By Yang Hongbo, Sinopec Chemical Sales Co., Ltd.

Changes in the market pattern

1. Domestic market competition gets more intense

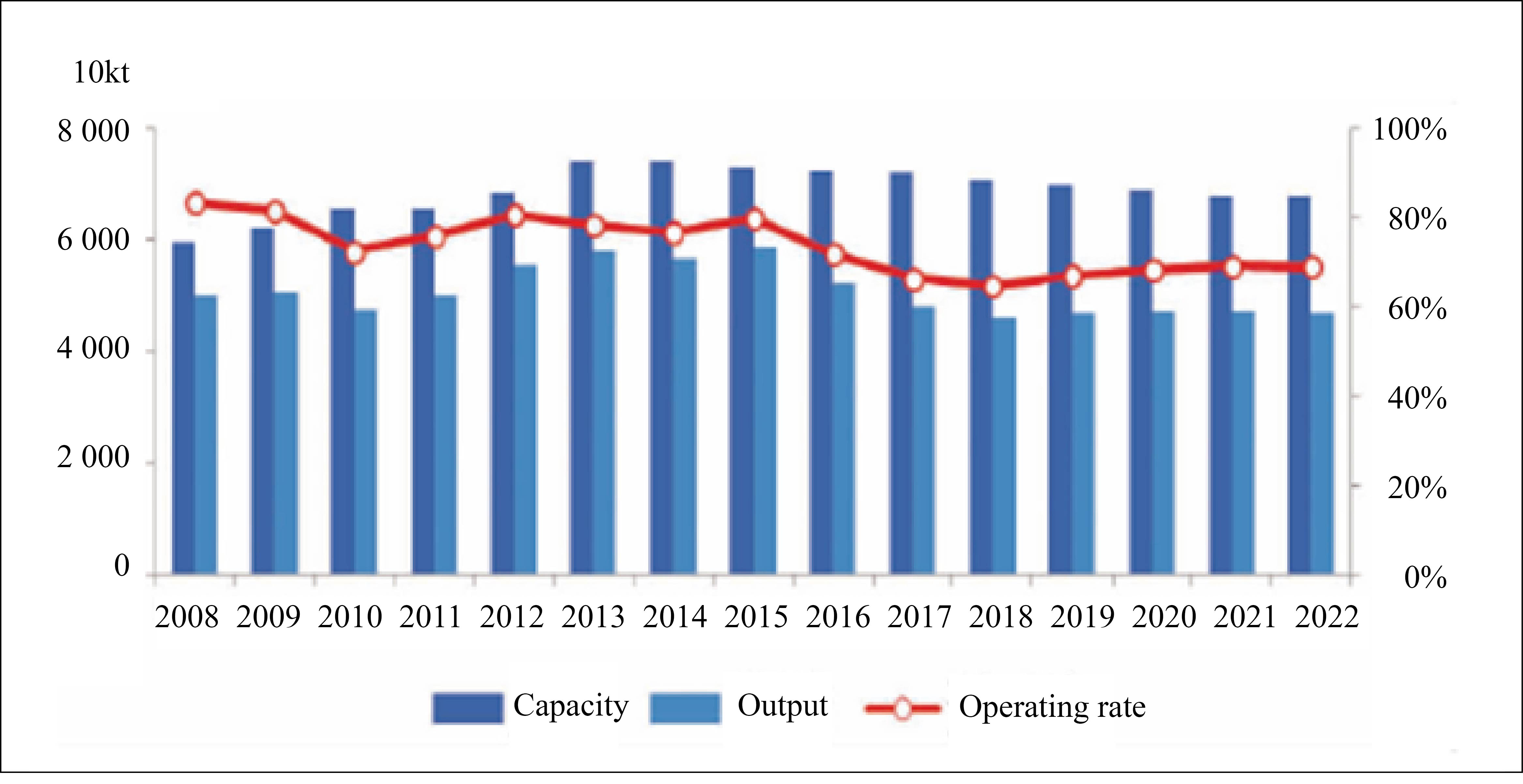

China’s synthetic ammonia capacity dropped from 74 million t/a in 2013 to 70 million t/a in 2019; the output fell from 58 million tons to 47.5 million tons. However, in 2020 and 2021, China will usher in an upsurge of new capacities, with the total number rising back to more than 71 million t/a. The new lines will be large in scale and low in cost, and market competition will become fiercer. Some producers in Hubei province and Fujian province will turn from buyer to seller of liquid ammonia, and the regional trade pattern will change greatly. Chart 1 shows China’s ammonia capacities and outputs from 2008 to 2022.

