By Li Xunjun, Sublime China Information

With monthly trading volumes ranging in million tons, China’s methanol futures have finally struggled to become the “star” in the futures market, since its inception on October 28, 2011. At present, methanol futures have become a vane of the spot market. Methanol enterprises have entered the era of “walk-on-two-legs” by involving in both futures and spot trade.

Volatile methanol futures in 2018

Domestic methanol futures underwent wider fluctuations in 2018. Similar to the spot market trend, the futures market suffered two rounds of downturns in the year. The peak and second-high emerged respectively in October and August, while the low ebbs were seen in early and end-year. China’s methanol futures peaked at RMB3 525/t on October 15 and bottomed at RMB2 300/t on December 4, forming a swing of 42.2%. The average level of the year hit RMB2 867/t, up by 7.6% from 2017.

Transport restrictions due to snowfalls in some parts of China in early 2018 restricted downstream buying. Hence, active restocking after the transport resumed pushed up methanol prices and methanol futures briefly topped RMB3 000/t. High methanol prices squeezed downstream producers’ margins and met with buying resistance. Pessimism prevailed in the market and methanol prices fell back. In mid-January, methanol futures slipped to below a key support level of RMB2 850/t.

The downtrend persisted after China’s Lunar New Year holiday and methanol futures sank to around RMB2 630/t in end February. Expectations about tightening supply as methanol producers announced their spring routine maintenance plans from March halted the price drops. Methanol prices began to rally and attempted the resistance level of RMB2 850/t several times.

In September-October, a series of positive news, including maintenance shutdowns at domestic and overseas plants and increased export volumes from China boosted the methanol market. Methanol futures exceeded RMB3 500/t in mid-October and peaked at RMB3 525/t, hitting a five-year high. However, from mid-October to end November, a string of olefins plants shutdowns in China’s coastal areas inflicted a hard blow on methanol futures, which crashed and plummeted below RMB3 200/t, RMB3 000/t and RMB2 800/t. In mid-late December, methanol futures even hit lower limits, as dragged down by plunged crude oil futures, shutdowns at a few methanol-to-olefins (MTO) plants and downbeat market sentiment and closed the year at RMB2 388/t.

In terms of paper trade, most traders chose to hold only long or short positions or pricing in order to maximize profits in 2018. The pricing mode using “futures prices + basis (spot prices – futures prices)” provides more choices for enterprises involved in spot trade and reduces the risks of traditional pricing method to a certain extent.

Price fluctuations may narrow in 2019

Slowing world global economy will inject uncertainties into the methanol market in 2019.

Feedstock

Tightly balanced coal market may ensure relatively stable costs for coal-to-methanol (CTO) plants. The prices of coal, as a major methanol feedstock in China (71.5% of domestic methanol production uses coal as feedstock) will greatly affect methanol prices. Domestic coal supply will be stable-to-higher in 2019 as new capacities are expected to put into operation.

Supply

A large number of methanol plants will start up in China in 2019 (as shown in Table 1). A total of 5.40 million t/a of methanol capacities at Heilongjiang Baotailong, Zhong’an United Coal Chemical and Yankuang Yulin will become operational, pushing up domestic methanol capacities to 89.92 million t/a in 2019, up by 6.4% year on year. Domestic methanol output is expected to rise to around 58.5 million tons in 2019, up by 4.9% year on year. Import volume may post a sharp gain and reach around 7.80 million tons in 2019.

