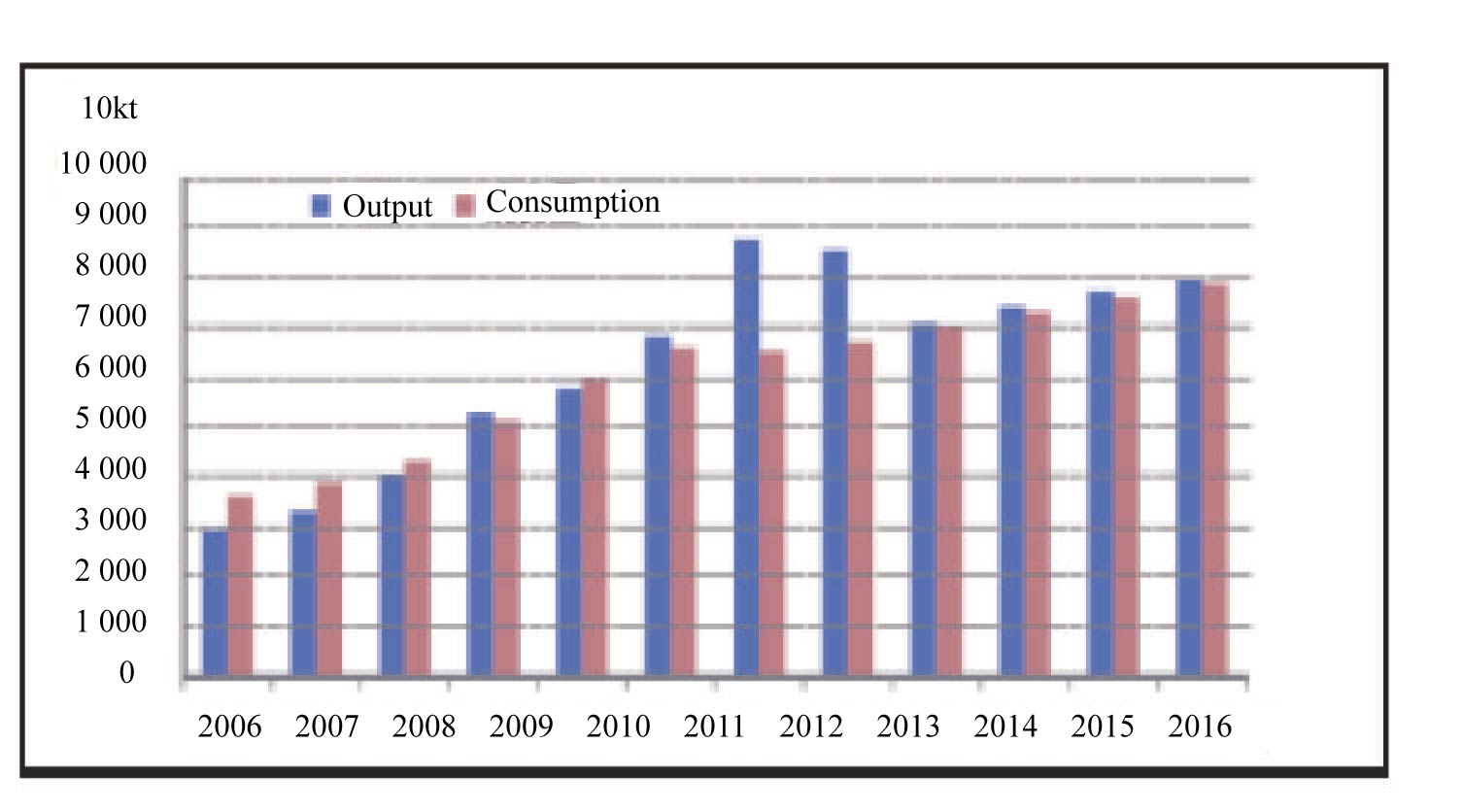

Global fuel ethanol production and consumption have grown rapidly. In 2016, global biofuel ethanol production was 79.78 million tons, after an average annual increase of 7.3% from 2005 to 2016, as shown in Chart 1. More than 40 countries and regions now promote bio-fuel ethanol and ethanol gasoline, and annual consumption of ethanol gasoline is about 600 million tons, or about 60% of global gasoline consumption.

