By Zhang Qisheng, Transportation and Sales Center of Tianjin Petrochemical

China’s chemical market suffered dramatic falls in 2019. Prices generally hovered at highs in the first quarter and then moved down in the rest of the year. The chemical price index released by ChemSino closed at 4 093 points, down by 11.2% from the 2018 level. Of these, 37 products or 23.1% logged price gains, while 119 products, or 74.4% were drags and the remaining 2.5%, or four products showed stable prices. See Table 1 and 2 for details.

Table 1 Market prices for popular chemical products (RMB/t)

Product | Prices on Dec 27 | Fluctuation range (%) | Up/down (%) |

CCPI | 4 093 | 17.3 | -11.2 |

Acetonitrile | 23 800 | 50.6 | 50.6 |

ECH | 14 500 | 88.8 | 48.0 |

Acetone | 5 400 | 119.0 | 47.9 |

MMA | 10 550 | 56.9 | -34.1 |

Lithium carbonate | 53 700 | 56.8 | -36.2 |

HMDA | 36 000 | 150.9 | -55.0 |

Table 2 Market prices for key chemical products (RMB/t)

Product | Prices on Dec 27 | Fluctuation range (%) | Up/down (%) |

Propylene | 6 450 | 27.9 | -20.9 |

BD | 8 450 | 66.7 | -21.8 |

Methanol (at ports) | 1 990 | 39.4 | -13.5 |

MEG | 4 950 | 34.5 | -4.4 |

PO | 10 280 | 18.9 | -1.6 |

ACN | 11 300 | 53.4 | -3.4 |

Acrylic acid | 6 700 | 38.1 | -22.1 |

Benzene | 5 850 | 41.2 | 29.4 |

Toluene | 5 480 | 41.2 | 15.4 |

PX | 6 790 | 44.0 | -12.5 |

SM | 7 400 | 31.5 | -8.1 |

