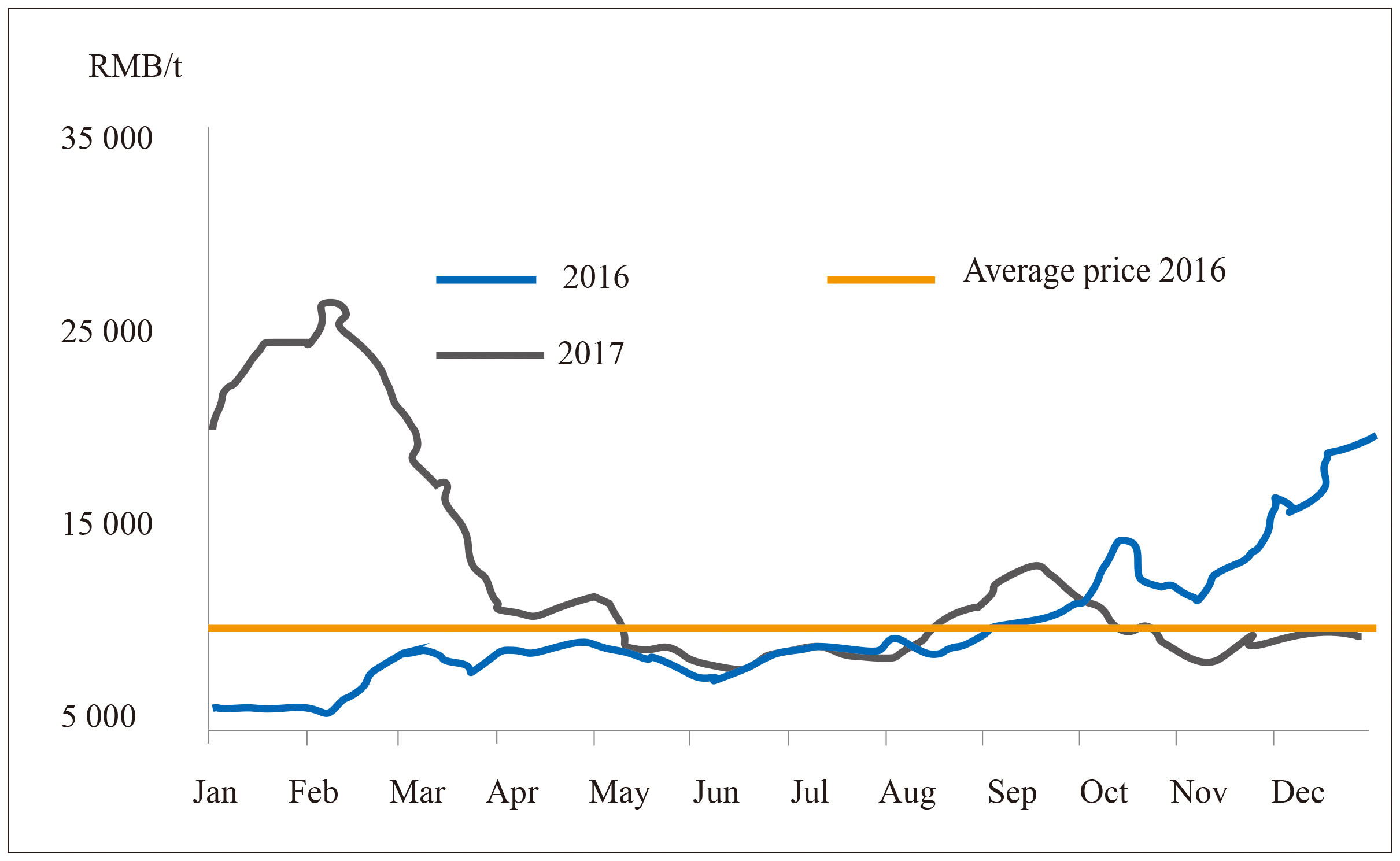

The price of butadiene fell dramatically in 2017 after a temporary rise in the first half and small increase in the second half. At the beginning of 2017 the market price continued the rising trend seen at the end of 2016. In early February the price reached the year’s highest of RMB26 700/t and then plummeted. In early June the price touched the year’s lowest of RMB7 650/t. In the second half of 2017 the market price of butadiene maintained a trend of consolidation. Figure 2 shows the details.

Figure 2 Market price of butadiene in China, 2017

The market price trend of butadiene in China will be quite stable in 2018, and demand will be quite sound. A 145 kt/a new butadiene unit of CNOOC Huizhou Refining & Chemical Co., Ltd. will be put on stream in the first quarter of 2018, likely easing the supply shortage. The constant rise of crude oil prices in the international market will however back the cost of butadiene to a certain extent. The outlook for operations of major downstream sectors is also very promising. The market will therefore have firm backing from rigid demand. There is no great possibility for a price drop in the near future.

Evasion of risks through integrated development

Butadiene capacity is expected to expand rapidly during the Thirteenth Five-Year Plan period (2016-2020). To better cope with market risks, new butadiene projects should include good upstream/downstream integration plans and construct matched units of downstream products with established market volume and good development prospects.

Butadiene units using the butylene oxidative dehydrogenation process have high production costs, and the process technology must be improved. There are also impacts from price fluctuations of crude oil. Some such units have already been renovated to use the C4 extraction process. At a time of constant capacity growth, to enhance competitiveness of production units, efforts should be made to improve product quality, reduce production cost and expand export on the premise of first satisfying domestic demand.