Chart 1 Global fuel ethanol production & consumption, 2005-2016

Domestic supply shortage

In 2017, China's fuel ethanol production capacity reached 3.045 million t/a, and many capacity development projects have been proposed. Table 1 shows the capacity and respective raw material of China's fuel ethanol produced in 2017, and Table 2 shows some of the fuel ethanol projects under construction, proposed, and planned.

Table 1 China's fuel ethanol production enterprises, 2017

Producer | Raw material | Capacity (kt/a) |

Henan Tianguan Group Fuel Ethanol Co., Ltd. | Wheat/corn /yams | 700 |

Jilin Fuel Ethanol Co., Ltd. | Corn | 600 |

Anhui Fengyuan Group Co., Ltd. | Wheat/corn | 440 |

Jilin Boda Biochemical Co., Ltd. | Corn | 300 |

COFCO Biochemical Energy (Zhaodong) Co. Ltd. | Corn | 280 |

Guangxi COFCO Biomass Energy Co. Ltd. | Cassava | 200 |

Guangdong Bio Energy Co. Ltd. | Cassava | 150 |

Yanchang Petroleum - Dalian Institute of Chemical Physics | Coal | 100 |

Zhongrong Science & Technology Co. Ltd. | Coal | 100 |

Shandong Longli Ethanol Technology Co. Ltd. | Corn cobs | 55 |

Liaoyuan Jufeng Biochemical Co. Ltd. | Corn | 50 |

Zhongxing Energy Co. Ltd. | Sweet sorghum stems | 30 |

Jinan Shengquan Co. Ltd. | Cellulose | 20 |

Shandong Zesheng Bio Technology Co. Ltd. | Corn stalks | 20 |

Total | 3 045 |

Table 2 Some fuel ethanol projects under construction, proposed and planned

Producer | Raw material | Capacity (kt/a) | Status |

Sinopec | Cassava | 100 | Under construction |

Meijie Guozhen Green Refinery Co., Ltd. | Cellulose | 182 | Under construction |

SDIC/Tiefa Coal Group | Corn | 300 | Under construction |

Jilin Tianlong Industrial Co., Ltd. | Cellulose | Proposed | |

Jilin Fuel Ethanol Co., Ltd. | Cellulose | 80 | Prepared for construction |

Inner Mongolia Shiqi Co., Ltd. | Corn | 300 | Prepared for construction |

COFCO Biochemical Co., Ltd. | Cellulose | 100 | Planned |

Total | 1 062 |

The fuel ethanol industry is driven by national policies. Demand for China's fuel ethanol depends on the demand for vehicle gasoline, the promotion of ethanol gasoline around the country, and the blend proportion of ethanol gasoline. In 2017, China promoted use of fuel ethanol in 11 provinces, including all the areas of Heilongjiang, Henan, Jilin, Liaoning, Anhui and Guangxi provinces and some areas of Hebei, Shandong, Jiangsu, Inner Mongolia and Hubei provinces.

On September 13, 2017, 15 ministries and commissions including the National Development and Reform Commission, the National Energy Administration, and the Ministry of Finance jointly issued the “Implementation Plan for Expanding Biofuel Ethanol Production and Promoting the Use of Automotive Ethanol Gasoline” and proposed that by 2020, ethanol gasoline should be used throughout the country. Gasoline consumption is expected to be reduced by 33.43 million t/a in the next three years. In 2020, the annual consumption of fuel ethanol in China will reach 15.7 million tons. The current domestic ethanol capacity falls about 12.65 million t/a short of 2020 requirements.