CPL | 11 000 | 35.5 | -11.6 |

PTA | 4 880 | 44.5 | -18.0 |

MDI | 13 100 | 64.0 | 14.9 |

PET chip (fiber grade) | 6 300 | 34.9 | -17.6 |

HDPE (yarn) | 8 050 | 23.4 | -18.7 |

PP (yarn) | 7 850 | 19.7 | -14.7 |

SBR1502 | 11300 | 20.6 | -5.0 |

BR | 10800 | 24.3 | -9.2 |

Urea (46%) | 1715 | 26.6 | -12.9 |

Price drivers

Acetonitrile Domestic

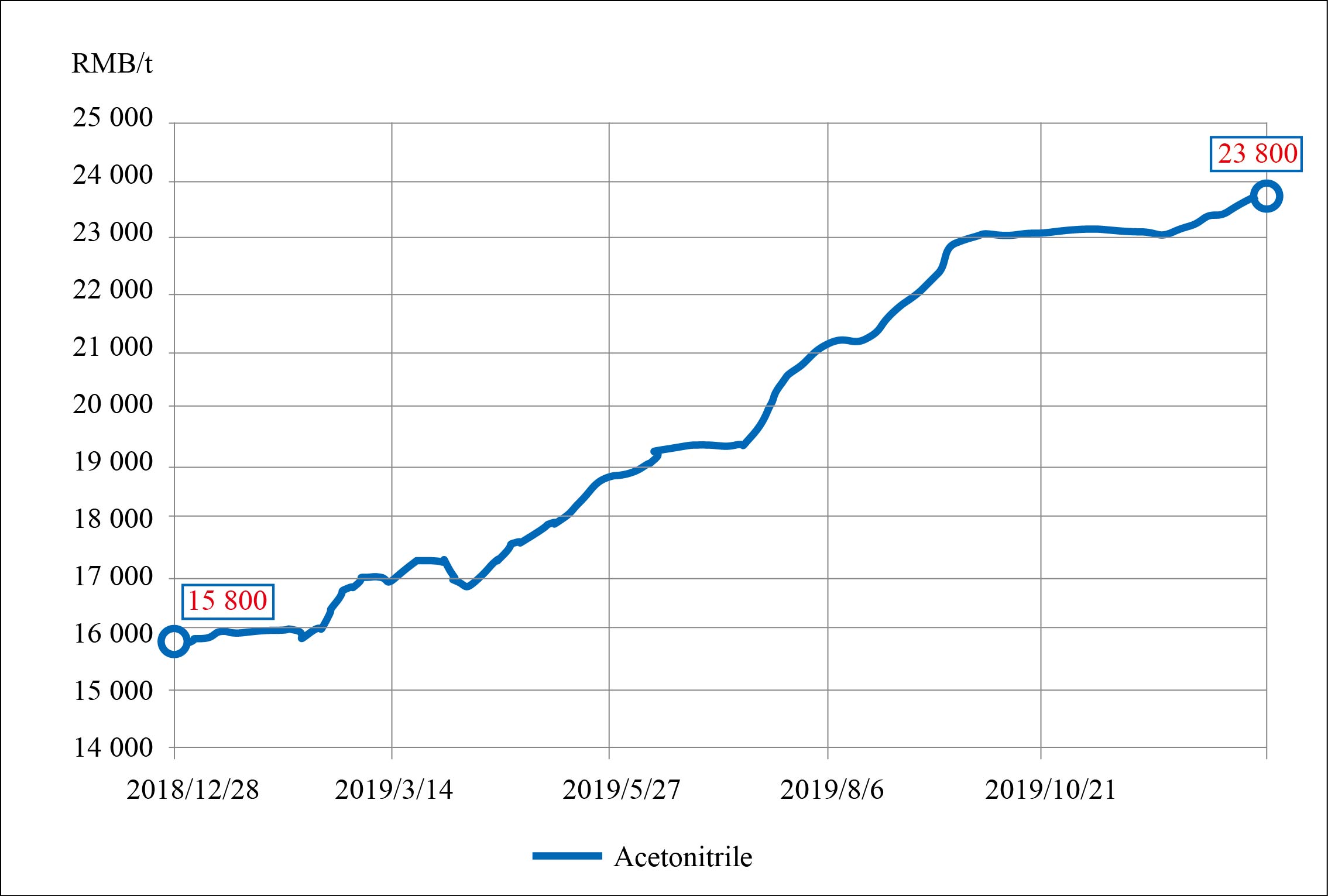

Domestic acetonitrile prices kept rising in 2019 and closed the year at RMB23 800/t, up by 50.6% year on year, as shown in Figure 1. Tight global supply resulted in a surge in acetonitrile exports from China.

Figure 1 Acetonitrile prices RMB/t

ECH

Domestic epichlorohydrin (ECH) prices underwent wide fluctuations in 2019 and closed 48% higher at RMB14 500/t. Reduced supply due to plants’ shutdown at major producers, Shandong Haili and Jiangsu Haixing boosted ECH prices, but when prices climbed to a too high level, downstream producers reined in buying, dragging down ECH prices slightly.

Acetone

The domestic acetone market staged a buoyant performance in 2019, ending the year 47.9% higher at RMB5 400/t. The spectacular gain was made in November, when Shiyou Chemical (Yangzhou) shut its 320 kt/a phenol/acetone unit and inventories at ports were falling. Also fueled the price rise were the start-up of Chongqing Yixiang’s 90 kt/a MMA plant and Qingdao Hailijia’s 50 kt/a isopropyl alcohol (IPA) unit.

