By Zhang Mengjie, OilChem China

Ramp-up capacities at the onset of new domestic LNG plants

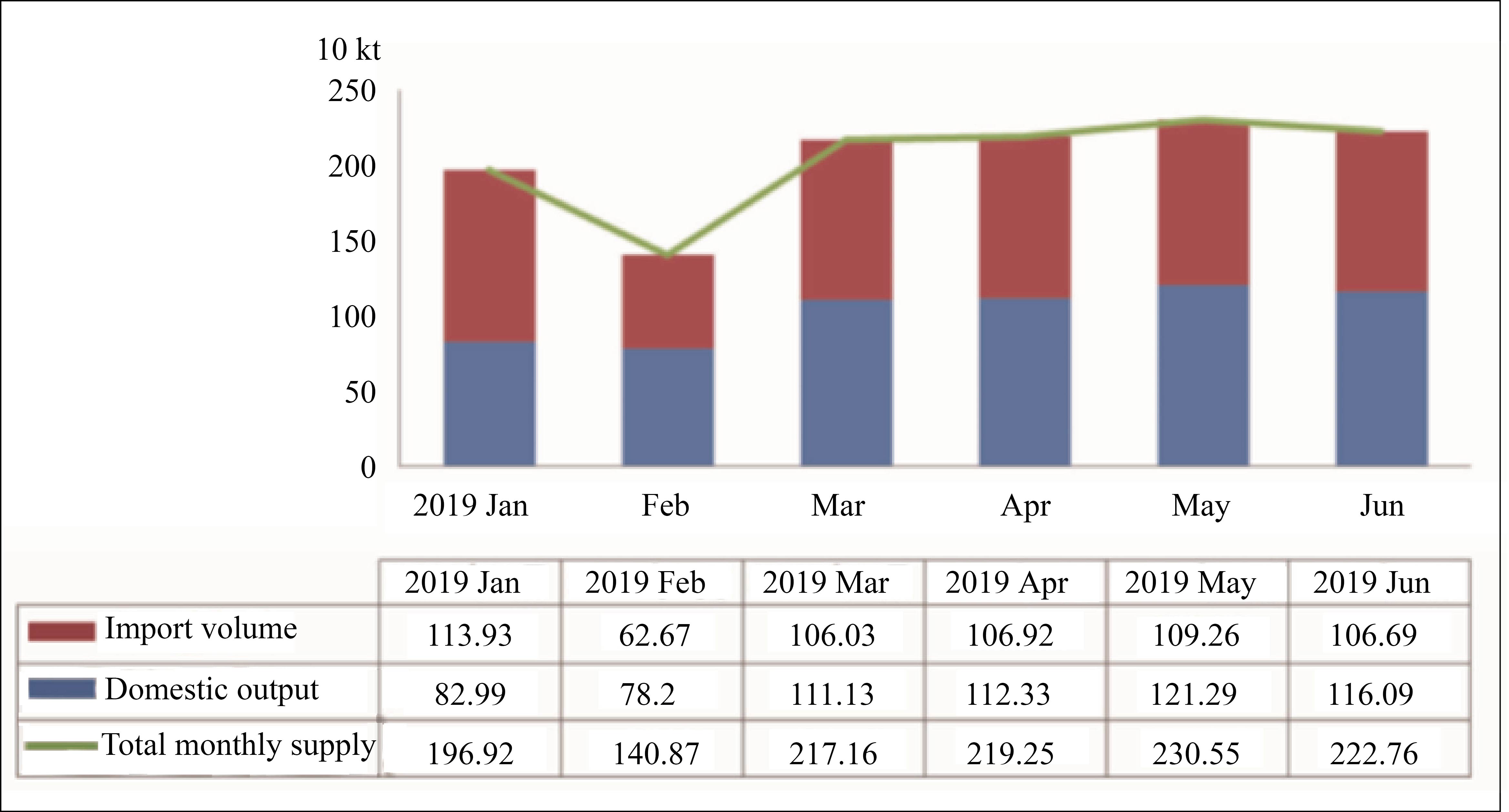

Domestic LNG output totalled 6.22 million tons in the first half of 2019, a sharp increase of 83.6% year on year (Figure 1). This was mainly fuelled by two reasons. Firstly, the overall operating rates of domestic LNG plants were relatively higher as a result of sufficient and steady pipeline gas supply. Secondly, a total of 6.9 million m3/d new capacities were brought on stream during the period, mostly located in Inner Mongolia and Shaanxi, adding considerable supply to the market, although not all of the capacities have been in full run.

