By Li Hui, Dong Shaoqi, Wang Ying, Oilchem

Downstream products in predicament

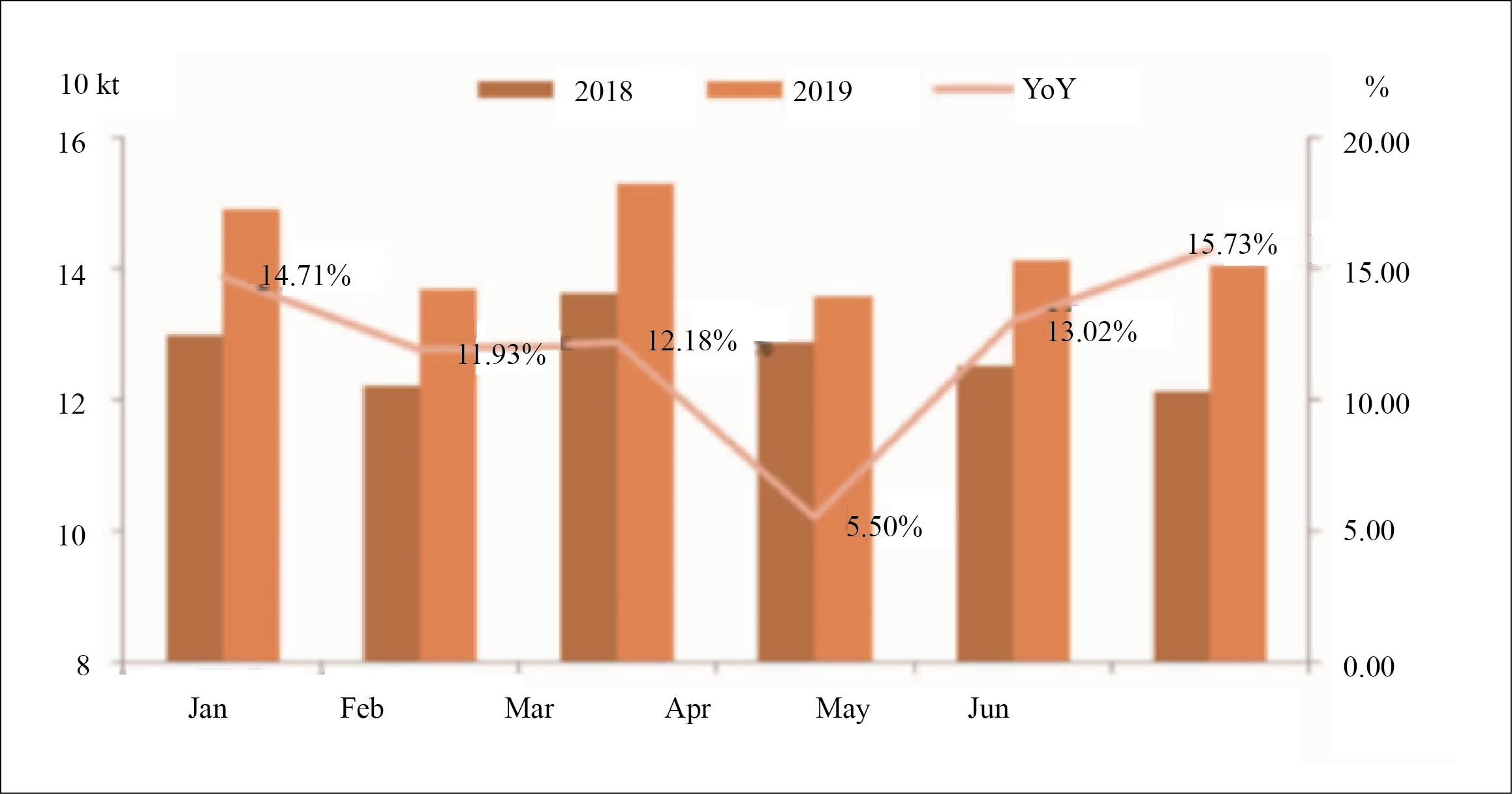

Domestic industrial-use cracked C9 prices averaged RMB3 856/t in the first half of 2019, down by RMB631/t or 14.06% from the same period of last year at RMB4 487/t. Meanwhile, domestic output of industrial-use cracked C9 reached 855.9 kt, up by 92.7 kt or 12.15% year on year. Figure 1 shows domestic output of industrial-use cracked C9 in H1 2018 and H1 2019.

