By Wu Yanni, Sublime China Information

TDI futures born with defect

Although TDI is not a commodity product, there is track of futures in the TDI market. However, the TDI futures are not standardized, and they could not even be called “paper goods”. The annual consumption of TDI in China is only a bit over 700 kt. As a niche market product, TDI does not have market fundamentals strong enough to support a standardized futures market. During the relatively active period of TDI futures, both buyers and sellers could trade goods for forward three months. In particular, the price of TDI futures is always lower than that of spot goods, at a discount basis. This is mainly because the TDI trade volume is small, and the scope of relatively big players (mostly refer to sellers) is limited, while, in addition to users of the futures, buyers include many speculators that are close to the industry.

TDI futures players’ features

Buyers of TDI futures usually consist of three types, namely users, second-hand traders, and speculative investors.

As for the type of users, after they buy the TDI futures, they will not require a one-time delivery of all the goods unless the prices are skyrocketing or plunging. Thus, the mode of delivering goods by batches is agreed by both buyers and sellers, and this is also the most common trading method that uses time to change space, as it barely leads to conflicts between buyers and sellers.

For the second-hand traders, they usually require delivery at expiration when buying futures. Whether they do back-to-back or unilateral trading operation, their final target is to gain revenues, so some of the traders usually chase short selling. Similarly, in a downturn market, these buyers are very easy to scrap the contract.

The purchasing and executing of futures by speculative investors are more flexible. Non-trading personnel along the TDI industry chain and at the TDI industry terminal are the main speculators, such as individuals in furniture factories, mattress factories, shoe factories or TDI downstream factories. TDI is highly regarded as a high-quality “financial” product, thanks to its huge price resilience (low at RMB10 000/t while high up to RMB50 000/t), and its storage adaptability, barreled package and strong liquidity. After the speculative investors buy futures, some of the futures are not delivered in the form of actual goods, but in a form similar to the valuation adjustment mechanism (VAM).