Figure 1 Domestic LNG supply in 1H 2019

Sufficient feedstock gas supply keeps production high

The sufficient supply of piped gas from PetroChina since the beginning of 2019, especially after the end of the heating season, kept the operating rates of LNG plants in the key northwest China market high. Accordingly, the overall operating rates in China were relatively high.

In general, domestic LNG supply was much bigger than last year amid the capacity addition and high operating rates.

Sharply increased LNG import volumes

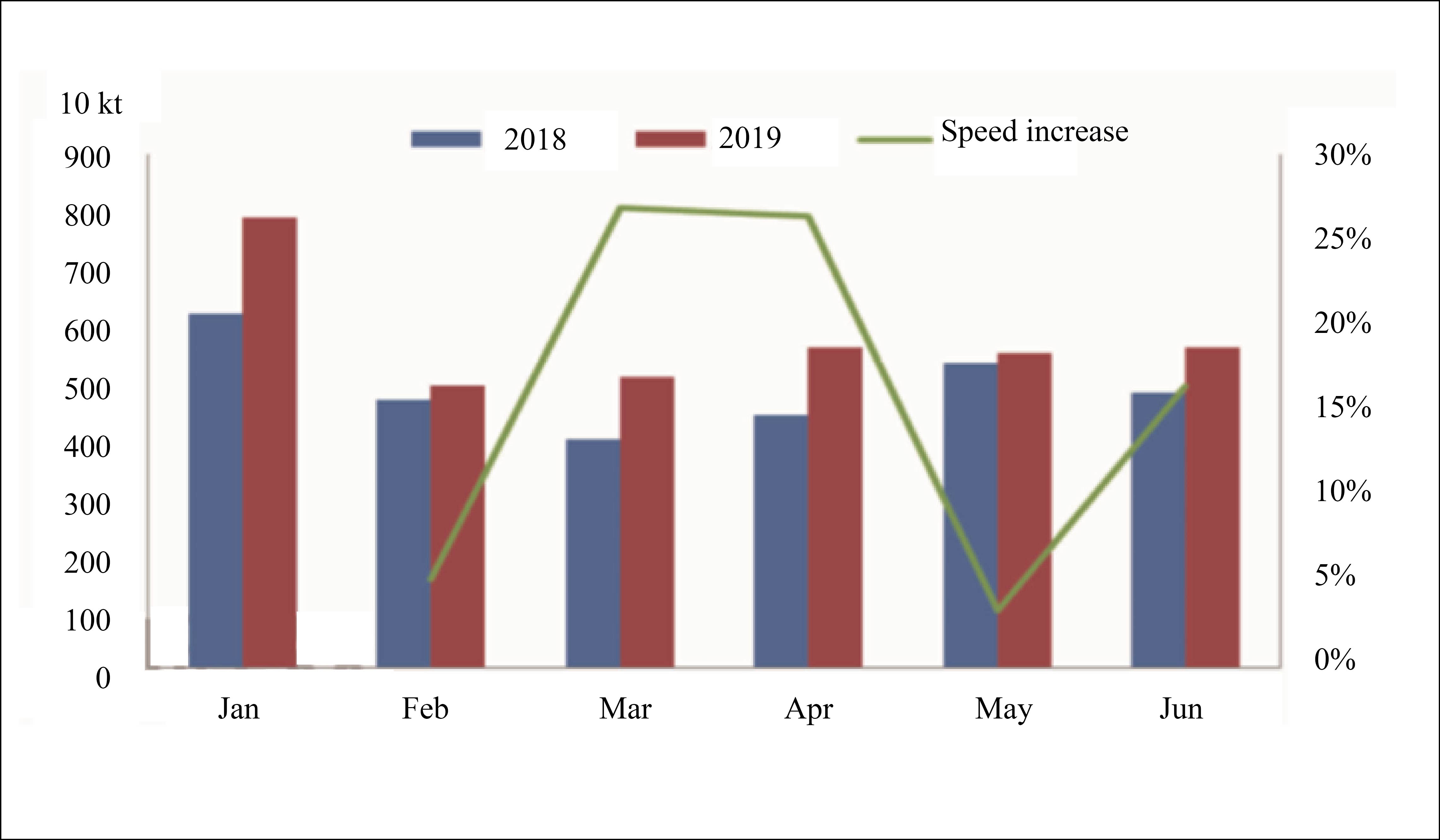

The import volumes of LNG in China totaled 28.41 million tons in the first half of 2019, up by 19.16% from the same period of last year. China received 308 LNG ships in the first half of 2019 versus 240 ships a year ago.

The sharp increase in import volumes was mainly because the international spot prices plunged from US$8/MMBtu to US$4.5/MMBtu CIF East Asia recently, whilst the levels were at US$9/MMBtu at the same period of last year.

Australia, Qatar and Malaysia remained as the key origins of LNG over the year. To be specific, the import volumes from Australia increased from 45% to 53%, primarily because some major LNG importers such as CNOOC have signed new purchase contracts with Australian LNG suppliers. In addition, a part of private-owned companies in China took initiatives to purchase LNG from Australia.

LNG tank turnover strategies at receiving stations shift - an increase in batch sales

Turnovers of LNG tank batches at domestic receiving stations hit 6.27 million tons in the first half of 2019, up by 10.1% year on year.

Apparent demand up, prices down

LNG apparent consumption increased significantly in the first half of 2019, largely attributed to the stable domestic market and cheap prices. However, the growth decelerated in May as a result of massive shutdowns of end-user plants amid environmental protection and security inspection. Figure 2 illustrates the domestic LNG supply in the first half of the year.

