By Wang Ying, Transportation & Sales Center of Tianjin Petrochemical Co., Ltd.

Capacity utilization declines

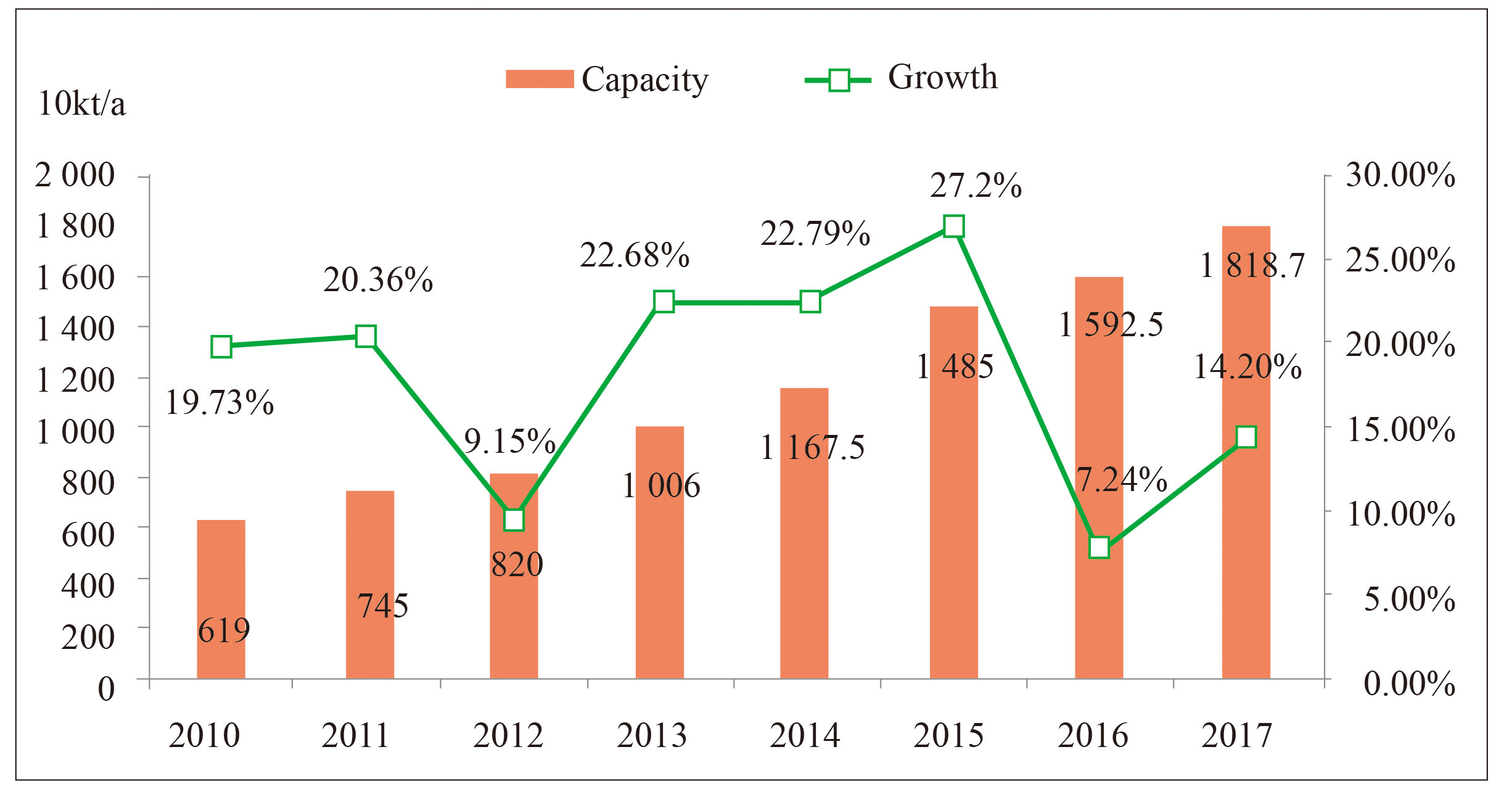

China’s MTBE capacity increased steadily during 2010-2017, with 18% average annual growth. Capacity was 6.19 million t/a in 2010, output was 3.85 million tons and average effective operating rate was 62.2%. Capacity reached 14.85 million t/a in 2015, but output was only 7.0389 million tons and the overall effective operating rate was down to 47.4%. Figure 1 shows the supply trend of MTBE in China during 2010-2017.