Chart 1 China’s ammonia capacities and outputs from 2008 to 2022

2. Domestic synthetic ammonia industry profits will reduce

The synthetic ammonia prices began declining in 2013, down from RMB2 663 / t to RMB2 058 / t in 2016. With the increase in coal prices, shrinkage of capacity and rise in chemical demands since 2016, the synthetic ammonia prices have risen sharply, reaching over RMB3 000 / t averagely in 2018. The industry profits have reached more than RMB500 / t. However, due to the stringent environmental protection policies, the launching of new capacities and low fertilizer utilization rates, the average domestic price in 2019 fell to below RMB2 800 / t, and the prices in some major producing areas decreased to RMB2 290 / t. It is expected that prices will keep going down in 2020, and the small-scale and high-energy-consuming plants will face a crisis of shutdown.

3. Synthetic ammonia import volume will drop

China’s ammonia imports in 2013 were less than 200 000 tons, however, the figure jumped up to 1.1 million tons in 2019. It is estimated that from 2020 to 2022, the annual import volume will fall slightly to about 1 million tons and will not return to 1.1 million tons until 2023. The reasons of the drop are: 1) less shipment supply pushed up the import prices and the import profits hence decreased; 2) only ports in Zhanjiang, Shanghai, Nanjing, and Lianyungang have ability to discharge and store synthetic ammonia, which limits the increase in the imports of synthetic ammonia.

Continuous optimization of raw materials and demand structure

The structure of domestic synthetic ammonia raw materials is continuously optimized and adjusted with the technological transformation of the plants. From oil to natural gas and anthracite, from anthracite to bituminous coal and lignite coal, the cost is continuously reduced. At the same time, the domestic ammonia demand structure has also changed greatly, and the proportion of chemical demand has increased. This part of the demand is mainly from South China and East China. At present, the prices of synthetic ammonia in East China and South China are relatively high.

