Year:2018 ISSUE:11

COLUMN:ORGANICS

Click:292 DateTime:Jun.08,2018

By Wang Hongqiu, PetroChina Petrochemical Research Institute

Capacity will keep growing rapidly

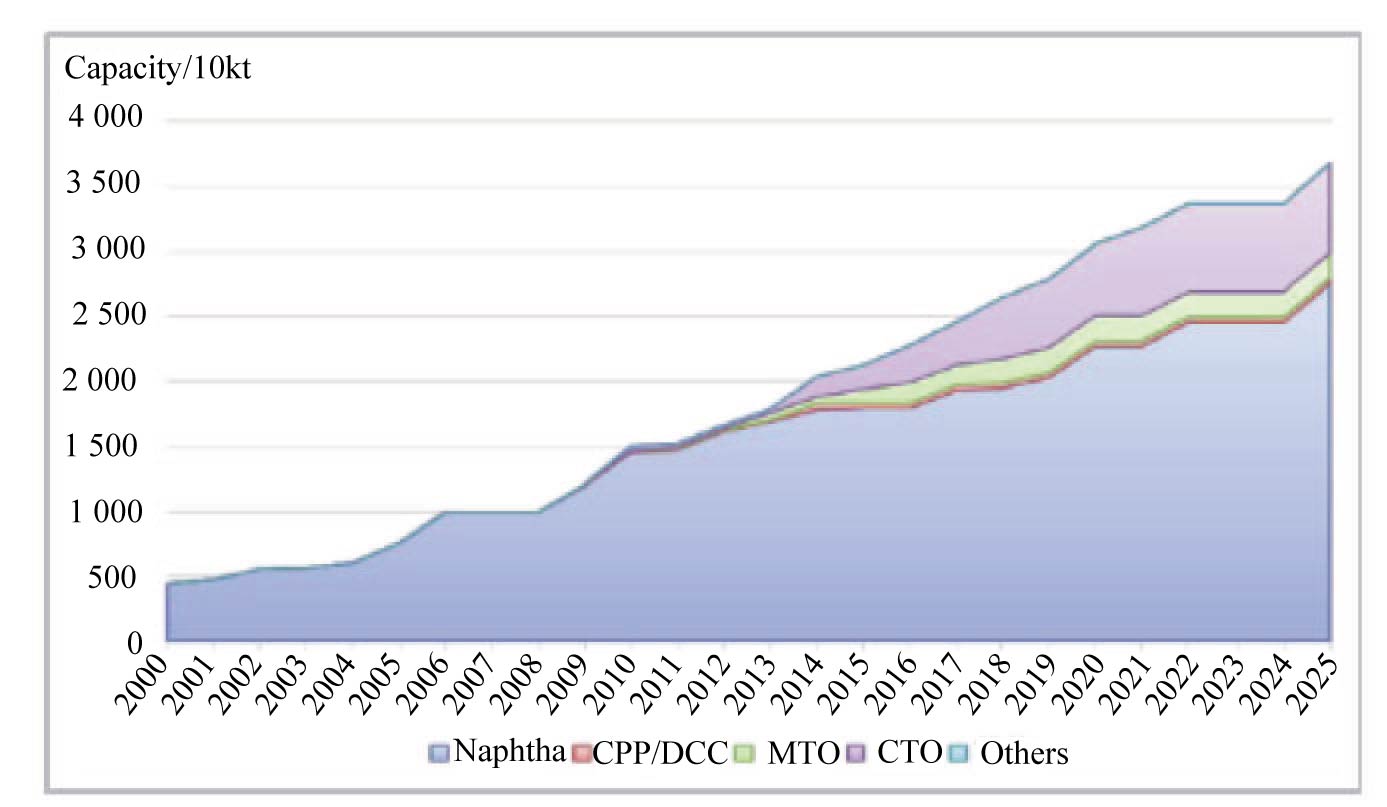

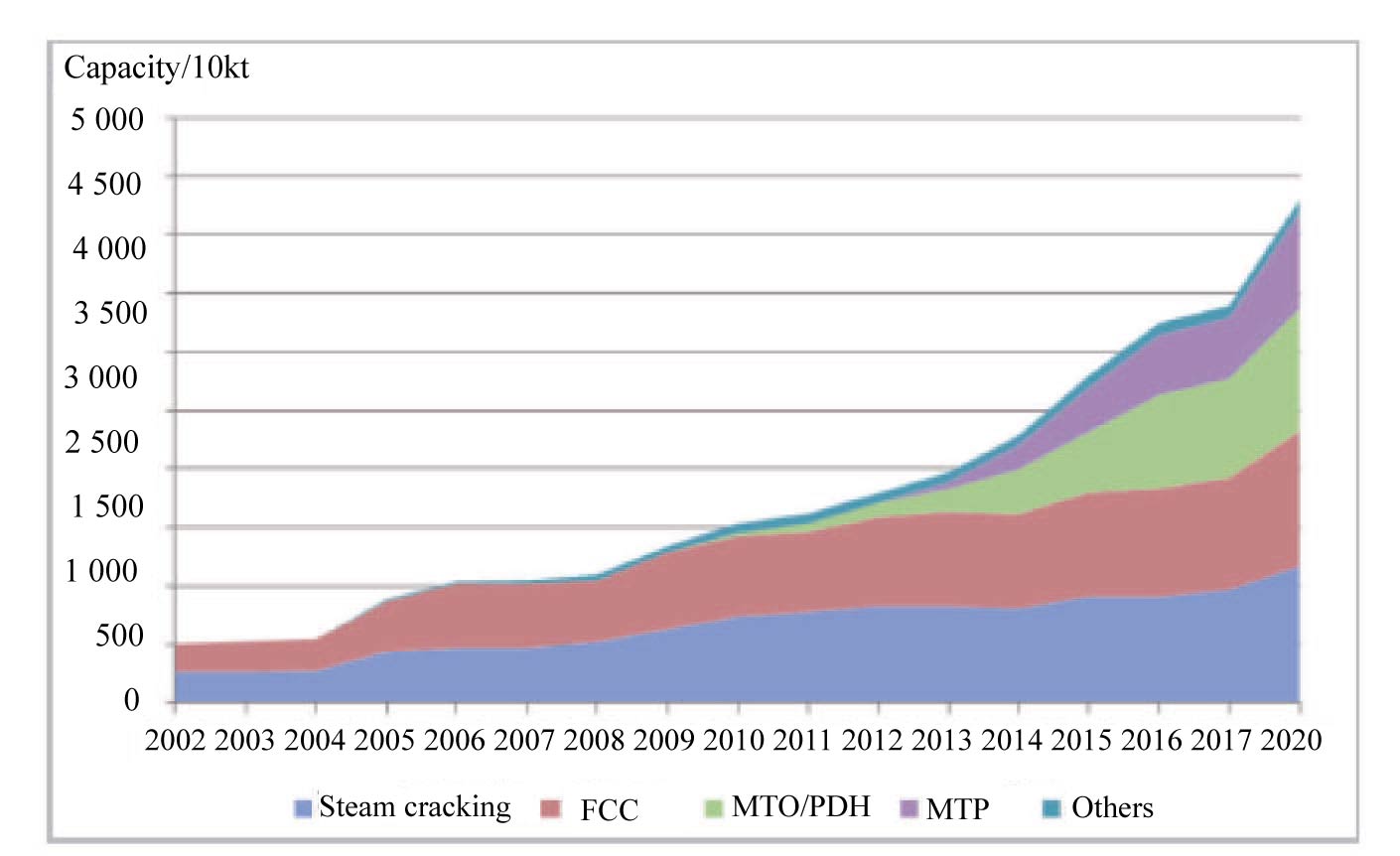

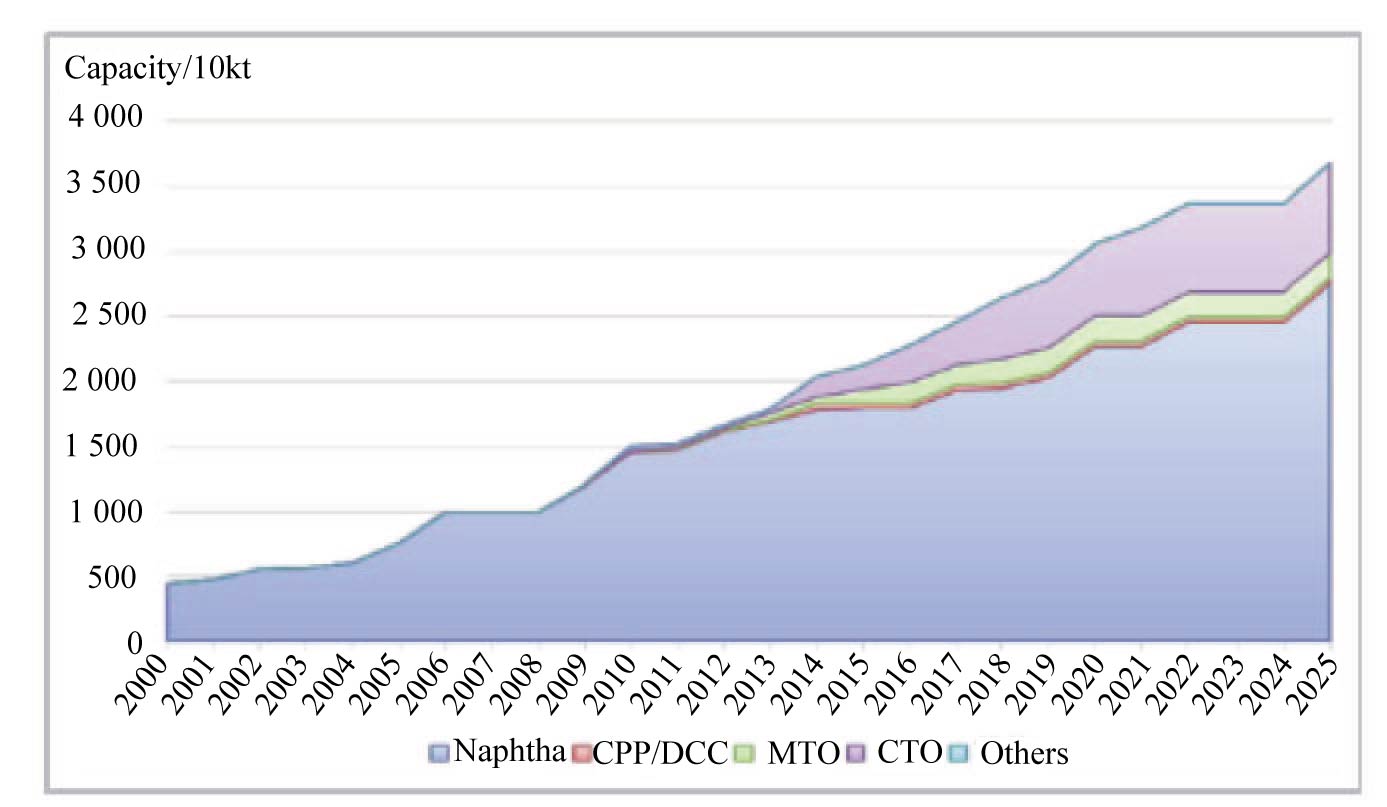

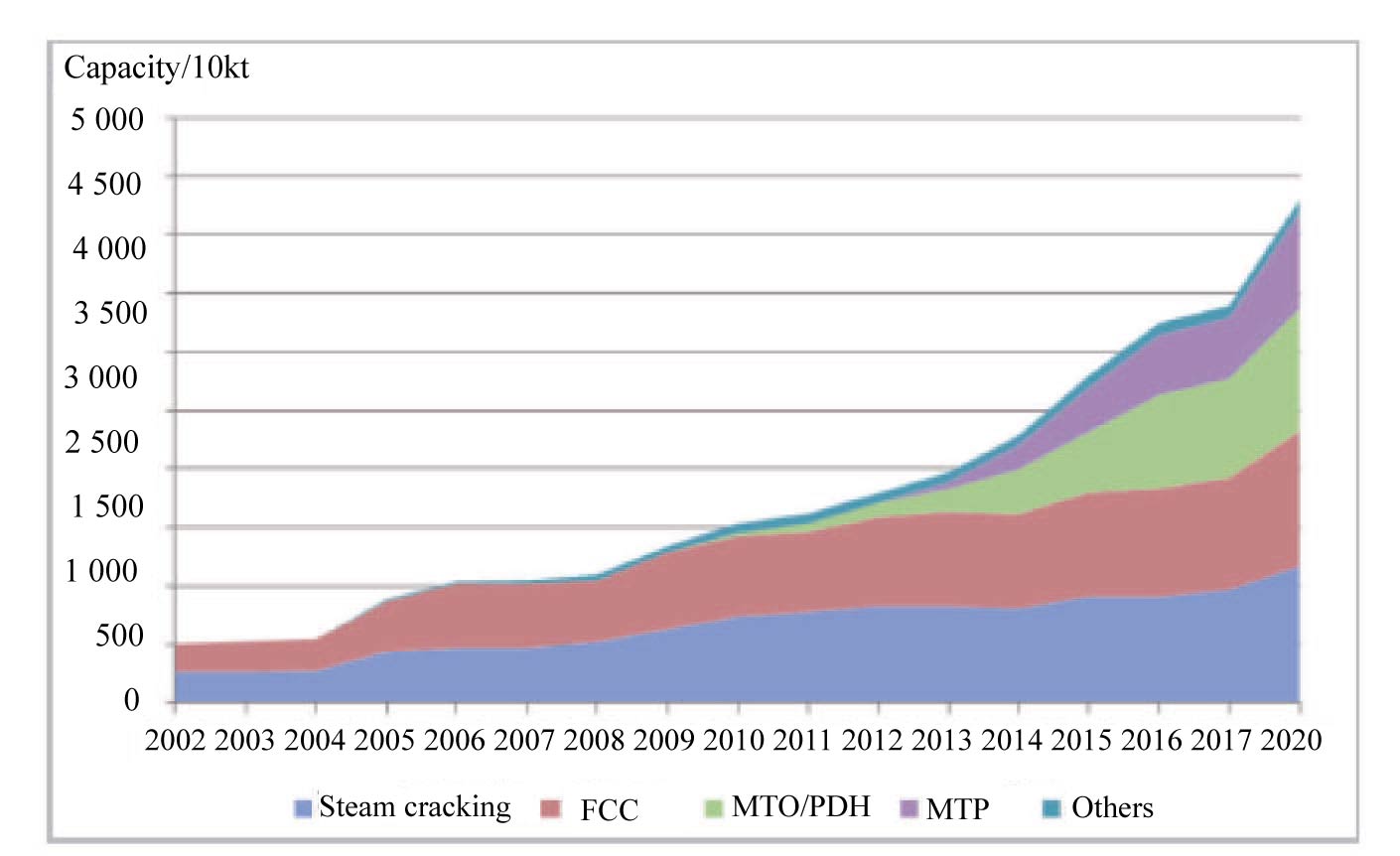

Ethylene production capacity in China increased from 4.422 million t/a in 2000 to 23.465 million t/a in 2017, and is likely to exceed 32.00 million t/a by the end of the Thirteenth Five-Year Plan period. The proportion of ethylene capacity using non-traditional processes grew from 3% in 2010 to 18% in 2017, and will likely decline by 2020 (See Figure 1). Propylene capacity has grown even more