Price drags

HMDA

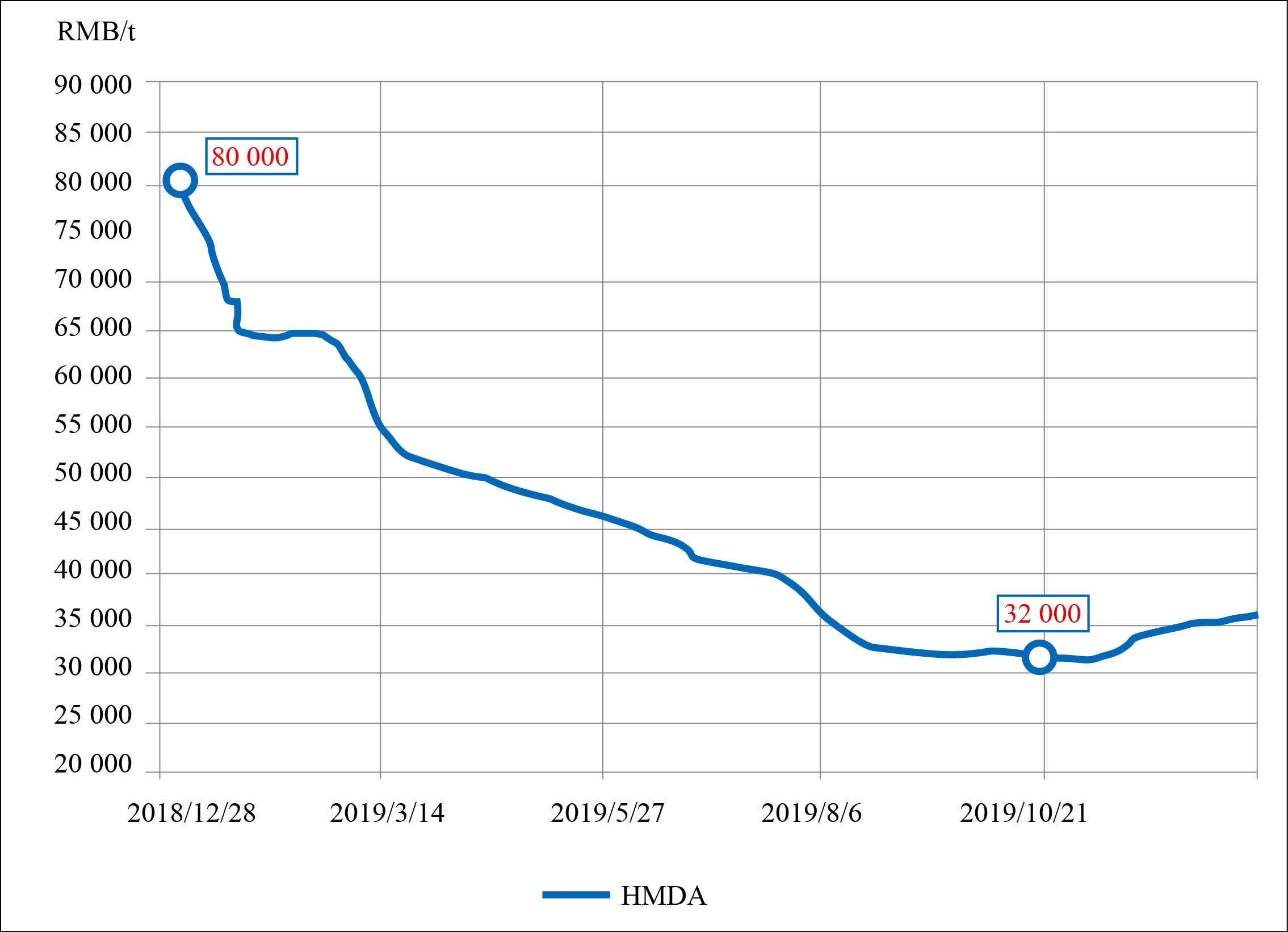

Domestic HMDA prices were on the downtrend in 2019, ending the year 55% lower at RMB36 000/t, as shown in Figure 2.

Figure 2 HMDA prices RMB/t

Lithium carbonate

The domestic lithium carbonate market stayed in a downturn in 2019 and closed the year at RMB53 700/t, down by 36.2%. Domestic output of lithium carbonate increased sharply, notably for salt lake products. Lithium carbonate is mainly used to produce batteries for new energy vehicles. But the new energy vehicles production fell dramatically as China’s Ministry of Finance issued a notice to cut subsidies for such vehicles, triggering consecutive losses in lithium carbonate prices.

MMA

Domestic methyl methacrylate (MMA) prices slid by 34.1% in 2019 to RMB10 550/t. Downstream demand was bearish, while supply was ample due to the start-up at Jiangsu Sailboat’s 90 kt/a, Wanda Hongxu’s 50 kt/a and Chongqing Yixiang’s 90 kt/a unit, and sufficient import supply. Continued declines in MMA prices also dragged down PMMA prices, with a cumulative loss of 32.1% in 2019.

Other key products

Aromatics

The domestic aromatics market was mixed in 2019. Prices of benzene, toluene, solvent xylenes and isomer xylenes closed the year with a gain of 29.4%, 15.4%, 6.9% and 6.3%, respectively, while those of para-xylene (PX) slipped by 12.5%. The firm crude oil market lent big support to the aromatics industry. Benzene prices reaped sharper gains than other aromatics, on low inventories at ports, which also shored up the market. China imported 1 835 kt of benzene in January-November 2019, down by 17.9% year on year. The price downturn for PX mainly took place in the first half of the year. Hengli Petrochemical’s new 4 500 kt/a PX unit launched production and Fuhaichuang’s No 2 800 kt/a PX unit resumed operation, which heaped heavy supply pressure on the market. In the second half of the year, new projects’ start-up, including those at Hengyi Brunei further weighed on domestic PX prices.

