By Du Shuoren, Creative and Strategy Department of Sinopec Group

At present, 97% of paraxylene (PX) in China is used in the production of purified terephthalic acid (PTA) and the rest is applied in fields such as medical intermediate (DMT), coating and solvents. PX import volume hit a record in 2018 and at the same time, many new large-sized PX plants have been or will be put into production, so it is forecast that the domestic PX industry will have a turning point in 2019.

Downstream demand to rise sharply

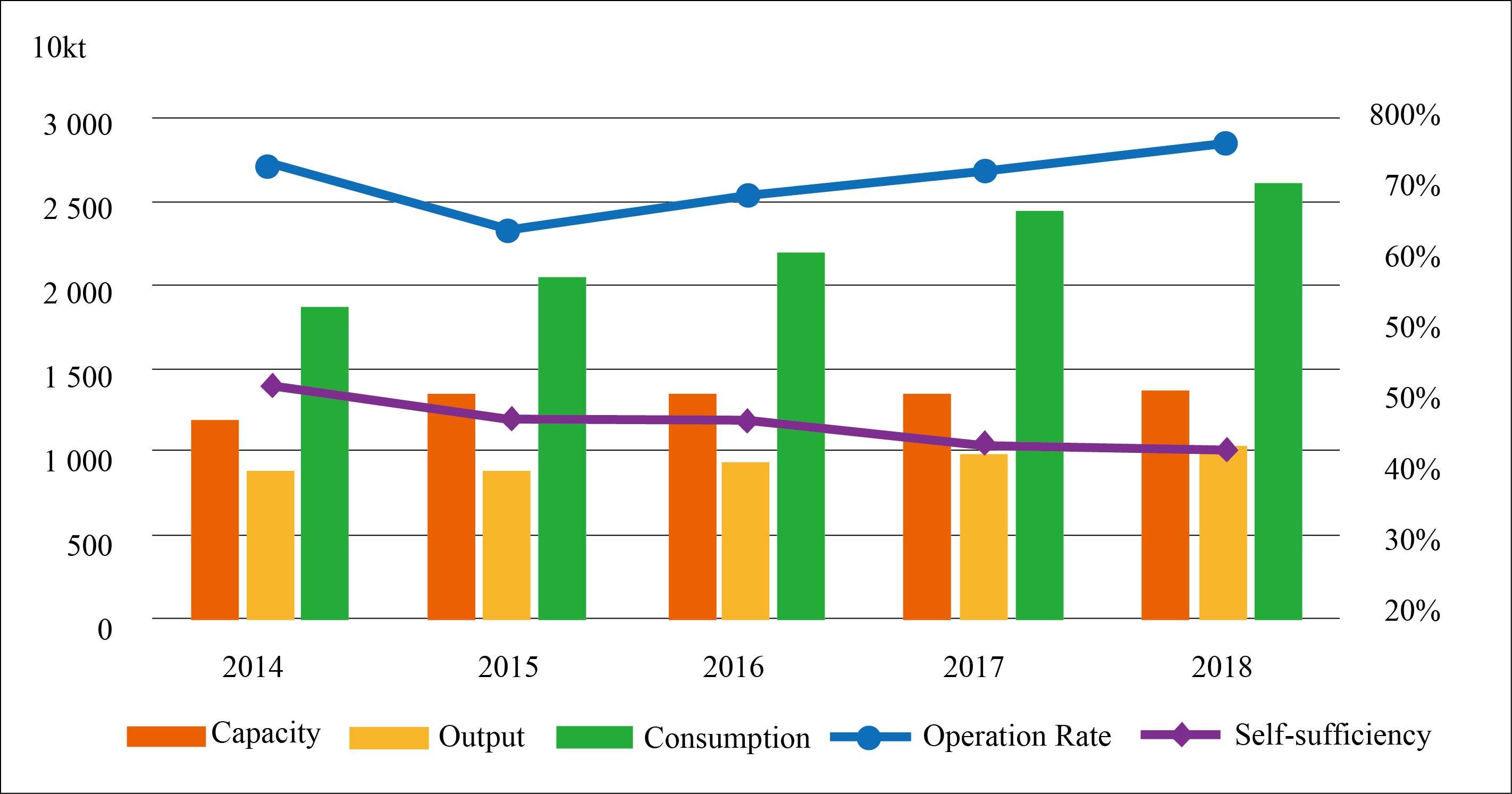

Fuelled by fast-growing polyester (PET) market, PX consumption increased rapidly during the period of 2014-2018. According to Figure 1, PX demand exceeded 26 million tons in 2018, an increase of 7.3% year on year. With no new capacities coming online, the overall operating rates of PTA plants rose to around 85%, as Tongkun Petrochemical’s 2.2 million t/a unit has been running stably since its start-up at the end of 2017, as well as Yuandong Petrochemical and Xianglu Petrochemical have resumed production from shutdowns. Many PET grades improved. For example, PFY output enjoyed a year-on-year increase of 12% in 1H 2018 and the growth slowed in 2H; PET bottle chip export volumes reached 2.23 million tons by October, a rise of 540 kt year on year and higher than the total export volume through 2017. Thus the PTA market was fairly balanced in the first three quarters of 2018, lending support to PX consumption.

