By Gong Yuqian, Sublime China Information Co., Ltd.

Different from steady development before 2010, China’s spandex industry has accelerated its growth since 2013, with new projects coming on stream and competition becoming severer. The domestic spandex capacity expanded continually in 2017. This led to oversupply as the demand kept rising stably, but failed to grow as fast as the supply.

Fluctuated prices

Spandex prices moved upwardly in 2017. Operating rates fell to nearly 65% from over 90% that spandex firms kept most of the time, due to more stringent environmental policies (e.g. regulations to reduce air pollution). Tightened supply and strong demand pushed up prices, which grew to around RMB5 000/t for a time and remained high in a relatively long period. However, near the end of 2017, the demand became weak, causing chaos in transaction prices. At the end of 2017, mainstream negotiated prices of 20D spandex in Jiangsu and Zhejiang were around RMB44 000-46 000/t; 30D spandex, RMB43 000-44 000/t; 40D spandex, RMB37 000-39 000/t.

While accelerating the industrial consolidation in 2018, spandex enterprises slowed down their capacity expansion, but could hardly achieve a balance between supply and demand. Mainstream negotiated prices of 20D spandex in Jiangsu and Zhejiang were down 12.2% YoY to around RMB39 000-40 000/t at the end of 2018; 30D spandex, down 13.8% YoY to RMB37 000-38 000/t; 40D spandex, down 14.5% YoY to RMB32 000-33 000/t.

Spandex prices remained low in the first half of 2019, given insufficient cost support, no big changes in the demand and increasing supply.