Figure 1 Domestic output of industrial-use cracked C9 in 2018 VS H1 2019

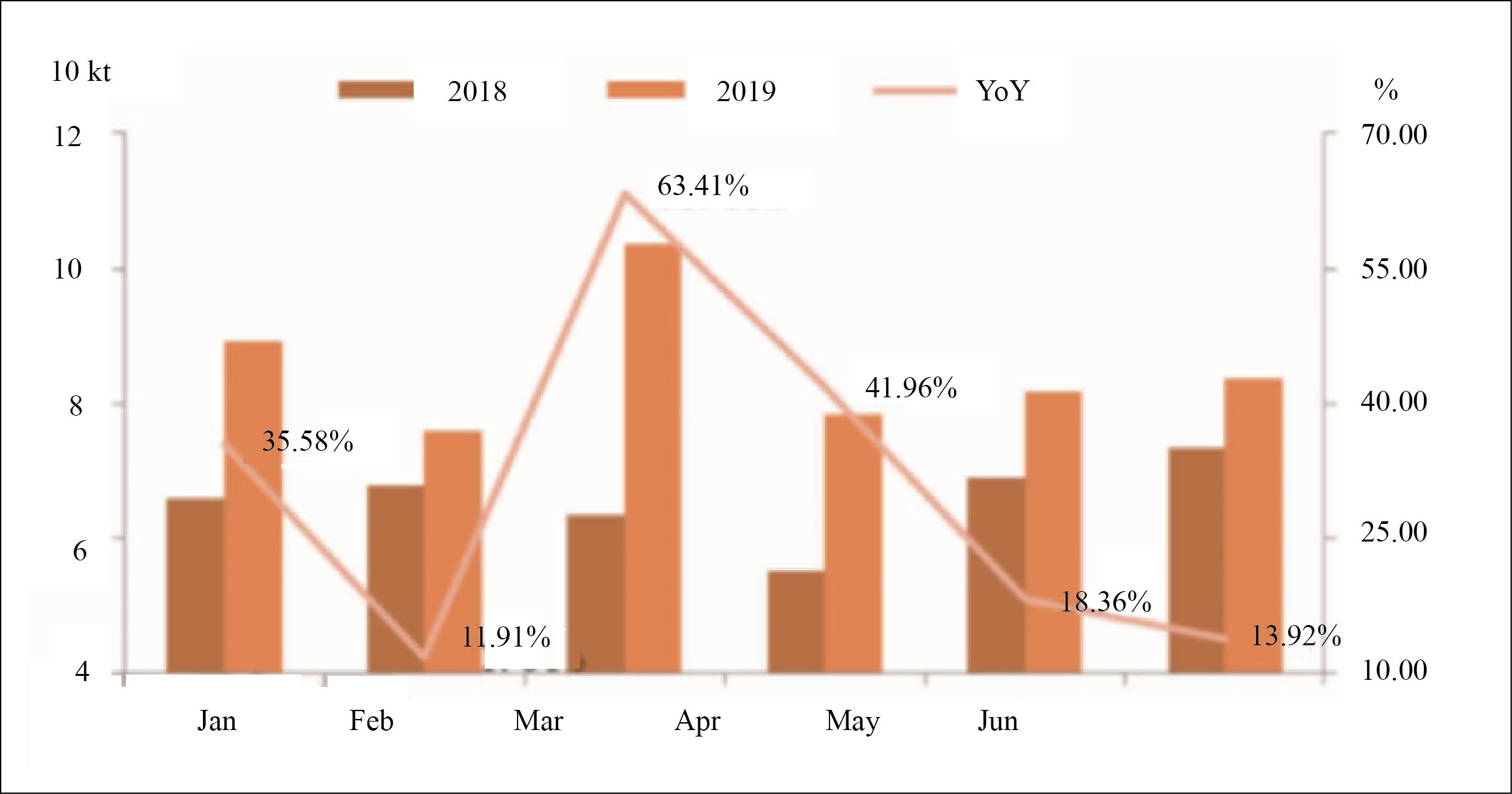

Two-stage hydrogenated C9 fraction is the largest downstream product of industrial-use cracked C9. Its production volume reached 512.7 kt in the first half of 2019, up by 114.8 kt or 29.54% from the level seen in the same period of 2018 at 394.9 kt, while its average price stood at RMB5 033/t, down by nearly 14.87% year on year. Figure 2 shows domestic output of two-stage hydrogenated C9 fraction in H1 2018 and H1 2019.

Figure 2 Domestic output of two-stage hydrogenated C9 fraction in 2018 VS H1 2019

The development of water-based coatings has snatched some market share from oily coatings, resulting in relatively low operating rates at C9 petroleum resins downstream industries, such as paints and coatings. In the first half of 2019, domestic output of thermal-polymerised C9 petroleum resin reached 119.3 kt, down by 3.87% year on year, while that of cold-polymerised C9 petroleum resin stood at 21.2 kt, down by 13.47% year on year. The production volume of C5-C9 copolymerised petroleum resin dropped by 4.63% year on year to 37.1 kt in the first half of 2019. Domestic prices of C9 petroleum resin averaged RMB5 526/t, down by RMB627/t or 10.19% from the same period of 2018 at RMB6 153/t.

The refined dicyclopentadiene (DCPD) market was not promising either. Prices suffered consecutive drops and plants run rate decreased due to shrinking end-user demand from the pesticides and other related industries amid China’s stricter environmental protection and safety inspections. By the end of June, domestic refined DCPD prices slipped to below the RMB7 000/t mark from the early-year level of RMB8 300/t, down by nearly 16.87%.

Squeezed margins for industrial-use cracked C9