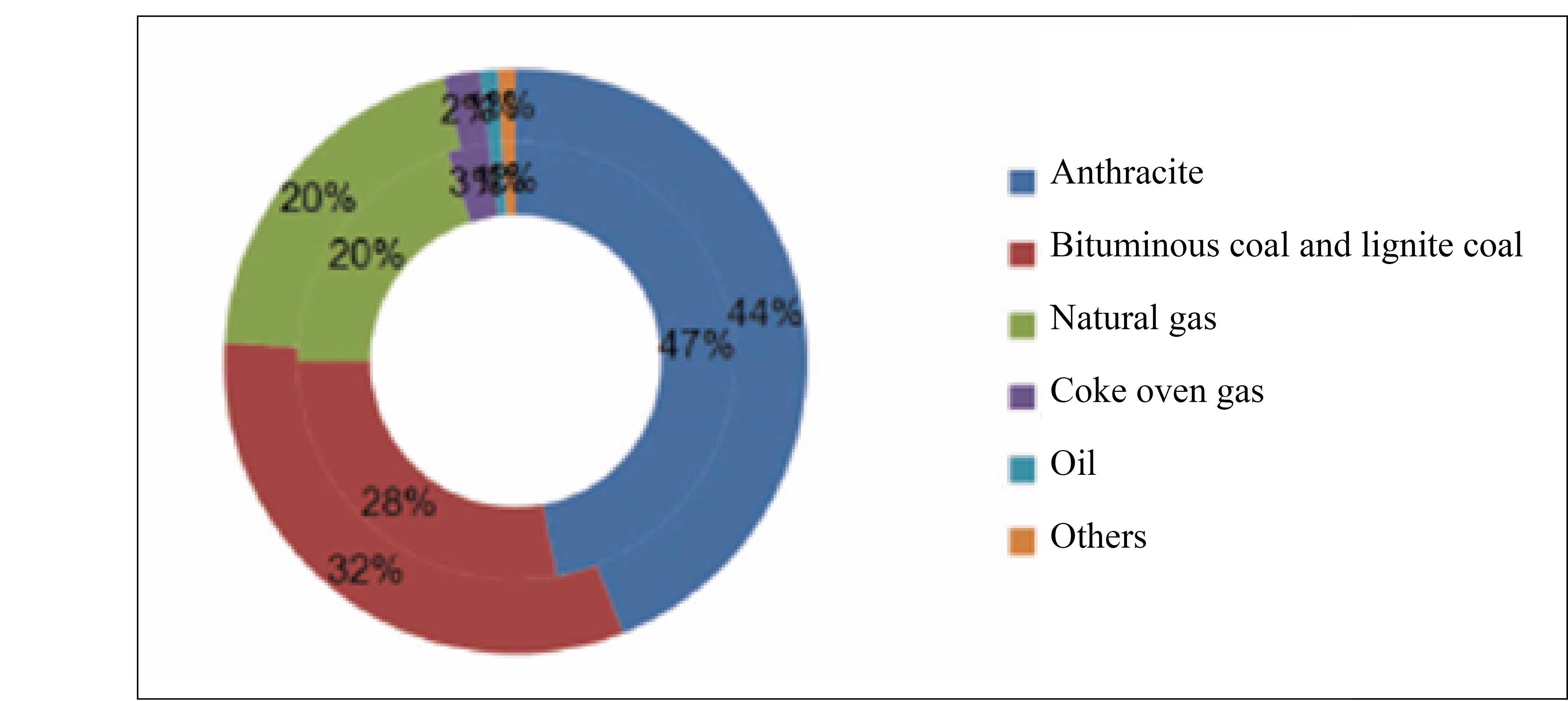

1. The raw material structure is constantly being optimized

The adjustment of the raw material structure of the synthetic ammonia is divided into two stages: the first stage is "from oil to gas" (with the raw material changed to natural gas by the oxidation process) and "from oil to coal" (with the raw material changed to coal or petroleum coke via coal gasification process). After such transformation, the capacity of the coal-based plants is about 78%, and the capacities using oil and coke oven gas as feedstock are being replaced. The second stage is to substitute the traditional fluidized bed gasification furnace with aerospace furnaces, which mainly use bituminous coal and lignite coal as the raw materials, and the cost is significantly lower than that of the fluidized bed gasification furnace. It is predicted that the coal prices will drop by 5% - 6% in 2020, which will also lead to the change of the prices of synthetic ammonia. The capacities of different raw materials of synthetic ammonia in China from 2017 to 2018 are shown in Chart 2.