Figure 1 Supply of MTBE in China, 2010-2017

As capacity expands continually, capacity utilization is declining, worsening the capacity surplus. Capacity growth slowed substantially after 2015, growing only 7.24% in 2016, and the average effective operating rate of MTBE units went up to 56.6%.

China added 2.262 million t/a of new capacity in 2017 (see Table 1 for detail). There are nine new producers, and eight of them have already started operation. Three of them use the traditional process, one unit uses the isomerization process, three units use the isobutane dehydrogenation process, one unit uses the mixed paraffin dehydrogenation process and one unit uses the PO/MTBE process. As the unit using the PO/MTBE process has huge capacity, capacity growth in 2017 was much faster than in 2016.

Table 1 New MTBE units, 2017

| Region | Producer | Capacity | Process | Overview | |

| Shandong | Dongying | Witt Chemical Co., Ltd. | Project capacity 220 kt/a, matched MTBE capacity 250 kt/a | Isobutane dehydrogenation | Operation started on March 13, daily output 300 tons, to be supplied only to Wanda Tianhong Chemical Co., Ltd. |

| Lushenfa Chemical Co., Ltd. | Project capacity 145 kt/a, matched MTBE capacity 200 kt/a | Isobutane dehydrogenation | Wet commissioning started in mid-March 2017 | ||

| Dezhou | Huachao Chemical Co., Ltd. | Project capacity 200 kt/a, matched MTBE capacity 300 kt/a | Isobutane dehydrogenation | Construction completed in August, wet commissioning not yet started | |

| Heze | Dongming Qianhai Chemical Co., Ltd. | Project capacity 350 kt/a, matched MTBE capacity 280 kt/a | Mixed paraffin dehydrogenation | Operation and wet commissioning started in July, daily output at full load 1 000 tons, 500 tons for in-house consumption | |

| East China | Nanjing | Jinling Huntsman New Material Co., Ltd. | 742 kt/a | PO/MTBE | Operation and wet commissioning started in July, product to be supplied to mainly Sinopec |

| South China | Guangzhou | Huiizhou Refining & Chemical Co., Ltd. Second Phase | 150 kt/a | Traditional C4 process | Operation started on September 22, product to be supplied mainly to CNOOC and Shell Petrochemical Co., Ltd. |

| Huizhou Zhongchuang Chemical Co., Ltd. | Project capacity 300 kt/a, matched MTBE capacity 200 kt/a | Isomerization | Commercial production started on August 20, product to be sold mainly to Huizhou Refinery | ||

| Yunnan | Yunnan Petrochemical Co., Ltd. | 80 kt/a | Traditional C4 process | Operation started in June | |

| Hainan | Dongfang Desen Energy Co., Ltd. | 60 kt/a | Traditional C4 process | Construction started at the beginning of the year, raw materials to be supplied by Dongfang Petrochemical Co., Ltd. through pipeline | |

| Total | 9 | 2.262 million t/a |

Output increases constantly

China’s MTBE output increased constantly during 2011-2017, with around 16.28% average annual growth of output. From 2015 to 2017, output grew year-by-year, with average annual growth of 18.73%, declining in 2017.

MTBE produced by major producers and matched MTBE units in local refineries accounted for 66% of the total in 2017. Completion of large units and a stable supply of raw materials were two major factors for the increased output. Raw materials for new units were supplied mainly by matched units of the MTBE producers themselves. Despite the sustained increase of both capacity and output, output growth slowed substantially, and capacity utilization declined. Annual growth of MTBE output in China will slow to around 2% and gradually stabilize after 2017. Large MTBE producers have absolute advantages in raw material import, sales channels and capital, so they will squeeze the opportunities of medium and small MTBE producers further. The sector faces upgrading and renovation of production units and/or transformation of enterprises.

The rise of apparent consumption remains stable

The apparent consumption of MTBE in China rose steadily during 2015-2017 but began to decline in 2017. Average annual growth in the last three years was 16.1%.

