By Sun Shaohua, Wei Yong, Han Yueming, Su Jianying, China Nitrogen Fertilizer Industry Association

Industry performance

1. Methanol output growth decelerated

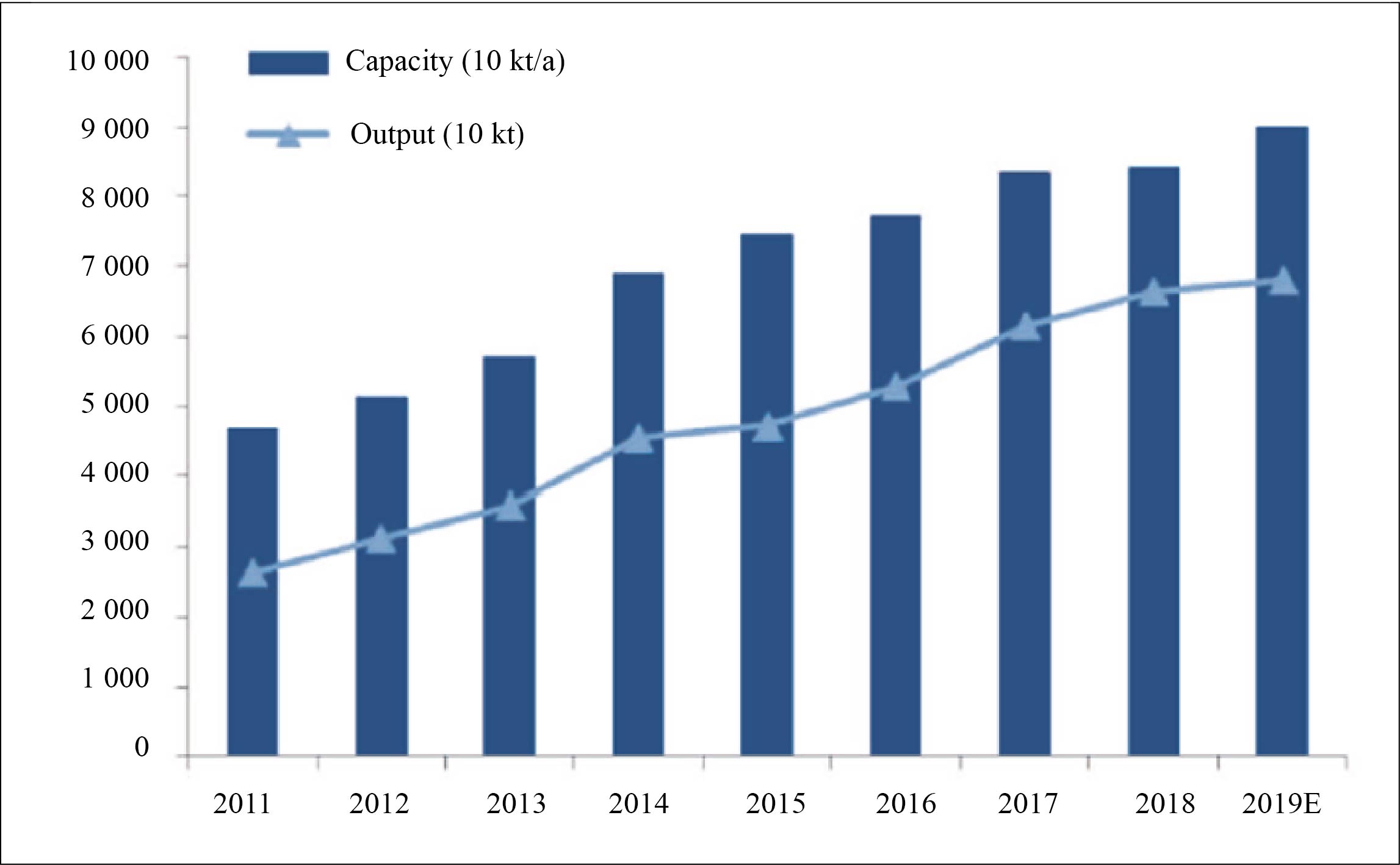

In the first nine months of 2019, domestic output of methanol was up 1.5% YoY to around 50.33 million tons, but the growth decelerated. Figure 1 shows China’s capacity and output of methanol in recent years.

Figure 1 China’s capacity and output of methanol during 2011-2019

2. Methanol importers purchased more products at lower prices

China imported more methanol in 2019, and by the end of September 2019 import volume, totaling 7.66 million tons, had exceeded annual quantity in 2018.

Around 83% of imported methanol was from Iran, New Zealand, Saudi Arabia, Oman, UAE, Trinidad and Tobago.

