By Song Binbin, CNPC Northeast Refining & Chemical Engineering Co., Ltd. Jilin Design Institute

Acetonitrile is an important organic chemical intermediate and is produced mainly via direct synthesis routes and an indirect process. The indirect route is the mainstream acetonitrile production route both in China and abroad. It extracts acetonitrile from the by-product of acrylonitrile production via propylene ammoxidation. Direct synthesis routes include reaction of acetic acid and ammonia, reaction of methanol and ammonia, ethane ammoxidation, acetylene ammoniation, acetylation, reaction of propane and ammonia, and reaction of ethanol and ammonia.

Imprudent capacity expansion leads to oversupply

In 2017, China’s acetonitrile capacity reached 102 kt/a, but output was only about 59.5 kt. At present, the acetonitrile producers in China either get acetonitrile as a byproduct from acrylonitrile production or get it directly from reaction of acetic acid and ammonia. The capacity employing the byproduct route amounts to 62 kt/a, with output at 51.5 kt, and capacity employing synthesis totals 40 kt/a, with output at 8 kt. Plants are located mainly in East China and Northeast China. Table 1 shows China’s acetonitrile producers and their respective capacities in 2017.

Table 1 China’s acetonitrile producers, 2017

| Region | Producer | Capacity (t/a) | Process |

| Northeast China | Daqing PC | 2 400 | Byproduct route |

| Daqing Refinery | 2 400 | Byproduct route | |

| Jilin PC | 13 500 | Byproduct route | |

| Fushun PC | 2 760 | Byproduct route | |

| Northwest China | Lanzhou PC | 1 050 | Byproduct route |

| East China | Shanghai PC | 3 900 | Byproduct route |

| Anqing PC | 6 300 | Byproduct route | |

| Qilu PC | 2 400 | Byproduct route | |

| Ke Luer Chemical | 3 900 | Byproduct route | |

| Shanghai SECCO | 15 600 | Byproduct route | |

| Jiangsu Sailboat | 7 800 | Byproduct route | |

| Nantong Acetic Acid | 500 | Synthesis route | |

| Weifang Zhonghui | 500 | Synthesis route | |

| Tongying Shida Hongyi | 500 | Synthesis route | |

| Zibo Jinma | 10 000 | Synthesis route | |

| Linyi Yurong Fine Chemical | 5 000 | Synthesis route | |

| Shandong Huihai PHARM | 5 000 | Synthesis route | |

| North China | Hebi SECCO Chemical | 5 000 | Synthesis route |

| Total | 102 010 |

China’s apparent consumption of acetonitrile in 2017 was 44 kt, and the export and import volumes were respectively 9 000 tons and 1 500 tons. Most of the imports were high-quality acetonitrile, such as products with a purity of 99.999% (mass fraction). Before 2010, China’s acetonitrile products were mostly obtained as byproducts of acrylonitrile manufacture, and output was low. However, since 2010, some producers have started to employ synthesis by reaction of acetic acid and ammonia, and the operating rates of acrylonitrile units increased, resulting in a substantial hike in output, and an oversupply of acetonitrile. So many units using the reaction of acetic acid and ammonia were forced to shut down due to the process’s high cost, and only a few such lines are now running, for in-house use or export.

In the next few years, there will be no newly-built/expanded capacity using the reaction of acetic acid and ammonia as the production route, due to its high cost. Meanwhile, as the demand for acrylonitrile is high, construction or expansion of acrylonitrile plants is hot. It is forecast that the capacity of acetonitrile will reach 135.3 kt/a by 2020. Please refer to Table 2 for China’s new/expanded acetonitrile capacity in coming years.