In 2017, the consumption of MTBE for chemical manufacture was 604.2 kt, or 5.43% of the total. The total output of gasoline in China reached 131.516 million tons in 2017. The average rate of adding MTBE to gasoline was around 8%. The consumption of MTBE for oil blending was therefore 10.5213 million tons, or 94.57% of the total. The total consumption of MTBE was 11.1259 million tons.

Schemes for broader application of ethanol gasoline were proposed in Shandong and Tianjin at the end of 2017. State policies indicated at an early date that vehicle-use ethanol gasoline would be used nationwide in 2020. Now, however, it has become evident that steps can hardly be so quick. Moreover, the State Administration of Taxation will issue the “Announcement on Relevant Issues Concerning the Administration of the Collection of Excise Tax for Oil Products” in 2018. The document will lead to a market shakeout, eliminating a large number of oil blenders as major MTBE sales channels.

Application of ethanol gasoline is still at a transitional stage today. Nevertheless, both the government and major and local refineries will make arrangements for going ahead. It is expected that with the evident reduction of oil blending demand in 2018, the demand for MTBE will decline precipitously during 2019-2020. MTBE for chemical manufacture will retain a certain demand.

It is not practical to rely on export to improve the situation

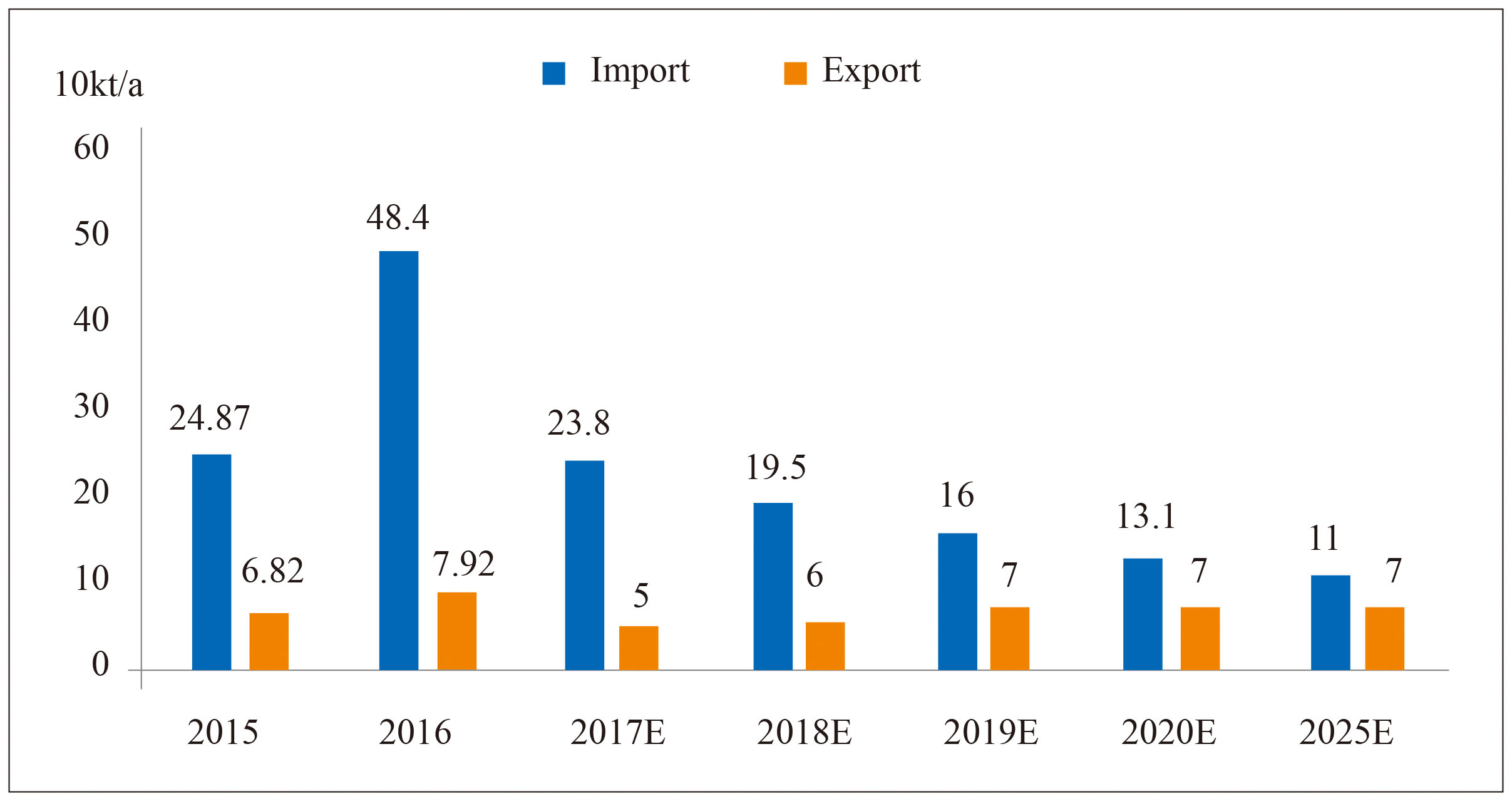

China’s MTBE capacity keeps growing, increasing the supply, and the price of MTBE remains relatively low. The price competitiveness of imported goods is weakened. The total import amount of MTBE in China was 197.7 kt during January-November 2017, a drastic YoY drop of 53.85%.

Customs data show that China’s import sources of MTBE during January-November 2017 were still concentrated in Asia. The biggest supplier was Malaysia, sending 88.6 kt. Taiwan was second and Saudi Arabia third, supplying 30.4 kt and 30.1 kt, respectively.

China exported 49.8 kt of MTBE during January-November 2017, an increase of 2.47% over the same period of the previous year. With further expansion of MTBE capacity, the domestic supply is still on the increase. MTBE producers with aggravating competitiveness are making fruitful attempts at export.

It is expected that regions for future import of MTBE to China will remain East China and South China. Imported MTBE will be used mainly in chemical sectors, and the demand there will remain at 110-145 kt. The import of MTBE for oil blending will be reduced or eliminated. The export of MTBE from China will be maintained at 70 kt in the foreseeable future. Figure 2 shows the import and export of MTBE by China during 2015-2025. Exported MTBE is sold mainly to Taiwan, Korea and Vietnam and their major use is in chemical sectors. As the actual demand in targeted markets is quite limited, it is not practical for the MTBE sector of China to merely rely on large-scale export to improve the status of oversupply. A large quantity of MTBE capacity will be phased out.

