By Cui Beibei, Chemical Department of JLC Network Technology

In recent years, with the launch of domestic refining-chemical integration units, the downstream industry chain has extended to the area of fine chemistry and high-end product manufacturing of which acrylonitrile industry has gradually become well-developed and part of its under-developed capacity has been eliminated. However, the mismatch between supply and demand pushes up the pressure of acrylonitrile industry.

The market operation status

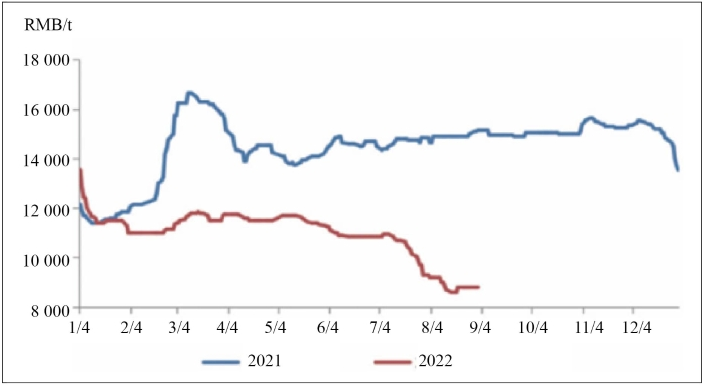

Chart 1 illustrates the price tendency of domestic acrylonitrile 2021-2022. As shown in the chart, the capacity of acrylonitrile industry experienced an outburst in 2022, a growth over 10% year on year, which passed an increasing pressure to the supply end. It is also noteworthy that the demand end of acrylonitrile is not up to expectation due to COVID-19 pandemic. To the end of July, the acrylonitrile market went into the downside channel, the spot price falling from RMB10 850/t at the beginning of July to RMB8 500/t of the end.

Chart 1 The price tendency of acrylonitrile in China, 2021-2022

Supply end

Domestic acrylonitrile producers are mainly located in Eastern China, Northeastern China and Northern China with only one unit in Lanzhou Branch of PetroChina in Northwestern China as presented in Table 1 which shows the capacities of acrylonitrile producers in China 2017-2022. According to the capacities and percentage of the main producers in three areas above, producers in Eastern China take up the largest share of the pie, 57% and down by 4% to the last year. The producers in Northeastern China take up 22% of the whole, and producers in Northern China 21%. With the development of refining-chemical integration industry, private owned acrylonitrile producers have kept growing and some uncompetitive outdated capacities have been eliminated gradually.

In terms of the relation between the production time and the price tendency in Chart 2, it is observed that acrylonitrile units were intensively put into production around the year of 2015 and 2020 with a gap period from 2016 to 2019. It is easy to find a production-to-price falling pattern, a chain reaction that the production of multiple new units piled up the pressure for acrylonitrile price which brought the market panic triggering the price diving. The acrylonitrile price fell repeatedly particularly in 2022 and was hardly expected to rebound.

Chart 2 Acrylonitrile market price tendency in China, 2014-2022

Several acrylonitrile producing units are expected to be completed in the last half of 2022 including the unit of Kingfa Technology of 260 000 t/a, Jieyang unit of 130 000 t/a of Guangdong province, unit of 200 000 t/a of Dongfang Petrochemical of CNOOC. If these newly built units can be put into production successfully, the total capacity of domestic acrylonitrile is estimated to hit 4 139 000 t/a, which will overlay the existing excessive capacity of acrylonitrile and intensify the pressure for supply-end.

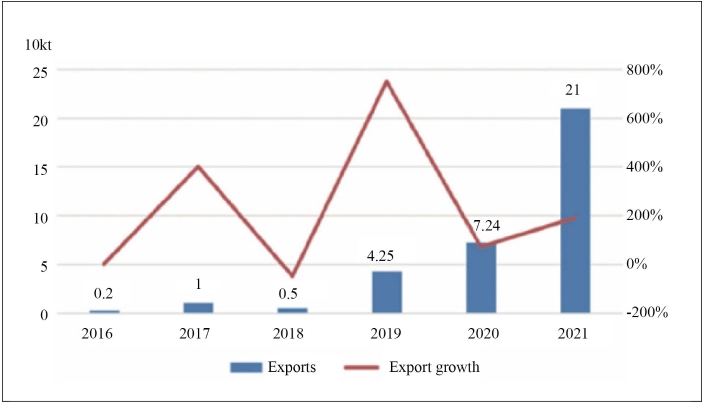

Due to the high profit of acrylonitrile products, the operation rate of producing units was kept high and many new units were constructed and put into production. The fast growing capacity led to a surge in output. In 2021, China’s export volume of acrylonitrile was 210 000 tons, 190% growth year on year (see Chart 3). New units which were put into production clustered around the port areas in Eastern China. The acrylonitrile made in China has been mainly exported to the countries neighboring Asia such as South Korea, India, Turkey, etc. These countries own demand gap in acrylonitrile and easily accessible shipping. Till July of 2022, the total export rate of domestic acrylonitrile reached 13.1%, 3.3 percentage points up year on year. Therefore, the export volume of 2022 is expected to keep growing.