Three-time short covering in 2018

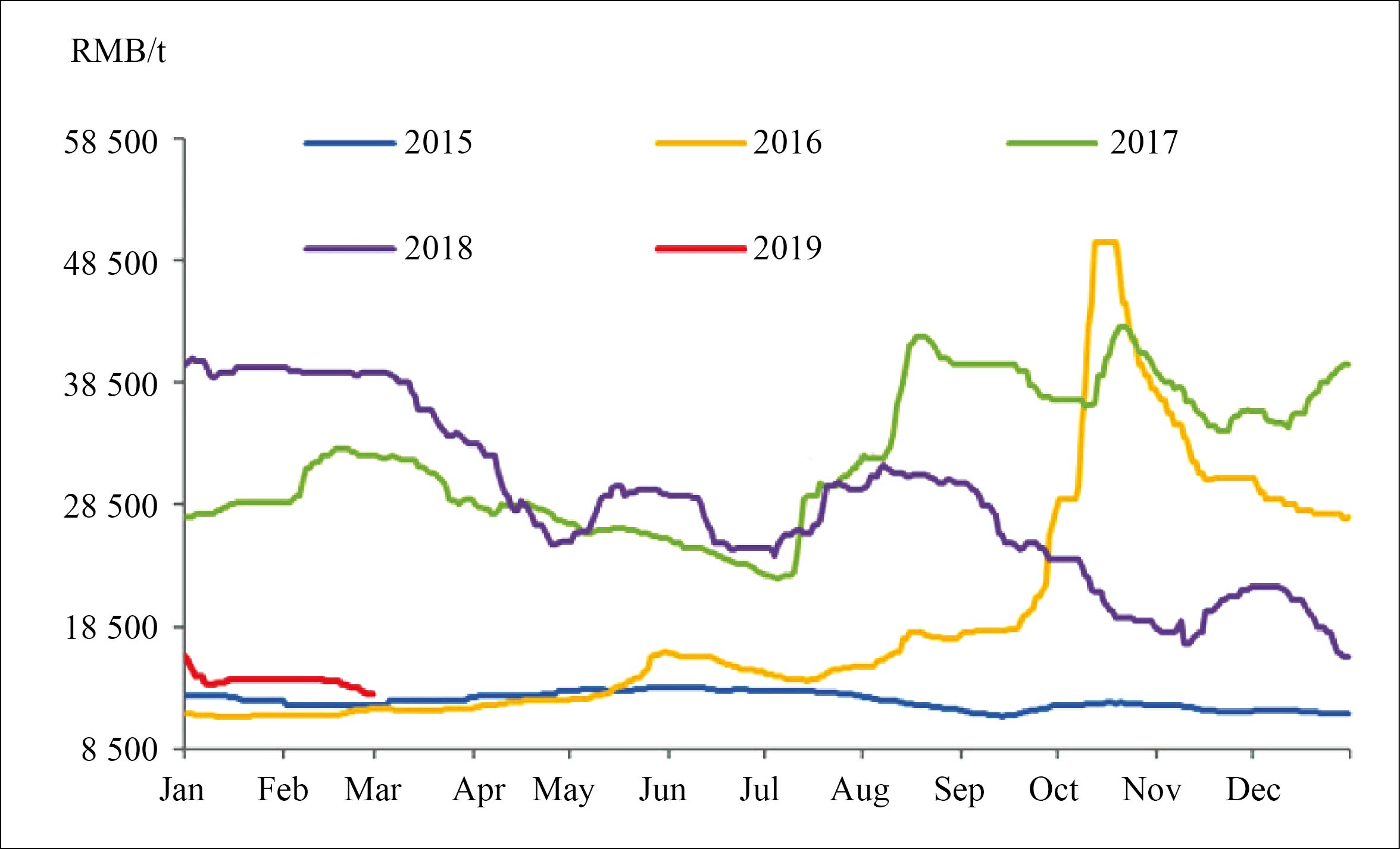

TDI futures transactions seen in the most time are only tools to serve short selling. TDI is a product with simple supply and demand structure and short selling usually occurs in the following conditions: producers have high inventories; prices have just experienced an uptrend; buyers have inventories and show weak buying interest; there are expectations that cargoes will flow in from outside. In the period of 2014-2015, short selling prevailed in the TDI market, which constrained TDI producers. In addition, the TDI prices lost resilience and broke low records, as supply was a bit beyond demand (see Figure 1). In 2018, the TDI market roughly saw concentrated short covering for three times.

Figure 1 Domestic TDI market prices, 2015-2019

March-April: TDI prices fell during the period. At the early stage of the price fall, most traders held a big amount of high-priced futures goods, which resulted in big economic losses. The reason behind the highly accumulated inventories was that buyers built stocks actively on expectations of an upward room before the Chinese Lunar New Year holidays. After the holiday, however, there was a long digestion period. This, combined with increasing inventories from producers, led to high inventory pressure. In April, traders almost ate up inventories and turned to conduct short selling, which caused a rapid price fall. Finally, the price of domestically-produced goods was as low as RMB24 500/t.

October: It was heard that Wanhua’s TDI plant will be put into operation in October 2018 and sources said that Wanhua’s extra supply will hit the market in the future. In the circumstances, short selling prevailed again in the TDI market. At the same time, TDI producers reported a contraction in sales volumes and an increase in inventories due to influx of import volumes in September. Therefore, although the domestic prices kept falling during August-September, some traders chose to conduct short-selling.

December: The start-up of Wanhua Chemical's 300 kt/a TDI unit was postponed from scheduled October-November to the end of December. With its commercial production, traders preferred short selling again, with futures delivered for February-March 2019 traded massively, in a price range of RMB12 000-12 500/t.

Not every short-selling ended with profit. As for the three-time short selling in 2018, the price levels in April and December were resisted by producers and most short activities theoretically created floating losses. However, there was no corresponding reshuffle in the traders’ group, mainly because TDI futures remain unstandard at the delivery segment. According to the transaction and follow-up execution of futures traced by Chem99, in fact, some of the futures were not delivered at due time, especially when prices rise that are not favourable to short positions.

In the past few years, domestic TDI has been in shortage of supply, so prices are affected by the market fundamentals significantly. Long and short positions were frequently seen during the period, and thus losses and profits were correspondingly enlarged. In 2019, the TDI market will be oversupplied, so the prices will lose some resilience and the moving range will narrow sharply. It is expected that the short-selling activities in the TDI market will be constrained.