Wang Yuwu, Liang Yating, ACMI, SAGSI

The year 2021 saw constant changes in the organosilicon market, with the prices first leading the rise and then the fall. New capacity start-ups are poised to cause a surplus supply of organosilicon. This may pose huge challenges to upstream enterprises but bring about great chances to downstream sectors.

From Top Performer to Worst Performer

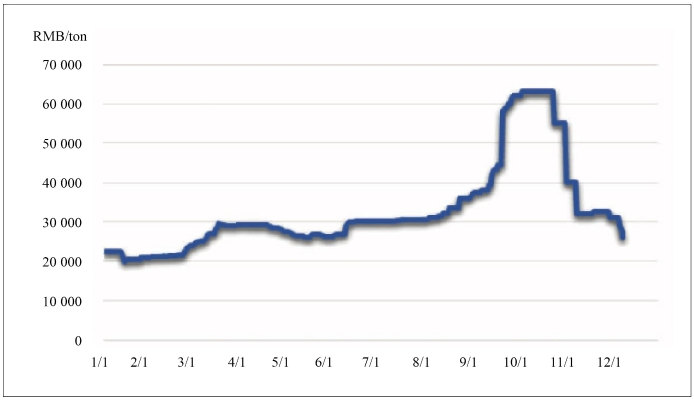

Organosilicon prices hovered at high levels alongside elevated chemical products prices in early 2021, on the back of increased demand amid global economic recovery and the over-issue of foreign currencies. Take DMC for instance, its prices surged to RMB30 000/ton from RMB20 000/ton and briefly retreated to RMB26 000/ton in May. Fire broke out at a monomer plant in May, boosting DMC prices to above RMB30 000/ton and then stabilised. The prices were back to the upward path in August and DMC became the top performer among all chemical products in September, in terms of price increases. In late September in particular, DMC prices rose consecutively and once broke the RMB60 000/ton mark and hit record highs. The major driver behind the round of price spike was the production reduction plan of silicon metal heard in Yunnan, which stirred market concerns about feedstock shortages. Meanwhile, some traders stocked up for speculation, leading to irrational price surges for silicon metal and organosilicon. However, the plan was not implemented. In addition, buyers could not afford high prices given bearish downstream demand. Hence, the price rise failed to sustain for a long period and DMC prices suffered a cliff-like fall from end October. Organosilicon became the worst performer. DMC prices have returned to RMB30 000/ton, while market prices are currently around RMB25 000/ton and are expected to drop further. Figure 1 shows domestic DMC price trends in 2021.

Figure 1 China DMC Price Trends in 2021

Overcapacity Shows up

1. Methyl monomers production

Statistics showed that China’s silicone polysiloxane capacity totalled 1 573 kt/a in 2020, with output at 1 338 kt. In 2021, the capacity is expected to reach 1 973 kt/a and output will rise to 1 500 kt.

There are 13 methyl silicon monomers producers in China, including the foreign enterprise Dow’s production base in Zhangjiagang. Incremental capacity in 2021 stood at 400 kt/a. Hoshine’s new 200 kt/a capacities have started up smoothly. Yunnan Energy Investment Group Silicon Materials’ 100 kt/a project is under test run and Inner Mongolia Hengxing Technology is about to start trial run. Table 1 shows China’s methyl monomer producers’ polysiloxane capacities.

2. Consumption

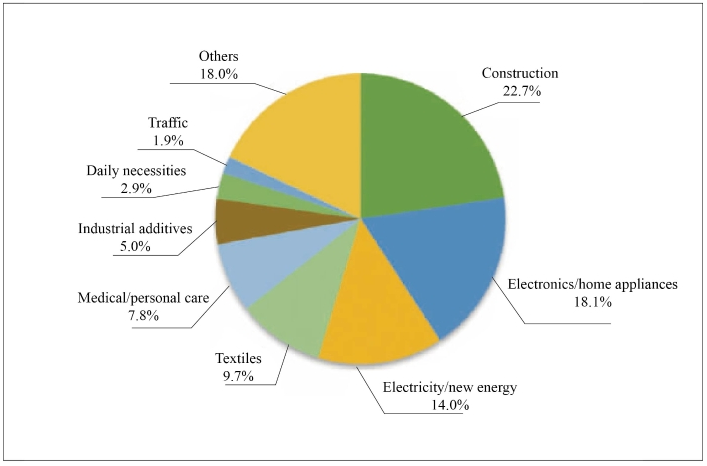

Organosilicon downstream products are widely used in construction, auto, textiles, electronics and home appliances, and electricity etc. Its demand is closely related to macro-economy. The demand growth rate is slowing down but still sustains year-on-year gains. Statistics showed that domestic polymethylsiloxane consumption totalled around 1 265 kt in 2020 and its consumption structure is shown in Figure 2. China provided products to the world markets in 2021, when the coronavirus outbreak slowed down overseas production. This greatly shored up domestic organosilicon consumption, with the year-on-year growth estimated at 12%.