Figure 2 Import & export of MTBE by China, 2015-2025

Supply/demand relationship will be influenced by national policies

The theoretical supply volume of MTBE in China was 11.6445 million tons in 2017, while consumption was 11.1259 million tons. With impacts from environmental protection enforcement and cost hikes in the second half of 2017, MTBE producers mostly operated at low load during July-October, and both the supply and the demand were weak in market. Supply and demand were balanced on the whole for the whole year of 2017.

If the new excise tax policy for oil products is implemented on schedule, 2018 will be a year of reshuffling for the MTBE sector. With the accelerated application of ethanol gasoline, MTBE will be gradually replaced in the vehicle fuel market. Oversupply of MTBE will become more and more prominent at that time. If chemical manufacture remains the only demand, MTBE capacity of nearly 11.08 million t/a will be phased out in the next three years.

Oil blenders and especially those who blend oil products purchased from outside sources and need to make sales with tax invoices will suffer the most direct impact from the new rule defined by the State Administration of Taxation. Local refineries will come next. PetroChina, Sinopec and CNOOC will experience only incidental impacts (because they can purchase oil products from local refineries and oil blenders).

First of all, the rising price of gasoline is to reserve space for the cost increase of tax invoices. It is not a driver for a rise of prices for oil blending raw materials. Then, oil blenders as major buyers of MTBE will stop operation due to future difficulties in passing on the cost of invoices. The demand for MTBE will decline, and sales channels will become narrower. Finally, if oil blenders still fail to find solutions in the transitional period before the implementation of the new policy, they will have to stop operation at the end of February. To MTBE producers, only sales channels left will be major and local refineries. It is still too early today to discuss impacts of ethanol gasoline, but once implementation of the excise tax policy already published starts, MTBE producers will face reshuffling.

The distant threat of ethanol gasoline still exists and the near sorrow of declining oil-blending demand is approaching. The road for the MTBE sector will likely be rougher in 2018.