Table 1 Start-up plan of new methanol plants in China, 2019

Producers | Feedstock | Capacity (kt/a) | Start-up plan |

Baotailong | Coal | 600 | Q1 2019 |

Xintai Zhengda | Coal | 250 | Q1 2019 |

Shanxi Lubao | Coke-oven gas | 200 | Q1 2019 |

Xinjiang Xinlianxian | Coal | 150 | Q2 2019 |

Dalian Hengli | Coal | 500 | Q2 2019 |

Jinmei Zhongneng Chemical | Coal | 300 | Q2 2019 |

Zhong’an United | Coal | 1 700 | Q2 2019 |

Yankuang Yulin | Coal | 800 | Q4 2019 |

Rongxin Chemical | Coal | 900 | Q4 2019 |

Demand

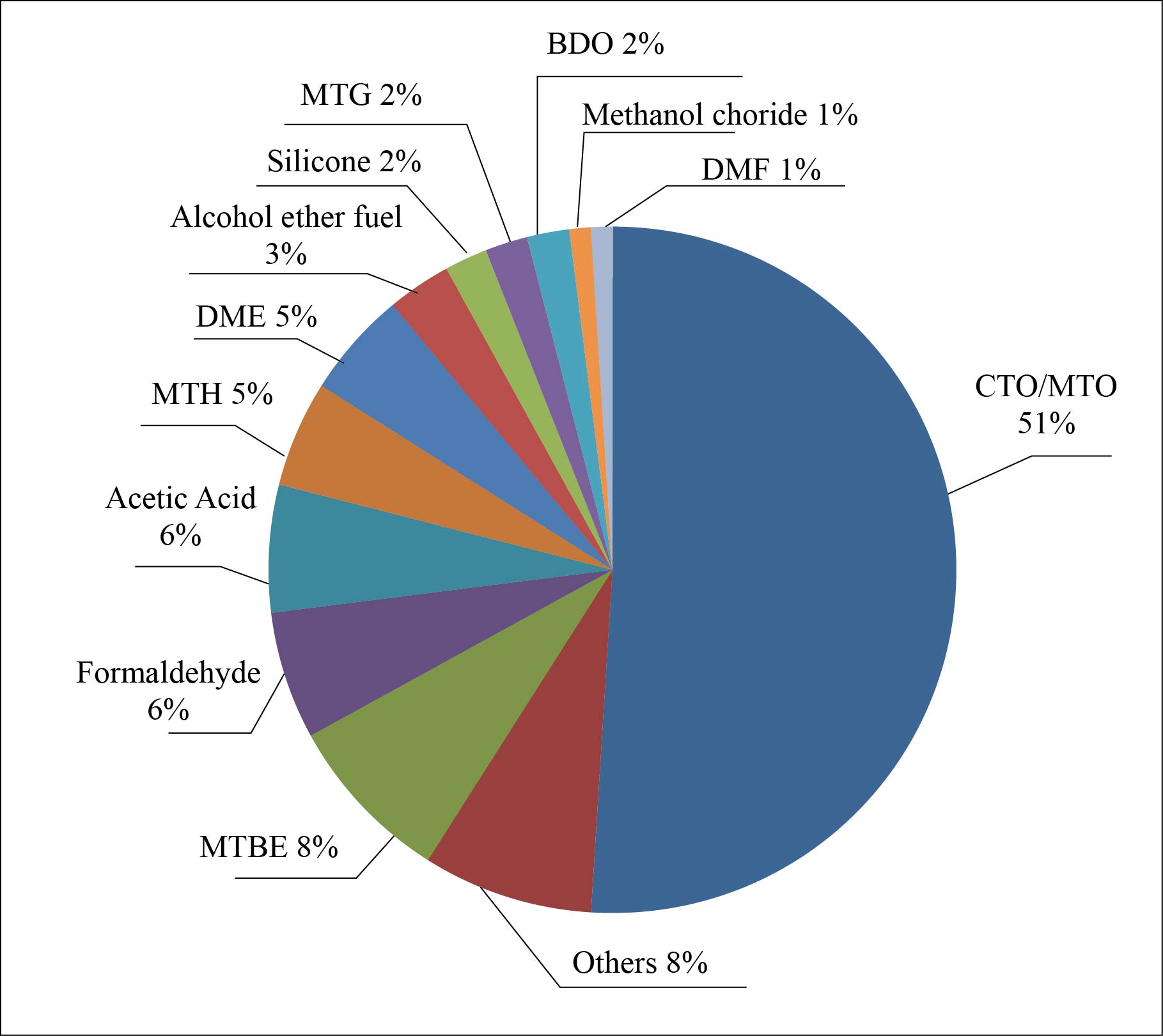

Downstream capacities may continue to expand in 2019. In terms of consumption structure, CTO/MTO is expected to cover 50% of methanol consumption, while traditional downstream industries may take a smaller share. A total of seven CTO/MTO plants, at Inner Mongolia Jiutai, Wilson Nanjing and Ningxia Baofeng are planned to launch production in 2019. Their methanol demand will equal 10.8 million tons (half of them have their own methanol plants, leaving net methanol demand at 5.40 million tons). These plants may have a strong possibility of starting up as scheduled, backed by ample margins for CTO/MTO. Except for Luxi Chemical, other CTO/MTO plants will become operational in the second and third quarter of 2019.

Figure 1 Methanol downstream consumption structure forecast in 2019

There are few bright spots in other traditional downstream industries in 2019. As environmental protection becomes the main concern, methanol consumption from the formaldehyde industry is unlikely to increase. The operating rates of domestic formaldehyde plants in 2018 fell dramatically as compared to 2017. MTBE plants at Dalian Hengli, Shaanxi Yanchang Petroleum, Guangdong Zhanjiang Zhongke Refinery are expected to start up in 2019, which will push up methanol consumption by around 900 kt theoretically. The planned commission of the butanediol (BDO) plants at Lanshan Tunhe Phase II and Yanchang Petroleum may lead to an increase of 264 kt in methanol consumption. As the Work Safety Committee of the State Council has clearly prohibited the blending of DME into liquefied petroleum gas (LPG) cylinders, methanol consumption from the DME sector will continue to shrink. Dalian Hengli will start up a 350 kt/a acetic acid plant, which will boost methanol consumption by 192.5 kt. A number of methanol-to-hydrogen (MTH) plants, at Shandong Dongfang Hualong, Kelida Petrochemical and Binzhou Banglian New Energy will be put on stream, which will increase methanol consumption by 363 kt.

Supply-demand contradictions in the overall methanol market may not be profound in 2019. The restart of gas-based methanol plants and the progression of new plants’ start-up will be in the spotlight in the first quarter of the year. Maintenance shutdowns at methanol plants and whether new CTO/MTO capacities will start up as planned will attract market attention in the second quarter. Methanol demand in the third quarter, which is a traditional high supply period, will mainly depend on the start-up of CTO/MTO plants. In the last quarter of the year, winter turnaround at methanol plants, natural gas supply curtailments and production cutbacks due to air pollution control measures will become the focus of market players.

The support from methanol supply on domestic methanol prices will diminish in 2019. The production recovery at overseas plants will mitigate the low inventories at China’s coastal regions, adding to sales pressure on inland cargoes. Domestic methanol prices will gradually move to reasonable levels and slip slightly as compared to 2018. China’s methanol futures are expected to fluctuate in the range of RMB2 100-3 000/t in 2019.