Chart 2 China’s synthetic ammonia capacities by raw materials, 2017-2018

2. Demand structure will be stable in short term

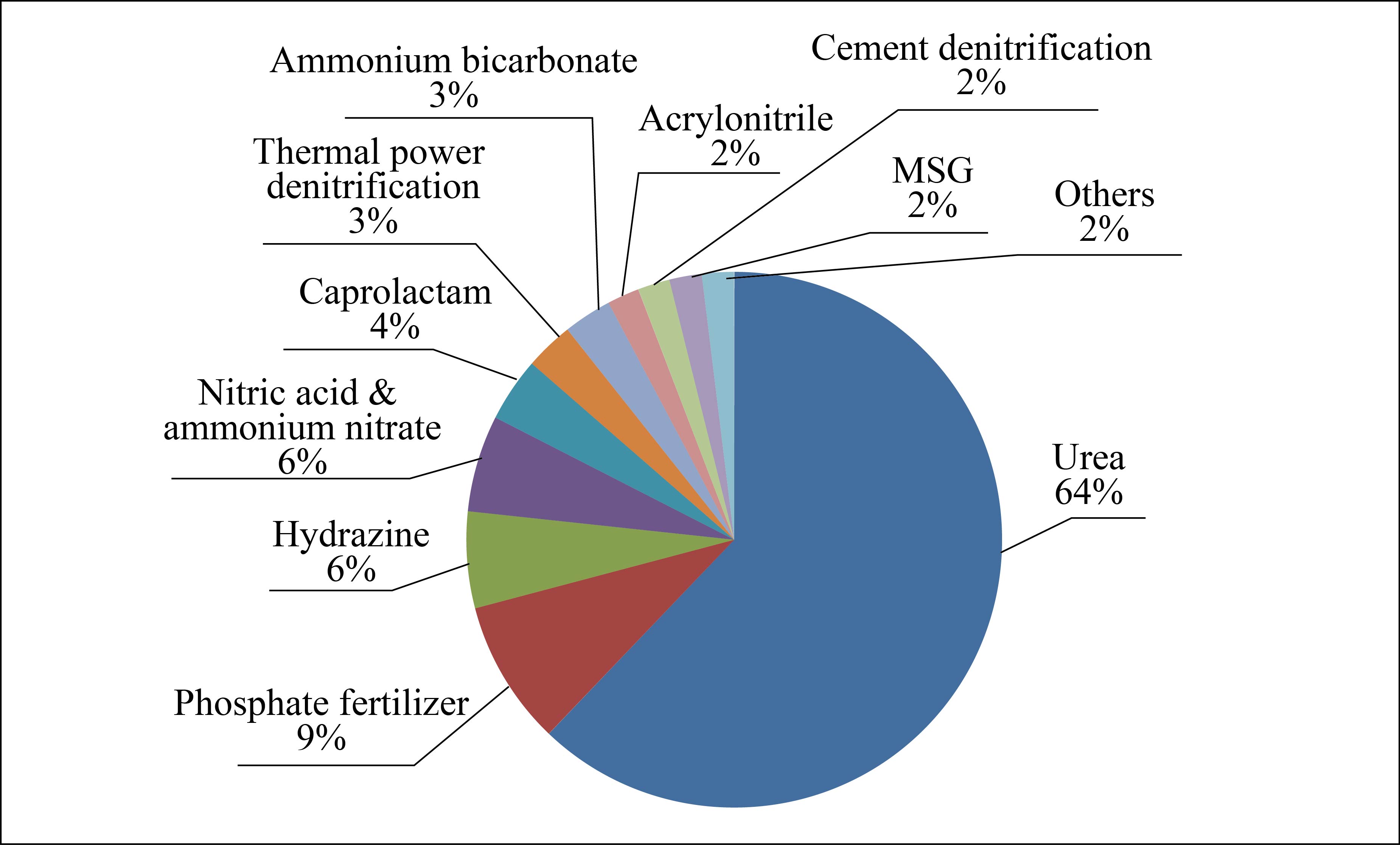

China’s consumption of synthetic ammonia in 2019 was 48 million tons, of which agricultural demand accounted for 80% and industrial demand 20%. The downstream demand distribution of ammonia is shown in Chart 3.

Chart 3 Synthetic ammonia’s downstream demand distribution

Among the chemical fertilizers, urea has the biggest demand for synthetic ammonia, accounting for 80% of all fertilizer demands. China's urea industry entered a period of capacity optimization in 2016, and the capacity and output kept shrinking, with an unstable operating rate: 55.3% in 2017, 53.2% in 2018, and 63.2% in 2019. The market will see additional capacities in the next three years, and the number in 2020 alone, will be 5 million t/a. It is expected that domestic production will continue to grow in 2020, and output will increase by about 3.8% year-on-year.

As for industry sector, synthetic ammonia is mainly used in the production of caprolactam and acrylonitrile. Compared with 2019, the production of caprolactam will increase by 1.89 million tons in 2023, and the demand for synthetic ammonia will accordingly increase by 1.4 million tons; the production of acrylonitrile will increase by 250 000 tons, and the demand for synthetic ammonia will accordingly increase by 200 000 tons.

In summary, the demand for synthetic ammonia from chemical fertilizer and industrial sector will increase. The proportion of the demand and the demand structure will be stable.

From policy regulation to market regulation

After 2015, the state will gradually transform policy regulation into market regulation, further deepen price reform, and establish and improve price formation, operation, and adjustment mechanisms that are compatible with the market economy.

1. With Synthetic Ammonia Industry Access Conditions abolished, competition will become fiercer

In 2019, 73% of the capacities were over 300 000 tons per unit. Synthetic ammonia capacity in major coal-producing provinces accounts for 56% of the country's total. In November 2019, the Ministry of Industry and Information Technology abolished the Synthetic Ammonia Industry Access Conditions. This will inevitably increase the industry supply, hence the intensity of competition in the industry. The manufacturers with large scale, strong technology, and low energy consumption will enjoy more advantages. At the same time, the industry layout will be optimized and the relationship between supply and demand in the regional markets will be changed.

2. Coal pricing mechanism moves towards marketization, and synthetic ammonia prices are under pressure

Rising coal prices since 2016 have pushed up the prices of synthetic ammonia. The state canceled the coal-electricity price linkage mechanism on January 1, 2020 and changed it to a "benchmark price + floating" system. With the improvement of marketization of the electricity market, coal prices will be under pressure and the cost of coal-based companies will reduce accordingly. Thus, the market prices of synthetic ammonia will also be adjusted.

3. Downstream urea industry continues to open up

The value-added tax has been levied uniformly on the sales and imports of fertilizers at a rate of 10% since September 1, 2015, and such value-added tax rate of fertilizers was reduced to 9% on April 1, 2019. With the increase in the operating rate of the urea industry, production has begun to rise. Given the cancellation of preferential policies for the industry, the urea market price will decline, and the synthetic ammonia market price will follow the downward trend.