Chart 3 The export volume and export growth speed of acrylonitrile in China

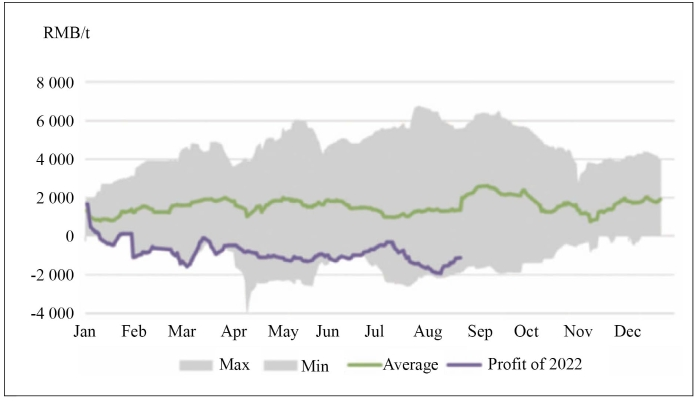

By reviewing relevant record, a wide profit gap between high-end and low-end products can be easily found in acrylonitrile industry. Before the industry was largely expanded, the annual average profit of the industry was RMB3 800 /t in 2018, RMB1 900/t in 2019. As for 2020 which was special due to domestic COVID-19 pandemic, the acrylonitrile was very gloomy with substantial fall of industrial profit, and the annual average profit was even down to RMB-830/t. Since 2021, mitigation of COVID-19 pandemic and recovery of global demand quickly pulled up the profit of acrylonitrile industry to above RMB2 000 /t in terms of annual average. However, since 2022, the boom of acrylonitrile industry took a nosedive: the rising cost and declining price cause by too much new capacity largely reduced the industrial profit. To the end of August of 2022, the theoretical profit loss of acrylonitrile hit RMB-1 130/t. Despite of relatively low cost of some producers of upstream and downstream industries, the acrylonitrile industry has been materially at a loss. It is can be seen in the Chart 4 that the profit of acrylonitrile industry has hovered near the floor around the five-year average line.

Chart 4 Domestic acrylonitrile profit comparison

Demand end

Acrylonitrile is consumed mainly in the industries of acrylic, ABS resin including styrene-acrylonitrile, SAN resin, acrylamide including polyacrylamide, NBR and fine chemical industry (see Table 2). The downstream industries of acrylonitrile such as ABS, acrylic and acrylamide/polyacrylamide (AM/PM) are concentrated in Eastern China, where there are not many ABS factories but each unit owns large capacity. Consequently, these units, coupled with acrylamide producing units consume as high as 44% of the acrylonitrile made in China. In Northeastern China, the acrylic factories of Jilin Chemical Fiber which is the regional head, the acrylamide factories in Daqing and 80 000 t/a ABS producing unit of Jilin Fiber consume about 23% of the total. Northern China, with fiber and amide producing as its main downstream industry, consumes 26% of the total.

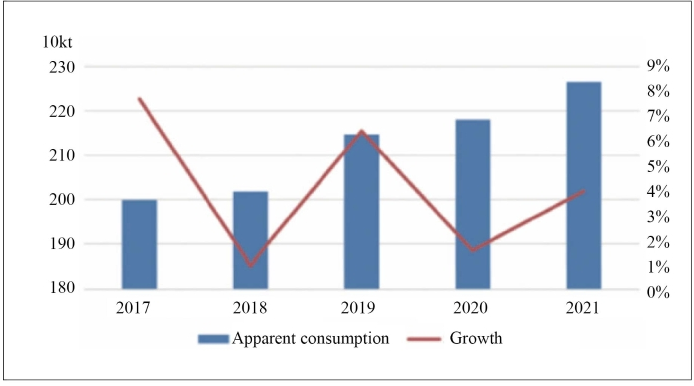

With the growth of acrylic and ABS industries, the apparent consumption volume of acrylonitrile in China has been continually increasing (see Chart 5). Particularly, the intensive overhaul of producing units home and abroad in 2018, led to a boom in acrylonitrile price and thereby the capacity was expanded more quickly. The year of 2019 witnessed the bonus of this expansion in the way of fast growth of apparent consumption volume, 6.3% up year on year. However, this figure dropped with COVID-19 pandemic since 2020. In 2021, the apparent consumption volume of acrylonitrile industry rose again by a large margin, 3.9% year by year, benefitting from recovery of global economy and export of domestic growth.

Chart 5 The apparent consumption volume and growth speed of acrylonitrile in China, 2017-2021

Currently there is an oversupply for acrylonitrile industry on the whole and this leads to a continually sluggish market and sustained loss of industrial profit even if the producers have actively reduced output to ease the burden. Moreover, on the one hand, the capacity is expected to rise largely in the last half year of 2022 and the supply will keep increasing; on the other hand, there are only new units of ABS put into production in downstream industries and the total demands are limited. Therefore, the imbalance between supply and demand will be intensified greatly by this mismatch. At that time, it is hard for producers to raise the operation rate of their producing units and compelling for them to take measures to ease burden.