Figure 1 China PX supply and demand, 2014-2018

PX demand will increase to 28 million tons in 2019, as PTA consumption will be driven by capacity ramp-ups in PET industry. There will be a total of over 4 million t/a of PFY and PSF capacities, led by Xinfengming, Suqian Yida and Jiaxing Yipeng, coming into production in 2019. This, combined with 5 million tons in 2018, translates into a big appetite for PTA. Meanwhile, the ban on importing plastic scraps has less influence on PTA demand growth. In 2018, the import volume of scrap PET bottle chip dropped to 20 kt versus the volume of 2.5 million tons in 2017. PTA capacities will not increase sharply in 2019, with only Sichuan Shengda Chemical’s 1.2 million t/a plant to be started up in 1H. Plus the start-up of Hengli’s Phase IV 2.2 million t/a plant at the end of 2018, PTA capacities will reach 50 million t/a, output will be 41 million tons and their demand for PX will be over 27 million tons in 2019.

More supply channels to enhance competition

PX supply has been growing slower than demand for recent years. When downstream demand is increasing sharply in recent 5 years, supply growth is only from Sichuan Petrochemical and Rongsheng Zhongjin, respectively in 2014 and 2015. PX capacities were at 13.79 million t/a and output around 10.6 million tons in 2018, with operating rates at 76.9% and output growth up by 4% year on year. The shortage of supply is mainly because Tenglong Aromatics (now named Fuhaichuang Petrochemical) remained offline after an explosion incident, and due to low operating rates of some plants such as Urumchi Petrochemical. Import volume hit a record of 14.44 million tons in 2017. The volume reached 13.02 million tons during January-October 2018, an increase of 11.2% year on year, and the whole-year volume is estimated at 15.7 million tons. South Korea, Japan and Taiwan remain as three key origins, accounting for 70% of the total.

Domestic PX capacities will increase significantly in 2019, according to Table 1. In details, new plants of Hengli Petrochemical and Zhejiang Petrochemical will be put into production; Sinopec Hainan Refining & Chemical and CNOOC Huizhou will have projects completed and in commissioning; Fuhaichuang Petrochemical’s plant will be running stably after one-year preparation. As a result, the total capacity will reach 24.29 million t/a by the end of 2019 and output will enjoy a year-on-year increase of over 30% to reach 14 million tons.

Table 1 New PX capacities in 2019

Producer | Capacity (kt/a) | Location | Progress | Time for starting production |

Hengli Petrochemical Co., Ltd. | 4 500 | Dalian | Construction completed | Q2 2019 |

Sinopec Hainan Refining & Chemical Phase II | 1 000 | Hainan | In construction | Q3 2019 |

CNOOC Huizhou Phase II | 1 000 | Huizhou | In construction | Q4 2019 |

Zhejiang Petrochemical Phase I | 4 000 | Zhoushan | In construction | Q4 2019 |

Total | 10 500 |

The import volume will decrease slightly in 2019. On one hand, Hengli Petrochemical and Zhejiang Petrochemical’s PX projects have their own downstream PTA units, sharply easing their dependence on imported cargoes. On the other hand, nearby countries such as South Korea and Japan and some Middle East regions are striving to seize Chinese market shares by virtue of their geographic and cost advantages. This, combined with increasing domestic capacities, will offer more access to PX for PTA producers. Therefore, the competition in the PX industry will get more furious, with laggard plants being driven out gradually.

Prices and profits to change

PX prices will move in accordance with upstream crude oil and naphtha trend in a long run, but will be subject to plant maintenance, operating rates of downstream PTA-PET plants, import shipping and unexpected events in the short term.

PX prices kept rising during 2016-2017 in line with a stable increase in crude oil prices. With a price spread between PX and naphtha at RMB3 000/t, PX players reported a lucrative profit. PX prices were stable in 1H 2018 and rose sharply in Q3. In September alone, Asian contract prices reached US$1 340/t, China’s domestic prices were even close to RMB12 000/t and the spread between PX and naphtha was across RMB5 000/t, as a result of tight import supply due to maintenance shutdowns, strong demand from highly operated downstream textile industry and high crude oil prices. PX prices fell back sharply in October on decreased crude oil prices and lower PTA operating rates. However, the overall price level of PX was relatively high through 2018, as it is roughly estimated that average PX price was at RMB8 450/t, up by 22.7% year on year, and gross margin was around RMB3 600/t, an increase of 24.6% year on year.

Brent crude oil prices were averagely around US$72/bbl in 2018 and are expected to fall in 2019; PX prices will be averagely lower than the level in 2018. In early 2019, PX supply will remain tight, as Hengli Petrochemical and Tenglong Aromatics are at early production stage. The spread between PX and naphtha will be sound. In May, PX prices will be revised down rapidly following stable plant operation and market expectations, which will squeeze gross margin. In addition, the upcoming start-up of plants at Zhejiang Petrochemical, Sinopec Hainan and CNOOC Huizhou will have direct influence on the PX prices. Therefore, the spread between PX and naphtha is expected to shift to a low level of RMB2 500-2 800/t in 2019.