By Shen Chunlin, Professional Committee of Waterproof Materials, China Ceramic Society

Excellent properties, great market potential

Polyurethane waterproof coating, a multifunctional polymer material, is featured with light waterproof layer, high strength, good elasticity, strong adhesion, high- and low-temperature resistance, corrosion resistance and simple use. Polyurethane waterproof coating has been widely used since the 1980s. JC 500 - the standard of building materials industry was formulated in 1992, and was put into effect in 1993, greatly spurring up the development and application of polyurethane waterproof coating in the market. In 2003, China Building Material Council proposed to regulate the national standard of the People's Republic of China GB/T 19250 Polyurethane Waterproof Coating. With the rapid national economic development in the 21st century, polyurethane waterproof coating has seen not only an explosive increase in the civil market, but also a leap-forward development in the major domestic construction fields, especially in the high-speed rail, subway, highway, and water conservancy engineering fields that have put forward higher requirements for high-performance polyurethane waterproof coating. China Building Material Council proposed to revise GB/T 19250 Polyurethane Waterproof Coating again in 2013.

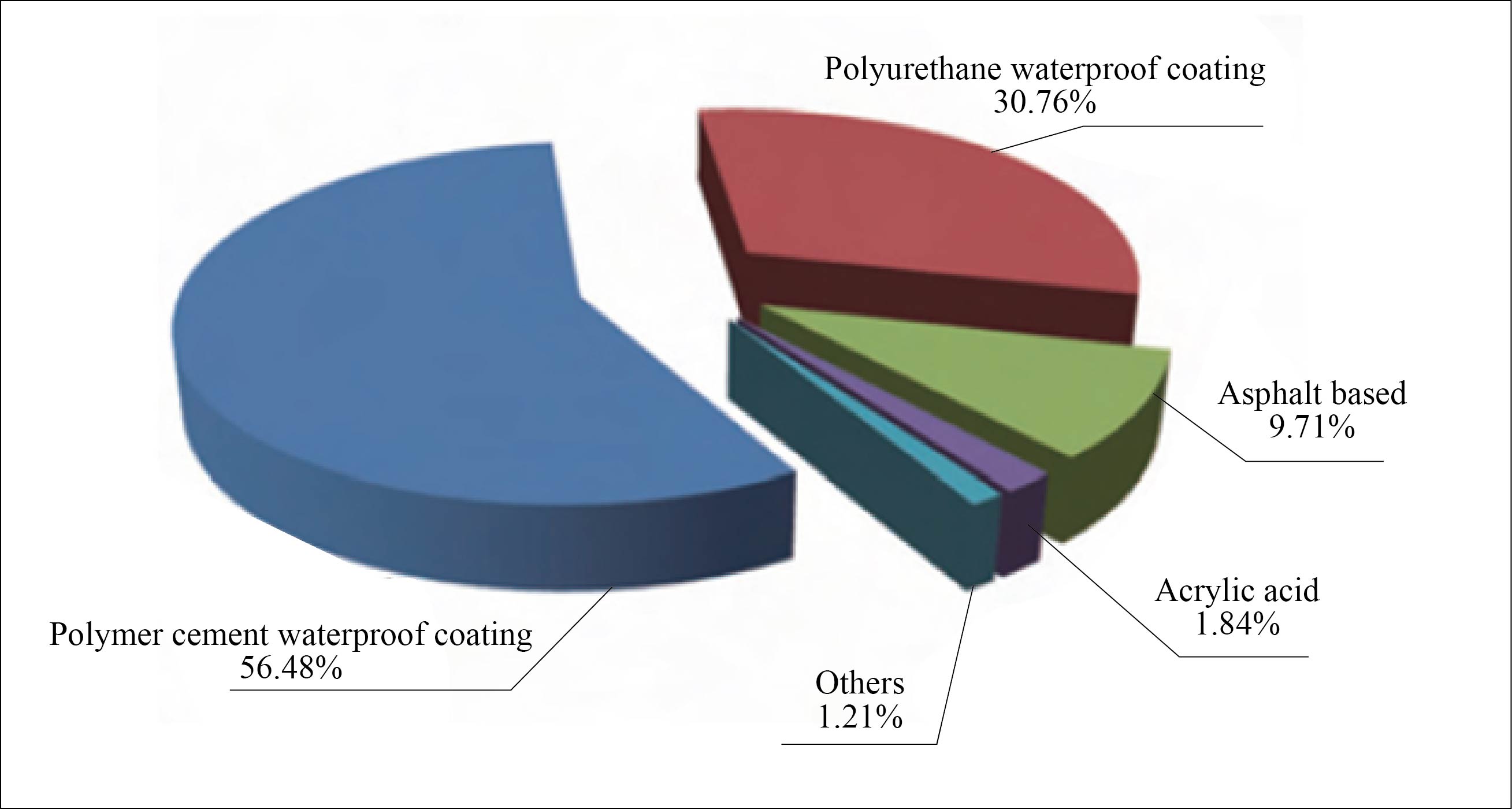

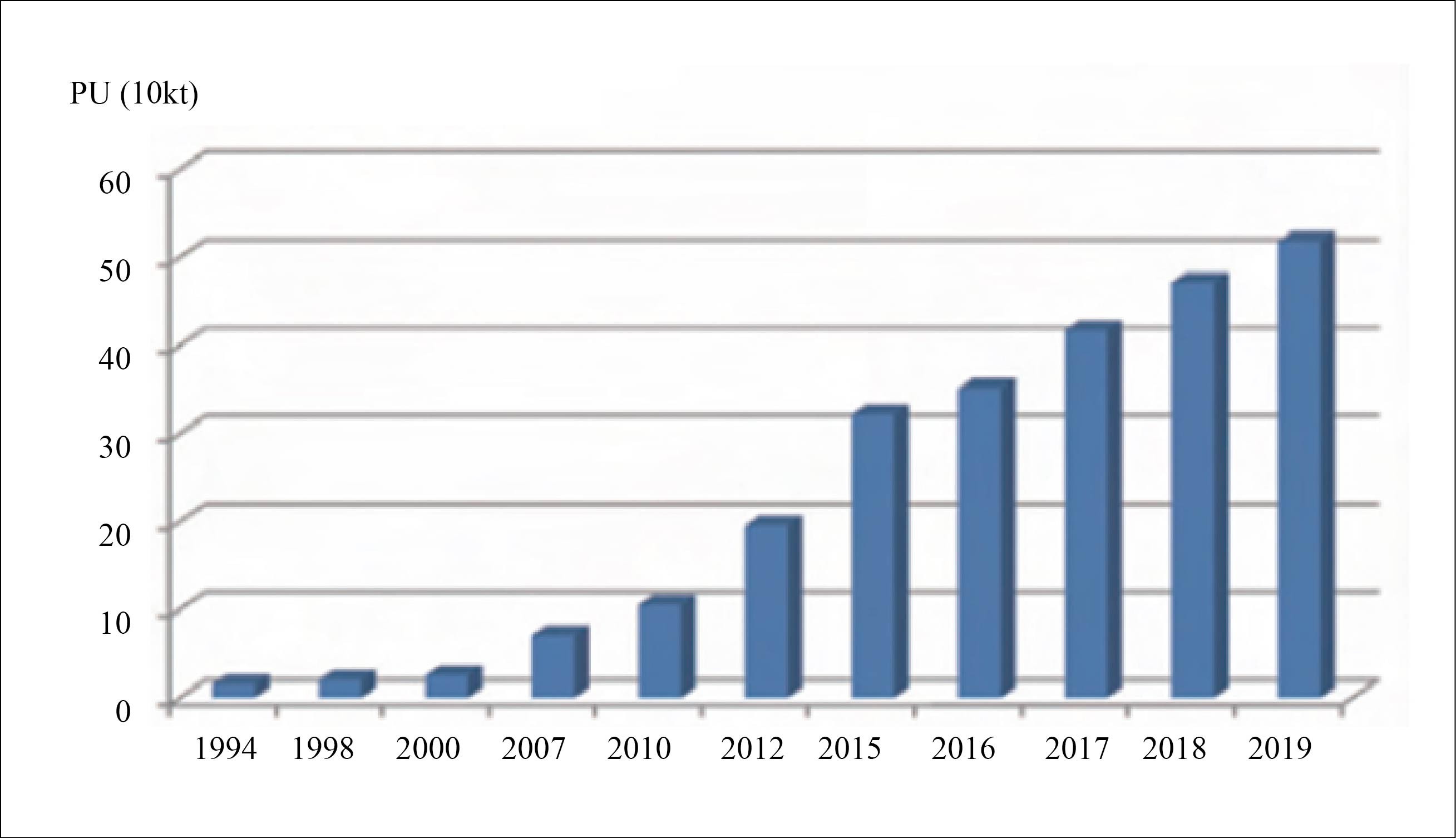

Polyurethane waterproof coating is taking up more and more proportion in the domestic waterproof coating market due to its excellent performance (Figure 1). The annual growth rate of polyurethane waterproof coating has been stable around 10% in recent years, and the market outlook is bullish. The capacity of polyurethane waterproof coating has increased from tens of thousands of tons per year in the 1990s to hundred thousand tons per year at the beginning of the 21st century, and then to hundreds of thousands of tons per year in recent years (Figure 2). The main producers and consumers are concentrated in the developed coastal regions, especially in Guangdong, Shanghai, Jiangsu, and Beijing where the total output has exceeded the half of the national total.

