By Qi Zhaoying, Mei Zhiyong, Ma Suoli, Shang Lipeng, CIESC Chemical Fertilizer

Committee/Potassium Salt (Fertilizer) and Medium/Microelement Industry Alliance,

Shang Lipeng, Beijing Zhonghua Combination Certification Co., Ltd.

Present functioning status of the potassium fertilizer sector in China

Soluble potassium resources are extremely scarce in China. They are mainly distributed in remote regions such as Qinghai and Xinjiang. According to the latest data (based on potassium chloride, also shown below), potash reserves in China are 730 million tons and there is still a mining period of 7-8 years. The average grade of potassium resources in China is around 0.8% (potassium chloride) and the major raw material used in potassium fertilizer enterprises in production is brine, with a high production cost. The output of potassium fertilizers in China is 9.70 million tons, but the self-sufficiency rate is only around 50%. Around 7.00 million tons of potassium fertilizers need to be imported each year on average. The annual import amount over the next 5 years will exceed 10.00 million tons. The demand for potassium fertilizers in China is around 20.00 million tons and the figure continues to rise.

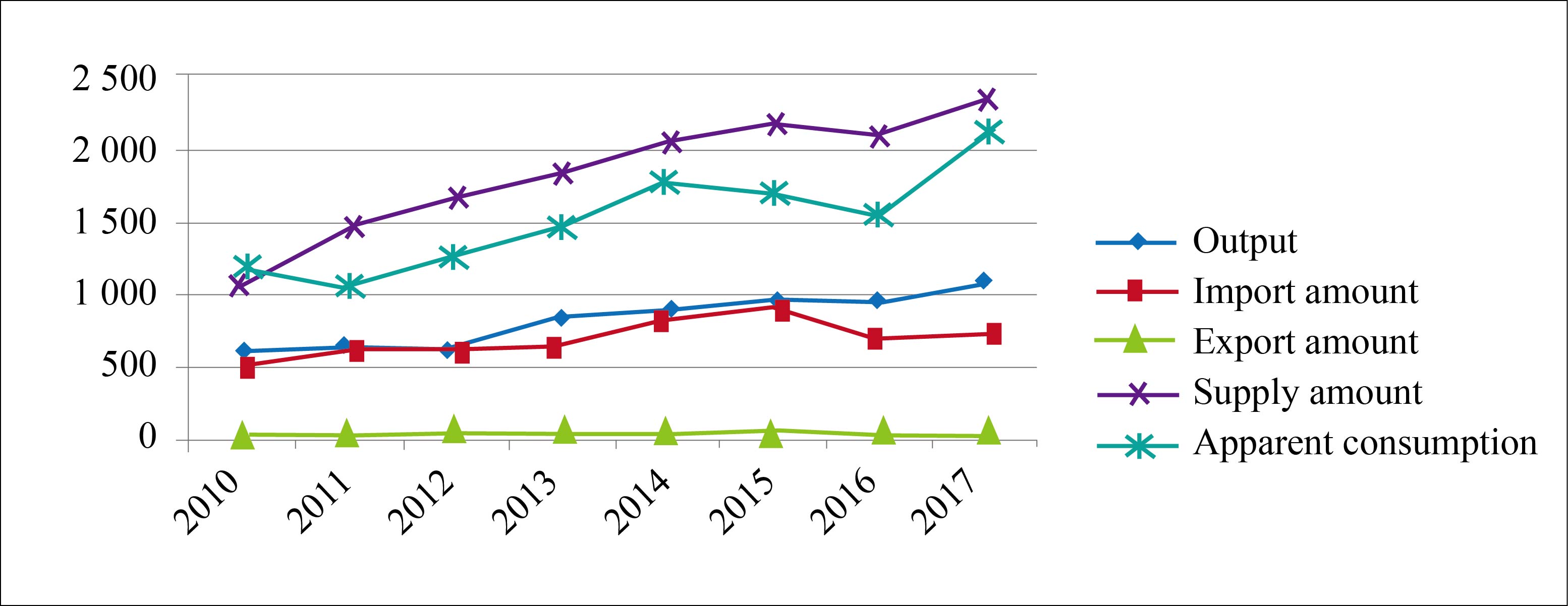

Figure 1 Supply/demand of potassium fertilizers in China during 2010-2017 (10kt)

1. Status of potassium resources

Proven soluble potassium resources in China were 1.057 billion tons in 2016. Of the total, basic reserves were 562 million tons.

Minerals such as feldspar and kasilite contain 10-12% of citric-soluble K2O. Slightly soluble potassium resources in China are over 300.0 billion tons and their distribution is also extremely extensive. Nevertheless, they can only be used as a supplement to soluble potassium resources and cannot replace them.

Thirty-three overseas potassium resource projects owned by China today have more than 26.0 billion tons of sylvite and carnallite reserves (incomplete statistics). Up to now only a 0.60 million t/a unit has been constructed in Laos.

2. Present supply/demand status of potassium fertilizers (as of 2017)

The supply of potassium fertilizers in China was 22.98 million tons in 2017 and the total consumption was 19.52 million tons, an increase of 38% over 2016. The domestic output was 9.68 million tons, only accounting for around 42% of the total supply. Imports from countries with rich potash resources, such as Canada and Russia, still have to be made each year. It can be seen from Figure 1 that the supply amount of potassium fertilizers also exhibits a trend of year-on-year increases.

3. Supply/demand forecast of the potassium fertilizer sector

The output of potassium fertilizers in China is expected to be 10.00 million tons in 2018. Due to the gradual reduction of potassium resources, the output will decrease during 2019-2025 and is estimated to drop to around 6.00 million tons in 2025.

