By Yu Lijuan, Oilchem

The supply-side structural reform of China’s fertilizer industry continued to advance. China's urea market, no longer being seriously imbalanced, became slightly tight in 2018 and relatively balanced now. At present, domestic urea demand (from agriculture and industry) is about 50 million tons. In 2018, China's urea output was 50.09 million tons. It is predicted that the output in 2019 will be slightly higher, reaching about 52.09 million tons (the number was over 60 million tons before 2017). The situation of highly dependence on exports before 2017 (13.44% of export dependence in 2016) has been changed and improved.

Urea futures were listed on the Zhengzhou Commodity Exchange on August 9, when more capital entered the urea market. This will not only change the traditional sales model of the urea market, but also bring new profit opportunities to it. It will also attract more players, greatly enhance the attention and activity of the urea market, and push China’s urea market into a new era.

Capacity

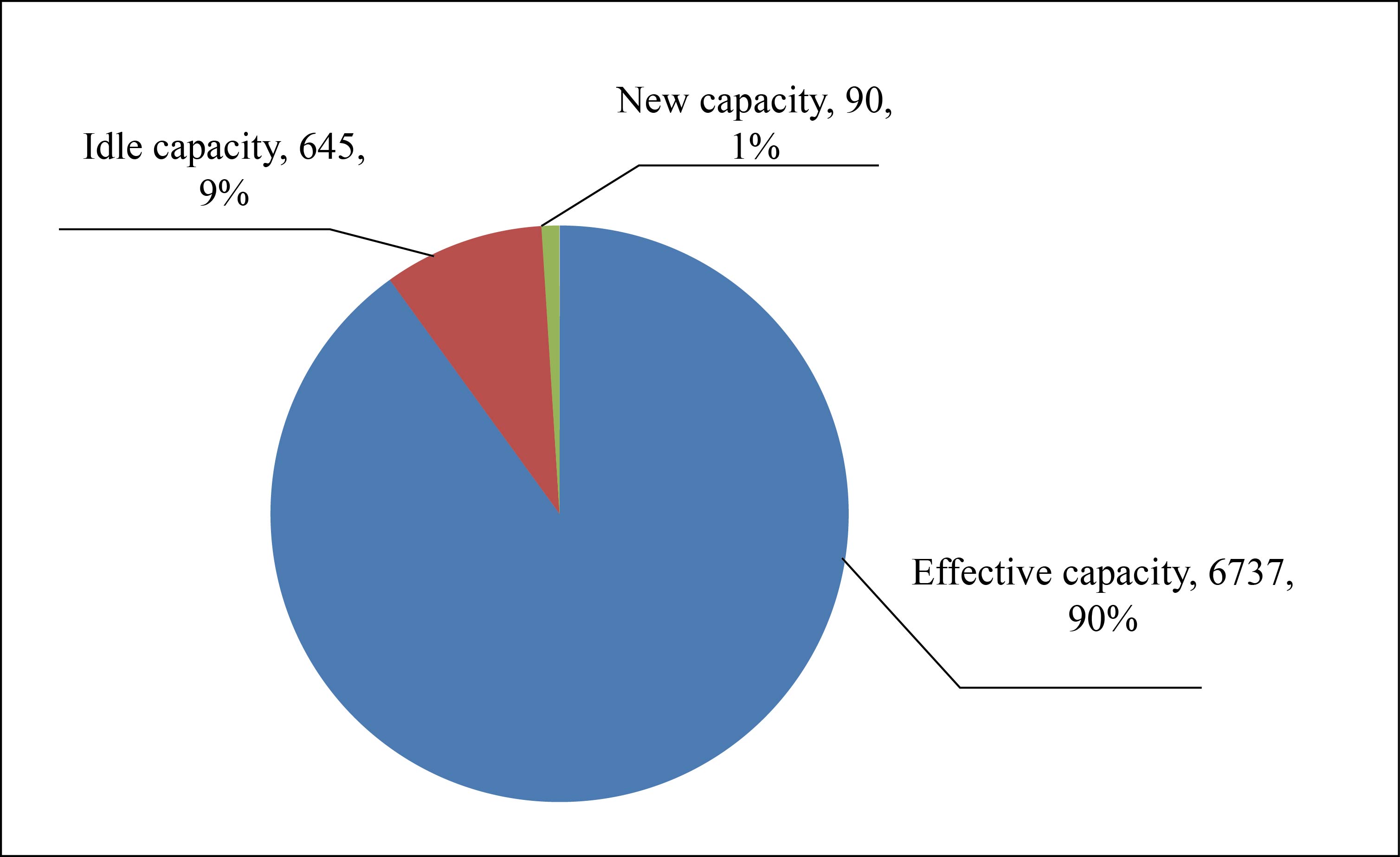

Domestic urea production capacity was 74.72 million t/a in 2019, a decrease of 8.06% compared with last year's 81.27 million t/a. The effective production capacity was 67.37 million t/a, accounting for 90.16%; the long-term idle capacity was 6.45 million t/a, accounting for 8.63%; the newly added capacity was 900 kt/a, accounting for 1.2% (see Figure 1). By raw materials, coal-based enterprises account for 71%; gas-based enterprises account for 26%, located in the northwest and southwest regions; and coke oven gas-based producers account for 3%, with all 6 of them located in Shanxi, Shaanxi and Xinjiang.

Figure 1 China’s urea capacity in 2019 (10kt)

Supply side

From January to June, the total domestic urea production was 26.32 million tons, an increase of 4% and 1.01 million tons compared with the 25.31 million tons in the same period last year. Higher production is one of the factors that cause the slight decrease in urea prices.

