By Song Xuemei, Sublime China Information

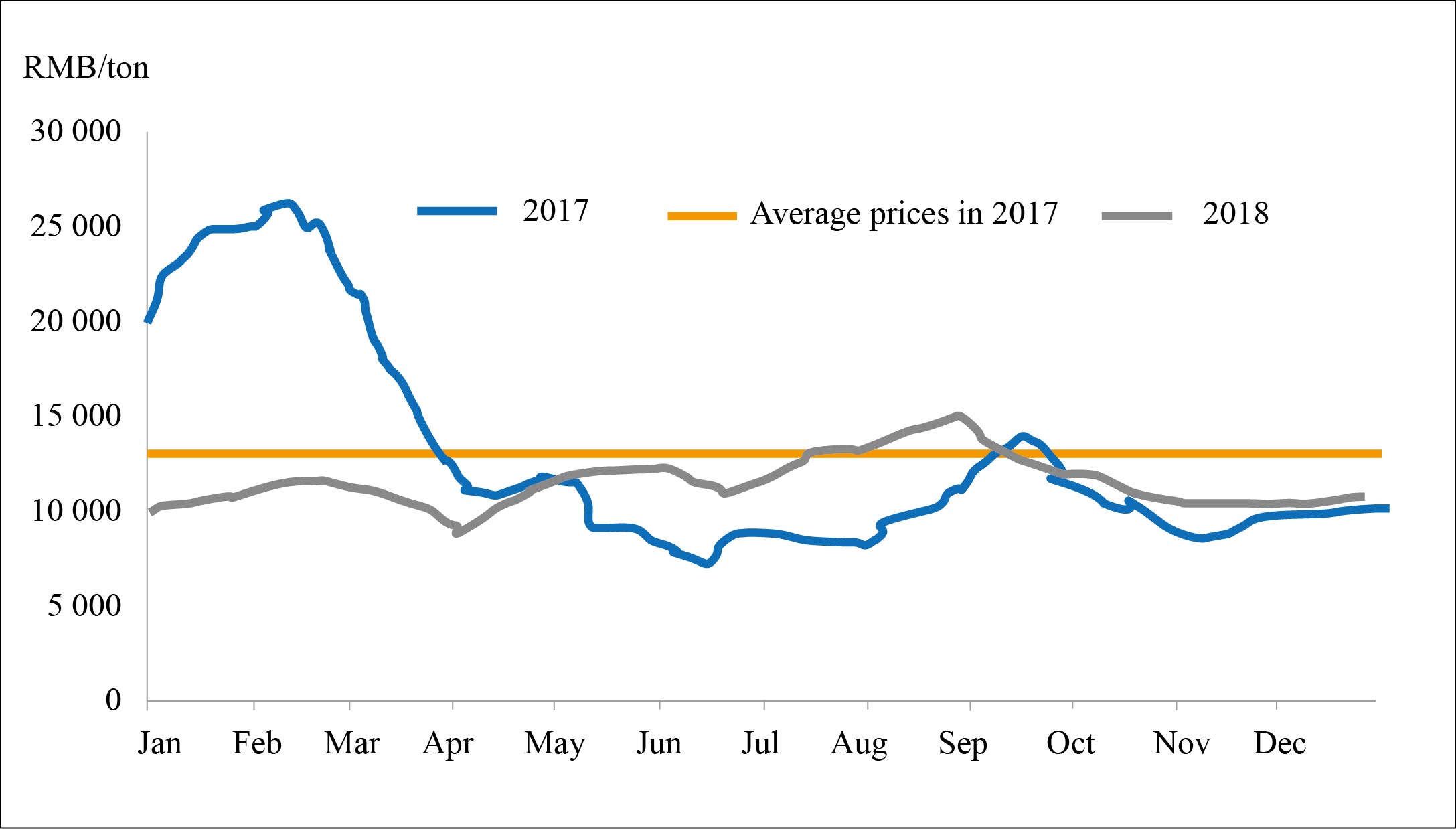

The range of China’s domestic butadiene (BD) prices narrowed significantly in 2018 (as shown in Figure 1 below). Take the market in Jiangsu for instance: BD prices in the region were at RMB9 600-14 600/t in 2018, with the yearly peak slumping and bottom rising from the 2017 level.