In countries where environmental policy is relatively stable, overseas potash projects started construction in 2018 and are planned to be put on stream in 2020. Laos was still the major region for potassium chloride being brought back to China in 2018, and the amount reached around 0.30 million tons. It is expected that an output of around 8.00 million tons will be brought back to China after 2025.

The only variety of potassium fertilizers that China lacks today is potassium chloride, and around 50% of the domestic demand has to be satisfied by import. Major application flows include compound fertilizers, direct applications, formula fertilizers, water soluble fertilizers, granular potassium fertilizers, potassium sulfate, potassium hydroxide and related potassium fine chemicals. Moreover, with the reduction of export tariffs for NPK compound fertilizers, chances for flowing to markets of countries along the “Belt and Road” will also make a drastic increase. The apparent consumption of potassium fertilizers in China in 2018 was slightly higher than 2017. It is expected that the consumption of potassium fertilizers in China will rise further during the Thirteenth Five-Year Plan period and the apparent consumption will likely increase to 25.00-26.00 million tons. The need for constructing overseas bases will become extremely urgent.

Mid-Asia potassium fertilizers back the sustainable development of agriculture in China

1. Advantages of Mid-Asia potassium fertilizers

Mid-Asia includes the Asian part of Kazakhstan, Uzbekistan, Kyrgyzstan, Turkmenistan and Tajikistan. The 6.00 million t/a potassium fertilizer project in Kazakhstan has already become a “No. 1 project” authenticated by government heads of two countries. The 0.60 million t/a potassium fertilizer project in Uzbekistan has already started production.

Today, the only potassium fertilizer project in China that “has gone outside the country” is the potassium fertilizer project in Kazakhstan. The project has the following features:

(1) Reserves of potassium resources are big and the grade of minerals is high with an average content of around 30% (potassium chloride).

(2) Traffic charges are low.

(3) There are several product varieties. Kazakhstan Potash Corporation owns 3 potash mines in Kazakhstan. As compositions of minerals are different, two varieties of potassium fertilizers, including potassium chloride and potassium sulfate, can be produced. In addition, boron resources that are also scarce in China are included.

(4) The product quality is high. Potash products with a K2O content of over 98% that are urgently needed in China can be produced.

(5) Products can easily go to countries along the “Belt and Road” that urgently need potassium fertilizers and therefore help attain the goals of the “Belt and Road” layout.

(6) Products can promote comprehensive agriculture industry park projects in Kazakhstan and in turn boost commercial and trade contacts for grains (such as flour) and meat products from Kazakhstan with China.

2. Backing role of Mid-Asia potassium fertilizers

There are 64 countries along the “Belt and Road” and the total population is 3.21 billion, accounting for 43.4% of the world total. The problem of agriculture sustainability in these countries is prominent and grain safety has hidden hazards. Quite a few agriculture-related new technologies and new products in China have won high applause in countries along the “Belt and Road”. These countries are willing to actively develop more extensive cooperation with China in economy, trade, investment, production capacity and infrastructural construction so as to tap their own development potentials.

Mid-Asia countries will become important sources for the importing of agricultural products in China. Judging from agricultural resources and environmental capacities in China today, the sustainable development of agriculture will face heavy pressures. More people, less land, and a water shortage are basic national conditions. The quality of cultivated land is deteriorating. Problems such as black earth layer thinning, soil acidification, and increasingly shallow plough layers are prominent. The gap between needs in the amount and quality of agricultural products and capacities of resources and environments is wider. Agricultural products from Mid-Asia countries will be constantly transported to China in future.

3. It is imperative to ensure the sustainable supply of potassium fertilizers

For a considerable period of time into the future, specific strategic measures for the sustainable development of the potassium fertilizer sector in China will be: protecting valuable soluble potassium resources in China, bridging the gap through 3 channels, including the development of overseas potassium fertilizer bases, importing potassium fertilizers, and developing slightly soluble potassium resources.

“Top-level design” suggestions on potassium fertilizers for the sound and sustainable development of agriculture in China

1. Restrict the development of soluble potassium resources in China

Strictly control the construction of new capacities of domestic potassium fertilizers. The output should be maintained at the level of 6.00-7.00 million tons. The capacity of existing potassium fertilizer units in Qinghai and Xinjiang has already reached the extreme limit of present resources. To achieve sustainable development of domestic products in the potassium fertilizer sector, it is suggested that a prudent attitude should be taken towards the construction and expansion of new resource-based potassium chloride, potassium sulfate, and potassium magnesium sulfate fertilizer projects. Existing units should be utilized efficiently to achieve a high operating rate.

2. Strengthen the support of state policies and quickly construct overseas potassium fertilizer bases with Mid-Asia potassium fertilizers as the core

Make adequate discrimination and screening for 34 potassium resources projects already underway in Kazakhstan, Djibouti, Canada, Laos and Congo (Brazzaville). Preferential policies in capital, technology, market and overseas talent should be offered for high-quality projects screened out and large upstream/downstream-integrated overseas group corporations should be formed. State-owned capital should be taken as the core and private capital should be used as additional boosters to organize large-scale production as soon as possible. Moreover, overseas potassium fertilizer projects that “have gone outside the country” should have more communications with local potassium fertilizer enterprises and strive for joint development. The world economy has entered a period of low tide today. As the expiry of the service life for potash mine development projects is approaching, potassium fertilizer giants such as Canada and Russia will have many chances for cooperation with China in production and logistics. This will be favorable for the smooth progress of projects.