Capacity expansion and industrial consolidation

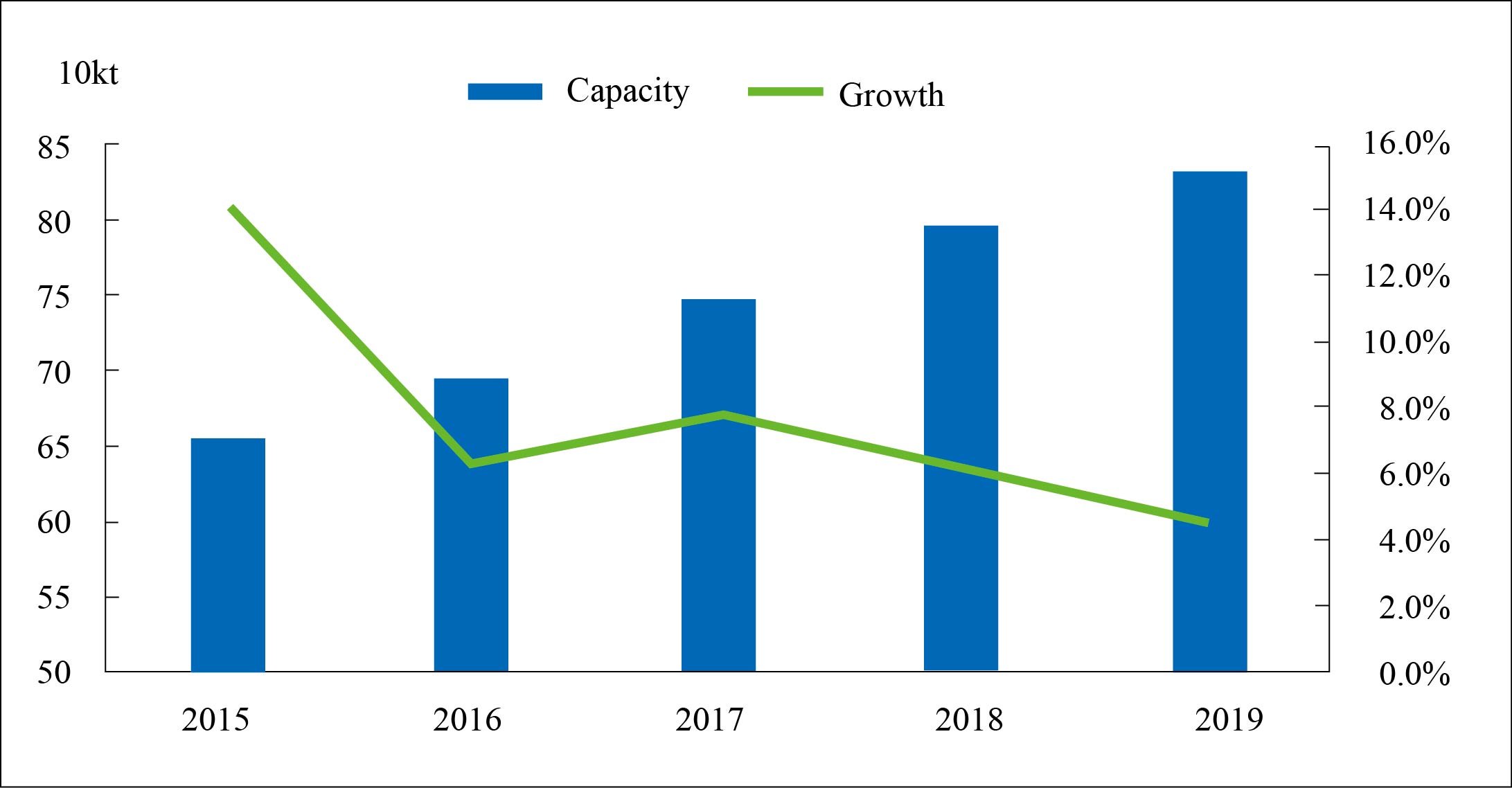

China’s spandex capacity was up 5%-7% annually in recent five years, increasing from 655 400 tons in 2015 to 831 500 tons (up over 5% YoY) at the end of June 2019. With new capacities (e.g. 30 000 t/a capacity of Huafon Chongqing Base) entering the market in the second half year, the total capacity for 2019 is forecast to exceed 860 000 t/a. The industry is to become more consolidated.