The margin for two-stage hydrogenated C9 fraction was RMB88.67/t in the first half of 2019, down by RMB40.17/t or 31.12% from the same period of 2018 at RMB128.84/t. Major refiners reduced their purchase prices of gasoline because of surplus supply, which led to low gasoline sales prices and limited margins for independent refiners. This subsequently dented feedstock buying of two-stage hydrogenated C9 fraction. In addition, passenger cars sales continued to decline nationwide and alternative energy consumption increased, dampening end-user demand for two-stage hydrogenated C9 fraction, with prices hovering at low levels.

The margin for C9 petroleum resin decreased by 1.55% year on year to RMB879.21/t in the first half of 2019. Environmental protection and safety inspections weighed down plants operating rate. Meanwhile, lack of recovery in end-user demand restricted C9 petroleum resins sales. Producers’ margins dropped as a result. In May-June, feedstock cracked C9 costs fell, but the drop in thermal-polymerised C9 petroleum resin prices was smaller as plants maintenance reduced the product availability. Hence, the margin for C9 petroleum resins plants improved slightly.

Lingering excess gasoline supply in the second half of 2019 may cast a cloud over the two-stage hydrogenated C9 fraction market. Meanwhile, strict environmental protection and safety controls are poised to dampen demand from the pesticides industry. The export market outlook is not optimistic. Refined DCPD prices are likely to fall further. But on the positive side, end-user demand for C9 petroleum resin tends to warm up in the third quarter of the year. In addition, supply for industrial-use cracked C9 is decreasing due to lighter ethylene, which may support the feedstock industrial-used cracked C9 market.