By Li Yushi, China National Chemical Information Center

Starting from the sharp downslide of the crude oil price in the international market in 2014, the price of toluene always hovered in a range of RMB4 500-6 500/t. Only in the second half of 2018 the price of toluene reached the peak of past 4 years. After the short-lived price peak in 2018, however, the price of toluene made an abrupt downturn. It is expected that in the first quarter of 2019 the price of toluene will drop to the lowest level of past few years.

PX has a considerable profit space, but its overall threshold is high and it is not a proper choice for small/medium enterprises

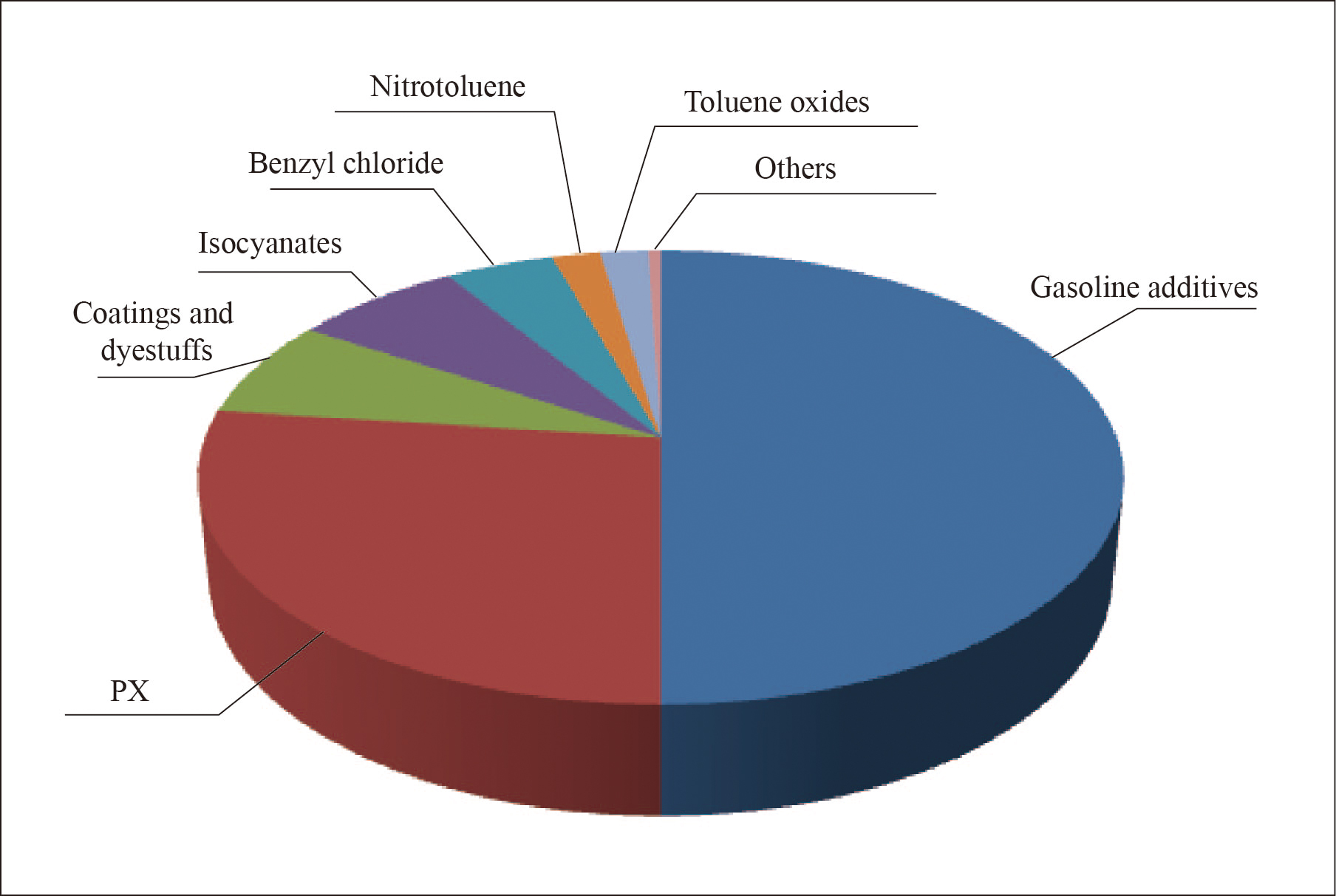

The capacity of toluene in China was over 13.00 million t/a in 2018, the output was more than 7.30 million tons, the import amount was around 330 kt, the export amount was less than 20 kt and the apparent consumption reached 7.61 million tons. Figure 1 shows the distribution of toluene consumption sectors.

Figure 1 Consumption of toluene downstream consumption in 2018

Reasons for the cooling of the toluene market: With impacts from the overall flagging of the crude oil market, it is hard for toluene that is used for oil blending to make much profit. China is implementing National VI standard for gasoline step by step. It is clearly stipulated in the standard that the content of aromatics in gasoline will be further reduced from below 40% as defined in National V standard to below 35%. Based on a gasoline output of 130 million tons in China, the consumption of aromatics in gasoline will have a drop of around 6.50 million tons. It will surely affect the application of toluene in oil blending.