Figure 1 Domestic BD prices in 2017-2018

Supply increased, while demand registered negative growth

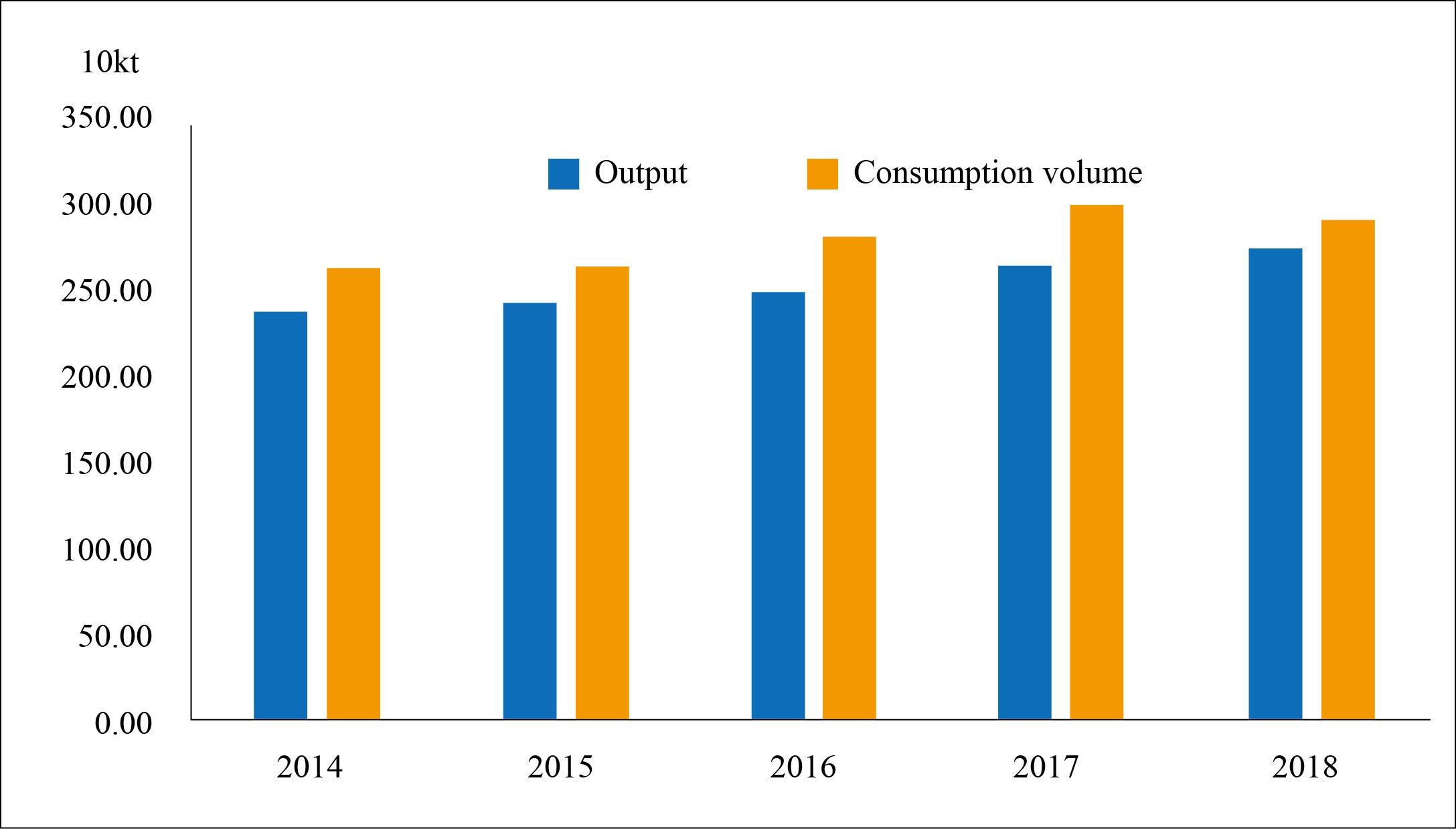

China’s BD capacities increased by 180 kt/a year on year to 3.889 million t/a in 2018, and domestic BD output is estimated to rise to above 2.75 million tons, up by 4.15% year on year. The increase in supply is mainly because of the normal operation of newly started up BD plants at Jiangsu Sailboat, Shenhua Ningxia Coal Industry Group (SNCIG), BlueStar Puyang and CNOOC and Shell Petrochemical Company Limited (CSPC) phase II project.