C3 industrial chain

Except for the aforesaid ECH and acetone, which posted a price surge of 48.0% and 47.9%, other products along the C3 industrial chain displayed soft performance in 2019. Domestic propylene prices ended the year 20.9% lower, because of increased supply, following MTO plants’ start-up at Nanjing Chengzhi and Inner Mongolia Jiutai and more imports arrivals. Prices of downstream 2-ethylhexyl acrylate, acrylic acid, acrylonitrile (ACN) and propylene oxide (PO) retreated by 23.5%, 22.1%, 3.4% and 1.6%, respectively, while those of ECH and acetone surged by 48.0% and 47.9%, respectively. Stricter safety inspections caused some acrylic esters plants to curtail production or shut down. Their demand for acrylic acid shrank sharply, but supply increased after Shanghai Huayi’s unit came on stream.

Methanol

Domestic methanol prices fell in 2019 amid ample supply to close the year at RMB1 990/t, down by 13.5%. The second quarter suffered bigger losses. Government’s environmental protection checks weighed on the downstream formaldehyde industry. Bearish demand dragged down its product prices.

Polyester feedstock

The polyester feedstock market was sluggish in 2019. Purified terephthalic acid (PTA) prices ended the year at RMB4 880/t, down by 18.0% year on year, due to decreased feedstock PX costs. Monoethylene glycol (MEG) prices inched down by 4.4% to RMB4 950/t at the end of 2019.

Plastic resins

The plastic resins market was bearish in 2019. Polyethylene (PE) prices edged downwards, with linear low density PE (LLDPE), high density PE (HDPE), and low density PE (LDPE) closed the year 21.2%, 18.7% and 11.0% lower. The futures market was also weak. Inner Mongolia Jiutai’s 280 kt/a, Zhong’an United’s 350 kt/a and Ningxia Baofeng’s Phase II 300 kt/a PE unit became operational, pushing up domestic PE supply. Meanwhile, import volumes increased. China’s HDPE imports reached 7 259 kt in the first 11 months of 2019, up by 17.2% year on year and LLDPE imports hit 4 755 kt, up by 19.6% year on year. The overall supply pressure was heavy as a result. The PP market was not immune to the downswing, with PP yarn and copolymer prices falling 14.7% and 9.1%, respectively, reflecting acute surplus supply. Polyvinyl chloride (PVC) prices posted slight gains on tightened supply, with acetylene-based PVC prices up by 6.0% in 2019.

Rubber

The synthetic rubber market was weak. Domestic butadiene (BD) prices registered a loss of 21.8% in 2019. Nanjing Chengzhi and Inner Mongolia Jiutai started up their oxidation dehydrogenation of butene units. This, together with increased imports into east China suppressed prices and the decline spilled over to the downstream synthetic rubber market. Butadiene rubber (BR) and styrene butadiene rubber (SBR) prices ended the year with a fall of 9.2% and 5.0%, respectively. Related product natural rubber (NR) prices rallied. Prices of ribbed smoked rubber (RSS) 3#, standard rubber 3L and 1# rose by 21.0%, 16.3% and 14.3% respectively, with sharper gains in the fourth quarter of 2019.

Spring comes after winter

The crude oil market will get a support from growing demand for Brent and other light sweet crude, as ships are required to use fuel oil with sulphur content not exceeding 0.5% conforming to the International Maritime Organization (IMO) 2020 sulphur cap effective from January 1, 2020.

Looming safety and environmental concerns, which had a profound impact on the chemical market in 2019 may continue to weigh on production of the highly-polluting and high energy-consumption dangerous chemical industries and influence the supply-demand fundamentals.

The chemical industry will brace itself for intensive capacity release in 2020. Zhejiang Petrochemical, Hengli Petrochemical, Sinochem Quanzhou and Wanhua Chemical will start up their large chemical and refining integrated projects. Domestic polyolefin and aromatics capacities are likely to boom and its import reliance rate will fall. Increasing domestic supply may reduce products’ production costs.

A number of chemical products prices are likely to bounce off in 2020 from its over-a-decade lows set in 2019, after slumping. A warm spring will come after a bitter winter.