Zhang Xiaohan, China National Chemical Information Center

Hydrogenated petroleum resin is a light-colored or colorless high-end petroleum resin obtained by catalytic hydrogenation with petroleum resin as raw material. It does not have special odor, at the meantime, its weather resistance, stability and compatibility have also been improved compared to non-hydrogenated petroleum resins. According to different raw materials and processes, hydrogenated petroleum resins can be generally classified into C5 hydrogenated petroleum resin, thermal poly C9 hydrogenated petroleum resin, cold poly C9 hydrogenated petroleum resin and DCPD hydrogenated resin.

Breakthrough in production and rapid expansion of capacity

China's hydrogenated petroleum resin industry started late. Before 2015, only Yangzi Eastman and Lanzhou Petrochemical had the capacity to produce C5 hydrogenated petroleum resins, with a total capacity of only 32 000 t/a. The domestic hydrogenated petroleum resin industry started its rapid development in 2015. Tianjin Luhua, Jinhai Chenguang, Puyang Ruisen, and Shandong Kairi have successively completed DCPD hydrogenated petroleum resin installations. Dalian University of Technology has successfully developed the C9 petroleum resin hydrogenation technology and successfully industrialized this application in Hebei Qiming and Xinjiang Tianli Henghua. As of the end of 2018, the total domestic hydrogenated petroleum resin production capacity reached 213 000 t/a and the total output reached 136 000 tons. In 2018, the actual domestic hydrogenated petroleum resin capacity utilization rate was about 80%.

DCPD hydrogenated petroleum resin is most mature

Among various types of hydrogenated petroleum resins in China, DCPD hydrogenated petroleum resins are the most mature products, which dominated the domestic supply in 2018, with an output of 62 500 tons, accounting for 46% of the total hydrogenated petroleum resins. At the same time, due to its large supply, the market prices of DCPD hydrogenated petroleum resins are lower than those of C5 hydrogenated petroleum resin and C9 hydrogenated petroleum resin. In 2018, the production of C5 hydrogenated petroleum resin and C9 hydrogenated petroleum resin was 48 500 tons and 25 000 tons respectively, and the market shares were 36% and 18% respectively.

In terms of capacity, after Henghe Materials’ 55 000 t/a C9 hydrogenated petroleum resin unit was put into operation in September 2018, the domestic C5 hydrogenated petroleum resin, C9 hydrogenated petroleum resin, and DCPD hydrogenated petroleum resin production capacity respectively accounted for 27%, 40% and 33%.

In terms of production technology, Chinese companies generally use cold poly petroleum resins as the raw materials for hydrogenation. Currently, only Henghe Materials has the ability to use thermal poly C9 petroleum resins as raw materials to produce hydrogenated petroleum resins. Due to the presence of double bonds or aromatic hydrocarbons in the structure of petroleum resins, as well as the presence of halides, hydrogen sulfide, and colloids, hydrogenation is difficult to reach, and the activity and selectivity of the catalyst thus have a crucial impact on product performance. C5 hydrogenated petroleum resin generally has Pd as the catalyst, while C9 hydrogenated petroleum resin and DCPD hydrogenated petroleum resin have Ni as the hydrogenation catalyst.