PX is a hot variety in toluene consumption sectors. As PX is an important raw material for the production of PTA, its capacity, output and consumption have always presented a rising trend. The import dependence of PX is quite high in recent years and the import amount was around 16.00 million tons in 2018. The capacity of PX in China made an increase of around 1.60 million t/a in 2018 and the total capacity exceeded 20.00 million t/a. The output of PX was around 13.00 million tons in 2018, being nearly 2.00 million tons higher than 2017. In such a situation, toluene producers prefer to produce PX so as to increase their product added value. Corresponding production processes include the traditional toluene disproportionation/isomerization process and also the toluene alkylation process that has started large-scale application in recent years.

Nevertheless, most of PX projects in China are large refining/chemical integrated projects with considerable investments, raw material supply pressures and environmental protection costs. In case toluene producers intend to choose the production of PX, therefore, in addition to making enormous refining/chemical industrial plans they should also have powerful policy supports. Small/medium toluene producers have no competitive edges whatsoever in either commercial production cost or market bargaining power.

The capacity of PX in China will make a large-scale expansion in future. Economic returns of PX will likely have a considerable reduction at that time. In the 7 major world-class petrochemical industry bases proposed in the Thirteenth Five-Year Plan, the total capacity of PX to be constructed or expanded is nearly 20.00 million t/a (see Table 1). Not only the import dependence of PX in China will be thoroughly changed, the risk of PX capacity surplus will also arise.

Table 1 New PX capacities in 7 major world-class petrochemical industry bases (million t/a)

Location | Integrated capacity | PX capacity |

Changxing Island of Dalian | 20.00 | 4.50 |

Lianyungang of Jiangsu | 16.00 | 2.80 |

Caofeidian of Hebei | 15.00 | 2.00 |

Caojing of Shanghai | 20.00 | 0.85 |

Ningbo of Zhejiang | 40.00 | 8.00 |

Gulei of Zhangzhou | 15.00 | 0.80 |

Huizhou of Guangdong | 10.00 | 1.00 |

In terms of isocyanates, the production of TDI with toluene as main raw material was a quite profitable route during 2015-2017, but the price of TDI made a sustained reduction in 2018 and the price of toluene that accounts for around 40% of the total TDI cost can hardly get any backing.

The overall supply/demand of toluene oxides is stable. The export proportion of benzoic acid, in particular, has kept going up in recent years and the price difference with raw material toluene is also getting wider. As the industrial volume of toluene oxides is quite small, however, they can in no way produce substantial changes to the toluene market.

The market development of toluene oxides is quite sound, small/medium enterprises can choose to make an access

Toluene oxides refer to benzyl alcohol, benzaldehyde and benzoic acid that are generated through the oxidation of toluene by different degrees. In these 3 products, benzoic acid has the least complexity in production process and its consumption is also the biggest, accounting for over 90% of toluene oxides.

Production processes for benzoic acid mainly include the toluene air oxidation process, the toluene chlorination/hydrolysis process and the phthalic anhydride decarboxylation process. Benzoic acid producers in China all use the toluene air oxidation process today. The process is already quite well-developed. It is simpler, has higher yield, causes less equipment corrosion and generates less pollution as compared with other processes. It is therefore in line with the direction of clean development in chemical industry. Moreover, the yield of other two toluene oxides (benzaldehyde and benzyl alcohol) can also be increased selectively through the use of different process parameters and catalysts.

The capacity of toluene oxides in China Mainland was around 500 kt/a in 2018. Tianjin Dongda Chemical Group Co., Ltd. (100 kt/a), Wuhan Youji Industries Co., Ltd. (80 kt/a) and Hunan Hongrun Chemical Technology Co., Ltd. (40 kt/a) are representative enterprises. Most producers have stayed in the business for long years. They also take large refining/chemical enterprises as the backing and therefore have stable supply of raw materials and high recognition of downstream clients. The output of toluene oxides in China Mainland was around 230 kt in 2018 and the operating rate was around 47%.

The downstream consumption of toluene oxides presents a trend of stableness with increase. Take benzoic acid for instance. Its biggest application sector is the use as anticorrosive agents. Basic varieties are benzoates (mainly sodium benzoate and also small amounts of ammonium benzoate and calcium benzoate). Sodium benzoate is used in great quantities as food anticorrosive additives. The use as anticorrosive agents accounted for over 55% of the total benzoic acid consumption in 2018.

In other application sectors, benzoate plasticizers have a promising prospect. Such plasticizers can be used to replace some phthalate plasticizers (such as DOP). As phthalate plasticizers have certain carcinogenic risks, they have been gradually replaced in advanced countries of America and Europe. The consumption of benzoic acid will therefore also have a quite satisfactory increase in this application sector.

Due to restrictions from production process (for example, chlorination-process products not allowed to be used in foods and daily chemicals) and problems in yield, benzaldehyde and benzyl alcohol still depend on import today. As their market volume is very small, however, toluene oxide producers can meet the demand through increasing the yield of benzaldehyde and benzyl alcohol coproduced in main products.

The development prospect of the toluene oxide business is quite optimistic. The investment in a toluene oxide unit with a capacity of below 50 kt/a is around RMB100 million today, being much lower than an investment of billions of RMB required in a PX unit. To small/medium toluene producers (with a capacity of below 400 kt/a), totally or partially extending toluene to the toluene oxide business can upgrade their own product economic returns, reduce inputs and also avoid competition with large chemical enterprises in the PX sector.