Figure 2 Domestic BD production and sales in 2014-2018

Domestic BD demand fell by 2.32% year on year to below 3 million tons in 2018. The first demand decline in nearly five years was mainly because maintenance shutdowns and cost factors weighed down styrene butadiene rubber (SBR) and butadiene rubber (BR) production in the second and third quarters of the year. And this was in spite of the marginal demand increase from the acrylonitrile-butadiene-styrene (ABS), styrene-butadiene-styrene (SBS), acrylonitrile-butadiene rubber (NBR) and rubber latex industries.

Downstream consumption structure changed in 2018. SBR and BR industries in combination contributed to less than 50% of domestic BD consumption, which was five percentage lower than the 2017 level. However, the BR industry remains the largest downstream consumer of BD, taking up a share of around 29%. There was no significant increase in consumption into the ABS sector, but with a higher share. The proportion of NBR latex and styrene-ethylene-butadiene-styrene (SEBS) in BD consumption also inched up, boosted by their increased output.

Fewer imports, more exports

Domestic BD supply decreased in the second and third quarters of 2018, due to a string of plants’ maintenance shutdowns. However, as overseas prices were much higher than domestic prices and as domestic demand was weak, some market players opted to export BD, which worsened the already tight domestic supply. Incomplete statistics showed that during that period, China’s BD exports hit a five-year high at 10 -20 kt.

Meanwhile, China’s BD import volume dropped notably due to high overseas prices and weakened demand as domestic synthetic rubber plants reduced their run rate to even below 40% in June-July. BD imports into China plummeted by 82% year on year from June to August 2018. Throughout the whole year 2018, China imported around 300 kt of BD, down by 11% year on year.

Of China’s major BD import origins in 2018, imports from Holland surged, and the country took a share of 25%, followed by Asian suppliers, including South Korea, Singapore, Taiwan, Thailand and Indonesia, which together accounted for around 40% of the total BD imports into China. The import volume from the Middle East decreased.

Ample BD supply in 2019

New BD plants at Inner Mongolia Jiutai Energy, Zhejiang Refining and Chemical and Nanjing Chengzhi Yongqing Energy, with capacities totalling 370 kt/a are expected to start up in the first half of 2019. If these plants become operational as scheduled, they will bring China’s BD capacities to 4.259 million t/a in 2019, up by 7.58% year on year. Most of the new BD plants are invested by private capitals, which means a possible fall of Sinopec and PetroChina’s proportion in total domestic BD capacities. In terms of capacity distribution, the capacity proportion of East China will continue to increase and so is case for the oxidation dehydrogenation process.

As for turnaround plans in 2019, only Lanzhou Petrochemical and Dushanzi Petrochemical plan for a major maintenance in the second and third quarters. However, as their turnaround will involve both upstream and downstream units, this will have limited impact on the BD market. Hence, domestic BD supply is expected to be relative ample in 2019, while import volume might shrink and China’s reliance on BD imports might decline further.

BD demand to increase in 2019

Capacity additions in downstream industries in 2019 will concentrate in the solution polymerized butadiene styrene rubber (SSBR), SBS, ABS and SEBS sectors. If the new plants will come on stream as planned, they will push up domestic BD consumption to around 3.05 million tons in 2019, up by around 4% year on year. The capacity increase in the emulsion polymerized butadiene styrene rubber (ESBR), BR, NBR and rubber latex industries might be limited. The overall utilization rate of these units is not high as the markets of these products are relatively saturated.

The growth in domestic BD supply is expected to outpace that in demand in 2019. Given abundant supply situation in China, the average domestic BD prices will likely trend lower to below the 2018 level. The prices in the first half of 2019 will be higher than those in the second half, when most of the new capacities will come on line.