Figure 2 China Polymethylsiloxane Consumption Structure in 2020

China’s organosilicon consumption soared year on year in 2021, but the performance varied among different application fields. Consumption from the largest contributor, construction industry did not increase in 2021 and fell slightly instead. While electricity and new energy industries reaped robust growths in consumption and the growth rate is expected at above 20%. Consumption from the electronics, home appliances, textiles, medical and personal care sectors is expected to rise by over 10%. In the future, electricity and new energy, new-type home appliances and medical/personal care industries will become the major driving force of organosilicon consumption.

3. Imports and exports

China has become a net exporter of organosilicon in 2015. China’s organosilicon exports were equivalent to 225 kt of pure polysiloxane in 2020. From January to October 2021, the export volume climbed to 290 kt and is expected to surpass 350 kt for the whole year, up by 55% year on year. The soar in organosilicon exports is highly related with the coronavirus outbreak. The uptrend will persist but the growth rate will decline. New capacities are concentrated in China and some backward overseas capacities will phase out gradually. Exports will become a major driver for the development of Chinese organosilicon producers.

Overcapacity Unavoidable

There are still many new capacities planned in China. By the end of 2021, only Hoshine Silicon Industry’s 200 kt/a polysiloxane project in Shihezi was completed and started up. Yunnan Energy Investment Group Silicon Materials’ phase I project is under test run, with siloxane capacities equivalent to 100 kt/a and expected to start up in early 2022. Inner Mongolia Hengxing Technology’s 130 kt/a siloxane project is scheduled to launch production in 2022.

A number of organosilicon monomer projects will be completed and become operational in 2022, with new siloxane capacities equivalent to 750 kt/a. The new capacities may reach 770 kt/a in 2023 and 200 kt/a in 2024. These are projects under construction or having high possibility of start-up. There are also several projects that have been announced with investment but have not yet made substantial progress. Their capacities amount to 800 kt/a. Only taking account of projects with a high possibility of being put into production, the total domestic polysiloxane capacity may reach 3 700 kt/a by 2025.

Yunnan Energy Investment Group Silicon Materials and Inner Mongolia Hengxing Technology have not yet released their capacities, but the overcapacity situation has showed up already. The pressure is poised to intensify with hefty new capacities coming on stream. Even if some outdated capacities will be phased out, it will take at least seven to eight years to absorb such a large number of new capacities.

Challenges and Chances Co-exist

Upstream organosilicon producers will face very big challenges. They shall make great efforts to upgrade technology, reduce costs and do well in the layout of the industrial chain to extend to upstream raw material silicon metal and downstream end products. But for the whole silicone industry, especially downstream manufacturers, it will be a very big opportunity to promote downstream products, given the ample capacity of primary raw materials and falling prices. According to the "14th Five-Year Plan" of China's silicone industry, the key development directions of upstream and downstream enterprises in the future are as follows:

1. Monomer enterprises

Actively promote new technologies and new processes, reduce the consumption of raw materials and energy, improve the comprehensive utilization of resources, and improve the technical level and product quality of methyl monomer production; focus on promoting VOCs management, and continuously improve the treatment rate. Strive to realize the integration of synthesis, fractionation and hydrolysis, serialization of technical equipment, intelligent automation and control, streamlined online disposal of three wastes, recycling of waste (silicon powder) slag, and maximizing energy saving and consumption reduction.

2. Application fields

High-temperature rubber field: develop new products around the needs of replacing petroleum-based synthetic rubber, as well as electric power, automobile, high-speed railway and rail transit, new energy, UHV power transmission and transformation, high-end manufacturing and other industries, and overcome a number of technical challenges that has impacted the industry development for a long period of time.

Room temperature adhesives: adjust product structure according to market changes and promote technology and product upgrades. Increase the development of new products of room temperature vulcanized silicone rubber in the fields of new energy, high-speed railway and rail transit, energy conservation and environmental protection, automobiles, electronic appliances/gas, etc., and increase the application ratio of industrial rubber.

Silicon oil field: accelerate the development of high-performance, multi-purpose, environment-friendly silicone oil and its secondary processed products, and increase the application ratio of silicone oil products.

Silicone resin field: focus on key application fields such as LEDs, high-performance coatings, and plastics, increase the development of silicone resins, increase the proportion of localization, and replace imports to meet domestic demand.

Functional siloxanes: promote green, large-scale and continuous production technology of silane coupling agents and cross-linking agents, and continue to maintain rapid growth and leading position.

Fumed silica: develop the large-scale technology for preparing fumed silica with organic silicon monomers and polysilicon by-products as the main raw materials, and its on-line surface modification technology, and form a dominant industry of fumed silica featuring comprehensive utilization and recycling of silicon and chlorine resources.

3. Development focus

Development focus shall be put on organosilicon materials for new and clean energy, organosilicon composite materials for smart equipment and wearable devices, organosilicon materials for bioengineering, and new organosilicon materials for environmental protection, as well as new silicone surfactants, silicone thermoplastic elastomers, silicone bioaccelerators, functional silicone fine chemicals and silicone electronic chemicals.