By Wang Yaoqing, Xinjiang Tianli Petrochemical Holdings

Yield ratio of ethylene tar decreased in 2019

Lower yield ratio tightened China’s domestic supply of ethylene tar in 2019, at 1.91 million tons, up by only 20 kt or 1.05% year on year. The short supply boosted average ethylene tar prices in 2019 to RMB2 958/t, up by RMB530/t or nearly 21.83% year on year. Table 1 shows China’s ethylene and ethylene tar capacity in 2019.

Table 1 China’s ethylene and ethylene tar capacity in 2019 (kt/a)

Producer | Ethylene capacity | Ethylene tar capacity |

PetroChina Daqing | 1 200 | 150 |

PetroChina Fushun | 950 | 150 |

PetroChina Jilin | 850 | 100 |

PetroChina Liaoyang Petroleum Fiber | 200 | 30 |

Liaoning Huajin Petrochemical | 650 | 100 |

Sinopec Yanshan | 860 | 100 |

Sinopec Qilu | 800 | 100 |

Sinopec Tianjin | 200 | 30 |

Sinopec Sabic Tianjin | 1 000 | 150 |

Sinopec Zhongyuan Petroleum | 300 | 40 |

SK (Wuhan) Petrochemical | 800 | 100 |

Sinopec Shanghai | 700 | 100 |

Sinopec Yangzi | 800 | 100 |

Sinopec Zhenhai Refining & Chemical | 1 000 | 150 |

BASF-YPC | 750 | 100 |

Shanghai Secco | 1 100 | 150 |

Shanghai Golden Phillips | 200 | 30 |

Sinopec Fujian | 1 000 | 150 |

Sinopec Guangzhou | 300 | 40 |

Sinopec Maoming | 1 000 | 150 |

CNOOC and Shell Petrochemical Company (CSPC) | 1 000 | 150 |

CSPC (Phase II) | 1 200 | 150 |

Sinopec Lanzhou | 1 000 | 150 |

Sinopec Dushanzi | 1 200 | 150 |

Sinopec Sichuan | 800 | 100 |

Total | 19 860 | 2 720 |

In 2019, domestic ethylene capacities of steam crackers totalled 19.86 million t/a, including the capacity additions from CSPC (phase II) at 1.2 million t/a, up by 7% year on year. The capacity of ethylene tar, the by-product of steam-cracked ethylene increased to 2.72 million t/a, but the effective capacity was around 2.5 million t/a, as Sichuan Petrochemical, Liaoyang Petrochemical and Shanghai Golden Phillips had no products available in the market.