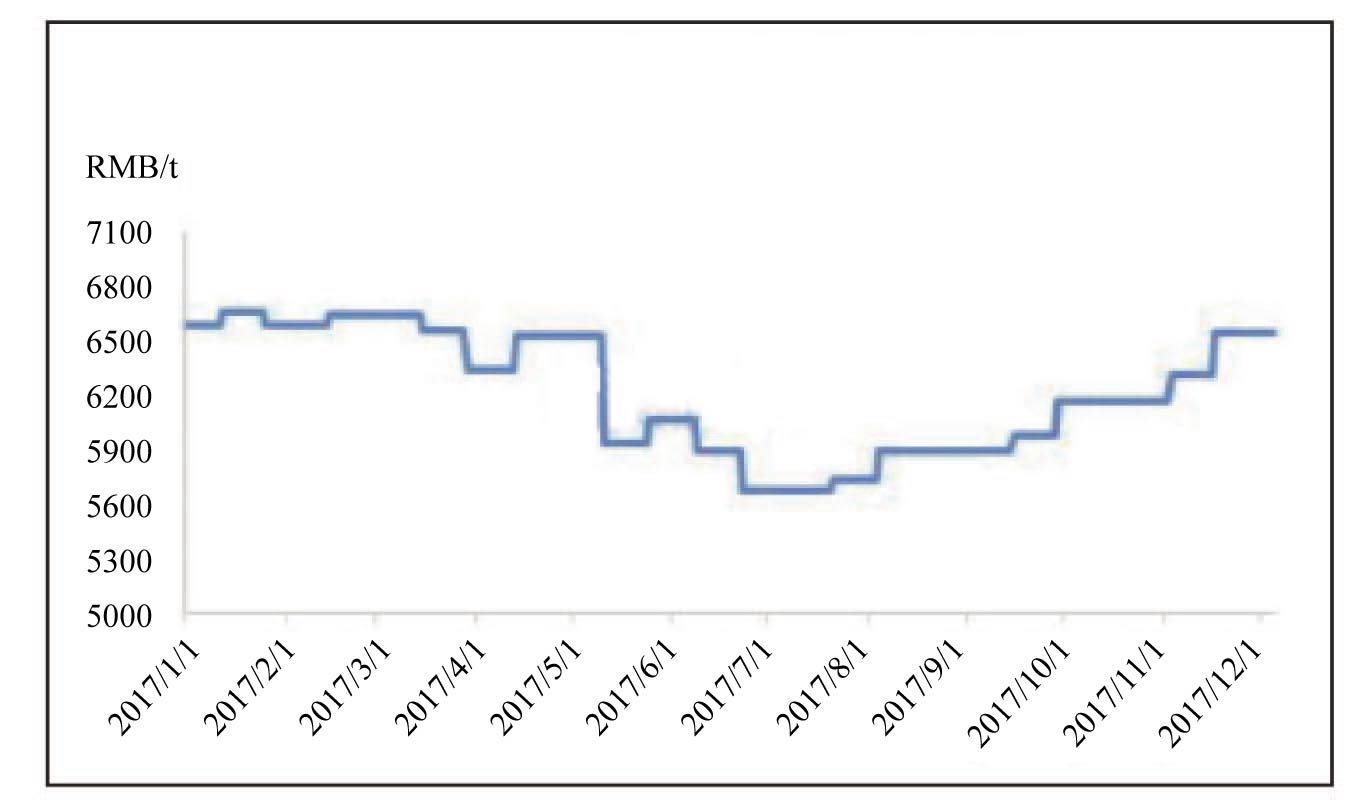

An approval system now exists for fuel ethanol, and the production and distribution of fuel ethanol are restricted in certain areas. Fiscal and taxation preferential policies are also in place. The retail prices of fuel ethanol are subject to the policy of multiplying the 93# gasoline ex-factory price by 0.911. The theoretical price of fuel ethanol in China in 2017 is shown in Chart 2. It can be seen that the overall price trend of domestic fuel ethanol is between RMB5 500 to 6 600/t.

In

In

Chart 2 China’s fuel ethanol prices, 2017

2017, China's ethanol import and export market continued to change. After the modified ethanol tariff was increased to 30%, the import volume decreased in 2017 to 9 000 tons, a sharp drop of 98.71% year-on-year. At the same time, due to corn alcohol export tax rebates and subsidies, the export volume of unmodified ethanol reached 131 000 tons, a sharp increase of 309.38% year-on-year. As for the export ports, 95.38% of exported ethanol was sent from Northeast China and Inner Mongolia. It can be seen that the tax rebate has increased the international competitiveness of China's ethanol.