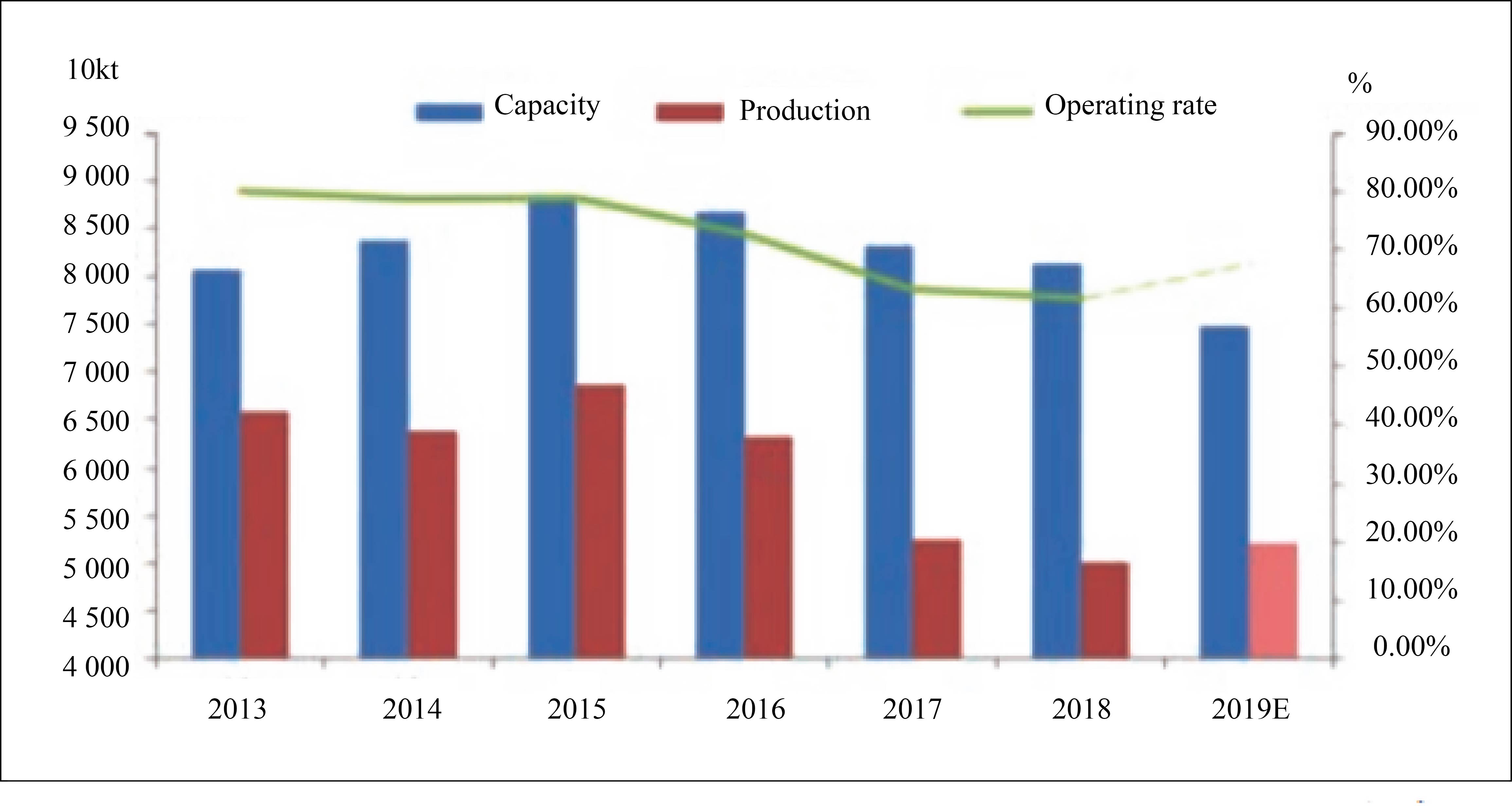

The daily output in the past few years could be 200 kt, but this number can only reach 160 kt as the highest, basically remaining at the level of 130 to 150 kt. In addition to the capacity reason, diversified development of enterprises is one of the reasons of such declining. The enterprises produce liquid ammonia, methanol, melamine, compound fertilizer or other chemicals, reducing the sales of urea.

In the first half of 2019, the operating rate of domestic urea plants was slightly higher than that of the same period of last year, at 48.71% - 68.41%, and the average daily output was 118 to 160.8 kt.

The urea capacities, productions and operating rates in recent years are shown in Figure 2.

Figure 2 China’s urea capacities, productions and operating rates during 2013-2019