Figure 1 Structure of waterproof coating products, 2018

Figure 2 Output of big-scaled polyurethane waterproof coating producers

Revenues of big-scaled architectural waterproof coating producers in China are increasing, while laggard products and capacities are being driven out of the market. Oriental Yuhong Waterproof Technology Co., Ltd. (002271. SZ), the first listed company in the industry, reported a revenue of more than RMB10 billion in 2017. In the same year, Jiangsu Canlon Building Materials Co., Ltd. (300715.SZ),?Feilu?High-Tech?Materials?Co.,?Ltd. (300665.SZ), Zhejiang Hithink Flush Information Network Co., Ltd. (300737.SZ) were listed on growth enterprise market (GEM). SKSHU (60373.SH) and WeiXing Co., Ltd. (002003.SZ) also announced the establishment of production lines for waterproof coatings and coiled materials. It is believed that more and more investments will flow into the waterproof industry in the next few years, which will lead to a new competitive market.

Environment-friendly raw materials, high-quality production and construction

In 2017, the State Council issued the 13th Five-year Plan Comprehensive Work Plan for Energy Conservation and Emission Reduction, in which VOCs were incorporated into the emission reduction target, and the total emission of VOCs by 2020 will be 10% lower than that in 2015. Polyurethane waterproof coating is one of solvent-based products, and the prevailing standard GB/T 19250-2013 has specified requirements for the limit of hazardous substances. In 2015, China continued to highlight the promotion and development of polyurethane waterproof coating in its 13th five-year development plan.

At present, domestic polyurethane waterproof coatings are mainly composed of prepolymer, plasticizer, inorganic filler, pigment, cross-linking agent, diluent and addition agent. Prepolymer is polycondensated by polyether polyols (PPG) and diisocyanate monomers. There are many brands of polyether polyols in China. The main producers include Fushun Petrochemical, Tianjin Petrochemical No. 3 Plant, Bluestar Dongda, Wanhua Chemical, and Shandong Inov Polyurethane Co., Ltd. The commonly used isocyanate monomers are liquid MDI (mainly including MI-50 of Wanhua, MIPS or MI-50 of BASF) and TDI (mainly including T-80 of Wanhua Chemical and BASF); plasticizers mainly consist of chlorinated paraffin and phthalate esters; inorganic fillers are composed of micro calcium carbonate, talcum powder and kaolin or the mixture; crosslinkers are largely constituted by MOCA of Xiangyuan Chemical; diluents are mainly aromatic solvent, such as S100 or S150; addition agents include catalyst, dispersant, defoamer and latent curing agent. In order to improve the production efficiency and reduce the energy consumption, the domestic polyurethane waterproof coating producers adopt the intermittent production mode.

Construction is pivotal to the quality of waterproof engineering. The traditional polyurethane waterproof coating construction process is scraping coating. It requires well-skilled workers, and the construction efficiency is quite low. As early as in 2012, Oriental Yuhong Waterproof Technology Co., Ltd. and US-based GRACO Co., Ltd. jointly researched mechanical spraying coating devices for construction. Their Z45 device is available for the spraying of all waterproof coatings, which, with strong compatibility, can greatly improve the quality and efficiency of waterproof coating construction and reduce the labor intensity. In addition, the spraying coating is denser and has better adhesion than the scraping coating. Jiangsu Canlon Building Materials Co., Ltd. and Zhejiang Hithink Flush Information Network Co., Ltd. have successively adopted the spraying construction method of polyurethane waterproof coating so as to popularize the mechanized coating in the waterproof coating industry. Replacing manual scraping, spraying coating is widely used in large-scale subway, mine, tunnel, bridge and other water-proof engineering fields. The coating on special-shaped surface highlights the advantages of mechanical spraying.

Bullish market outlook due to robust demand

The architectural waterproof industry is speeding up the reshuffle as pressured by both environmental protection policies and security inspection. The development trend of polyurethane waterproof coating in the future will be presented as below:

1. Technological innovation will become the key way to enhance competitiveness in the industry. As the labor cost is getting higher and higher, the development of polyurethane waterproof coating that can dry quickly and meet the requirement for coating thickness for once will be welcomed by the market;

2. The application of exposed polyurethane waterproof coating is emerging. At present, most polyurethane waterproof coatings in the market are aromatic products, which cannot be directly exposed to the air. With the rise of the maintenance and repair market, the exposed polyurethane waterproof coating will become a popular newcomer in the retail polyurethane waterproof coating market in the future;

3. Environmental protection is the eternal theme of building materials. Producers should select quality raw materials, improve production processes, change the production and application modes of polyurethane waterproof coating, and develop waterborne, powdered and UV curable coatings with low VOCs.

With more and more investments in the construction of traditional and new infrastructures, waterproof materials market has seen new opportunities. The growth rate of investments in subway will hit over 20% from 2019 to 2025. One of the common design schemes of Sponge city is to revamp roof by paving waterproof protective layer between the roof vegetation and the concrete floor. According to the Ministry of Housing and Urban- rural Development, more than 80% of the urban built-up area must meet the target requirements of Sponge city by 2030, which will bring in great demand for waterproof materials. The planned construction mileage of pipe gallery pilot cities will exceed 2 000 km by 2020, also reflecting huge demand for waterproof materials. In the next few years, the waterproof industry will keep growing at a medium and high speed in the short and mid-term, and the demand for waterproof materials will strengthen too.