Radical capacity expansion leads to much heavier supply pressure

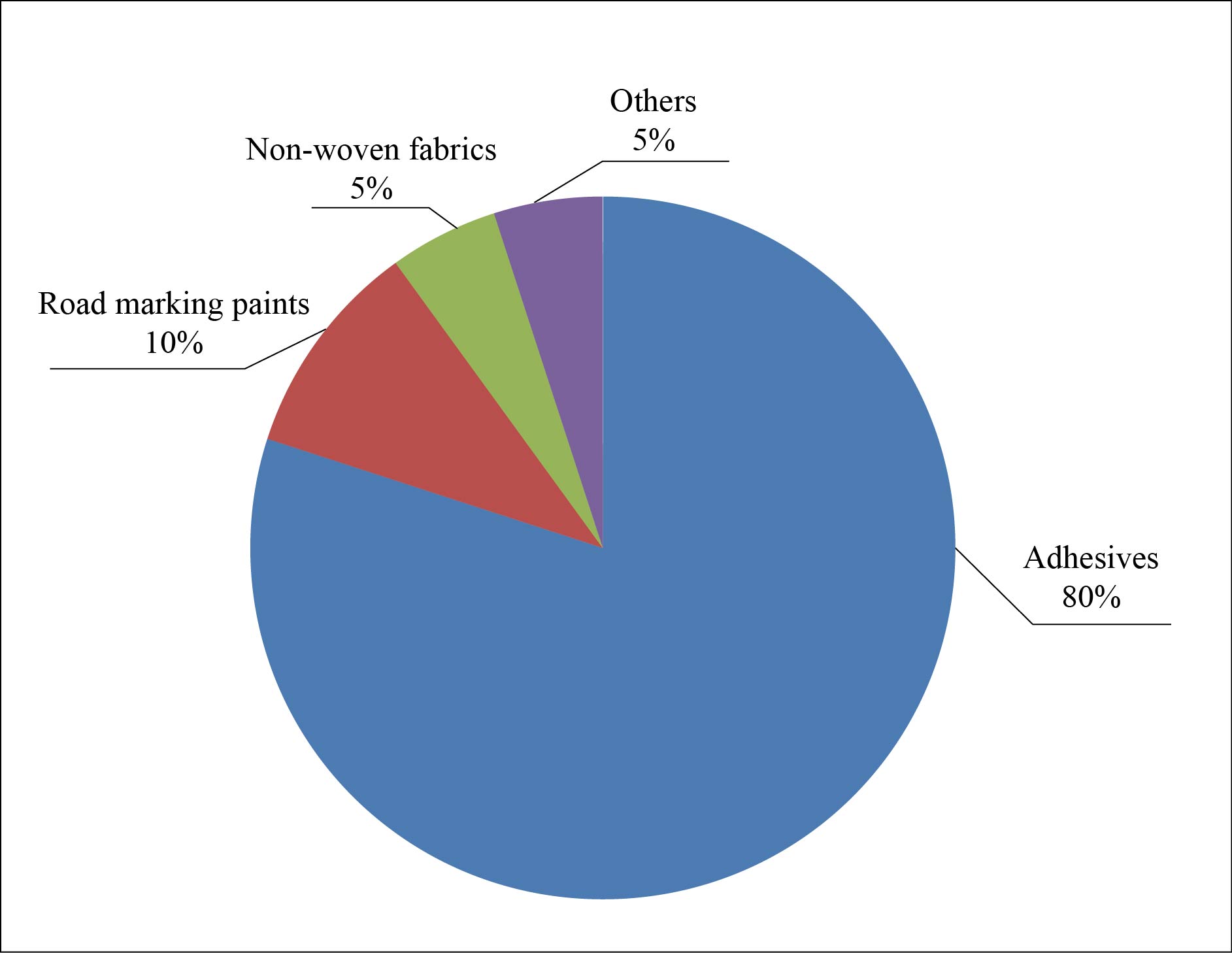

As its price is higher than ordinary petroleum resins, domestically produced hydrogenated petroleum resins are mainly used in the field of adhesives (hot melt adhesives and pressure-sensitive adhesives), with a small amount being applied to road marking paints and non-woven fabrics (Figure 1). In the next 5 years, hot melt adhesives are expected to maintain a growth rate of 5% to 6% as the main application area of hydrogenated petroleum resins.

Figure 1 Hydrogenated petroleum resin consumption structure in China

In the next 1-2 years, the domestic hydrogenated petroleum resin capacity will embrace an aggressive expansion. By 2021, it is estimated that the domestic capacity of hydrogen petroleum resin will increase by 425 000 tons (Table 1), nearly doubling the existing capacity. If all new and planned projects are successfully completed and put into operation, domestic hydrogenated petroleum resin will become excess.

Table 1 New and planned projects of hydrogenated petroleum resin

Producer | Product | Capacity (kt/a) | Launching time |

Taixing Tianma Chemical | Cold poly C9 hydrogenated petroleum resin | 40 | Construction completed, launching time TBD |

Shandong Qilong | Cold poly C9 hydrogenated petroleum resin | 20 | Construction completed, launching time TBD |

Xinjiang Liming Xintong | DCPD hydrogenated petroleum resin | 30 | 2019,12 |

Henghe Materials | Thermal poly C9 hydrogenated petroleum resin | 20 | 2020 |

Wuhan Luhua Yueda | Thermal poly C9 hydrogenated petroleum resin | 20 | 2020 |

Jinhai Chenguang | DCPD hydrogenated petroleum resin | 20 | 2020 |

Henghe Materials | C9 H2HCR | 80 | 2021 |

Zhejiang Derong | DCPD hydrogenated petroleum resin | 100 | 2021 |

Shandong Ruisen | DCPD hydrogenated petroleum resin | 30 | 2021 |

Puyang Ruisen | DCPD hydrogenated petroleum resin | 40 | 2021 |

Maoming PC Shihua | C5 hydrogenated petroleum resin | 25 | |

Total | 425 |

About 50% of the new and planned projects are capacity expansion, and the producers have mature technology and stable downstream customers, whose launching possibility is thus relatively high. While Taixing Tianma, Shandong Qilong, and Zhejiang Derong are newcomers, and they are facing a large uncertainty as to whether the new hydrogenated petroleum resin units can be completed and successfully put into operation.

With the breakthrough of the production technology of hydrogenated petroleum resins, the domestic capacity has increased rapidly, but the downstream consumption growth rate is limited, and the problem of excess capacity will become prominent. Therefore, actively expanding the downstream consumption of hydrogenated petroleum resins and actively exploring overseas markets will become an important development direction for hydrogenated petroleum resin manufacturers in the future.