Table 1 Major origins of imported methanol in 2018 and 2019

Country | Import volume (kt) | Proportion in 2019 (%) | YoY growth in 2019 (%) | |

Jan-Sep 2018 | Jan-Sep 2019 | |||

Iran | 1 877 | 2 023 | 26.4 | 7.8 |

New Zealand | 1 176 | 1 192 | 15.6 | 1.4 |

Saudi Arabia | 654 | 801 | 10.5 | 22.5 |

Oman | 483 | 786 | 10.3 | 62.7 |

UAE | 35 | 765 | 10.0 | 2085.7 |

Trinidad and Tobago | 296 | 761 | 9.9 | 157.1 |

Malaysia | 268 | 433 | 5.7 | 61.6 |

Venezuela | 58 | 310 | 4.0 | 434.5 |

Brunei | 208 | 230 | 3.0 | 10.6 |

Indonesia | 95 | 150 | 2.0 | 57.9 |

Monthly import volume (excluding March) was higher than in 2018, with the volume per month exceeding 800 000 tons after May 2019 (in August, higher than one million tons). However, import prices have been decreasing since April 2019. In the first nine months of 2019, average price reached US$280/t, down over US$120/t or around 30.2% YoY, and in September it fell to US$241/t.

3. Market prices remained low

Domestic methanol prices have decreased rapidly since October 2018, and average price during Jan-Sep 2019 was down 23.1% YoY to RMB2 167/t. This could be attributed to high inventory exceeding one million tons in 2018, falling slightly in 1H 2019 but staying at over one million tons since middle of July.

4. Downstream consumers adjusted demand for methanol

In the first nine months of 2019, domestic apparent consumption of methanol reached around 57.8 million tons, up 5.4% YoY. Olefin was the largest downstream consumption area. MTO producers made higher profits in 2019 due to lower prices of raw materials methanol. Hence, they raised operating rates and this stimulated methanol consumption. A promising area in downstream sectors, methanol fuel accounted for 11% of downstream methanol consumption.

Situation was not good in most traditional downstream areas like formaldehyde, acetic acid, etc.:

* Formaldehyde sector accounted for around 20% of downstream methanol consumption. Safety and environmental protection regulations curbed operating rates of formaldehyde plants in 2019, resulting in both weak demand and falling prices of formaldehyde (average price, down 19% YoY to RMB1 243/t during Jan-Sep 2019).

* Acetic acid sector took up 5% of downstream methanol consumption. Weak demand greatly lowered acetic acid prices in 2019, with average price down 35% YoY to RMB3 053/t in the first nine months of 2019.

* Dimethyl ether sector occupied 5%. In China, 93% of dimethyl ether was used to replace liquefied gas, but price gap between the two products narrowed due to decreases in crude oil prices. Meanwhile, overcapacity has troubled the dimethyl ether industry for a long term, and operating rates hovered at 20%. Hence, dimethyl ether prices were dragged down, and during Jan-Sep 2019 average price reached RMB3 232/t, down 31% YoY.

* MTBE sector absorbed 4%, and was greatly impacted by gasoline market. Application of ethanol gasoline cut demand for MTBE, and new units exacerbated MTBE oversupply. Average price of MTBE for Jan-Sep was down 10% YoY to RMB5 398/t.

Future development

1. Capacity

New units with a combined capacity of 6.9 million t/a are to be put into production in 2020, with 90% of them equipped with downstream supporting facilities. Hence, actual increment of commodity methanol is to be limited (see Table 2 for details). A group of units are to be eliminated, such as those medium-sized, outdated, uncompetitive or idle for a long term.

Table 2 Some methanol projects to be put into production in 2020

Company | Capacity (kt/a) |

Inner Mongolia Yankuang Rongxin Chemical | 900 |

Jinmei Zhongneng Chemical | 300 |

Yankuang Yulin Energy and Chemical | 800 |

Ningxia Baofeng Energy | 1 800 |

Shaanxi Yanchang Coal Yulin Energy and Chemical | 1 800 |

Guangxi Huayi Energy and Chemical | 1 000 |

Inner Mongolia Black Cat Coal Chemical | 300 |

Total | 6 900 |

2. Structural adjustment

Most domestic methanol producers currently adopt coal as raw materials. China issued Three-Year Plan to Combat Air Pollution in 2018 and Industrial Restructuring Guidance Catalogue (2019 Edition) in November 2019. This suggested that methanol capacity expansion is to be decelerated, and industry focuses are to be energy conservation, production safety and environmental protection.

3. Crude oil prices

Methanol market was and will be greatly influenced by oil prices – methanol price remaining low in 2019 was mainly because of low oil prices.

China’s capacity and output of methanol are to increase continually although the growth is to slow down. MTO firms are to remain the most important downstream consumers of methanol, and methanol fuel sector has big potential. Methanol enterprises are to face bigger pressure from energy, production safety and environmental protection.