Figure 2 Domestic LNG apparent consumption in 1H 2019

LNG prices were in downtrend during the period, except in the second half of February when prices showed a remarkable recovery due to resurgent demand after the Chinese Lunar New Year holidays. The broad-based price fall was largely because supply of both domestic products and imported goods increased markedly.

Crude LNG end-users in Hebei and Shandong who were heavily affected by the big fluctuation of LNG prices in 2017-2018 have installed pipelines in connection with the urban gas network so as to put the dual gas supply structure in place. This, combined with the stable and sufficient supply of piped gas since this year, trimmed LNG consumption and hence curbed the price uptick.

Gloomy market outlook

From the perspective of producers’ margins, for example, the production margins of the LNG plants Inner Mongolia were theoretically around RMB200/t in the first half of 2019, down by 74% year on year. Both the cheap LNG selling prices and lofty feedstock gas prices contributed to the squeezed margins.

As for the retailing of gas stations, the profits at the majority of gas stations across the nation were stable whilst profits at the stations in Bayan Nur and Wuhai of Inner Mongolia were relatively lower, as there were many gas stations in the two areas arising furious competition.

Traders also reported that margins are being lowered continuously on the back of sufficient supply and fierce competition. Only mid and large-sized traders with strong capital could secure a big amount of LNG at preferential prices so as to obtain profits while small ones could hardly survive.

Although LNG consumption grew at a high rate in the first half of the year, the continuous falling of prices strongly suggested that the LNG market remained as a buyer’s market, with a clear picture of oversupply seen. In the future, domestic supply will continue to increase following the start-up of new plants from Inner Mongolia Xingjie and Dalad ENN Group, which will weigh down on the LNG market.