Table 2 China’s new/expanded acetonitrile capacity in coming years

| Region | Producer | Location | Capacity (t/a) | Status |

| South China | CNOOC Dongfang PC | Hainan | 6 000 | Pre-planning |

| North China | INEOS & BCIG | Tianjin | 7 800 | Pre-planning |

| East China | Zhejiang PC | Zhoushan | 7 800 | Pre-planning |

| Shenghong Refinery | Lianyungang | 7 800 | Pre-planning | |

| Shandong Haili Chemical | Zibo | 3 900 | Was to launch in 2017 | |

| Total | 33 300 |

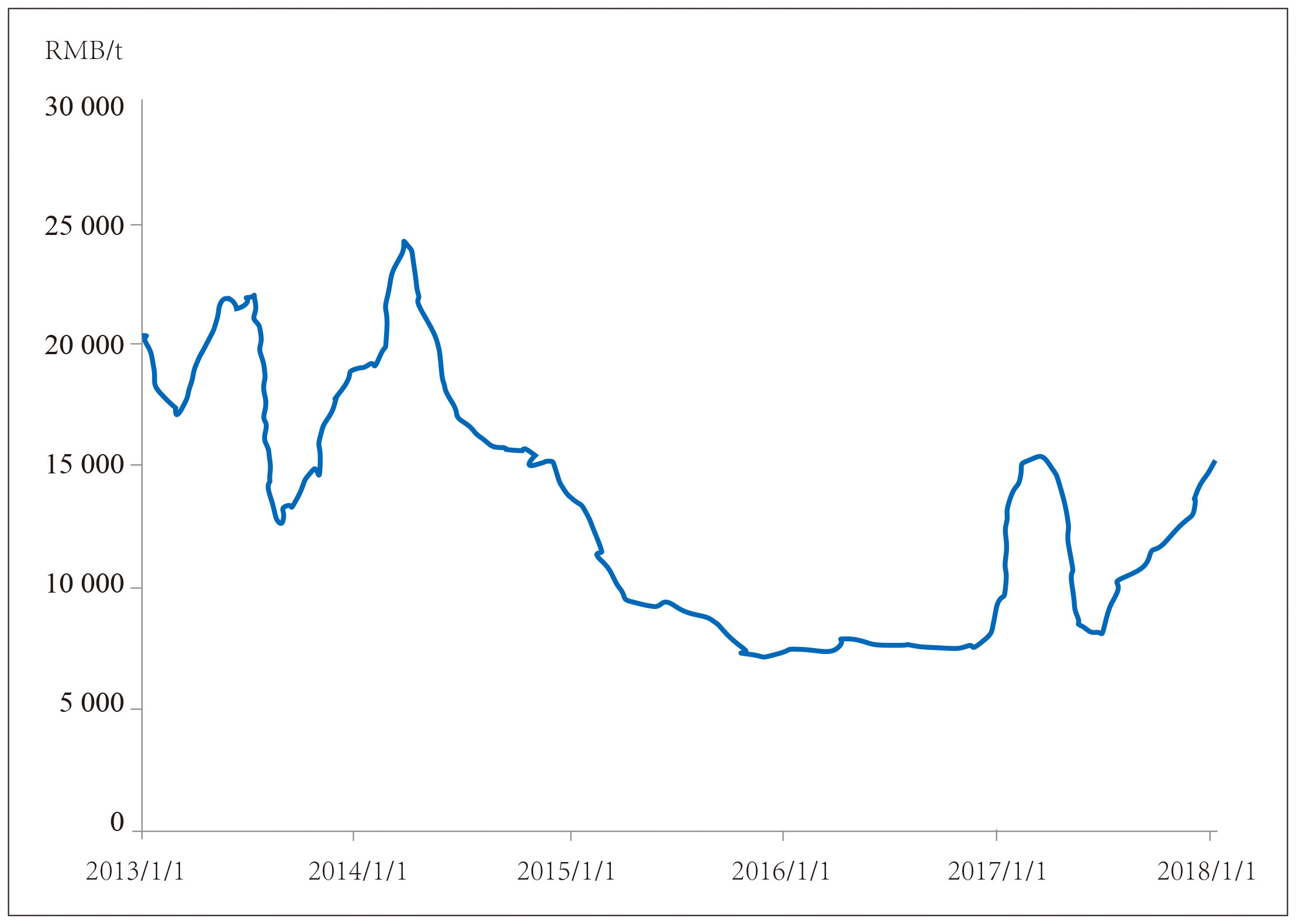

Market prices fluctuate widely

Domestic acetonitrile prices are affected mainly by the prices of crude oil and market fundamentals. In 2008, the prices of acetonitrile increased from RMB17 500 / t at the beginning of the year to RMB60 000 / t at the end of the year, and then climbed to a historic high of RMB120 000 / t in January 2009. The main reason was a short supply caused by low utilization of acrylonitrile plants during the financial crisis. Then, with the economic rebound, acrylonitrile plants’ operating rates started to rise, and prices of acetonitrile gradually returned to a rational level, averaging RMB17 974 / t and RMB17 933 / t in 2013 and 2014 respectively. Crude oil prices started to plunge in the second half of 2014, leading to plummeting propylene and acetonitrile prices. In 2016, the average price of acetonitrile was only RMB7 645 / t. In early 2017, the prices of acetonitrile rose sharply again in response to strong demand, mainly from makers of pesticides and butadiene. Prices of acetonitrile will likely linger in the range of RMB8 000 – 15 000 / t. The average market price of acetonitrile in China from 2013 to 2017 is shown in Figure 1.

Figure 1 The average market price of acetonitrile in China, 2013-2017