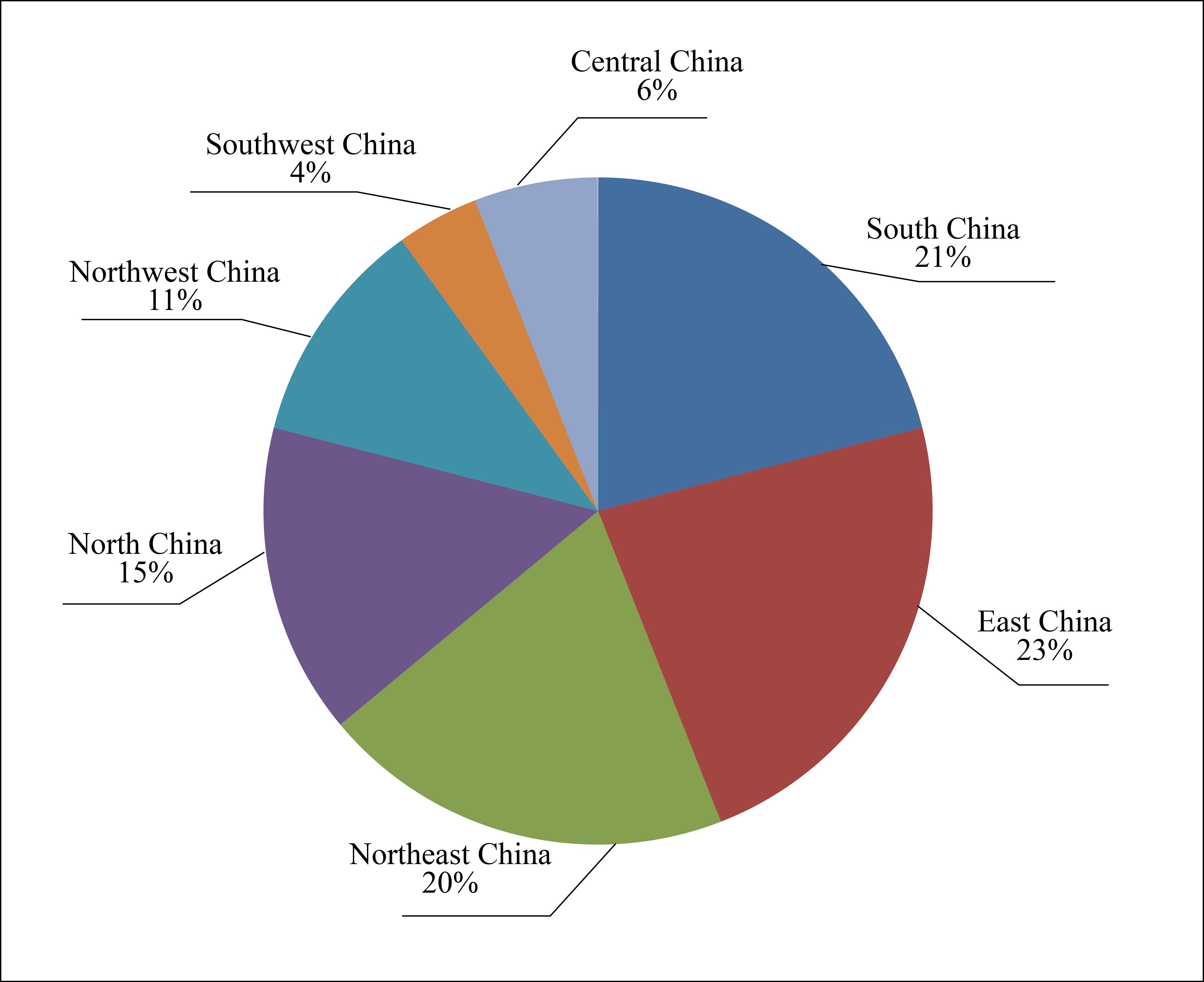

Figure 1 Regional distribution of domestic ethylene tar products

Domestic ethylene tar capacity is concentrated in east, south and northeast China, at 550 kt/a, 540 kt/a and 400 kt/a, respectively. In east China, ethylene tar is mainly supplied to carbon black, fuel oil and ethylene tar deep-processing enterprises. In south China, CSPC has no ethylene tar sold in the market, while Maoming Petrochemical mainly supplies to the fuel oil and ethylene tar deep-processing market and therefore is heavily affected by the oil products market. Theoretical ethylene tar capacity in north China is 340 kt/a, targeting regional carbon black and ethylene tar deep-processing enterprises.

Looming supply shortages in the short run

Domestic steam cracking-based ethylene capacity will increase by 13.4 million t/a in 2019-2021, translating into an increase of 1.95 million t/a in theoretical ethylene tar capacity, as shown in Table 2. The capacity additions were 750 kt/a in 2019 and are estimated at 750 kt/a in 2020 and 450 kt/a in 2021, representing a slowing growth rate. Lighter feedstock for steam crackers will consume more C5, C6 and gas condensate, which will further drag down the yield ratio of ethylene tar.

Table 2 China’s ethylene tar capacity additions in 2019-2021 (kt/a)

Producer | Steam cracking-based ethylene capacity | Ethylene tar capacity | Start-up time (or E) |

Zhejiang Zhoushan Petrochemical Phase I | 1 400 | 200 | Early 2019 |

CNOOC Huizhou (Phase I renovation) | 1 000 | 150 | 2019 |

Dalian Hengli Petrochemical | 1 500 | 200 | End 2019 |

Zhongke Refining and Chemical Integrated Project | 800 | 100 | End 2019 |

Panjin Baolai | 1 000 | 100 | Sept 2019 |

Fujian Gulei Refining and Chemical Phase I | 800 | 100 | Jun 2020 |

Zhejiang Zhoushan Petrochemical Phase II | 1 400 | 200 | Jun 2020 |

Sinochem Quanzhou | 1 000 | 150 | Jun 2020 |

Lianyungang Shenghong | 1 100 | 150 | End 2020 |

Jieyang Petrochemical | 1 200 | 150 | 2021 |

Puyang Refining and Chemical | 1 000 | 150 | 2020 |

Sinopec Hainan Refining and Chemical | 1 000 | 150 | 2021 |

Zhenhai Refining and Chemical | 1 200 | 150 | 2021 |

Total | 13 400 | 1 950 |

Higher consumption tax and environmental protection policies have been weighing on ethylene tar demand from the fuel oil sector, while a lot of new carbon black projects are under planning. Domestic ethylene tar output is estimated at around 2.3 million tons and lingering tight supply may keep its prices in the RMB2 100- 3 600/t.

Carbon black has become the major target of ethylene tar development. High-temperature coal tar is listed as dangerous waste in some regions, but it remains the major feedstock for carbon black given its sufficient supply. Colour carbon black capacity is trending up and most rubber and tyre producers prefer to use ethylene tar to produce carbon black in a bid to enhance their competitiveness. These will in turn raise the competitive edge of ethylene tar.