Figure 1 China’s spandex capacity and growth 2015-2019

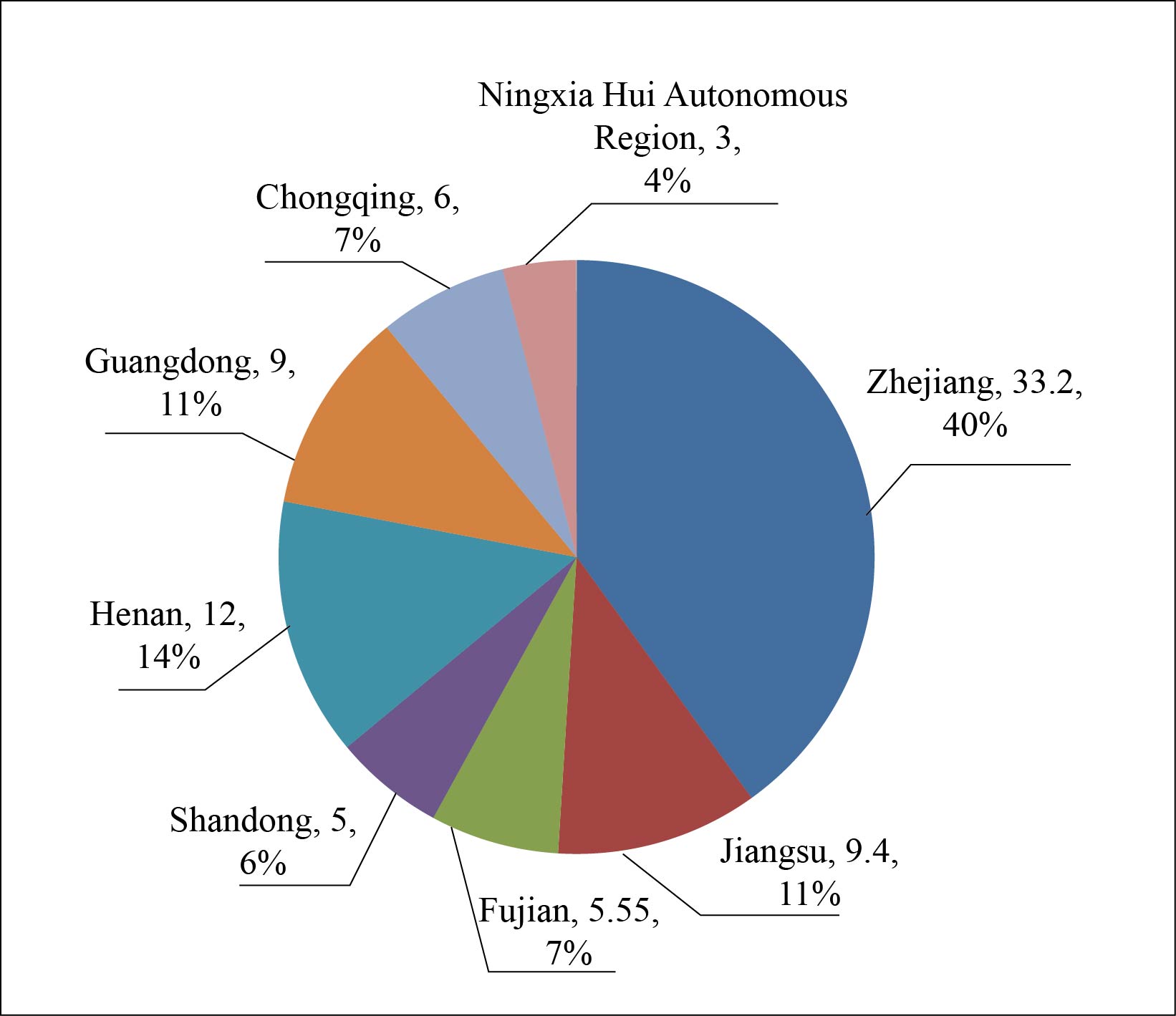

Domestic spandex firms are mainly distributed in Jiangsu, Zhejiang, Henan, Shandong, Fujian and Guangdong. Combined capacity of Jiangsu and Zhejiang reached 426 000 t/a, accounting for 51% of the nation’s total. At present, oversupply can hardly be changed as some enterprises are still planning to expand capacities, such as Huafon Group, Yantai Tayho Advanced Materials Co., Ltd. and Hyosung.

Figure 2 China’s spandex capacity distribution 2019

Most products for domestic consumption

Domestic apparent consumption had been rising until 2015, began to decrease in 2016 and reached 606 214 tons in 2018. Spandex enjoys good elasticity, and no other products can fully replace it. Hence, firms engaged in textiles and garments are to consume more spandex. Domestic demand grew stably from 2017 to 2018, and is forecast to keep the steady growth continually.

Spandex export grew 6.4% YoY to 56 193.9 tons in 2018 from last year’s 52 830 tons. The increase could be attributed to both the government encouraging the export (via measures like export tax rebate subsidies), and spandex firms willing to seize overseas market shares, raise popularity and upgrade product quality.

China exported spandex mainly to Turkey, Taiwan, South Korea, Vietnam and Egypt in 2018. In detail, export volume to Turkey was up 32.34% YoY to 10 375.79 tons, valued at US$50.62 million, and the volume to Egypt totaled 4 171.82 tons, up 41.2% YoY, valued at US$20.63 million. Around 3 028.73 tons (up 46.78% YoY) of spandex were exported to Indonesia, and the export value was US$14.91 million. Export volume to Taiwan and South Korea fell slightly, and that to the US was just around one thousand tons, accounting for less than 2% of the total. Spandex export is forecast to continue to rise stably, and industry players are to expand overseas markets gradually.

Table 1 China's spandex export 2018

Country and region | Export volume (t) |

Turkey | 10 375.791 |

Taiwan | 4 578.95 |

Vietnam | 4 501.401 |

South Korea | 4 438.754 |

Egypt | 4 171.818 |

Pakistan | 3 447.391 |

Indonesia | 3 028.73 |

Bangladesh | 2 018.815 |

Netherlands | 1 914.744 |

US | 1 072.075 |

Domestic demand is taking up a major part in China’s spandex consumption structure, and this will not be changed in a long term in spite of rising export.

China imported 21 287 tons of spandex (mainly high-end products) in 2017, and 26 186 tons in 2018, with the dependence on imported spandex rising from 3.9% to 4.1%.

Promising future

The oversupply can hardly be changed as the capacity and the demand are both increasing stably. However, spandex firms can strengthen their competitiveness, via weakening the competition of homogeneous products and seeking differentiated development.

Spandex is widely used in many fields (e.g. sportswear, home textiles, medical supplies, etc.), and its consumption in jeans and T-shirt may grow. Spandex firms are wise to accelerate industry consolidation, abandon outdated production facilities and upgrade products to develop sustainably.