rapidly, increasing from 5.02 million t/a in 2002 to 33.96 million t/a in 2017. Prodution processes have been diversified. The capacity from the coal (methanol) chemical industry is over 8 million t/a. Propylene capacity in propane dehydrogenation units is around 5.5 million t/a. around 40% of China’s propylene capacity now uses non-traditional methods. By 2020, propylene capacity will likely reach 42.00 million t/a, while still, around 40% will be using non-traditional processes (See Figure 2).

Figure 1 Ethylene capacity development trend in China

Figure 2 Propylene capacity development trend in China

Ethylene-related import will remain quite big

China made 18.24 million tons of ethylene in 2017, and the equivalent consumption was around 42.5 million tons. Great quantities of ethylene downstream derivatives such as polyethylene and ethylene glycol must be imported. Around 20 million tons of ethylene downstream derivatives will be imported in 2020.

Propylene output in 2017 was 27.36 million tons, and equivalent consumption was around 34.68 million tons, a gap exceeding 7 million tons. In addition to 3.10 million tons of imported propylene, more than 4 million tons of propylene downstream derivatives must be imported from abroad. Around 7 million tons of propylene and downstream derivatives will likely be imported in 2020.

Large scale, integration and industry bases will become trends

With the completion of large new ethylene units and the renovation of existing units, the scale of ethylene units in China using the steam cracking process has increased constantly, reaching 636 kt/a (not including currently idle units such as the unit of Beijing Oriental Petrochemical Co., Ltd.), an increase of 40% over 2008. Thirteen units’ capacities exceed 800 kt/a, nine more than 2008. “Planning and Layout Scheme of Petrochemical Industry” issued by the National Development and Reform Commission in 2015 specifies that new ethylene projects should be situated in seven large petrochemical industry bases, their construction should meet requirements for refining/chemical integration and (large) scale, and the capacity of a new ethylene unit should exceed 1 million t/a.