Demand side

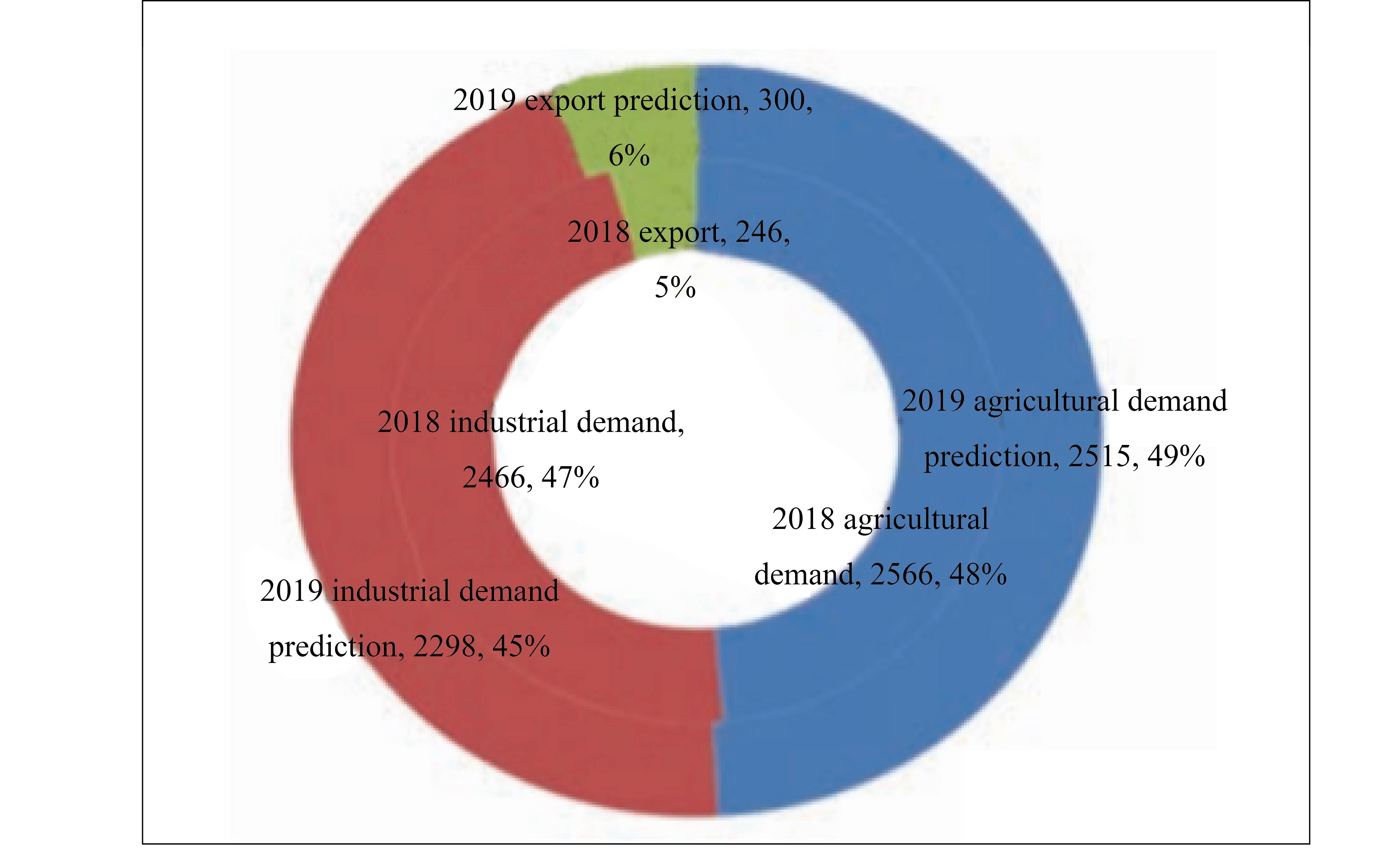

As for the downstream demand for urea in China, agriculture is the largest user, followed by the industries. In 2018, demand from agricultural sector was about 25.66 million tons, accounting for 48%; demand from industrial sector was 24.66 million tons, accounting for 47%; and exports were 2.46 million tons, accounting for 5% (Figure 3). The industrial demand includes compound fertilizer, urea-formaldehyde resin, cyanuric acid, and environmentally friendly urea.

Figure 3 Urea downstream demand in China, 2018-2019

In 2019, agricultural demand showed a downward trend. On one hand, the urea prices were relatively high, and some substitutes grabbed the market shares. On the other hand, because of the adjustment of planting structure, the cultivation of rice fields, and the rotation of land, the use of urea has been further reduced. In the industrial sector, the demand for compound fertilizers and urea-formaldehyde resins will decline, while the consumption of environment friendly products (urea for vehicles, thermal denitration) will increase.

Import & export

The domestic market started to tighten since 2017, and the export has fallen sharply, and the import has started to increase significantly.

China's urea imports from January to May 2019 were 103.9 kt, compared with 87 kt in the same period last year, an increase of 19.36% year-on-year. From January to May 2019, the cumulative export volume of urea was 1 623.7 kt, an increase of 182.11% YoY compared with 561.6 kt in the same period of last year. The tenders in India in November 2018 and January 2019 attracted some domestic suppliers, resulting in a substantial increase in exports. Meanwhile, as the domestic market prices in 2019 are lower than 2018, the export volume increased.

China’s exports have fallen sharply in recent years. At present, export destinations are mainly in East Asia, South Asia and Southeast Asia, and exports to other countries have decreased significantly.

Market forecast for the second half of 2019

On the supply side: As the operating rate continues to be relatively high this year, the production in 2019 is expected to be higher than the 50.09 million tons in 2018. The daily output has a small downward trend from July to September compared with June and is expected to fluctuate within the range of 130 to 150 kt, while this figure was 120 to 140 kt in the same period last year.

On the demand side: In the second half of the year, the agricultural demand will take about one-third of the year’s total, especially in the period of September to October and the off-season reserve after November. In terms of industrial demand, as compound fertilizer is mainly for the production of high-phosphorus fertilizer in autumn, its consumption of urea will be weaker than that in the first half of the year; while the demand from rubber sheet factory will be higher than that of the first half of the year because its peak season is September and October.

Export: The export volume plays a decisive role in the supply and demand pattern in the second half of the year. In view of the ample supply in China this year, it is expected that the export volume will be forced to increase.

Others: The listing of futures will attract more capitals, making urea market more volatile; and the economic uncertainty and the expectation of decrease in coal prices might drag down the cost. If the supply continues to be long in the second half of the year, the prices are expected to hit the bottom.