Wang Ziqing, Liu Cunsheng, Yuan Wenxiong, Luo Xuliang, Min Yonggang, Liu Yidong

High performance polymers are basically polyimide, polyaryl ether and fluorine resins. This article details the industrial status, pain points and market prospects of these three categories.

Industrial status of three high performance polymers

1. Industrial status

(1) Polyimide

According to Newsijie’s Polyimide (PI) Industry In-Depth Research and Investment Prospects, the global market size of PI films was US$1.78 billion in 2018 and is expected to reach US$3.61 billion in 2024, with an average annual growth rate of 12.5%. The production of polyimide polymers including PI, PAI, PEI and TPI was 140 000 tons in 2016 and will be 285 000 tons in 2025 due to the rapid growth of electronic semiconductors, solar PV & military industry, with a market size of US$142.5 billion.

(2) Polyaryl ether

Polysulfone (PSU)

China’s PSU market size was RMB880 million in 2018 and will increase to RMB1.3 billion in 2022, with a compound growth of 10%. The market demand will rise steadily, and the supply will generally shift from imports to domestic production. Please see Chart 1 for global and Chinese PSU market sizes.

Chart 1 Global and Chinese PSU market sizes

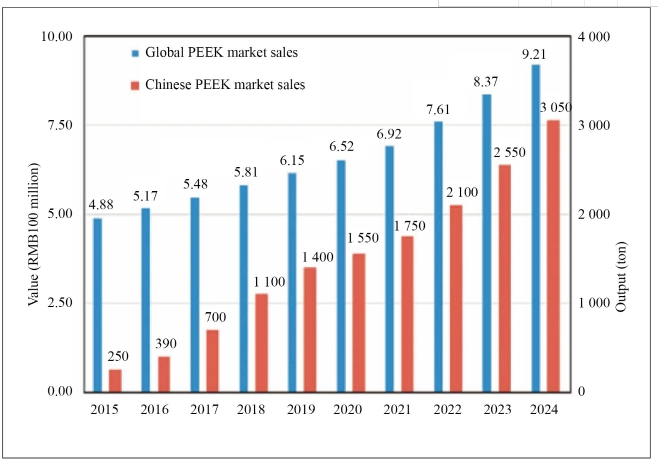

PEEK

According to CNCIC, China’s PEEK market demand has developed rapidly, from 2015’s 250 ton to 2019’s 1 400 tons. Alongside with the development of PEEK polymer synthetic industry and smart manufacturing, China’s PEEK industry achieved breakthroughs from 2017 to 2019, both in resin synthesis and applications. From 2020 to 2024, the growth will be maintained at 20% annually, and the consumption and industry value will respectively reach 3 050 tons and RMB1.83 billion by 2024. Chart 2 shows Global and Chinese PEEK market sales from 2015 to 2024.

Chart 2 Global and Chinese PEEK market sales, 2015—2024

(3) Fluorine resins

Major producers of fluorine resins are Dongyue, Chenguang, Juhua and Huayi 3F, with a total capacity of 265 600 t/a. The total capacity and production of all types of fluorine resins in China have surpassed those of their overseas counterparts. However, China does not have a strong fluorine resin industry because the technology and quality of high-end fluorine resins such as perfluorinated alkoxy resin (PFA), polyvinylidene fluoride (PVDF), and polyvinylidene trifluoride (PCTFE) are yet to be improved. China’s fluorine resins consumption was 194 000 tons in 2021, taking up 40.5% of the global total, and is anticipated to reach 245 000 tons in 2024, with an annual growth of 8%. Chart 3 shows details.

Chart 3 China’s fluorine resin demand trend, 2021-2024

Eight major applications

1. Automobile and high-speed rail

China had produced 25 million automobiles in 2020, and its consumption of PEEK was 675 tons, based on the average use of 2.7 grams of PEEK per vehicle. The Chinese automakers have become increasingly eager to localize high-performance polymer components, and joint ventures also have a demand of localization considering supply chain and logistics cost. Hence, Chinese automotive industry will be one of the major markets for high-performance polymer materials in the future.