Major players will become more diverse

With ethylene projects already completed by joint venture enterprises such as BASF-YPC Co., Ltd., CNOOC-Shell Petrochemical Co., Ltd., Sinopec SABIC Tianjin Petrochemical Co., Ltd., Fujian Refining & Petrochemical Co., Ltd. and Sinopec-SK (Wuhan) Petrochemical Co., Ltd. and the completion of CTO/MTO projects by Shenhua Baotou Coal Chemical Co., Ltd., Sinopec Zhongyuan Petrochemical Co., Ltd. and Ningbo Heyuan Chemical Co., Ltd., the ethylene market in China now has four major supply systems – state-owned enterprises, joint venture enterprises, CTO/MTO enterprises and importers. With further opening of the market, private enterprises and local enterprises will participate in downstream products. A market pattern will gradually form with diverse players including coal chemical enterprises, private petrochemical enterprises, local petrochemical enterprises and the large state-owned petrochemical enterprises.

Adoption of light, high-quality raw materials for cracking will quicken

When crude oil prices are low, decision makers have greater latitude for optimizing the production of olefins from naphtha. Owing to adjustments made to the refining/chemical structure, more low-cost, high-quality raw materials now enter ethylene cracking units. Companies such as Zhejiang Satellite Petrochemical Co., Ltd. and Yantai Wanhua Chemical Group Co., Ltd. plan to use ethane and LPG purchased from outside sources as raw materials. Various ethylene producers have also made big strides in recent years to strengthen the organization and utilization of light, high-quality raw materials such as light oilfield hydrocarbons, condensates and light refinery hydrocarbons. Consumption of such materials has increased constantly, reaching 25.7% of all raw materials in 2017.

The olefin industry in China is developing rapidly today. Private enterprises have become a major force in the polyester and synthetic fiber sectors. Some large private enterprises with great strength are marching upstream in the industrial chain. A large refining/chemical project to be constructed by Zhejiang Petrochemical Co., Ltd. in Zhoushan has attracted the greatest attention. The project was approved by Zhejiang Development and Reform Commission on May 8, 2017. It will be built in two phases from 2017 to 2021, each including 20.00 million t/a oil refining capacity, 4.00 million t/a xylene capacity and 1.40 million t/a capacity for ethylene and downstream chemical products. The total investment of the project is RMB173.09 billion. The first phase was launched in July 2017, and production is planned to start at the end of 2018.

Another refining/chemical project, to be constructed by Shenghong Group in Jiangsu Lianyungang Petrochemical Industry Base, is getting publicity prior to approval. The plan includes 16.00 million t/a oil refining capacity, 2.80 million t/a xylene capacity, 1.10 million t/a capacity for ethylene and downstream chemical products. A 20.00 million t/a refining/chemical integrated project in Hengli Petrochemical Co., Ltd. is undergoing construction and installation.

The coal chemical industry in China has entered a period of adjustments, but it still impacts on oil-based olefins. After the completion of China’s first CTO unit in Shenhua Baotou Coal Chemical Co., Ltd. in 2010, the coal chemical industry developed rapidly. By the end of 2017, coal-based ethylene capacity had reached 4.53 million t/a, while coal-based propylene capacity had reached 8.00 million t/a. With the drop of crude oil prices, the increasing severity of environmental standards and the relative scarcity of water in China, CTO/MTO projects have lost their advantages. Although more than 10.00 million t/a the capacity of CTO/MTO projects are being constructed or planned for construction, at a time of low oil prices, the new capacity that can profitably be put on stream on schedule is very small.

Demand for petrochemical products will keep increasing steadily, and greater attention will be paid to product quality, performance and variety. The market for ethylene downstream products in China is being hit with low-cost petrochemical products from the Middle East. The high-end market is occupied mainly by imports from Europe, Japan and the United States. With the release of new capacity, undifferentiated products will fight for declining prices and differentiated products will fight for access to the high-end market. Competition will be fiercer and there will be higher, newer and more detailed requirements for product quality, variety and function.