The application of polyethersulfone (PES) in automotive gears and headlights has been mature, with annual of around 400 tons. With the increasing requirements on temperature resistance performance from new energy vehicles, PES will continue to replace polyphenylene ether (PPS) and PC materials.

2. Electronic semiconductor

High-performance polymers are widely used in the electronic semiconductor sector as cell phones, computers, 5G base stations, wafers, and LCD are all in need of large quantities of high-performance polymers. The potential demand for PEEK from smart phone is about 2 000 tons in China, worth RMB 1.2 billion.

Semiconductor industry has high requirement on the purity, electrical properties, and quality consistency of high-performance polymers. In the next 5 to 10 years, China will enhance the research and development of semiconductor industry, increase investment and accelerate the pace of localization.

3. Aviation and aerospace

As China's economy continues to grow, the middle class continues to expand, and the aviation business evolves, China's civil aviation industry develops rapidly. It is estimated that 72 040 new aircrafts will be produced in China in the following 20 years, with a market value of US$110 million.

PI has been widely applied in the aviation field because of its excellent performance in temperature resistance, wear resistance and high strength. Meanwhile, PEEK has largely substituted metal materials in a large number of components due to its outstanding properties of high temperature resistance, wear resistance, fatigue resistance, high strength, low density, flame retardant, low smoke, non-toxic properties, etc. By March 1, 2021, there have been 1 015 C919 aircrafts using PEEK, which will be applied to more C919 and CR929 aircrafts in the future.

4. Energy industry

Polyimide, polyaryl ether and polyarylsulfone have been widely applied in petroleum gas, hydrogen energy fuel cells, nuclear power, solar power, wind power, hydropower and geothermal. The Chinese market will be occupied by domestic products. With the implementation of the "carbon neutral and carbon peaking" policy, China's future energy market will see a lot of more new applications, and the demand for high-performance polymer materials will increase significantly.

5. Home appliances and daily goods

Many functional parts of home appliances and daily goods are made from high-performance polymers like PAEK, PPSU, PSU and PES.

China is a large producer of refrigerators and air conditioners. The year 2020 saw a total of 90.147 million refrigerators produced in China, with a demand of 450 tons of PAEK if each unit uses 5 grams of it instead of metal. Its market value is over RMB200 million. In 2019, China's air conditioner production and sales volume both exceeded 210 million units, and the output was 218.66 million. When each unit uses 5 grams of PAEK instead of metal, the air conditioner industry consumed 1 090 tons of PAEK that year, with a market value of more than RMB500 million.

6. Biomaterials

PEEK, due to its excellent biocompatibility, has been recognized by the medical implant industry as the most desirable and commonly used biomaterial and has been applied in orthopedics, trauma, spine, and sports medicine. The rapid development of companies like Weigao, Dabo, and Kehui will make them major manufacturers of PEEK medical implant products. The market potential is huge.

7. Special coatings

The specialty coatings industry usually uses high-performance polymers such as PI, PAI, PES, PEEK, PTFE, PFA and FEP as the main raw materials for coating formulations. The application of specialty coatings exists in almost all industrial fields, and new markets will be developed as long as the pain points of industries are solved.

8. Composite modified materials

To be alloyed and functional is the future market trend of high-performance polymers, and the China’s demand for composite modified materials will increase rapidly, bringing huge business opportunities to international and local Chinese companies.

Industry pain points and market prospect

China has not commercialized the synthesis of PAI, PEI and TPI, and the scales of those having been commercialized, like PEEK, PEKK, PPSU, PES, PPS, and PI are not large enough. There are polymers that have been produced on scale, but the products are all low-end, such as PTFE, PFA, FEP, PCTFE, PVDF, etc. Although China has ranked first in the output of fluorine resins, it lags behind the whole world in terms of core synthesis technology, product performance consistency, processing technology, product formulation, and applications. The pain points, corresponding solutions and market prospects of China's high performance polymer products are detailed in Table 1.